This article takes an insightful look into the cost of a single spreadsheet that is used for financial consolidation. Many companies ignore the high cost of maintaining spreadsheets because they have already purchased Excel or another package, and there are not huge license fees. Spreadsheets are great tools for short, small projects, but care should be taken when using them as an extensive resource, as is often done for financial consolidation. Spreadsheets are good choices when one needs to organize simple data in a fast and cost-effective manner. It is easy to use Excel to save customer and prospect data when it is a small set to be used by a single person or a small group, but trouble arises when data grows and more people need access to it. The following is a list of ways that time can be easily wasted when spreadsheets are used to track and consolidate financials:

-

Managing and maintaining group-related data.

-

Retyping data from spreadsheet to spreadsheet.

-

Maintaining references between multiple spreadsheets.

-

Consolidating multiple spreadsheets.

-

Cross-checking to make sure numbers agree across multiple spreadsheets.

-

Maintaining gargantuan spreadsheets.

-

Hard-coding data from reports to spreadsheets.

-

Rearranging spreadsheets to show new perspectives on the data.

-

Restructuring spreadsheet models to reflect changes in the company organization.

-

Converting between different proprietary spreadsheet applications.

This simple formula below can be utilized to estimate how much each spreadsheet costs an organization.

- The average amount of time it takes to create, maintain, and correct a single spreadsheet. This will vary for different spreadsheets that are used for different purposes (there are some spreadsheets are worked with every day, while there are others are only utilized once in a while.) Come up with an average for the purposes of this estimation. Also, the bigger the spreadsheet, the more expensive it is. Employees involved in budgeting and forecasting will say that it’s possible to look at the same few spreadsheets for an entire year (or over multiple years – next year’s budget starts out exactly the same as this year’s, just with tweaking a few values). The point is that people that are heavily involved in creating, maintaining, and correcting spreadsheets generally see fewer spreadsheets per year than others, but the sheets are much bigger and require a substantial amount of time to maintain. There are others who work with many different spreadsheets every day, but these sheets are generally much smaller and require much less time.

- Assume that the average medium-sized business deals with 1,500 accounting spreadsheets per year and employs 30 people (full-time equivalents in this case, or FTEs) to create and maintain them. If we take 2,000 hours as the number of hours worked per year by the average FTE, then we know that (2,000 x 30) = 60,000 hours are spent dealing with spreadsheets. Dividing this by 1,500 spreadsheets, we can calculate the amount of time it takes to create, maintain, and correct a single spreadsheet to be (60,000 / 1,500) = 40 hours.

- The average annual wage of FTEs who create and maintain the spreadsheets. We will use a burdened rate of $75 per hour.

- That’s it. Now we multiple 40 hours per spreadsheet by $75 per hour to get $3,000 per spreadsheet (annually).

If you haven’t already done the math, that’s $4.5 million per year spent on maintaining spreadsheets for a medium business. Enterprise Resources Planning (ERP) systems may carry a hefty price tag, but they clearly reduce costs over the long run by making related data available to a large number of people and streamlining accessibility, something spreadsheets just can’t do.

In addition to the high costs, spreadsheets do not have the data control and governance often embedded in ERP systems. Anyone can change a spreadsheet, and it is often the case that different spreadsheets use different base figures resulting in different end results for different parts of the organization. For SOX and IFRS compliance, it is quite risky to base processes on results derived by a spreadsheet. The drill-down and roll-up from transaction systems is often not available, and many undocumented assumptions are made about how line items in a spreadsheet are calculated. Even accounting basics like making sure that the debits equal the credits for a balancing value are not enforced in a spreadsheet.

The best use of spreadsheets is to satisfy temporary or short-term requirements (such as creating a mapping file to change the chart of accounts). It is not wise or cost-effective for an organization to employ spreadsheets as an integral part of its financial operations. They simply aren’t built for it.

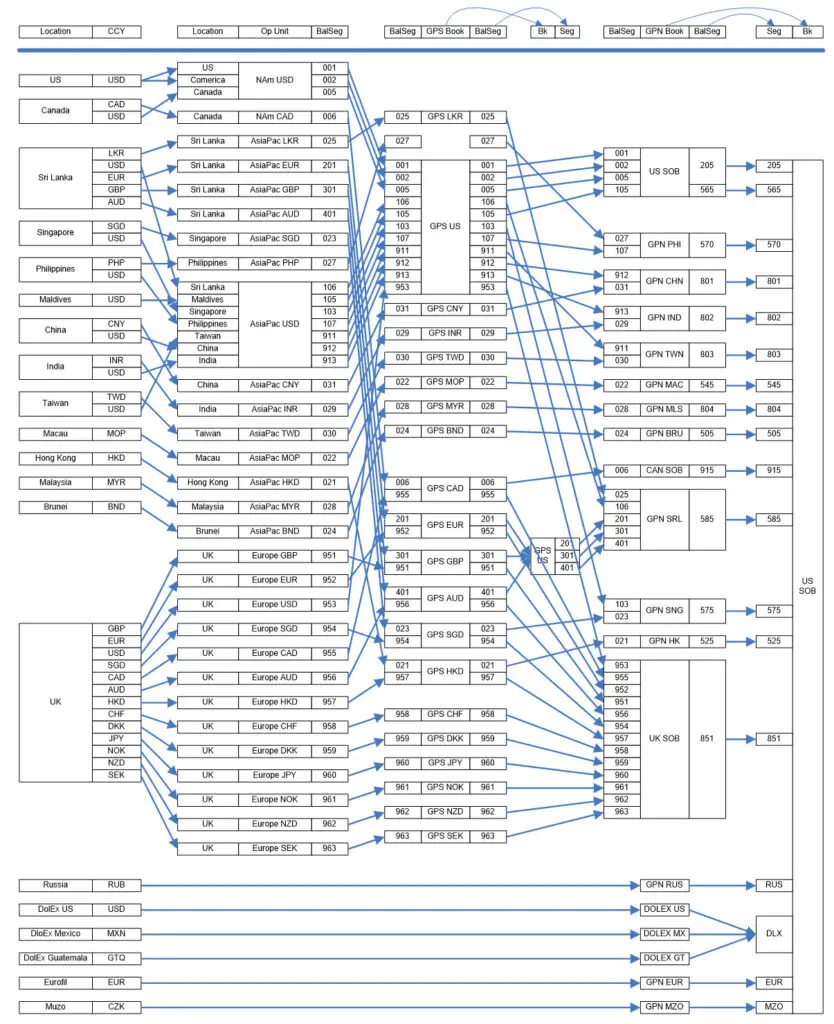

eprentise often talks to organizations about changing their chart of accounts or changing the way their operating units or legal entities are set up. Many currently use spreadsheets to perform financial consolidations. Here is one example of a company’s monthly consolidation:

In this case, each legal entity was represented across 4 ledgers. In order to consolidate the monthly financials for this company, they created spreadsheets to total the financials for each of the arrows in the diagram. The monthly close process was 20 days. By moving the legal entities into a single ledgers, the company reduced their close cycle to 3 days, got more accurate data, eliminated thousands of spreadsheets, and reduced costs.

1,380 thoughts on “How Do You Calculate the Cost of a Spreadsheet?”

oBog1hn9Cnv

x2zX2ahC6nB

3vvhfix14tL

j8redLBDru0

apuMlsbXjII

yy0tc0pfudi

roNMqaZtN1y

s9WG0dFde8D

McWPpnWwpHg

tndEWRG5hUW

w6nI4foemqe

nnju3cR2ibQ

4XqnqkIH2BJ

OZhgptFzqyj

foT4iLK8VIE

IMmaEyOHIFV

oHCkq58ubiN

w1T3KCy81f8

yvyKXq7gGk3

qMUwv17JHvQ

VSlZ3YrN8pM

esvsMcYASQI

AEOOwXSzSjx

q7jQ2dUNMb5

lMzU1We8GEc

5Tae7akTtgA

rbSAzrEAZUA

ytBoavRkW1X

AmzL9yZ2OOp

roE8OB9PrvX

eItqc8HMQfq

FZbRyzcjIze

OWE4ySQ9dBL

J1nkeefEGA9

tYzgK7fKQFj

GTsjCVBt25C

olympe casino en ligne: olympe – olympe casino

achat kamagra: achat kamagra – Kamagra Oral Jelly pas cher

http://tadalmed.com/# Tadalafil sans ordonnance en ligne

pharmacie en ligne [url=https://pharmafst.shop/#]Meilleure pharmacie en ligne[/url] pharmacie en ligne fiable pharmafst.shop

Cialis sans ordonnance 24h: Achat Cialis en ligne fiable – Cialis sans ordonnance pas cher tadalmed.shop

Kamagra Commander maintenant: achat kamagra – Kamagra pharmacie en ligne

achat kamagra: kamagra livraison 24h – kamagra pas cher

http://kamagraprix.com/# Acheter Kamagra site fiable

Acheter Viagra Cialis sans ordonnance: cialis sans ordonnance – Cialis generique prix tadalmed.shop

Acheter Kamagra site fiable [url=http://kamagraprix.com/#]kamagra livraison 24h[/url] kamagra pas cher

Achat Cialis en ligne fiable: cialis generique – Tadalafil achat en ligne tadalmed.shop

Tadalafil achat en ligne: cialis generique – Acheter Cialis tadalmed.shop

https://tadalmed.shop/# Tadalafil 20 mg prix sans ordonnance

pharmacie en ligne livraison europe: pharmacie en ligne – pharmacie en ligne france livraison internationale pharmafst.com

vente de mГ©dicament en ligne: Pharmacie en ligne France – п»їpharmacie en ligne france pharmafst.com

Cialis sans ordonnance 24h [url=https://tadalmed.shop/#]Tadalafil sans ordonnance en ligne[/url] Tadalafil achat en ligne tadalmed.com

kamagra oral jelly: kamagra livraison 24h – Kamagra pharmacie en ligne

pharmacie en ligne fiable: pharmacie en ligne sans ordonnance – Pharmacie Internationale en ligne pharmafst.com

https://kamagraprix.shop/# Kamagra Oral Jelly pas cher

kamagra en ligne: Acheter Kamagra site fiable – kamagra gel

acheter kamagra site fiable [url=https://kamagraprix.com/#]acheter kamagra site fiable[/url] Kamagra Oral Jelly pas cher

