Data protection and security protocols have become more robust in the last two decades. This has been driven both by increasing incidents of data breaches – statutorily acts such as the EU General Data Protection Regulation (GDPR), the Gramm-Leach- Bliley Act, Health Information Technology for Economic and Clinical Health (HITEVH) Act, Health Insurance Portability and Accountability Act (HIPAA), and the Fair and Accurate Credit Transactions Act – and by the Payment Card Industry Security Standard, to name just a few drivers. In general, most entities have implemented strong safeguards to ensure that issues such as inadvertently sharing identifying information with third parties and the existence of sensitive data (credit/procurement card numbers, tax IDs, social security numbers, vendor/customer bank account numbers, etc.) for their current and active data are addressed.

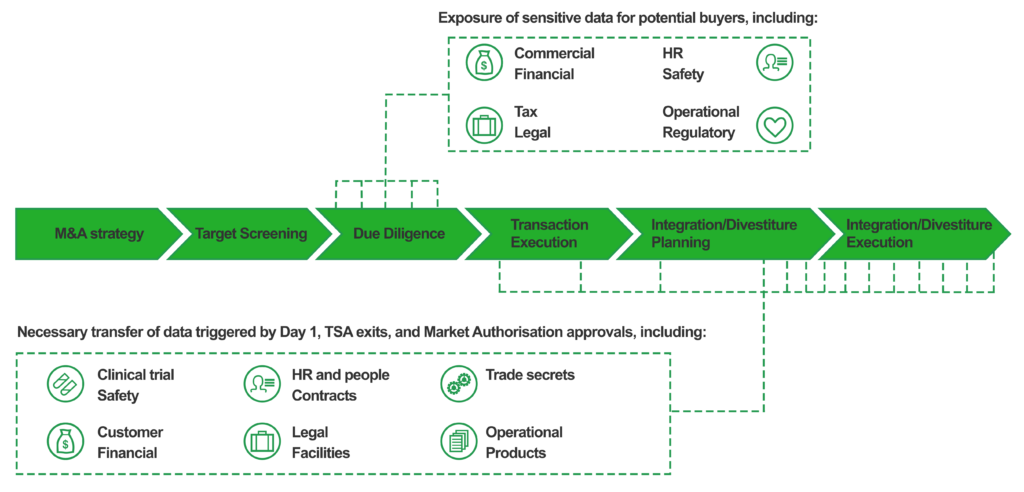

Though these measures have become more commonplace, the threat of cybercrime and data breaches is unfortunately still on the rise. Cybesecurity Ventures, a cybercrime magazine, estimates that cybercrime will cost approximately $10.5 trillion per year on average by 2025, up from $6 trillion in 2021. IBM estimates the average cost of a data breach for a company is $4.24 million per incident. This figure covers detection, containment, revenue loss and equipment damage, but there are also unspecified irreversible losses to the company’s reputation and goodwill. Even more worrisome during merger, acquisition, or divestiture activity is loss of intellectual property, the impact of operational disruption, and the costs of regulatory compliance. The below figure from Deloitte illustrates typical points in the M&A lifecycle that are dependent on data transfer, putting the involved companies at increased risk of cybersecurity threats:

These threats are more likely to arise when a company has legacy or inactive ERP data. Prior to the enhanced security protocols of the last two decades, it was common practice to put sensitive data into an ERP system’s unsecured fields, such as memo and descriptive fields, or in otherwise re-purposed fields. As a result, much legacy data does not meet privacy and security standards. This risk can be managed without having the expense of a hygienic data purge when the legacy data is buttressed by access controls. The biggest risk is when a third party is given access to or possession of either a portion or clone of an existing ERP instance. This most commonly occurs in divestiture or partial divestiture situations.

In fact, it’s been speculated that undergoing complicated large-scale business changes (like a divestiture, an acquisition or a merger) opens an enterprise up as an easier target for a security breach because of infrastructure changes and limited resource allocation. This is an especially vulnerable time because if a parent company creating a clone for their acquired company still retains the data of a (now sold) child company and suffers a theft or data breach, not only do they have the downfall of their own reputation, but they could be liable for damages to the child for the compromise (or vice versa), compounding the threat if that company in question is flipped again and purchased by another entity. If they have data belonging to the parent company, they are at risk if any of the companies has a breach that involves the parent company’s data. As companies are repeatedly bought and sold, a data breach can be very costly for both the acquirer (parent) and the acquired (child) company. Over time, the original source of the data is not clear, and the breach can have untold impacts and ever-increasing costs. The bottom line is that all parties will bear the burden, monetary expense of remediation, and opportunity cost of a damaged reputation.

