Presented by our partner Crystallize Analytics

Introduction

Preparing adjusting entries often involves a lot of journal entries, staff input and tedious work. This common pain point can be avoided with the use of adjustment-only secondary ledgers in Oracle® E-Business Suite (EBS). As a more efficient processing of adjustments, adjustment ledgers reflect only adjustments without affecting your primary ledger, allowing entries to be made discretely. This whitepaper explores the benefits of using adjustment ledgers, complete with a step-by-step setup guide.

The Challenges of Adjusting Journal Entries

Companies spend significant time and effort both when implementing and on a continual basis to ensure that their ERP provides a consistent, complete, and correct record of financial position and results. Most ERPs provide a robust set of application controls and workflow options to ensure that transactions and balances, as they relate to routine data processes, are free from errors and have the necessary transparency for processes such as order-to-cash and procure-to-pay, these controls and workflow options are very effective. However, the wrench in the works for many companies is caused by adjusting journal entries.

Adjusting journal entries are an essential part of the financial reporting process. However, due to the non-routine nature of these types of entries, adjusting journal entries are more likely to contain errors, circumvent the routine data processing controls, impede system transparency, and can incur additional audit effort.

Most ERPs now have the ability to create secondary ledgers and aggregate those secondary ledgers with the primary ledger for audit and reporting. These secondary ledgers provide the opportunity to close the primary ledgers while adjustments are still being made. Previously, the only real options for adjusting journal entries were to make the entries directly to the primary ledger, requiring the ledger period be left open until all adjustments were made, or if a company had defined adjusting periods on its calendar, then the normal period could be closed with the adjusting entries being made to the primary ledger in a discrete period. While the second solution of using adjusting periods is better, it still doesn’t solve many of the problems associated with adjusting journal entries.

Adjustment Only Secondary Ledgers – An Overview

Adjustments only secondary ledgers do not maintain a complete accounting picture but instead only reflect adjustments. This is a very useful type of secondary ledger because it allows entries to be made discretely and to be provided to management and/or auditors as a separate ledger. This allows for a very high level of transparency of adjustments made. It can act, in essence, as a new control level by which entries can be made by staff level accountants, approved by line level accounting supervisors, but then accumulated in the adjustments only secondary ledger for final high level management approval in aggregate. Then to obtain a full secondary accounting representation, the secondary ledger can be consolidated with the primary ledger prior to report generation or an audit. The adjustments only secondary ledger allows a soft close of the primary ledger within a very short period of time, and segregates the adjusting entries so that the finance team and the auditors can quickly identify anomalies, inconsistencies, and potential risks without impacting the day-to-day operations and the close of the primary books.

Using Oracle E-Business Suite (EBS), this is how it works:

- Define your primary ledger and its related secondary ledgers. The secondary ledger may have a different currency, chart of accounts, calendar, or accounting method.

- Specify the ledger attributes for the primary ledger.

- Assign one or more secondary ledgers to each primary ledger for an accounting setup.

- Specify the ledger attributes for one or more secondary ledgers (optional).

- Assign one or more reporting currencies (optional).

- Define Create Accounting Rules to map the transactions that post to your primary ledger to transactions in your secondary ledgers.

- The secondary ledgers assigned can only perform the accounting for the legal entities within the same accounting setup.

- Note: If an additional ledger is needed to perform accounting across legal entities or ledgers in different accounting setups, use a ledger in an accounting setup with no legal entity assigned. This can be used for multiple purposes, such as performing management reporting or consolidation across multiple legal entities.

- When accounting is created, the journal entries are automatically generated for all of the associated secondary ledgers based on the defined mapping rules from the primary ledger to the secondary ledgers.

The Adjustments Only Secondary Ledger addresses a long-standing internal control concern that manual journal entries that have been made directly to the general ledger are commingled with the automated, routine journal entries flowing from subledgers or other automated sources. This causes problems such as poor transparency, reconciliation difficulties, and difficulty monitoring critical Sarbanes-Oxley (SOX) Section 404 controls.

Solving the Problems of Adjusting Journal Entries Using Adjustments Only Secondary Ledgers and Ledger Sets

As discussed at the beginning of the whitepaper, adjusting journal entries create several problems. So how does the use of adjustments only secondary ledgers address these problems

Ideally, your primary ledger should only contain data and balances that have assurance of correctness due to the underlying routine data processing controls, and only correcting entries that are made at the sub-ledger or detail level. As an example, accounts payable balances and related expense entries in the primary ledger should only contain entries that results from the normal day-to-day processing of bills which is assured with regard to correctness by controls such as the three-way match (i.e., a vendor invoice must be supported by a purchase order and a receiving confirmation). In this way, you do not circumvent the routine data processing controls. By avoiding making adjusting entries directly to your primary ledger, drill down from the primary ledger to the underlying transaction detail and roll up from the transaction detail to the primary ledger is always maintained – the definition of system transparency.