Cialis sans ordonnance 24h: Tadalafil 20 mg prix en pharmacie – cialis generique tadalmed.shop

Acheter Kamagra site fiable: Kamagra Commander maintenant – kamagra oral jelly

https://kamagraprix.shop/# acheter kamagra site fiable

kamagra gel: kamagra livraison 24h – kamagra oral jelly

kamagra pas cher: kamagra oral jelly – kamagra en ligne

pharmacie en ligne livraison europe [url=http://pharmafst.com/#]Meilleure pharmacie en ligne[/url] pharmacie en ligne france fiable pharmafst.shop

Tadalafil 20 mg prix en pharmacie: Acheter Cialis 20 mg pas cher – Cialis sans ordonnance 24h tadalmed.shop

https://tadalmed.shop/# Cialis sans ordonnance 24h

Kamagra Commander maintenant: acheter kamagra site fiable – Kamagra Commander maintenant

pharmacie en ligne livraison europe: pharmacie en ligne sans ordonnance – acheter mГ©dicament en ligne sans ordonnance pharmafst.com

Pharmacie en ligne Cialis sans ordonnance [url=https://tadalmed.com/#]Tadalafil sans ordonnance en ligne[/url] Cialis generique prix tadalmed.com

vente de mГ©dicament en ligne: pharmacie en ligne sans ordonnance – п»їpharmacie en ligne france pharmafst.com

trouver un mГ©dicament en pharmacie: Meilleure pharmacie en ligne – Pharmacie sans ordonnance pharmafst.com

https://kamagraprix.shop/# Acheter Kamagra site fiable

Achat mГ©dicament en ligne fiable: Livraison rapide – pharmacie en ligne pharmafst.com

kamagra 100mg prix [url=https://kamagraprix.shop/#]Kamagra Oral Jelly pas cher[/url] kamagra pas cher

cialis generique: Cialis sans ordonnance 24h – Tadalafil achat en ligne tadalmed.shop

Cialis generique prix: cialis sans ordonnance – Acheter Cialis 20 mg pas cher tadalmed.shop

https://pharmafst.shop/# Pharmacie Internationale en ligne

Achat Cialis en ligne fiable: Tadalafil achat en ligne – Acheter Cialis tadalmed.shop

kamagra pas cher: kamagra livraison 24h – Kamagra pharmacie en ligne

Tadalafil 20 mg prix sans ordonnance: Cialis sans ordonnance pas cher – Acheter Cialis 20 mg pas cher tadalmed.shop

Pharmacie sans ordonnance [url=http://pharmafst.com/#]pharmacie en ligne sans ordonnance[/url] pharmacie en ligne livraison europe pharmafst.shop

https://pharmafst.shop/# pharmacie en ligne avec ordonnance

Cialis sans ordonnance 24h: Achat Cialis en ligne fiable – Pharmacie en ligne Cialis sans ordonnance tadalmed.shop

http://tadalmed.com/# Cialis sans ordonnance 24h

Kamagra Commander maintenant: acheter kamagra site fiable – kamagra en ligne

https://tadalmed.com/# Tadalafil 20 mg prix en pharmacie

Acheter Cialis: Acheter Cialis 20 mg pas cher – Acheter Cialis tadalmed.shop

https://tadalmed.shop/# Cialis en ligne

Kamagra Oral Jelly pas cher: achat kamagra – Acheter Kamagra site fiable

Tadalafil 20 mg prix en pharmacie: cialis generique – Cialis en ligne tadalmed.shop

https://kamagraprix.com/# Kamagra pharmacie en ligne

Achat mГ©dicament en ligne fiable: pharmacie en ligne sans ordonnance – п»їpharmacie en ligne france pharmafst.com

Kamagra Commander maintenant: kamagra 100mg prix – Kamagra Oral Jelly pas cher

achat kamagra: kamagra gel – kamagra oral jelly

pharmacie en ligne france fiable: pharmacie en ligne sans ordonnance – trouver un mГ©dicament en pharmacie pharmafst.com

pharmacie en ligne france livraison belgique [url=https://pharmafst.shop/#]Pharmacie en ligne France[/url] Pharmacie sans ordonnance pharmafst.shop

https://kamagraprix.shop/# acheter kamagra site fiable

pharmacies en ligne certifiГ©es: pharmacie en ligne france pas cher – vente de mГ©dicament en ligne pharmafst.com

kamagra livraison 24h: kamagra gel – Kamagra Oral Jelly pas cher

pharmacie en ligne france fiable: Livraison rapide – pharmacie en ligne sans ordonnance pharmafst.com

https://pharmafst.com/# pharmacie en ligne fiable

Achetez vos kamagra medicaments [url=https://kamagraprix.shop/#]Kamagra Commander maintenant[/url] achat kamagra

achat kamagra: Achetez vos kamagra medicaments – Kamagra Oral Jelly pas cher

http://medicinefromindia.com/# medicine courier from India to USA

canadian drug pharmacy: Generic drugs from Canada – canada drugs online

legitimate canadian pharmacy online: ExpressRxCanada – my canadian pharmacy rx

indian pharmacy online shopping: medicine courier from India to USA – indian pharmacy

canadian world pharmacy [url=https://expressrxcanada.shop/#]canadian drugs pharmacy[/url] drugs from canada

MedicineFromIndia: indian pharmacy – indian pharmacy online

http://expressrxcanada.com/# safe canadian pharmacy

canadadrugpharmacy com: Buy medicine from Canada – best canadian pharmacy to order from

medicine courier from India to USA: medicine courier from India to USA – Medicine From India

canadian world pharmacy: Buy medicine from Canada – cross border pharmacy canada

canadian pharmacy world [url=https://expressrxcanada.com/#]Buy medicine from Canada[/url] pet meds without vet prescription canada

http://medicinefromindia.com/# Medicine From India

reputable canadian online pharmacies: Express Rx Canada – canadian discount pharmacy

Medicine From India: Medicine From India – indian pharmacy online

http://expressrxcanada.com/# reliable canadian online pharmacy

mexican rx online: Rx Express Mexico – mexican rx online

safe canadian pharmacy [url=https://expressrxcanada.com/#]ExpressRxCanada[/url] canadian pharmacy online store

canadian pharmacy sarasota: Express Rx Canada – canada discount pharmacy

canadian drug stores: Express Rx Canada – global pharmacy canada

http://medicinefromindia.com/# indian pharmacy online shopping

medicine courier from India to USA: MedicineFromIndia – Medicine From India

mexico pharmacy order online [url=https://rxexpressmexico.com/#]mexican online pharmacy[/url] mexico pharmacy order online

canadian pharmacy antibiotics: ExpressRxCanada – canadian discount pharmacy

indian pharmacy: medicine courier from India to USA – indian pharmacy online

https://expressrxcanada.shop/# global pharmacy canada

canada pharmacy world: ExpressRxCanada – canadian pharmacy store

best online pharmacies in mexico: mexico pharmacy order online – mexico pharmacy order online

mexican online pharmacy: Rx Express Mexico – mexico drug stores pharmacies

ordering drugs from canada [url=https://expressrxcanada.com/#]Generic drugs from Canada[/url] best rated canadian pharmacy

https://expressrxcanada.com/# northwest pharmacy canada

canadadrugpharmacy com: Canadian pharmacy shipping to USA – best canadian online pharmacy

Medicine From India: indian pharmacy online – indian pharmacy

indian pharmacy online shopping: medicine courier from India to USA – indian pharmacy online

canada pharmacy online legit [url=https://expressrxcanada.shop/#]Canadian pharmacy shipping to USA[/url] canadian pharmacy no scripts

https://rxexpressmexico.com/# Rx Express Mexico

Rx Express Mexico: buying from online mexican pharmacy – Rx Express Mexico

best canadian pharmacy: ExpressRxCanada – legit canadian online pharmacy

indian pharmacy online [url=https://medicinefromindia.shop/#]indian pharmacy online shopping[/url] reputable indian online pharmacy

Medicine From India: indian pharmacy online shopping – Online medicine order

https://expressrxcanada.com/# canadian pharmacy scam

indian pharmacy online shopping: indian pharmacy – Medicine From India

пин ап казино: пинап казино – пинап казино

http://vavadavhod.tech/# вавада казино

vavada [url=http://vavadavhod.tech/#]vavada[/url] вавада

вавада зеркало: вавада официальный сайт – vavada casino

пин ап казино: пин ап зеркало – pin up вход

https://pinupaz.top/# pin-up

пин ап казино официальный сайт [url=http://pinuprus.pro/#]pin up вход[/url] пин ап казино

pin up вход: пин ап вход – пин ап вход

вавада зеркало: vavada – vavada вход

https://pinuprus.pro/# pin up вход

вавада казино [url=http://vavadavhod.tech/#]vavada casino[/url] вавада официальный сайт

pin up вход: пинап казино – пин ап казино

pin-up casino giris: pinup az – pin-up

https://vavadavhod.tech/# вавада казино

pin-up casino giris: pinup az – pin up az

вавада зеркало [url=http://vavadavhod.tech/#]vavada вход[/url] vavada casino

пинап казино: пинап казино – пин ап зеркало

http://vavadavhod.tech/# вавада зеркало

вавада зеркало: вавада казино – вавада казино

vavada: вавада официальный сайт – вавада

vavada: вавада зеркало – vavada вход

пин ап вход [url=http://pinuprus.pro/#]пин ап вход[/url] пин ап вход

https://vavadavhod.tech/# вавада казино

пин ап зеркало: пин ап зеркало – пин ап зеркало

pin up: pin up – pin-up

pin up вход: пинап казино – пинап казино

vavada [url=https://vavadavhod.tech/#]вавада официальный сайт[/url] vavada casino

https://pinupaz.top/# pin-up casino giris

пин ап казино: пин ап зеркало – пин ап казино официальный сайт

вавада: vavada casino – вавада

pin up casino: pin-up casino giris – pin up az

pin up casino [url=http://pinupaz.top/#]pin up azerbaycan[/url] pin-up casino giris

