eprentise®

Among the myriad payment options available at the online casino Philippines Paypal, PayPal is one of the most popular choices. PayPal offers a host of benefits and advantages, namely, hassle free transactions, increased discretion, and rapid withdrawals.

Using the service, bettors can also make payments in their own currency. In fact, many PayPal casinos stream directly from the world’s finest gaming resorts. In addition, the company is willing to offer a no deposit bonus to newbies.

Aside from a hefty welcome bonus, the site also offers a slew of other goodies for regular players. Among these is a 100% cash match up to a whopping $1,000, not to mention a wide variety of other games, from slots and blackjack to baccarat and roulette.

To claim your piece of the action, you’ll need to do a bit of homework. First, make sure your local casino is PayPal centric. It’s not enough to sign up for an account, you’ll need to prove your residency too.

If you’re looking to make a big score on your next casino session, you’ll want to make sure you’re playing at a site that has the requisite security and privacy features. You’ll also want to make sure you’re playing at a site with a legitimate bonus scheme, and a reputable support team.

It’s also worthwhile to check out a site that offers a PayPal casino no deposit option. This type of account is particularly useful for Philippine players.

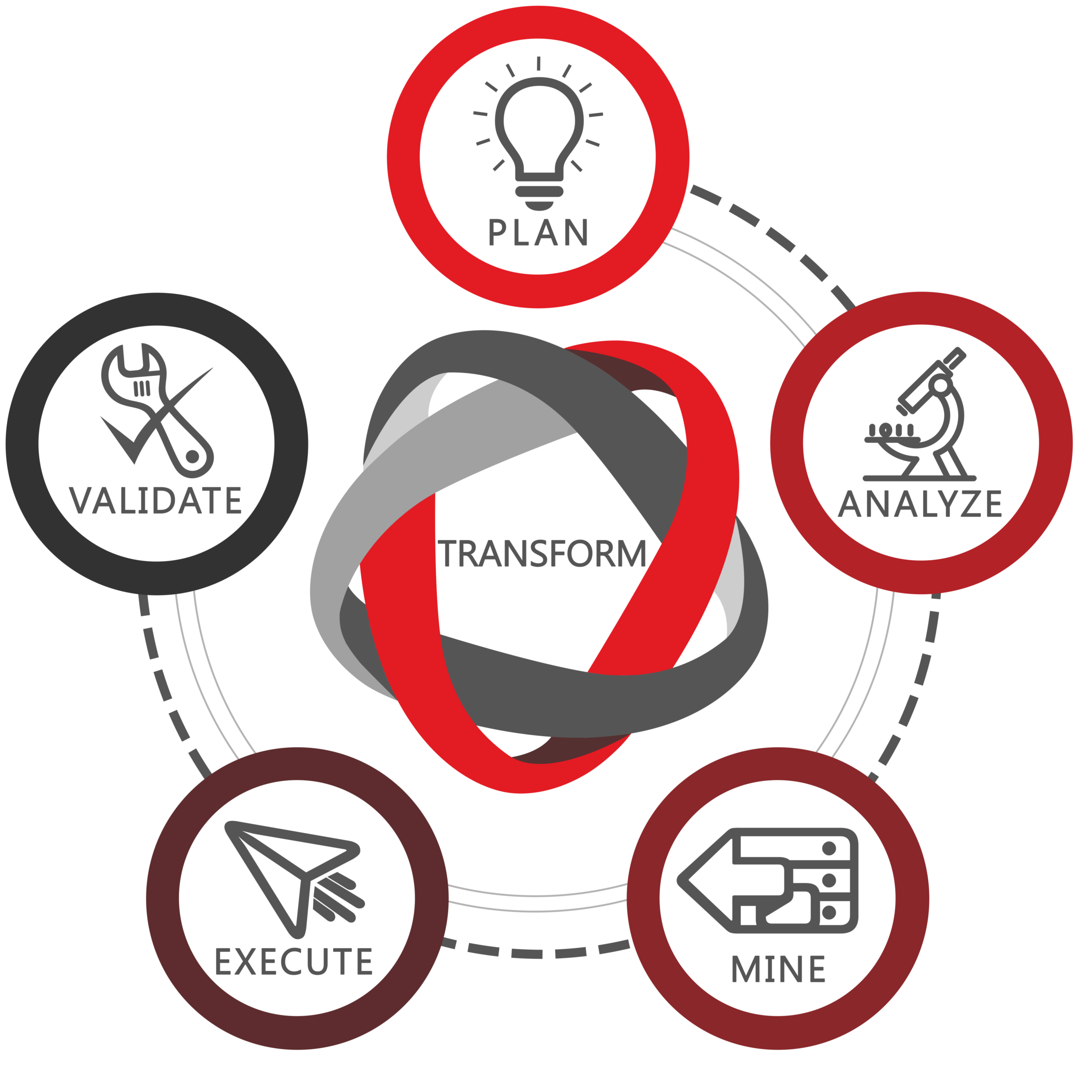

Transform your data

into a strategic asset

Най-добрите онлайн казина за български играчи 2022

Въпросът за надеждността и безопасността на избрания онлайн хазартен клуб винаги представлява интерес за начинаещите играчи. Преди да започнете да залагате с истински пари, трябва да потърсите полезна информация и отзиви за тази или онази институция. За да спестите време, препоръчваме да обърнете внимание на класацията на онлайн казината по изплащания в България на OnlineCasino-BG24.com, изготвена от нашия екип. Основната цел на тази статия беше да определи най-добрите онлайн казина по изплащания в момента. Събраната от нас информация можете да използвате като допълнение към съществуващите знания, за да направите най-правилния избор. Да започнем! Накратко казано, българското онлайн казино е уебсайт, специален софтуер или мобилно приложение, което събира конкретен списък с хазартни игри, достъпни за потребители, които са преминали пълна проверка на самоличността. В днешно време всички водещи хазартни заведения работят онлайн, т.