Distinct from correcting entries, which should be made directly to the primary ledger, adjusting journal entries should not be made directly to the primary ledger. To explain, adjusting journal entries are intended to ensure revenues and expenses match to the proper period. This action results in a correct net income because the revenues earned are matched with the expenses incurred within the period. This is the basis for accrual accounting under GAAP ‐‐Generally Accepted Accounting Principles.

Adjusting journal entries are of two types: accruals and deferrals. Accruals are amounts for either expenses incurred for which the vendor has not invoiced or, in rare cases, revenue earned that has not been billed. Deferrals are entries made to ensure that revenue is not recognized before it is earned (i.e., a full annual membership payment received in January must be deferred and then recognized over the year.) or that expenditures are not recognized early (i.e., an annual insurance premium that is paid at the beginning of the year should be recognized evenly over the year).

In the past, deferred income was booked to the primary ledger at the end of each reporting period, and then reversing entries were made at the beginning of the next reporting period to make reconciliation of sales activity and AR subledger to revenue easier. Because the deferral entries were manual and supported externally, either through spreadsheets or another external tool, errors were more likely. The two most common errors that occur are spreadsheet formula errors, keying errors, and errors caused by getting out of synch with the primary ledger. To be sure, there are tools that help avoid spreadsheets errors, but it is important to recognize that by their nature, spreadsheets are subject to human error.

However, an adjustments only secondary ledger can eliminate the need to book and reverse those entries to the primary ledger. Instead, the adjustment is booked to the adjustment only secondary ledger. Then the adjustments are not reflected in the primary ledger and no reversing entries are required. For reporting, the adjustment ledger is combined with the primary ledger through consolidation (or in Oracle EBS – ledger sets), resulting in an adjusted trial balance without disruption to processing in the primary ledger.

Through the proper use of secondary ledgers, manual errors in the primary ledger are minimized or eliminated entirely. Then separate controls around the deferral adjusting entry process can be established to further eliminate the likeliness of errors. Some of these controls might be review and approval requirements or better yet, the automation of the deferral entries by linking the adjustments only ledger to the appropriate sub-ledger.

The adjustment only secondary ledger also gives one ledger for auditors to use and for supervisory approvers to review. This is ideal for enhancing transactional controls, but an even better benefit is that it can reduce audit time. Each year, external auditors do a general controls review around a company’s ERP system. Based upon that review, a decision is made regarding whether to try to rely on the routine data processing controls. If the auditor decides to try to rely, they will perform tests of system controls specifically as they related to routine processes such as order-to-cash and procure-to-pay. If the auditor can get to an assessment of effective-rely, then the amount of audit effort related to testing potentially hundreds of transactions and balance is significantly reduced. What this potentially could mean is that audit time spent in your primary ledger will be minimized. By segregating adjusting journal entries to an Adjustments Only Ledger, the auditors can focus on the adjusting journal process discretely with an emphasis on review and approval controls. In short, using a secondary ledger can avoid incurring additional audit effort.

Using Adjustments Only Secondary Ledger can help avoid circumventing the routine data processing controls, impeding system transparency, the likelihood of errors and incurring additional audit effort. However, the true power of Adjustments Only Secondary Ledgers is only realized when you begin using them in conjunction with a consolidation ledger or in Oracle EBS, a ledger set.

Solving the Problems of Adjusting Journal Entries Using Adjustments Only Secondary Ledgers and Ledger Sets – An Example

In general, most companies have good controls established around the routine data processing of transactions that flow up from the subledgers, such as accounts payable and accounts receivable transactions, but the same controls do not necessarily exist for manual journal entries. Instead, review and approval of journal entries is the most common control. But for any control to be effective, it is essential that the efficacy of that control is easily able to be monitored. When manual journal entries blend in with automated entries, such monitoring is impaired. Having a discrete, adjustments-only secondary ledger provides the ability to have only the routine, automated entries in the primary ledger with no manual journal entries allowed or needed. Then, any manual entries are booked to the Adjustments Only Secondary Ledger where they are easily monitored and have complete transparency.

Take, for example, the case of deferred revenue. A company books its sales as invoiced in the Accounts Receivable subledger. However, under GAAP rules, if the company had a service commitment for a period extending beyond the close of the reporting period, then an entry would have been made to defer part of the revenue or to reverse previously deferred revenue as income. This is a critical revenue recognition matter, and based on experience, one that your auditors will likely examine closely while testing revenue deferrals and also prior to making conclusions on the controls around revenue recognition. Prior to the Adjustments Only Secondary Ledger feature, analysis of the general ledger transactions had to be carried out to bifurcate the deferral entries from the automated subledger entries — a time-consuming process.