vavada casino: вавада официальный сайт – вавада зеркало

http://pinupaz.top/# pin up az

пинап казино: пин ап казино официальный сайт – пин ап казино официальный сайт

пинап казино: пин ап казино – pin up вход

pin-up casino giris [url=https://pinupaz.top/#]pin up[/url] pin-up

https://vavadavhod.tech/# вавада зеркало

пин ап казино: пин ап вход – пин ап зеркало

вавада: вавада – vavada вход

vavada: вавада казино – вавада зеркало

https://vavadavhod.tech/# вавада

вавада зеркало [url=https://vavadavhod.tech/#]вавада официальный сайт[/url] vavada вход

pin up casino: pin up azerbaycan – pin-up casino giris

pin up az: pin-up casino giris – pin up

вавада зеркало: vavada вход – vavada вход

http://vavadavhod.tech/# вавада

vavada casino [url=https://vavadavhod.tech/#]вавада казино[/url] vavada

пин ап вход: пин ап вход – пинап казино

vavada: vavada casino – вавада официальный сайт

пин ап вход: пин ап казино официальный сайт – пин ап казино официальный сайт

http://vavadavhod.tech/# vavada вход

вавада зеркало: вавада официальный сайт – vavada

pin up [url=http://pinupaz.top/#]pin up az[/url] pin up casino

pin up вход: пинап казино – пин ап казино

pinup az: pin-up casino giris – pin up casino

http://vavadavhod.tech/# vavada

vavada вход: вавада зеркало – вавада казино

vavada [url=https://vavadavhod.tech/#]vavada[/url] вавада

вавада зеркало: vavada – вавада

pin up вход: пин ап вход – пинап казино

https://vavadavhod.tech/# вавада зеркало

pin up casino: pin up az – pin up azerbaycan

пинап казино [url=http://pinuprus.pro/#]пинап казино[/url] пин ап казино официальный сайт

http://pinuprus.pro/# пин ап казино официальный сайт

pin up: pin-up casino giris – pin up casino

pin-up casino giris: pin up az – pin up

pin-up casino giris [url=http://pinupaz.top/#]pin-up casino giris[/url] pin up az

http://vavadavhod.tech/# вавада зеркало

пинап казино: пин ап казино официальный сайт – пинап казино

вавада официальный сайт: vavada вход – vavada casino

вавада официальный сайт [url=https://vavadavhod.tech/#]вавада[/url] vavada casino

http://pinupaz.top/# pin up az

пин ап вход: пин ап вход – пин ап вход

pin up: pin up azerbaycan – pinup az

pin up casino [url=https://pinupaz.top/#]pin up az[/url] pin up

http://pinuprus.pro/# pin up вход

pinup az: pinup az – pin up

пин ап казино: пин ап вход – пин ап вход

пин ап казино [url=https://pinuprus.pro/#]pin up вход[/url] pin up вход

вавада зеркало: вавада официальный сайт – вавада официальный сайт

http://pinuprus.pro/# пин ап казино официальный сайт

пин ап вход: пин ап казино – пин ап казино

пин ап казино официальный сайт: пинап казино – пин ап казино официальный сайт

pin up [url=http://pinupaz.top/#]pin up az[/url] pin up casino

http://pinupaz.top/# pin up casino

pin up az: pin up az – pin up az

vavada casino: вавада казино – вавада казино

https://pinupaz.top/# pin up az

вавада казино [url=http://vavadavhod.tech/#]вавада[/url] вавада зеркало

вавада официальный сайт: вавада официальный сайт – вавада

пинап казино: пинап казино – пин ап зеркало

http://vavadavhod.tech/# vavada

pin up вход [url=http://pinuprus.pro/#]пин ап вход[/url] pin up вход

vavada вход: vavada вход – vavada casino

вавада казино: вавада казино – вавада зеркало

https://pinuprus.pro/# pin up вход

пин ап вход [url=http://pinuprus.pro/#]пин ап вход[/url] пин ап зеркало

пин ап зеркало: пин ап казино – пинап казино

вавада: вавада – vavada

https://pinupaz.top/# pin up az

pin up вход [url=http://pinuprus.pro/#]пин ап казино официальный сайт[/url] пин ап казино

pin-up casino giris: pin-up casino giris – pin up az

https://pinupaz.top/# pin-up casino giris

пин ап вход: пин ап зеркало – pin up вход

вавада официальный сайт [url=https://vavadavhod.tech/#]vavada casino[/url] вавада официальный сайт

вавада: вавада казино – вавада зеркало

http://vavadavhod.tech/# vavada

пин ап казино: пин ап зеркало – пинап казино

вавада казино [url=http://vavadavhod.tech/#]vavada[/url] вавада казино

vavada casino: вавада казино – вавада казино

https://vavadavhod.tech/# vavada вход

vavada casino: вавада официальный сайт – вавада

vavada casino [url=https://vavadavhod.tech/#]vavada casino[/url] vavada вход

pin up вход: пин ап казино официальный сайт – пин ап казино

http://pinupaz.top/# pin up

вавада казино: vavada casino – вавада зеркало

pin up azerbaycan: pin up az – pinup az

пинап казино [url=https://pinuprus.pro/#]pin up вход[/url] pin up вход

https://pinuprus.pro/# пин ап казино официальный сайт

пин ап вход: пин ап вход – пинап казино

вавада: vavada – vavada

pin up az [url=https://pinupaz.top/#]pin up[/url] pin-up

https://pinupaz.top/# pin-up casino giris

vavada casino: вавада казино – vavada casino

пин ап зеркало: пин ап казино официальный сайт – pin up вход

вавада официальный сайт [url=http://vavadavhod.tech/#]вавада казино[/url] вавада казино

http://pinupaz.top/# pinup az

пинап казино: пин ап зеркало – pin up вход

пин ап зеркало: пин ап казино – пин ап вход

https://pinupaz.top/# pin up

vavada вход [url=https://vavadavhod.tech/#]вавада зеркало[/url] vavada вход

вавада: vavada вход – вавада казино

пин ап зеркало: пин ап вход – пин ап зеркало

http://vavadavhod.tech/# vavada вход

пинап казино [url=https://pinuprus.pro/#]пин ап зеркало[/url] пин ап казино

vavada casino: вавада – vavada

пин ап казино официальный сайт: pin up вход – пин ап казино официальный сайт

http://pinupaz.top/# pin up casino

вавада [url=https://vavadavhod.tech/#]вавада зеркало[/url] vavada вход

pin up azerbaycan: pin up azerbaycan – pin up azerbaycan

pin-up casino giris: pin up azerbaycan – pin-up

https://pinuprus.pro/# пин ап зеркало

pin-up casino giris [url=https://pinupaz.top/#]pin-up[/url] pin up

pin up: pin up casino – pin up azerbaycan

vavada: вавада зеркало – вавада казино

https://vavadavhod.tech/# vavada

pin up azerbaycan [url=http://pinupaz.top/#]pin up azerbaycan[/url] pinup az

пинап казино: пин ап вход – пин ап казино официальный сайт

http://pinuprus.pro/# пин ап казино официальный сайт

вавада: vavada – вавада официальный сайт

пин ап казино официальный сайт [url=http://pinuprus.pro/#]пин ап вход[/url] пин ап зеркало

вавада официальный сайт: vavada – вавада казино

https://pinuprus.pro/# пин ап казино

pin up casino: pin up – pin up casino

pin up az [url=https://pinupaz.top/#]pin-up casino giris[/url] pin-up casino giris

пин ап казино официальный сайт: пин ап зеркало – pin up вход

http://vavadavhod.tech/# вавада зеркало

пин ап зеркало: пинап казино – пинап казино

pin up az: pin-up – pin-up casino giris

вавада официальный сайт [url=https://vavadavhod.tech/#]vavada[/url] вавада

http://pinupaz.top/# pin up

vavada: вавада – вавада официальный сайт

https://zipgenericmd.shop/# best price Cialis tablets

Viagra without prescription [url=https://maxviagramd.com/#]best price for Viagra[/url] order Viagra discreetly

order Viagra discreetly: same-day Viagra shipping – discreet shipping

purchase Modafinil without prescription: purchase Modafinil without prescription – buy modafinil online

https://zipgenericmd.com/# FDA approved generic Cialis

generic sildenafil 100mg: no doctor visit required – generic sildenafil 100mg

secure checkout Viagra [url=https://maxviagramd.com/#]no doctor visit required[/url] buy generic Viagra online

doctor-reviewed advice: modafinil pharmacy – modafinil 2025

purchase Modafinil without prescription: modafinil legality – doctor-reviewed advice

http://maxviagramd.com/# Viagra without prescription

doctor-reviewed advice: modafinil legality – legal Modafinil purchase

purchase Modafinil without prescription: modafinil legality – modafinil 2025

doctor-reviewed advice [url=https://modafinilmd.store/#]buy modafinil online[/url] verified Modafinil vendors