There has been an uptick in the handling of divestiture and acquisitions by cloning the instance in question, masking the data and handing it off as part of the sale – but there are inherent risks for both the buyer and the seller when using a clone or masking solution for a divestiture. Companies who are creating a clone for their acquired company still have data belonging to the child company, and therefore, they would not only have the reputation of their own customers, but they will likely have to pay the child company compensation for breach of their data. The reality is that an experienced hacker can undertake an unmasking initiative, access that data by finding related data, or querying at the data base level, and open vulnerabilities for both an internal and external data breach.

With the exceptional dangers involved, it begs the question: why have these processes become commonplace? The seller risks inadvertently sharing trade-secrets or competitive advantage via sensitive information left in the database, and the buyer undertakes the complication of carrying the masked data that it does not own in their system, causing delays and increasing infrastructure costs (i.e. a larger footprint, additional license fees, added expense to manually segregate the data for reporting or compliance, etc.).

This risk cannot be understated. A single inadvertent unauthorized disclosure of private customer or vendor information could result in large penalties, sometimes into the millions of dollars. If the clone instance is provided to a competitor in a partial divestiture, added to this risk is the possibility of damage resulting from inadvertent disclosure of the non-divested business’ proprietary strategic information, such as vendor and customer credit lines, discounts, customer and vendor contractual details, etc.

Finally, to magnify these risks, the threat of litigation losses respective of inappropriate data disclosure can dwarf the costs of other risks.

So what is an appropriate risk management strategy to adopt during a divestiture? An entity has three choices: minimize the risk, accept the risk, or ignore the risk.

Minimizing the Risk:

This strategy involves a variety of steps, including non-disclosure agreements with third-parties, contractual obligation, and other due diligence around the risks. However, the ideal way to minimize the risk is to purge old/legacy non-divestiture related data from the clone instance provided to the divested or acquired entity.

Accepting the Risk:

Accepting the risk can be an effective risk mitigation strategy. However, to accept the risk, entity management must have a relatively accurate estimate of the risky data exposure accompanied by a what- could-go-wrong quantification of the potential risk respective losses.

Barring a means to quantify the risks associated with the divested clone instance’s legacy and non- divested entity related data, entity management is not accepting the risk. Instead, by default, entity management has chosen the riskiest approach – Ignoring the Risk.

Ignoring the Risk:

If an entity’s management cannot be provided with a reasonable estimate of quantified risks associated with the divested clone instance’s legacy and non-divested entity related data, then barring minimizing the risk by purging unrelated and legacy ERP information, management has chosen to ignore the risks. This is the worst possible strategy, because it leaves the entity open to the risk of being deemed negligent, which can significantly exacerbate litigation, business and other risks

In conclusion, during the rapid transition of a divestiture, it is critical to ensure that due attention is given to the risk of legacy, inactive, and unrelated to the divestiture ERP data. The best strategies are to either minimize or accept the risk and avoid the unacceptable act of ignoring the risk.

1,300 thoughts on “Your Competitor’s Spyglass: Data Risks During a Divestiture”

casino olympe: olympe casino – casino olympe

kamagra en ligne [url=https://kamagraprix.shop/#]Kamagra pharmacie en ligne[/url] kamagra gel

cialis sans ordonnance: Tadalafil 20 mg prix sans ordonnance – cialis generique tadalmed.shop

cialis generique: Acheter Cialis 20 mg pas cher – Tadalafil 20 mg prix en pharmacie tadalmed.shop

Acheter Kamagra site fiable: kamagra livraison 24h – kamagra en ligne

http://pharmafst.com/# trouver un mГ©dicament en pharmacie

Cialis sans ordonnance pas cher: cialis prix – Achat Cialis en ligne fiable tadalmed.shop

cialis sans ordonnance: Pharmacie en ligne Cialis sans ordonnance – Tadalafil achat en ligne tadalmed.shop

http://pharmafst.com/# pharmacie en ligne livraison europe

pharmacie en ligne avec ordonnance: pharmacie en ligne pas cher – Pharmacie en ligne livraison Europe pharmafst.com

cialis sans ordonnance: Pharmacie en ligne Cialis sans ordonnance – Cialis en ligne tadalmed.shop

Acheter Viagra Cialis sans ordonnance: Acheter Viagra Cialis sans ordonnance – Cialis generique prix tadalmed.shop

Pharmacie sans ordonnance [url=https://pharmafst.com/#]pharmacie en ligne fiable[/url] п»їpharmacie en ligne france pharmafst.shop

kamagra pas cher: kamagra gel – Kamagra Commander maintenant

https://pharmafst.com/# pharmacie en ligne fiable

pharmacie en ligne sans ordonnance: pharmacie en ligne pas cher – pharmacie en ligne livraison europe pharmafst.com