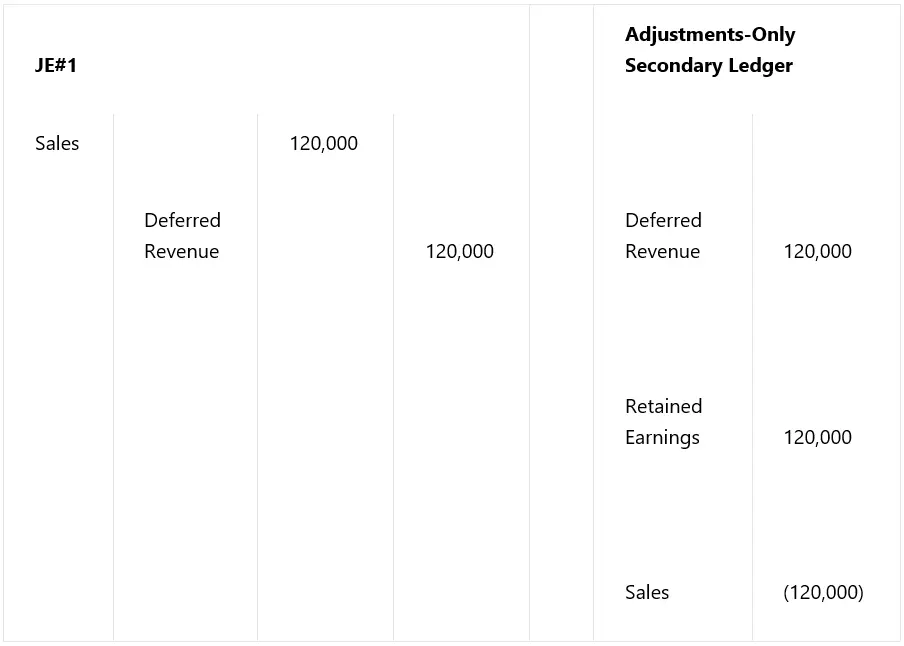

With the Adjustments Only Secondary Ledger, instead of booking the adjustments directly to the primary ledger, the adjustments are booked to the secondary ledger. For example, let’s say fictitious Company A determined that $120,000 in revenue needed to be deferred (revenue recognition deferral) because installation had not been completed (an open service ticket). With the adjustments only secondary ledger, if this was the only adjustment, the ledger would look like this:

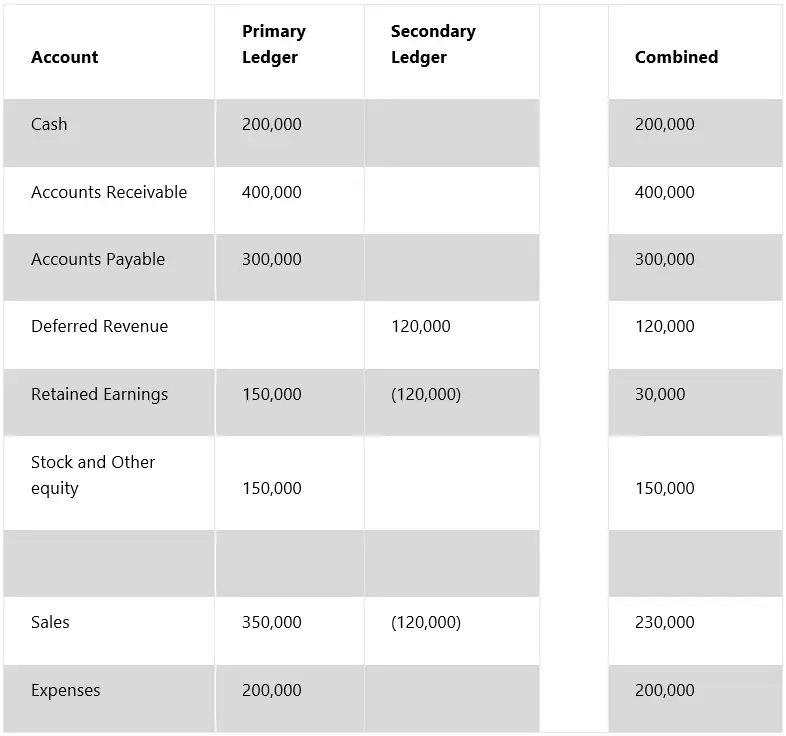

Now to report financial results, the adjustments only secondary ledger is consolidated to the primary ledger and then a combined report is generated. The result is as follows:

The result is that the non-automated journal entries are segregated into a separate Adjustments Only Secondary Ledger, ideally with the accountants’ (who do manual type entries) user permissions prevented from making entries into the primary ledger. This way, monitoring of these critical entries is simple, and the SOX 404 controls around the automated entries can be more easily tested and concluded upon.

Secondary ledgers allow a company to meet varied reporting needs. If there is a single global chart of accounts and a single global calendar and a single EBS instance, companies can leverage a single source of truth that includes transparency into all transactions from the primary ledger to the secondary ledgers as well as full drill-down capability to the subledgers. That means that there is consistency of reported information across business units and reduced effort for management reporting, maintenance, and reconciliation.

Conclusion

Using an Adjustments Only Secondary Ledger streamlines the close process by allowing a quick close of the automated accounting entries to the General Ledger generated by subledgers (Payables, Receivables, etc.) and allowing the accounting team to focus time and resources on the more difficult-to-close manual journal entries and adjustment entries. Segregating the adjustment entries allows better controls, cost reduction, and mitigation of risk while improving internal controls benefiting auditors and finance professionals alike.