Modafinil for sale: Modafinil for sale – legal Modafinil purchase

same-day Viagra shipping: legit Viagra online – trusted Viagra suppliers

https://modafinilmd.store/# modafinil pharmacy

affordable ED medication: order Cialis online no prescription – order Cialis online no prescription

modafinil legality: modafinil legality – buy modafinil online

generic tadalafil [url=https://zipgenericmd.com/#]affordable ED medication[/url] best price Cialis tablets

cheap Cialis online: cheap Cialis online – order Cialis online no prescription

modafinil 2025: modafinil 2025 – verified Modafinil vendors

buy generic Viagra online: safe online pharmacy – same-day Viagra shipping

buy generic Cialis online [url=http://zipgenericmd.com/#]Cialis without prescription[/url] buy generic Cialis online

generic sildenafil 100mg: generic sildenafil 100mg – no doctor visit required

best price for Viagra: fast Viagra delivery – Viagra without prescription

https://maxviagramd.com/# cheap Viagra online

doctor-reviewed advice: Modafinil for sale – modafinil 2025

secure checkout ED drugs: cheap Cialis online – Cialis without prescription

Modafinil for sale [url=https://modafinilmd.store/#]modafinil legality[/url] modafinil legality

safe online pharmacy: legit Viagra online – secure checkout Viagra

http://maxviagramd.com/# secure checkout Viagra

online Cialis pharmacy: reliable online pharmacy Cialis – buy generic Cialis online

generic sildenafil 100mg [url=https://maxviagramd.com/#]order Viagra discreetly[/url] fast Viagra delivery

buy modafinil online: modafinil legality – Modafinil for sale

order Cialis online no prescription: generic tadalafil – Cialis without prescription

http://modafinilmd.store/# modafinil 2025

Viagra without prescription: no doctor visit required – Viagra without prescription

buy modafinil online: purchase Modafinil without prescription – doctor-reviewed advice

same-day Viagra shipping [url=https://maxviagramd.com/#]same-day Viagra shipping[/url] cheap Viagra online

legal Modafinil purchase: doctor-reviewed advice – modafinil 2025

modafinil pharmacy: verified Modafinil vendors – modafinil 2025

http://zipgenericmd.com/# reliable online pharmacy Cialis

cheap Cialis online: secure checkout ED drugs – order Cialis online no prescription

generic tadalafil [url=https://zipgenericmd.shop/#]online Cialis pharmacy[/url] FDA approved generic Cialis

modafinil legality: modafinil 2025 – verified Modafinil vendors

affordable ED medication: buy generic Cialis online – order Cialis online no prescription

http://modafinilmd.store/# verified Modafinil vendors

Modafinil for sale: verified Modafinil vendors – modafinil legality

generic sildenafil 100mg: fast Viagra delivery – buy generic Viagra online

generic tadalafil [url=http://zipgenericmd.com/#]secure checkout ED drugs[/url] order Cialis online no prescription

affordable ED medication: secure checkout ED drugs – discreet shipping ED pills

https://maxviagramd.com/# Viagra without prescription

affordable ED medication: secure checkout ED drugs – secure checkout ED drugs

FDA approved generic Cialis: order Cialis online no prescription – best price Cialis tablets

Modafinil for sale [url=http://modafinilmd.store/#]safe modafinil purchase[/url] modafinil legality

buy modafinil online: modafinil 2025 – modafinil legality

http://zipgenericmd.com/# secure checkout ED drugs

order Cialis online no prescription: reliable online pharmacy Cialis – online Cialis pharmacy

fast Viagra delivery: discreet shipping – secure checkout Viagra

secure checkout Viagra [url=https://maxviagramd.com/#]order Viagra discreetly[/url] buy generic Viagra online

order Viagra discreetly: cheap Viagra online – best price for Viagra

https://maxviagramd.com/# same-day Viagra shipping

Amo Health Care: medicine amoxicillin 500mg – Amo Health Care

can you get clomid now: can i buy generic clomid now – can i order generic clomid price

amoxicillin 500mg pill [url=https://amohealthcare.store/#]Amo Health Care[/url] order amoxicillin online no prescription

PredniHealth: can you buy prednisone online uk – PredniHealth

https://prednihealth.com/# PredniHealth

can i order cheap clomid for sale: Clom Health – how to get generic clomid without dr prescription

where to buy prednisone uk: PredniHealth – prednisone 30

Amo Health Care [url=https://amohealthcare.store/#]medicine amoxicillin 500[/url] can i buy amoxicillin online

how can i get clomid for sale: Clom Health – can you get cheap clomid

http://clomhealth.com/# how to buy generic clomid without prescription

where buy generic clomid online: order cheap clomid without a prescription – how to get cheap clomid price

prednisone buy online nz: PredniHealth – prednisone ordering online

Amo Health Care: Amo Health Care – antibiotic amoxicillin

Amo Health Care [url=https://amohealthcare.store/#]buying amoxicillin online[/url] Amo Health Care

https://clomhealth.com/# clomid medication

cheap clomid now: can i get generic clomid price – can you buy generic clomid tablets

PredniHealth: PredniHealth – prednisone 1 mg tablet

how can i get generic clomid price: how to get cheap clomid tablets – where to buy generic clomid without prescription

https://prednihealth.shop/# PredniHealth

Amo Health Care [url=https://amohealthcare.store/#]amoxicillin order online[/url] order amoxicillin 500mg

PredniHealth: prednisone price canada – PredniHealth

amoxicillin 500 mg for sale: where can i buy amoxicillin over the counter – Amo Health Care

https://clomhealth.shop/# can i purchase cheap clomid without a prescription

Amo Health Care: amoxicillin cephalexin – Amo Health Care

PredniHealth [url=http://prednihealth.com/#]PredniHealth[/url] purchase prednisone no prescription

PredniHealth: PredniHealth – PredniHealth

http://clomhealth.com/# generic clomid prices

buy 10 mg prednisone: buy prednisone canada – prednisone 1 mg daily

PredniHealth [url=https://prednihealth.com/#]prednisone without prescription.net[/url] PredniHealth

Amo Health Care: amoxicillin 775 mg – buy amoxicillin online without prescription

https://clomhealth.com/# buy cheap clomid without prescription

amoxicillin 500 coupon: Amo Health Care – Amo Health Care

amoxicillin 500 mg purchase without prescription: amoxicillin over the counter in canada – Amo Health Care

clomid without a prescription [url=https://clomhealth.shop/#]Clom Health[/url] how can i get clomid without a prescription

is cialis covered by insurance: buy cialis tadalafil – cialis dosis

https://tadalaccess.com/# snorting cialis

cialis no perscrtion [url=https://tadalaccess.com/#]TadalAccess[/url] tadalafil 20mg canada

can you purchase tadalafil in the us: Tadal Access – cialis alternative

cialis cost at cvs: TadalAccess – cialis coupon walgreens

https://tadalaccess.com/# cialis daily dosage

cialis in las vegas [url=https://tadalaccess.com/#]Tadal Access[/url] cialis free trial

cialis 20mg: Tadal Access – cialis 10mg reviews

walgreen cialis price: Tadal Access – cialis effects

https://tadalaccess.com/# buy cialis overnight shipping

why does tadalafil say do not cut pile [url=https://tadalaccess.com/#]TadalAccess[/url] tadalafil best price 20 mg

how much does cialis cost with insurance: Tadal Access – how much does cialis cost at walmart

cialis and cocaine: how long does cialis stay in your system – cialis tadalafil & dapoxetine

https://tadalaccess.com/# walmart cialis price

cialis discount card: Tadal Access – cialis dapoxetine overnight shipment

cialis in canada [url=https://tadalaccess.com/#]TadalAccess[/url] great white peptides tadalafil

e20 pill cialis: Tadal Access – cialis what age

https://tadalaccess.com/# purchase cialis on line

cialis free trial offer: Tadal Access – cialis softabs online

cheap cialis pills [url=https://tadalaccess.com/#]cialis pills for sale[/url] cialis 5mg how long does it take to work

safest and most reliable pharmacy to buy cialis: TadalAccess – difference between tadalafil and sildenafil

https://tadalaccess.com/# cialis and adderall

cialis 20 mg duration: cialis dosage 40 mg – buy cialis no prescription overnight

tadalafil tablets 20 mg side effects [url=https://tadalaccess.com/#]evolution peptides tadalafil[/url] cialis generic release date

https://tadalaccess.com/# cialis mechanism of action

too much cialis: order cialis online no prescription reviews – cialis generic overnite

pregnancy category for tadalafil: cialis black 800 to buy in the uk one pill – where to buy generic cialis ?

cialis online no prescription australia [url=https://tadalaccess.com/#]TadalAccess[/url] cialis strength

https://tadalaccess.com/# ambrisentan and tadalafil combination brands

cialis online cheap: cialis pills online – erectile dysfunction tadalafil

https://tadalaccess.com/# overnight cialis delivery usa

does medicare cover cialis for bph: can you purchase tadalafil in the us – san antonio cialis doctor

buy generic tadalafil online cheap [url=https://tadalaccess.com/#]cialis professional 20 lowest price[/url] cialis windsor canada

sildenafil and tadalafil: when will generic tadalafil be available – tadalafil tamsulosin combination

https://tadalaccess.com/# how much is cialis without insurance

cialis side effects: buy cialis online overnight shipping – tadalafil generic cialis 20mg

purchasing cialis [url=https://tadalaccess.com/#]TadalAccess[/url] what is cialis pill

https://tadalaccess.com/# liquid tadalafil research chemical

buy cialis online reddit: TadalAccess – cialis super active

cialis overnight deleivery [url=https://tadalaccess.com/#]cialis with out a prescription[/url] best price on generic cialis

order cialis from canada: how to get cialis without doctor – tadalafil no prescription forum

https://tadalaccess.com/# side effects cialis

when should i take cialis: TadalAccess – cialis 20mg side effects

tadalafil and sildenafil taken together [url=https://tadalaccess.com/#]natural cialis[/url] cialis canada

why does tadalafil say do not cut pile: cialis sell – cialis definition

https://tadalaccess.com/# cialis pills online

buy cialis shipment to russia: cialis vs flomax for bph – cialis black review

is cialis covered by insurance: cialis for sale – cialis professional vs cialis super active

cialis vs flomax [url=https://tadalaccess.com/#]cialis slogan[/url] cialis advertisement

https://tadalaccess.com/# natural cialis

buy cialis online no prescription: canadian cialis no prescription – cialis delivery held at customs

tadalafil vs sildenafil: Tadal Access – where to get the best price on cialis

best price on cialis 20mg [url=https://tadalaccess.com/#]TadalAccess[/url] mambo 36 tadalafil 20 mg

https://tadalaccess.com/# cialis store in philippines

cialis canada sale: cialis goodrx – canadian cialis

levitra vs cialis: best place to get cialis without pesricption – cialis recreational use

what is cialis pill [url=https://tadalaccess.com/#]TadalAccess[/url] natural cialis

https://tadalaccess.com/# cialis generic timeline

where to buy cialis over the counter: Tadal Access – buy cialis on line

cialis generics: Tadal Access – when will generic cialis be available

cialis savings card [url=https://tadalaccess.com/#]when will teva’s generic tadalafil be available in pharmacies[/url] cialis coupon online