Acheter Cialis 20 mg pas cher: Cialis sans ordonnance 24h – Acheter Cialis tadalmed.shop

https://tadalmed.com/# Pharmacie en ligne Cialis sans ordonnance

kamagra livraison 24h: achat kamagra – Acheter Kamagra site fiable

cialis sans ordonnance [url=https://tadalmed.shop/#]Cialis sans ordonnance 24h[/url] Acheter Cialis tadalmed.com

pharmacie en ligne france livraison belgique: Medicaments en ligne livres en 24h – pharmacie en ligne pas cher pharmafst.com

pharmacie en ligne livraison europe: Pharmacie sans ordonnance – pharmacie en ligne sans ordonnance pharmafst.com

https://kamagraprix.com/# kamagra oral jelly

Acheter Cialis 20 mg pas cher: cialis sans ordonnance – Cialis generique prix tadalmed.shop

kamagra 100mg prix [url=https://kamagraprix.shop/#]kamagra oral jelly[/url] kamagra gel

Achetez vos kamagra medicaments: acheter kamagra site fiable – kamagra livraison 24h

vente de mГ©dicament en ligne: Pharmacie en ligne livraison Europe – trouver un mГ©dicament en pharmacie pharmafst.com

https://pharmafst.shop/# pharmacie en ligne france pas cher

kamagra gel: Acheter Kamagra site fiable – kamagra pas cher

Pharmacie en ligne livraison Europe: vente de mГ©dicament en ligne – pharmacie en ligne pharmafst.com

Achat Cialis en ligne fiable [url=http://tadalmed.com/#]Tadalafil sans ordonnance en ligne[/url] Acheter Cialis 20 mg pas cher tadalmed.com

pharmacie en ligne sans ordonnance: Meilleure pharmacie en ligne – pharmacie en ligne france fiable pharmafst.com

https://tadalmed.com/# Pharmacie en ligne Cialis sans ordonnance

kamagra pas cher: kamagra pas cher – Acheter Kamagra site fiable

acheter mГ©dicament en ligne sans ordonnance: Medicaments en ligne livres en 24h – п»їpharmacie en ligne france pharmafst.com

Kamagra Commander maintenant [url=http://kamagraprix.com/#]kamagra pas cher[/url] kamagra oral jelly

https://pharmafst.shop/# Achat mГ©dicament en ligne fiable

acheter mГ©dicament en ligne sans ordonnance: Pharmacie en ligne France – pharmacie en ligne pharmafst.com

Cialis sans ordonnance 24h: Cialis sans ordonnance pas cher – Achat Cialis en ligne fiable tadalmed.shop

pharmacie en ligne sans ordonnance: Medicaments en ligne livres en 24h – pharmacie en ligne sans ordonnance pharmafst.com

kamagra en ligne [url=http://kamagraprix.com/#]achat kamagra[/url] kamagra oral jelly

https://pharmafst.com/# п»їpharmacie en ligne france

pharmacie en ligne france fiable: Livraison rapide – pharmacie en ligne sans ordonnance pharmafst.com

http://pharmafst.com/# trouver un mГ©dicament en pharmacie

pharmacies en ligne certifiГ©es: pharmacie en ligne – Pharmacie en ligne livraison Europe pharmafst.com

https://kamagraprix.com/# Kamagra Commander maintenant

achat kamagra: Kamagra Commander maintenant – acheter kamagra site fiable

https://kamagraprix.shop/# Achetez vos kamagra medicaments

Kamagra Commander maintenant: Achetez vos kamagra medicaments – kamagra oral jelly

Kamagra Commander maintenant: Kamagra pharmacie en ligne – achat kamagra

http://tadalmed.com/# Tadalafil sans ordonnance en ligne

trouver un mГ©dicament en pharmacie: Pharmacie en ligne France – pharmacie en ligne avec ordonnance pharmafst.com

pharmacie en ligne france livraison belgique: Pharmacie en ligne France – pharmacies en ligne certifiГ©es pharmafst.com

Cialis en ligne: cialis prix – Acheter Cialis 20 mg pas cher tadalmed.shop

pharmacie en ligne france livraison belgique: Livraison rapide – pharmacie en ligne livraison europe pharmafst.com

Kamagra Oral Jelly pas cher [url=https://kamagraprix.shop/#]kamagra 100mg prix[/url] kamagra oral jelly

https://kamagraprix.shop/# Kamagra pharmacie en ligne

Acheter Kamagra site fiable: kamagra oral jelly – Kamagra Commander maintenant

cialis generique: Cialis sans ordonnance 24h – Cialis sans ordonnance 24h tadalmed.shop

Tadalafil 20 mg prix sans ordonnance: Acheter Cialis 20 mg pas cher – Cialis sans ordonnance 24h tadalmed.shop