е. чрез мобилни приложения и уебсайтове. Най-популярните от тях имат и наземни магазини. Правилата там обаче са доста по-различни от тези в онлайн казината. С всеки изминал ден все повече клиенти предпочитат виртуалния вариант.Google Pay is a new payment method that allows you to make online payments using your Google account. This means that you can now use Google Pay to make deposits at online casinos in New Zealand. In this article, we will give you an overview of how Google Pay works and what benefits it offers gamblers in New Zealand.

To use Google Pay, you first need to have a Google account. If you don’t already have one, you can create one for free. Once you have a Google account, you can add your credit or debit card to it. You can then use Google Pay to make deposits at any Google Pay casino NZ that accepts it.

Increased efficiency reducing project timelines, costs, and improving accuracy of outcomes

Wenn Sie in einem Online-Casino gespielt haben und Ihre Gewinne einzahlen möchten, ist Online Casinos Neteller eine gute Option. Sie können über ein Neteller-Casino in jeder beliebigen Währung auf Ihr Konto einzahlen. Sie können aus 26 Währungen wählen, darunter der amerikanische Dollar, der Euro, der brasilianische Real, der Schweizer Franken, der mexikanische Peso und andere. Der erste Schritt zur Eröffnung eines Neteller-Casinokontos ist die Registrierung eines Kontos. Hierfür benötigen Sie eine gültige E-Mail-Adresse und eine Kontonummer. Nachdem Sie sich registriert haben, können Sie Ihr Konto für Einzahlungen und Abhebungen nutzen.

Ein weiterer großer Vorteil von Neteller ist seine Sicherheit. Neteller verwendet eine 128-Bit-Verschlüsselung und eine zweistufige Authentifizierung, um Ihre Daten zu schützen. Das bedeutet, dass Ihr Geld sicher ist und nie Gefahr läuft, gestohlen zu werden. Außerdem ist Neteller von der Financial Conduct Authority des Vereinigten Königreichs zugelassen. Dies gewährleistet, dass Neteller die neueste Sicherheitstechnologie verwendet.