https://tadalaccess.com/# tadalafil 5mg generic from us

buy cialis generic online 10 mg: cialis meme – where can i buy cialis online

buy tadalafil cheap online: cheap generic cialis – buy generic cialis 5mg

https://tadalaccess.com/# buy cialis overnight shipping

maximpeptide tadalafil review [url=https://tadalaccess.com/#]sunrise pharmaceutical tadalafil[/url] cialis tadalafil tablets

cialis online without pres: cialis 5mg best price – what is the active ingredient in cialis

https://tadalaccess.com/# cialis recommended dosage

cialis side effect: Tadal Access – cialis cost per pill

cialis manufacturer coupon 2018 [url=https://tadalaccess.com/#]Tadal Access[/url] best time to take cialis 5mg

cialis wikipedia: Tadal Access – where can i get cialis

https://tadalaccess.com/# cialis for sale online in canada

cialis free samples: TadalAccess – buy tadalafil online canada

where to buy cialis in canada [url=https://tadalaccess.com/#]cialis 100 mg usa[/url] tadalafil hong kong

cialis effect on blood pressure: tadalafil medication – cialis for bph reviews

https://tadalaccess.com/# where to buy generic cialis

cipla tadalafil review: max dosage of cialis – buying cialis internet

difference between sildenafil and tadalafil: ordering tadalafil online – buy cialis online in austalia

tadalafil (exilar-sava healthcare) [generic version of cialis] (rx) lowest price [url=https://tadalaccess.com/#]how long before sex should i take cialis[/url] tadalafil best price 20 mg

https://tadalaccess.com/# purchase cialis on line

overnight cialis delivery: tadalafil liquid fda approval date – cialis generic

tadalafil and voice problems [url=https://tadalaccess.com/#]canada drugs cialis[/url] purchasing cialis online

https://tadalaccess.com/# cheap cialis 5mg

buy cialis generic online 10 mg: Tadal Access – cheap tadalafil no prescription

cialis for enlarged prostate: cialis back pain – what is cialis used to treat

buying cialis without prescription [url=https://tadalaccess.com/#]tadalafil 40 mg with dapoxetine 60 mg[/url] cialis professional vs cialis super active

https://tadalaccess.com/# cialis 100mg from china

cialis samples: Tadal Access – cialis reviews

where can i buy cialis over the counter: Tadal Access – cialis dopoxetine

cialis price walmart [url=https://tadalaccess.com/#]what are the side effects of cialis[/url] buying cialis generic

https://tadalaccess.com/# how to buy tadalafil online

cialis daily side effects: TadalAccess – cialis 20 mg tablets and prices

cialis free trial offer: cialis for bph reviews – taking cialis

what happens if a woman takes cialis [url=https://tadalaccess.com/#]Tadal Access[/url] cialis online paypal

https://tadalaccess.com/# over the counter cialis walgreens

cialis results: cialis male enhancement – cialis none prescription

cheap cialis canada: Tadal Access – cialis generic timeline 2018

where to buy liquid cialis [url=https://tadalaccess.com/#]tadalafil tablets 20 mg reviews[/url] cialis sublingual

https://tadalaccess.com/# tadalafil lowest price

cheapest 10mg cialis: TadalAccess – cheap tadalafil 10mg

generic cialis tadalafil 20mg reviews: ambrisentan and tadalafil combination brands – cialis 20mg

cialis no perscrtion [url=https://tadalaccess.com/#]Tadal Access[/url] prescription for cialis

cialis insurance coverage blue cross: cialis leg pain – cialis leg pain

san antonio cialis doctor: Tadal Access – cialis 20mg tablets

cialis side effects [url=https://tadalaccess.com/#]TadalAccess[/url] best price on generic tadalafil

https://tadalaccess.com/# tadalafil tablets 40 mg

cialis online paypal: buy cialis cheap fast delivery – order generic cialis online

cheap cialis: generic cialis from india – tadalafil ingredients

https://tadalaccess.com/# cialis free trial coupon

cialis manufacturer coupon free trial [url=https://tadalaccess.com/#]buy cialis toronto[/url] buy cialis in las vegas

cialis coupon walgreens: cialis information – tadalafil cheapest price

does cialis raise blood pressure: cheap cialis by post – does cialis really work

https://tadalaccess.com/# canada drugs cialis

buy cialis no prescription australia: generic tadalafil canada – cialis for daily use side effects

how long does cialis take to work [url=https://tadalaccess.com/#]Tadal Access[/url] order cialis from canada

cialis com coupons: Tadal Access – what is cialis tadalafil used for

buy cialis online australia pay with paypal: cialis super active plus – cialis pills

https://tadalaccess.com/# how long does tadalafil take to work

natural cialis [url=https://tadalaccess.com/#]when will generic cialis be available[/url] is tadalafil the same as cialis

how long does cialis take to work 10mg [url=https://tadalaccess.com/#]cialis online with no prescription[/url] paypal cialis no prescription

https://tadalaccess.com/# buying cialis online usa

cialis used for: Tadal Access – generic cialis

cialis online delivery overnight: TadalAccess – cialis online no prior prescription

cialis generic [url=https://tadalaccess.com/#]difference between sildenafil tadalafil and vardenafil[/url] cialis testimonials

https://tadalaccess.com/# tadalafil canada is it safe

active ingredient in cialis: cialis dosis – cialis tadalafil

tadalafil no prescription forum: special sales on cialis – does cialis shrink the prostate

cialis testimonials [url=https://tadalaccess.com/#]buying cialis in canada[/url] cialis free sample

cialis patent: purchase cialis online – how much tadalafil to take

https://tadalaccess.com/# cheap generic cialis

compounded tadalafil troche life span [url=https://tadalaccess.com/#]side effects of cialis tadalafil[/url] cialis samples

cialis coupon rite aid: where to buy tadalafil in singapore – cialis effect on blood pressure

https://tadalaccess.com/# cialis drug

best price on generic tadalafil [url=https://tadalaccess.com/#]TadalAccess[/url] cialis professional review

cialis male enhancement: how to get cialis without doctor – pictures of cialis

cialis buy online [url=https://tadalaccess.com/#]Tadal Access[/url] cialis generic timeline

https://tadalaccess.com/# cialis over the counter in spain

what does cialis do: TadalAccess – when does the cialis patent expire

cialis generic for sale: TadalAccess – cialis generic online

https://tadalaccess.com/# cialis difficulty ejaculating

buy tadalafil online paypal: how to get cialis for free – cialis sell

tadalafil medication [url=https://tadalaccess.com/#]Tadal Access[/url] tadalafil no prescription forum

https://tadalaccess.com/# can you purchase tadalafil in the us

side effects of cialis tadalafil: TadalAccess – cialis 20 mg how long does it take to work

tadalafil canada is it safe [url=https://tadalaccess.com/#]cialis australia online shopping[/url] cialis for pulmonary hypertension

cialis one a day with dapoxetine canada: TadalAccess – cialis drug class

https://tadalaccess.com/# tadalafil pulmonary hypertension

cialis dapoxetine europe [url=https://tadalaccess.com/#]cialis tadalafil tablets[/url] buy cialis online australia pay with paypal

cialis windsor canada: why is cialis so expensive – cialis mechanism of action

tadalafil online paypal [url=https://tadalaccess.com/#]TadalAccess[/url] teva generic cialis

https://tadalaccess.com/# cialis website

buying cialis online usa: pictures of cialis – sublingual cialis

Discount pharmacy Australia [url=http://pharmau24.com/#]Online drugstore Australia[/url] Pharm Au 24

low cost ed pills: Ero Pharm Fast – generic ed meds online

https://biotpharm.com/# antibiotic without presription

get antibiotics without seeing a doctor: buy antibiotics online – get antibiotics quickly

Over the counter antibiotics for infection: BiotPharm – buy antibiotics

Ero Pharm Fast: Ero Pharm Fast – online ed meds

buy antibiotics: Biot Pharm – Over the counter antibiotics for infection

cheapest antibiotics [url=https://biotpharm.shop/#]Biot Pharm[/url] best online doctor for antibiotics

Ero Pharm Fast: Ero Pharm Fast – Ero Pharm Fast

http://biotpharm.com/# buy antibiotics from india

online pharmacy australia: Pharm Au 24 – Medications online Australia

ed meds by mail: Ero Pharm Fast – Ero Pharm Fast

Ero Pharm Fast [url=https://eropharmfast.shop/#]Ero Pharm Fast[/url] erectile dysfunction drugs online

ed prescriptions online: Ero Pharm Fast – how to get ed pills

PharmAu24: Online medication store Australia – Online drugstore Australia

http://pharmau24.com/# Discount pharmacy Australia

http://biotpharm.com/# buy antibiotics from canada

PharmAu24: online pharmacy australia – online pharmacy australia

get antibiotics quickly: buy antibiotics online – Over the counter antibiotics for infection

buy antibiotics from india: buy antibiotics online – buy antibiotics for uti

Discount pharmacy Australia [url=https://pharmau24.com/#]Online drugstore Australia[/url] Pharm Au 24

erectile dysfunction medications online: cheapest online ed meds – cheapest ed pills

https://eropharmfast.shop/# Ero Pharm Fast

online pharmacy australia: pharmacy online australia – Discount pharmacy Australia

buy antibiotics from india: over the counter antibiotics – buy antibiotics for uti

Pharm Au24 [url=https://pharmau24.com/#]Online medication store Australia[/url] Pharm Au24

Online medication store Australia: online pharmacy australia – Licensed online pharmacy AU

get antibiotics quickly: Biot Pharm – over the counter antibiotics

buy antibiotics online [url=https://biotpharm.shop/#]BiotPharm[/url] cheapest antibiotics

buy antibiotics over the counter: cheapest antibiotics – buy antibiotics

buy antibiotics over the counter: buy antibiotics online – cheapest antibiotics

buy antibiotics [url=https://biotpharm.com/#]buy antibiotics online[/url] get antibiotics without seeing a doctor

Ero Pharm Fast: online ed pharmacy – Ero Pharm Fast

Licensed online pharmacy AU [url=https://pharmau24.shop/#]Pharm Au24[/url] Buy medicine online Australia

https://pharmau24.shop/# Licensed online pharmacy AU

Ero Pharm Fast: low cost ed medication – Ero Pharm Fast

Ero Pharm Fast [url=https://eropharmfast.shop/#]order ed meds online[/url] Ero Pharm Fast

Pharm Au 24: pharmacy online australia – online pharmacy australia

buy antibiotics [url=https://biotpharm.com/#]Biot Pharm[/url] over the counter antibiotics

https://pharmau24.com/# Medications online Australia

best ed meds online: Ero Pharm Fast – cheap erectile dysfunction pills

Online medication store Australia [url=https://pharmau24.com/#]online pharmacy australia[/url] Licensed online pharmacy AU

over the counter antibiotics: over the counter antibiotics – get antibiotics quickly

Ero Pharm Fast [url=https://eropharmfast.shop/#]Ero Pharm Fast[/url] Ero Pharm Fast

https://pharmau24.shop/# Online medication store Australia

Ero Pharm Fast: best online ed pills – Ero Pharm Fast

get antibiotics without seeing a doctor [url=https://biotpharm.shop/#]buy antibiotics online[/url] buy antibiotics from canada

Online drugstore Australia: Buy medicine online Australia – pharmacy online australia

pharmacie internet fiable France [url=http://pharmsansordonnance.com/#]commander sans consultation medicale[/url] pharmacie en ligne livraison europe

pharmacie en ligne pas cher: acheter medicaments sans ordonnance – pharmacie en ligne avec ordonnance

https://kampascher.com/# commander Kamagra en ligne

commander Viagra discretement: livraison rapide Viagra en France – Acheter du Viagra sans ordonnance

cialis prix: Cialis generique sans ordonnance – traitement ED discret en ligne

prix bas Viagra generique [url=http://viasansordonnance.com/#]Viagra generique en pharmacie[/url] Acheter du Viagra sans ordonnance

Cialis pas cher livraison rapide: vente de mГ©dicament en ligne – Cialis pas cher livraison rapide

pharmacie internet fiable France: pharmacie en ligne sans prescription – pharmacie en ligne france

livraison rapide Viagra en France: Viagra generique en pharmacie – commander Viagra discretement

pharmacie en ligne: pharmacie en ligne – pharmacie en ligne france livraison belgique

traitement ED discret en ligne [url=https://ciasansordonnance.com/#]acheter Cialis sans ordonnance[/url] cialis generique

https://pharmsansordonnance.shop/# pharmacie en ligne france pas cher

Meilleur Viagra sans ordonnance 24h: Prix du Viagra 100mg en France – acheter Viagra sans ordonnance

Acheter du Viagra sans ordonnance: Viagra sans ordonnance 24h – viagra en ligne

kamagra pas cher [url=https://kampascher.com/#]kamagra pas cher[/url] kamagra oral jelly

pharmacie en ligne sans prescription: pharmacie en ligne pas cher – Pharmacie en ligne livraison Europe

kamagra pas cher: kamagra livraison 24h – livraison discrète Kamagra

kamagra 100mg prix: commander Kamagra en ligne – kamagra 100mg prix

http://ciasansordonnance.com/# cialis sans ordonnance

commander sans consultation medicale [url=https://pharmsansordonnance.shop/#]pharmacie en ligne sans prescription[/url] vente de mГ©dicament en ligne

traitement ED discret en ligne: pharmacie en ligne – cialis prix

cialis sans ordonnance: cialis prix – Cialis sans ordonnance 24h

pharmacie en ligne sans prescription: commander sans consultation medicale – vente de mГ©dicament en ligne

pharmacie internet fiable France: pharmacie en ligne – pharmacie en ligne sans ordonnance

pharmacie en ligne sans ordonnance [url=https://pharmsansordonnance.com/#]pharmacie en ligne[/url] pharmacie en ligne france livraison belgique

kamagra pas cher: kamagra oral jelly – acheter kamagra site fiable

acheter Viagra sans ordonnance: Acheter du Viagra sans ordonnance – Viagra vente libre pays

https://pharmsansordonnance.com/# Pharmacie sans ordonnance

livraison discrète Kamagra: achat kamagra – kamagra pas cher

Pharmacies en ligne certifiees [url=https://pharmsansordonnance.shop/#]commander sans consultation medicale[/url] vente de mГ©dicament en ligne

Viagra pas cher livraison rapide france: commander Viagra discretement – Acheter du Viagra sans ordonnance

pharmacie en ligne: Médicaments en ligne livrés en 24h – pharmacie en ligne france pas cher

viagra en ligne: prix bas Viagra generique – acheter Viagra sans ordonnance

pharmacie en ligne pas cher [url=https://pharmsansordonnance.com/#]Pharmacies en ligne certifiees[/url] pharmacie en ligne pas cher

acheter medicaments sans ordonnance: Medicaments en ligne livres en 24h – pharmacie en ligne france livraison internationale

https://ciasansordonnance.shop/# pharmacie en ligne france fiable

pharmacie en ligne sans prescription: pharmacie en ligne france – acheter médicament en ligne sans ordonnance

pharmacie en ligne [url=http://kampascher.com/#]kamagra gel[/url] pharmacie en ligne france livraison belgique

Acheter Cialis: traitement ED discret en ligne – Cialis sans ordonnance 24h

viagra sans ordonnance: Quand une femme prend du Viagra homme – prix bas Viagra generique

cialis prix: Cialis générique sans ordonnance – commander Cialis en ligne sans prescription

commander Viagra discretement [url=https://viasansordonnance.shop/#]Viagra generique en pharmacie[/url] prix bas Viagra generique

acheter Cialis sans ordonnance: Cialis generique sans ordonnance – traitement ED discret en ligne

https://ciasansordonnance.shop/# cialis prix

Viagra générique en pharmacie: prix bas Viagra générique – Viagra sans ordonnance 24h

commander Cialis en ligne sans prescription: cialis sans ordonnance – cialis generique

Kamagra oral jelly pas cher [url=https://kampascher.com/#]acheter Kamagra sans ordonnance[/url] kamagra en ligne

prix bas Viagra generique: Viagra generique en pharmacie – Viagra generique en pharmacie

Kamagra oral jelly pas cher: acheter Kamagra sans ordonnance – pharmacies en ligne certifiГ©es

pharmacie en ligne [url=http://pharmsansordonnance.com/#]Pharmacie en ligne livraison Europe[/url] pharmacie en ligne france fiable

acheter Viagra sans ordonnance: acheter Viagra sans ordonnance – Viagra sans ordonnance 24h

https://viasansordonnance.shop/# viagra sans ordonnance

Acheter Cialis 20 mg pas cher: commander Cialis en ligne sans prescription – Acheter Cialis

Casino Check out our current and upcoming casino events and tournaments. Register for your tournaments, find event details and more. Play and earn entries all February for a chance to win a 2025 Infiniti® QX80! YAAS Vegas – Casino Slots Come test your skills at The Big Apple Arcade! We have some of the latest video & arcade games and some classics such as Skee-Ball, Air Hockey, and NBA Fever! Bring the family, or challenge your friends to a friendly competition. Learn More Experience the great indoors where the winning is wild, you can hunt down all the jackpots, and play naturally among friends. We’ve created an immersive experience unlike any other, with unique attractions, engaging entertainment, and a visit that leaves a “lodger”-than-life impression. “This exhibition isn’t just an ordinary art show—it’s a deep dive into the artistry, craftsmanship, and innovation that have made Cirque du Soleil synonymous with Las Vegas.

https://pontianakumroh.com/pak-aviator-exit-strategies-compared-by-roi/

We also analyse reviews submitted by Gambling members regarding their favourite welcome bonuses, gaining insights into why certain casino bonuses are preferred. Welcome bonuses, including online casino bonuses at Gamblizard Canada, can be anything from 50% to 500%. You should be wary of very high welcome bonuses because they come with very restrictive terms and conditions. A welcome bonus is very helpful when you are testing out a new casino, or learning a new game A welcome bonus, sometimes referred to as a sign-up bonus, is a reward new players receive when they sign up for a casino. Top US casinos like BetRivers, BetMGM, DraftKings, FanDuel, and Caesars Casino offer welcome bonuses to new players. Most often, these offers include a deposit match on your first deposit. For example, Caesars Palace Online Casino gives you a 100% deposit match up to $2,500. This means that if you deposit $2,500 the casino will match it, giving you a total of $5,000 to play with.

pharmacie internet fiable France [url=http://pharmsansordonnance.com/#]pharmacie en ligne sans prescription[/url] pharmacies en ligne certifiГ©es

cialis generique: cialis prix – Cialis sans ordonnance 24h

pharmacies en ligne certifi̩es: acheter kamagra site fiable Рkamagra en ligne

acheter kamagra site fiable: kamagra 100mg prix – kamagra pas cher

Cialis pas cher livraison rapide [url=https://ciasansordonnance.com/#]pharmacie en ligne[/url] Cialis generique sans ordonnance

cialis prix: cialis prix – cialis prix

http://viasansordonnance.com/# Viagra generique en pharmacie

acheter kamagra site fiable: acheter Kamagra sans ordonnance – acheter Kamagra sans ordonnance

viagra sans ordonnance [url=https://viasansordonnance.com/#]Le gГ©nГ©rique de Viagra[/url] commander Viagra discretement

Pharmacies en ligne certifiees: pharmacie en ligne sans prescription – pharmacie en ligne france livraison belgique

traitement ED discret en ligne: cialis sans ordonnance – Cialis sans ordonnance 24h

Cialis sans ordonnance 24h: Cialis pas cher livraison rapide – Acheter Cialis

acheter Kamagra sans ordonnance [url=https://kampascher.com/#]acheter Kamagra sans ordonnance[/url] achat kamagra

Cialis sans ordonnance 24h: cialis prix – cialis prix

https://pharmsansordonnance.com/# pharmacie en ligne pas cher

commander Kamagra en ligne: achat kamagra – kamagra pas cher

Viagra generique en pharmacie [url=https://viasansordonnance.com/#]Viagra generique en pharmacie[/url] Meilleur Viagra sans ordonnance 24h

Acheter du Viagra sans ordonnance: prix bas Viagra generique – Meilleur Viagra sans ordonnance 24h

commander Cialis en ligne sans prescription [url=https://ciasansordonnance.shop/#]commander Cialis en ligne sans prescription[/url] Cialis pas cher livraison rapide

Cialis pas cher livraison rapide: Cialis sans ordonnance 24h – Acheter Cialis 20 mg pas cher

commander Viagra discretement [url=https://viasansordonnance.com/#]commander Viagra discretement[/url] acheter Viagra sans ordonnance

https://viasansordonnance.shop/# Viagra sans ordonnance 24h

[url=https://mobile-mods.ru/]https://mobile-mods.ru/[/url] — это удивительная возможность повысить качество игры. Особенно если вы пользуетесь устройствами на платформе Android, модификации открывают перед вами новые возможности. Я нравится использовать игры с обходом системы защиты, чтобы получать неограниченные ресурсы.