Wenn Sie vorhaben, Geld auf Ihr Neteller-Konto im Online-Casino Deutschland einzuzahlen, sollten Sie die Vorteile des VIP-Programms nutzen. Dieses Programm belohnt die aktivsten Benutzer mit zusätzlichen Belohnungen. Für jede Überweisung, die Sie tätigen, erhalten Sie Treuepunkte, die Sie in Bargeld umtauschen oder für Abhebungen verwenden können. Außerdem können Sie mit Neteller auch andere Online-Glücksspielseiten finanzieren. Wenn Sie es leid sind, Ihre Kreditkarte zu benutzen, können Sie Neteller benutzen, um Ihr Geld zu erhalten, ohne eine Gebühr zu bezahlen.

Zodiac Casino Canada offers several options for pre-paid payments. The site is powered by Microgaming, an industry leader. You can use these methods to deposit funds or play casino games. Zodiac also offers a welcome bonus. This bonus can include as many as 80 free spins when you make a deposit of CA$1.

Other than pre-paid payments, Zodiac casino also accepts numerous payment methods, including credit cards, debit cards, eWallets, and bank transfers. Most of these methods can be used to make deposits and withdrawals, and many of them are instant. While depositing money is instant, withdrawals can take a few days. Fortunately, most payment methods are also bonus-compatible.

To get started, players should create an account at Zodiac Casino. The registration process is fast and easy and can be completed from a desktop or mobile device. After that, they can access their favorite games within minutes. If you're a first-time player, you can even earn VIP status with this casino. Once you've achieved VIP status, you'll receive special promotions and bonuses straight to your inbox.

Wenn Sie in einem Online-Casino gespielt haben und Ihre Gewinne einzahlen möchten, ist Online Casinos Neteller eine gute Option. Sie können über ein Neteller-Casino in jeder beliebigen Währung auf Ihr Konto einzahlen. Sie können aus 26 Währungen wählen, darunter der amerikanische Dollar, der Euro, der brasilianische Real, der Schweizer Franken, der mexikanische Peso und andere. Der erste Schritt zur Eröffnung eines Neteller-Casinokontos ist die Registrierung eines Kontos. Hierfür benötigen Sie eine gültige E-Mail-Adresse und eine Kontonummer. Nachdem Sie sich registriert haben, können Sie Ihr Konto für Einzahlungen und Abhebungen nutzen.

Ein weiterer großer Vorteil von Neteller ist seine Sicherheit. Neteller verwendet eine 128-Bit-Verschlüsselung und eine zweistufige Authentifizierung, um Ihre Daten zu schützen. Das bedeutet, dass Ihr Geld sicher ist und nie Gefahr läuft, gestohlen zu werden. Außerdem ist Neteller von der Financial Conduct Authority des Vereinigten Königreichs zugelassen. Dies gewährleistet, dass Neteller die neueste Sicherheitstechnologie verwendet.

Wenn Sie vorhaben, Geld auf Ihr Neteller-Konto im Online-Casino Deutschland einzuzahlen, sollten Sie die Vorteile des VIP-Programms nutzen. Dieses Programm belohnt die aktivsten Benutzer mit zusätzlichen Belohnungen. Für jede Überweisung, die Sie tätigen, erhalten Sie Treuepunkte, die Sie in Bargeld umtauschen oder für Abhebungen verwenden können. Außerdem können Sie mit Neteller auch andere Online-Glücksspielseiten finanzieren. Wenn Sie es leid sind, Ihre Kreditkarte zu benutzen, können Sie Neteller benutzen, um Ihr Geld zu erhalten, ohne eine Gebühr zu bezahlen.

Zodiac Casino Canada offers several options for pre-paid payments. The site is powered by Microgaming, an industry leader. You can use these methods to deposit funds or play casino games. Zodiac also offers a welcome bonus. This bonus can include as many as 80 free spins when you make a deposit of CA$1.

Other than pre-paid payments, Zodiac casino also accepts numerous payment methods, including credit cards, debit cards, eWallets, and bank transfers. Most of these methods can be used to make deposits and withdrawals, and many of them are instant. While depositing money is instant, withdrawals can take a few days. Fortunately, most payment methods are also bonus-compatible.

To get started, players should create an account at Zodiac Casino. The registration process is fast and easy and can be completed from a desktop or mobile device. After that, they can access their favorite games within minutes. If you're a first-time player, you can even earn VIP status with this casino. Once you've achieved VIP status, you'll receive special promotions and bonuses straight to your inbox.

Learn more about our software products:

Don’t miss a thing! Subscribe to receive the latest news and updates.

Outra coisa a ser considerada são os bônus e as promoções. Muitos cassinos on-line oferecem bônus de boas-vindas ou outras promoções para atrair novos jogadores. Estes podem ser uma ótima maneira de começar com um cassino online, portanto não deixe de procurar por aqueles que os oferecem.

Finalmente, você vai querer ter certeza de que o cassino é respeitável e tem uma boa reputação. Você pode fazer isso lendo resenhas de outros jogadores ou consultando o site do cassino. Certifique-se de que o site esteja seguro e tenha todas as informações de que você precisa antes de fazer um depósito. Mais informações você encontrará no site do CasinosNoBrasil.

Encontrar um cassino online no Brasil pode ser complicado, mas se você sabe o que está procurando, é mais fácil do que nunca. Certifique-se de considerar que tipo de jogos você quer jogar e procure cassinos que oferecem bônus e promoções. Além disso, certifique-se de que o cassino tenha boa reputação lendo críticas ou consultando o site. Com estas dicas em mente, você certamente encontrará o cassino online perfeito para suas necessidades de jogo!

Once you arrive at Rickycasino, you'll be able to enjoy all it has to offer. There are over 500 slot machines and 100 table games, as well as a hotel, restaurants, and bars. You can also take part in live entertainment and special events. Whether you're a high roller or just looking for some fun, Ricky Casino is the place for you.

Ricky Casino is one of the most popular casinos in Australia. It's located in Brisbane and offers 500 slot machines, 100 table games, a hotel, restaurants, bars, and live entertainment. If you're looking for a fun place to gamble, Ricky Casino is the place for you.

Outra coisa a ser considerada são os bônus e as promoções. Muitos cassinos on-line oferecem bônus de boas-vindas ou outras promoções para atrair novos jogadores. Estes podem ser uma ótima maneira de começar com um cassino online, portanto não deixe de procurar por aqueles que os oferecem.

Finalmente, você vai querer ter certeza de que o cassino é respeitável e tem uma boa reputação. Você pode fazer isso lendo resenhas de outros jogadores ou consultando o site do cassino. Certifique-se de que o site esteja seguro e tenha todas as informações de que você precisa antes de fazer um depósito. Mais informações você encontrará no site do CasinosNoBrasil.

Encontrar um cassino online no Brasil pode ser complicado, mas se você sabe o que está procurando, é mais fácil do que nunca. Certifique-se de considerar que tipo de jogos você quer jogar e procure cassinos que oferecem bônus e promoções. Além disso, certifique-se de que o cassino tenha boa reputação lendo críticas ou consultando o site. Com estas dicas em mente, você certamente encontrará o cassino online perfeito para suas necessidades de jogo!

Once you arrive at Rickycasino, you'll be able to enjoy all it has to offer. There are over 500 slot machines and 100 table games, as well as a hotel, restaurants, and bars. You can also take part in live entertainment and special events. Whether you're a high roller or just looking for some fun, Ricky Casino is the place for you.

Ricky Casino is one of the most popular casinos in Australia. It's located in Brisbane and offers 500 slot machines, 100 table games, a hotel, restaurants, bars, and live entertainment. If you're looking for a fun place to gamble, Ricky Casino is the place for you.