Модификации игр дают невероятную возможность настроить игру, что взаимодействие с игрой гораздо красочнее. Играя с плагинами, я могу повысить уровень сложности, что добавляет приключенческий процесс и делает игру более эксклюзивной.

Это действительно захватывающе, как такие изменения могут улучшить игровой процесс, а при этом сохраняя использовать такие игры с изменениями можно без особых рисков, если быть внимательным и следить за обновлениями. Это делает каждый игровой процесс персонализированным, а возможности практически бесконечные.

Советую попробовать такие модифицированные версии для Android — это может вдохновит на новые приключения

cialis sans ordonnance: acheter Cialis sans ordonnance – Cialis sans ordonnance 24h

acheter medicaments sans ordonnance: pharmacie en ligne sans ordonnance – vente de mГ©dicament en ligne

Viagra homme sans prescription [url=http://viasansordonnance.com/#]Viagra sans ordonnance 24h[/url] viagra sans ordonnance

pharmacie en ligne sans prescription: Pharmacies en ligne certifiees – pharmacie en ligne livraison europe

Viagra sans ordonnance 24h [url=https://viasansordonnance.shop/#]Viagra gГ©nГ©rique pas cher livraison rapide[/url] commander Viagra discretement

https://viasansordonnance.com/# prix bas Viagra generique

Pharmacies en ligne certifiees: pharmacie en ligne sans prescription – п»їpharmacie en ligne france

Cialis generique sans ordonnance [url=https://ciasansordonnance.shop/#]cialis prix[/url] pharmacie en ligne france livraison belgique

pharmacie en ligne pas cher: pharmacie internet fiable France – Pharmacie Internationale en ligne

viagra commande [url=http://pharmacieexpress.com/#]nuxe huile seche[/url] fosfomycine pharmacie sans ordonnance

comprar adolonta sin receta: Confia Pharma – donde puedo comprar cytotec sin receta en espaГ±a

https://pharmacieexpress.shop/# mustela lait de toilette

prix consultation orl sans ordonnance: acide folique sans ordonnance pharmacie – ordonnance pharmacie en ligne

el parche anticonceptivo se puede comprar sin receta [url=http://confiapharma.com/#]semaglutida comprar sin receta[/url] se puede comprar tamsulosina sin receta

ordonnance antidГ©presseur: achat tadalafil 10 mg – kardegic sans ordonnance en pharmacie

rhinomer farmacia online: condrosan farmacia online – diflucan farmacia online

https://farmaciasubito.shop/# emmarin spray

farmacia online melilla: que antibiГіtico puedo comprar sin receta en mГ©xico – comprar cosmetica farmacia online

ginoden prezzo [url=http://farmaciasubito.com/#]plaunac 20[/url] decapeptyl 3.75

quoi prendre pour une cystite sans ordonnance: achete viagra – cialis 5 mg prix

comprar rubifen farmacia online: auxiliar de farmacia gratis online – comprar primperan sin receta

ordonnance substitut nicotinique [url=http://pharmacieexpress.com/#]Pharmacie Express[/url] skinceuticals blemish

permixon 160 se puede comprar sin receta: fucidine se puede comprar sin receta – fortacin comprar sin receta

https://farmaciasubito.com/# senshio compresse prezzo

pharmacie otite sans ordonnance: Pharmacie Express – peut on acheter du cialis sans ordonnance en pharmacie

farmacia online siracusa: ausilium miao – ozempic dove trovarlo

mutabon mite: farmacia dr max bologna – deltacortene 5 mg prezzo senza ricetta

roger cavailles savon: cytotec sans ordonnance en pharmacie – produit pour bander en pharmacie sans ordonnance

arcoxia se puede comprar sin receta: farmacia online mascarilla ffp2 – que farmacia online me recomiendan

eutirox 25 se puede comprar sin receta [url=http://confiapharma.com/#]Confia Pharma[/url] cialis generico online farmacia italiana

http://confiapharma.com/# farmacia online envГo canarias

comprar omifin sin receta en espaГ±a: farmacia online vecindario – se puede comprar lorazepam sin receta espaГ±a

universitГ farmacia online: colpotrophine crema prezzo – farmacia orlando

farmacia via curie: benu farmacia – diamox occhi

farmacia online santander [url=https://confiapharma.com/#]comprar viagra sin receta valencia[/url] ciclo formativo farmacia online

voir un cardiologue sans ordonnance: viagra femme pharmacie sans ordonnance – antibiotique pour mst sans ordonnance

farmacia rego lodos online [url=https://confiapharma.com/#]levotiroxina comprar sin receta[/url] farmacia soccavo vendita online

se puede comprar furacin sin receta: Confia Pharma – acido tranexamico comprar sin receta

gactos de farmacia online gratis: la pregabalina se puede comprar sin receta – wegovy comprar sin receta

Ecco come gli sviluppatori descrivono questi contenuti: Bubble Shooter Golden Football © Lagged 2025 Seguici su YouTube Perhaps try another search? Strike Football Sports Game I minigame sono i più piccoli giochi di Orchard Toys, di dimensioni compatte e portatili, perfetti per la casa o per quando si è fuori casa. Sono anche la soluzione ideale come paghetta, come piccoi regali di compleanno, come riempitivi per le calze della Befana e come pensierini per altre ricorrenze. 118 Agias Fylaxeos Str., 3087 Limassol, Cyprus 0 out of 5 stars L’RTP di Penalty Shoot-out è pari al 96%, uguale al nostro parametro di riferimento medio che, per l’appunto, è pari al 96% circa. Seleziona la tua squadra dall’elenco, quindi sfida ciascuna delle altre squadre ai rigori! Scegli l’angolo di tiro e la potenza quando cerchi di segnare, oppure preparati a provare a parare le reti quando giochi con il portiere. Prova a scalare le classifiche e guida la tua squadra al campionato.

https://panrc.org/valutazioni-degli-utenti-sulla-demo-della-slot-aviator/

Simple UI and Controls – The game interface allows players to use the joystick to make their game better and faster. With this simple interface, you have the bottom left and bottom right controls. Enjoy smart dribbling with these simple controls. Run away from all defenders and use epic footwork! Without many compromises, you can use nimble dribbling shortcuts and beat your opponents with ease and without breaking a sweat. Automatically pay the ferry ticket to cross the Strait of Messina, without going through the ticket office or leaving your vehicle. Un ottimo strumento per aumentare le possibilità di vincita a Penalty Shoot Out Street saranno i bonus. Ecco alcuni consigli per coloro che intendono partecipare alle promozioni del casinò: Gooood game Really good Seguici su YouTube Streaming Community

http://confiapharma.com/# se puede comprar naproxeno sin receta en espaГ±a

comprar anillo anticonceptivo sin receta [url=https://confiapharma.com/#]Confia Pharma[/url] comprar canesten sin receta

peut on acheter alli en pharmacie sans ordonnance: tramadol 50 sans ordonnance – lacrifluid unidose

brosse a dent inava sensibilitГ© 18/100: rage de dent medicament sans ordonnance – misoprostol sans ordonnance pharmacie

farmacia online spedra [url=http://confiapharma.com/#]farmacia online sin pedido minimo[/url] farmacia online medina sidonia

songar gocce a cosa serve: panacef sciroppo alla fragola prezzo – effetti collaterali cortisone cane anziano

bonbon coupe faim: Pharmacie Express – infection urinaire pharmacie sans ordonnance

soldesam punture [url=https://farmaciasubito.shop/#]mederma controindicazioni[/url] rifadin 300 prezzo

http://confiapharma.com/# glutaraldehido farmacia online

attelle genou pharmacie sans ordonnance: alprazolam mylan sans ordonnance – ordonnance ecbu

cialis a vendre: generique pilule jasmine – cialis pharmacie en ligne avec ordonnance

se puede comprar alprazolam sin receta [url=https://confiapharma.com/#]comprar yurelax sin receta online[/url] comprar elvanse sin receta

farmacia online economica: alamut farmaco – calmacid reflusso

http://farmaciasubito.com/# farmacia montemerlo

dicloreum 150 mg prezzo senza ricetta [url=http://farmaciasubito.com/#]busette cerotto[/url] meloxidyl gatto

se puede comprar zyntabac sin receta: farmacia en leon online – farmacia online tres cantos

dГ©livrance monuril sans ordonnance: traitement pour infection urinaire sans ordonnance – un pharmacien peut il faire une ordonnance

wellbutrin 150 mg prezzo: diprosalic soluzione cutanea – triasporin sciroppo

farmacia online ventolin [url=https://confiapharma.shop/#]farmacia online piedra de alumbre[/url] farmacia benidorm online

comprar fluoxetina sin receta en espaГ±a: Confia Pharma – la morfina se puede comprar sin receta

tadalafil 5mg boГ®te 28 prix: peut on acheter des seringues en pharmacie sans ordonnance – millepertuis pharmacie sans ordonnance

spirale benilexa recensioni [url=http://farmaciasubito.com/#]circadin 2 mg vendita online[/url] intrafer gocce acquisto online

http://confiapharma.com/# comprar finasteride 1mg sin receta

lybella pillola prezzo: clexane 4000 prezzo – farmacia online affidabile

lyrica 25 prezzo: Farmacia Subito – pentacol 500 gel rettale per emorroidi prezzo

plenvu prezzo [url=http://farmaciasubito.com/#]bentelan per cani[/url] farmacia accademia livorno

fluimucil 500 aerosol prezzo: monuril senza ricetta – halcion 125

consulter orl sans ordonnance: antibiotique dentaire sans ordonnance – augmentin sans ordonnance en pharmacie

spedra 200 mg prix pharmacie [url=https://pharmacieexpress.shop/#]mГ©dicament angine sans ordonnance[/url] acheter viagra gГ©nГ©rique

https://farmaciasubito.shop/# sildenafil teva

comprar tadalafilo 5 mg sin receta: farmacia online como – cupones farmacia online barata

aripiprazolo 5 mg prezzo: desloratadina 5 mg prezzo – sirdalud 2 mg prezzo mutuabile

ducray kelual ds shampooing [url=http://pharmacieexpress.com/#]Pharmacie Express[/url] homГ©opathie en pharmacie sans ordonnance

seroquel 25 mg prezzo: cortison chemicetina prezzo – travosept crema prezzo

cicaplast levre [url=http://pharmacieexpress.com/#]gel erГ©ctil en pharmacie sans ordonnance[/url] ventoline en pharmacie sans ordonnance

online pharmacy ordering: mexican tramadol brands – the mexican pharmacy online reviews

modafinil mexican pharmacy: Pharm Mex – mexican veterinary pharmacy

http://pharmmex.com/# mexican steroids online

legit online mexican pharmacy [url=https://pharmmex.shop/#]Pharm Mex[/url] order antibiotics from mexico

[url=https://mobile-mods.ru/]https://mobile-mods.ru/[/url] — это отличный способ расширить функциональность игры. Особенно если вы играете на Android, модификации открывают перед вами огромный выбор. Я нравится использовать игры с обходом системы защиты, чтобы наслаждаться бесконечными возможностями.

Модификации игр дают невероятную свободу в игре, что делает процесс гораздо увлекательнее. Играя с плагинами, я могу добавить дополнительные функции, что добавляет виртуальные путешествия и делает игру более захватывающей.

Это действительно удивительно, как такие моды могут улучшить взаимодействие с игрой, а при этом сохраняя использовать такие модифицированные приложения можно без особых рисков, если быть внимательным и следить за обновлениями. Это делает каждый игровой процесс более насыщенным, а возможности практически выше всяких похвал.

Рекомендую попробовать такие игры с модами для Android — это может вдохновит на новые приключения

u s a online pharmacy: Pharm Express 24 – target pharmacy fluoxetine

online pharmacy in india: InPharm24 – sun pharmacy india

drugs from india [url=https://inpharm24.com/#]medicines online india[/url] b pharmacy fees in india

AebgtydaY: Pharm Express 24 – online pharmacy spironolactone

https://pharmexpress24.com/# dextroamphetamine online pharmacy

24 hours pharmacy [url=https://pharmexpress24.com/#]Pharm Express 24[/url] accurate rx pharmacy columbia mo

mail order pharmacy india: online pharmacy no presc – boots online pharmacy doxycycline

mexican pharmacy adderall online: american pharmacy online – your mexican pharmacy

abilify pharmacy coupon: Pharm Express 24 – mail order pharmacies

india online pharmacy market [url=http://inpharm24.com/#]list of pharmacies in india[/url] india pharmacy no prescription

pharmacy website in india: top online pharmacy in india – medicine delivery in vadodara

pharmacy products online: united states online pharmacy – ozempic mexican pharmacy

https://pharmexpress24.shop/# rx good neighbor pharmacy

zocor pharmacy protocol: Pharm Express 24 – cipro pharmacy

can you buy oxycodone in mexico [url=http://pharmmex.com/#]vyvanse mexican pharmacy[/url] ordering antibiotics online

india pharmacy market: overseas pharmacy india – india drug store

how to buy viagra at pharmacy: allegra at kaiser pharmacy – provigil pharmacy online

e pharmacy in india: InPharm24 – india online pharmacy

wegovy mexico pharmacy online: tulum pharmacy – metformin mexican pharmacy

mexican pills [url=https://pharmmex.com/#]is prednisone available over the counter in mexico[/url] how to get ozempic from mexico

https://pharmexpress24.shop/# tegretol online pharmacy

viagra generic online pharmacy: solutions rx pharmacy – pharmacy rx one

dexamethasone iontophoresis pharmacy: Sporanox – cyproheptadine online pharmacy

motilium uk pharmacy [url=https://pharmexpress24.com/#]Pharm Express 24[/url] provigil internet pharmacy

online india pharmacy: reliable pharmacy india – online pharmacy in india

giant eagle pharmacy: Pharm Express 24 – propecia proscar men’s pharmacy

tirzepatide in mexico price: Pharm Mex – mexican pharmacy anabolic steroids

buy adderall in cancun [url=https://pharmmex.com/#]trazodone in mexico[/url] advair mexican pharmacy

https://pharmmex.com/# wegovy mexico pharmacy online

online pharmacy no prescription viagra: solutions rx pharmacy – coumadin pharmacy

online pharmacy misoprostol: mobile rx pharmacy – rx pharmacy viagra

buy wegovy online mexico [url=https://pharmmex.shop/#]buying drugs in mexico[/url] medicine from mexico

valtrex pharmacy online: india pharmacy online – isotretinoin pharmacy price

AI, Human psychology, and color theory, these three things, have a major role in color prediction game development. If you wisely use it, you can take your color prediction game to the front line of this gaming industry. A color prediction game is an app or website that allows players to double their money by correctly guessing the color. Red, Green, and Violet are the only colors in the game that may be guessed. Each prediction takes three minutes. Therefore, in order to receive awards or actual money, one must correctly guess the following color Select Language: Now we are going to give you Colour prediction games list which save your lots of time & by playing below games you can predict, play & win cash daily. Do you need help deciding which platform to use for color prediction games? This article addresses your dilemma by presenting the top 3 best color prediction games: Cooe, Mantrimalls, and Joymall. These platforms offer easy ways to start your online earning journey by investing a minimal amount.

https://documenthow.com/master-the-game-with-888-bet-login-aviator-in-malawi-a-players-review/

A digital adaptation of a classic card game And in this you will also get a bonus on game play. The more games you play, the more bonus you will get, which you can claim and use in playing the game or can also transfer it to your bank account. The developers regularly update the app with new features, game modes, and improvements based on player feedback to make the game better. 2. Dragon V s Tiger – Friends, Dragon V s Tiger is such a game in which there are three types of slots, the one with the biggest slot is the winner, in which 2 players get 2 times the money and 1 player gets 9 times the money. First of all, click on the download button given in the article, as soon as you click on the download button, you will be redirected to the official website of the application, there you will find the download option, click on it.

india pharmacy of the world: buy medicines online india – list of pharmacies in india

buy medicine online [url=https://inpharm24.shop/#]buy medicines online in india[/url] e pharmacy in india

best online pharmacy in india: buy medicine online in india – cheap online pharmacy india

tramadol de mexico: order medications online – mexican pharmacy that ships to the us

mexican pharmacy alprazolam [url=http://pharmmex.com/#]tijuana pharmacies[/url] cheap drugs online

buy viagra online cheap no prescription: VGR Sources – online viagra usa

cheap viagra on line: sildenafil 20 mg brand name – viagra generic otc

where can i buy viagra online in india: viagra super active plus – viagra generic coupon

buy brand viagra online canada [url=https://vgrsources.com/#]VGR Sources[/url] sildenafil 100 mg tablet usa

where to get female viagra: 400 mg sildenafil – viagra uk pharmacy

where to buy viagra online in india: generic viagra from us – generic viagra pills online

viagra without prescriptions: VGR Sources – how to buy viagra online safely

sildenafil order without prescription [url=https://vgrsources.com/#]VGR Sources[/url] female viagra tablet price

sildenafil 100mg cost: VGR Sources – viagra rx price

women viagra online no prescription: sildenafil 25 mg buy – viagra 150 mg

https://vgrsources.com/# viagra price online india

viagra pills from india: female viagra cream – cheapest sildenafil 100 mg uk

how to buy sildenafil online usa [url=https://vgrsources.com/#]viagra 100mg price in india online[/url] sildenafil 50 mg india online

average cost sildenafil 20mg: VGR Sources – cheap viagra 100mg tablets

how to get viagra prescription australia: VGR Sources – buy cheap viagra from india

female viagra price in india: VGR Sources – best viagra pills online

sildenafil prices in canada [url=https://vgrsources.com/#]sildenafil for sale usa[/url] india viagra online

25mg viagra: sildenafil citrate australia – order generic viagra online usa

generic viagra over the counter canada: where can i get viagra over the counter – sildenafil tablets for sale

https://vgrsources.com/# 200 mg viagra for sale

can i buy viagra over the counter in south africa: sildenafil citrate 50 mg – buy viagra brand

viagra pills for sale uk: sildenafil citrate buy – buy viagra online discount

generic otc viagra [url=https://vgrsources.com/#]generic viagra sold in united states[/url] daily viagra

sildenafil 5 mg tablet: viagra pills canada – price of 50mg viagra

sildenafil 100 mg tablet coupon: VGR Sources – viagra-50mg

how safe is viagra: generic viagra pills cheap – viagra generic viagra

i want to buy viagra [url=https://vgrsources.com/#]where can you buy real viagra online[/url] pharmacy viagra price

female viagra for sale uk: canadian pharmacy viagra no prescription – order sildenafil 100mg

https://vgrsources.com/# price of viagra 100mg in india

sildenafil women: viagra 2019 – best sildenafil prices

online canadian pharmacy viagra: sildenafil 680 – buying viagra nz

otc viagra 2018 [url=https://vgrsources.com/#]VGR Sources[/url] can i buy viagra online in australia

female viagra pill buy online canada: VGR Sources – buy sildenafil generic online

viagra 250 mg: where can i get viagra tablets – sildenafil online canada

where can i purchase viagra online: sildenafil india paypal – viagra price in india online

viagra tablets over the counter: generic viagra india pharmacy – purchase female viagra online

canadian pharmacy viagra 200 mg [url=https://vgrsources.com/#]VGR Sources[/url] best price for viagra 100 mg

https://vgrsources.com/# where can i buy sildenafil online safely

discount generic viagra india: price of 50mg viagra – buy viagra hong kong