Pharmacie en ligne livraison Europe [url=https://pharmafst.shop/#]trouver un mГ©dicament en pharmacie[/url] pharmacie en ligne pharmafst.shop

canadian drug: Express Rx Canada – canada drugs online

Rx Express Mexico: RxExpressMexico – mexican online pharmacy

medicine in mexico pharmacies: RxExpressMexico – RxExpressMexico

https://medicinefromindia.com/# medicine courier from India to USA

RxExpressMexico [url=https://rxexpressmexico.com/#]mexico pharmacies prescription drugs[/url] Rx Express Mexico

safe canadian pharmacies: Express Rx Canada – canada rx pharmacy world

indian pharmacy online shopping: medicine courier from India to USA – indian pharmacy

mexican online pharmacy: mexico pharmacies prescription drugs – Rx Express Mexico

http://rxexpressmexico.com/# mexico pharmacy order online

Rx Express Mexico: mexico pharmacy order online – Rx Express Mexico

Rx Express Mexico: mexico pharmacy order online – mexico drug stores pharmacies

medicine courier from India to USA [url=https://medicinefromindia.shop/#]medicine courier from India to USA[/url] MedicineFromIndia

mexico pharmacies prescription drugs: Rx Express Mexico – mexico drug stores pharmacies

http://rxexpressmexico.com/# mexico pharmacies prescription drugs

canadian online pharmacy reviews: Canadian pharmacy shipping to USA – online canadian pharmacy

best canadian online pharmacy: canadian pharmacy world reviews – reputable canadian online pharmacy

indian pharmacy online shopping [url=https://medicinefromindia.com/#]Medicine From India[/url] indian pharmacy online shopping

Rx Express Mexico: Rx Express Mexico – mexico pharmacies prescription drugs

prescription drugs canada buy online: ExpressRxCanada – canada drug pharmacy

medicine courier from India to USA: medicine courier from India to USA – Medicine From India

online pharmacy canada [url=http://expressrxcanada.com/#]Express Rx Canada[/url] reputable canadian online pharmacy

https://rxexpressmexico.shop/# Rx Express Mexico

mexico drug stores pharmacies: mexico drug stores pharmacies – RxExpressMexico

MedicineFromIndia: MedicineFromIndia – Medicine From India

https://expressrxcanada.com/# cheapest pharmacy canada

cheap canadian pharmacy: Express Rx Canada – canada drugstore pharmacy rx

mexican online pharmacy [url=https://rxexpressmexico.shop/#]best online pharmacies in mexico[/url] mexican online pharmacy

legit canadian pharmacy: ExpressRxCanada – canadian pharmacy ed medications

Medicine From India: indian pharmacy online – Medicine From India

https://medicinefromindia.com/# Medicine From India

indian pharmacy: indian pharmacy online shopping – indian pharmacy

canadian online pharmacy: canada pharmacy online – canadian pharmacy 365

certified canadian pharmacy [url=http://expressrxcanada.com/#]canadian pharmacies compare[/url] canadian pharmacy in canada

indian pharmacy online shopping: indian pharmacy online shopping – indian pharmacy online

https://expressrxcanada.com/# canadian pharmacy meds

MedicineFromIndia: medicine courier from India to USA – indianpharmacy com

Rx Express Mexico [url=http://rxexpressmexico.com/#]mexico drug stores pharmacies[/url] mexico pharmacies prescription drugs

indian pharmacy online: pharmacy website india – indian pharmacy paypal

MedicineFromIndia: pharmacy website india – Medicine From India

https://pinuprus.pro/# пинап казино

pin up casino: pin up az – pin up

pin up: pin up – pin-up casino giris

вавада [url=https://vavadavhod.tech/#]вавада казино[/url] vavada casino

вавада официальный сайт: вавада зеркало – vavada casino

pin up вход: пин ап казино официальный сайт – пин ап казино

vavada вход [url=http://vavadavhod.tech/#]vavada casino[/url] вавада казино

https://vavadavhod.tech/# vavada вход

pin-up: pin up azerbaycan – pin up

вавада официальный сайт [url=http://vavadavhod.tech/#]вавада[/url] вавада казино

https://pinupaz.top/# pin up az

pin-up casino giris: pin up – pin up casino

pin up casino: pin up az – pin up casino

https://pinuprus.pro/# пин ап зеркало

vavada вход [url=http://vavadavhod.tech/#]вавада казино[/url] вавада казино

пин ап вход: пинап казино – pin up вход

pin up az: pin up azerbaycan – pin up

pin up: pin up – pin up

пин ап зеркало [url=http://pinuprus.pro/#]пин ап вход[/url] pin up вход

pin up casino: pin-up – pin up az

вавада: вавада зеркало – вавада зеркало

https://pinuprus.pro/# пин ап казино официальный сайт

пин ап зеркало: пинап казино – пинап казино

pin up вход [url=http://pinuprus.pro/#]pin up вход[/url] пин ап вход

вавада: вавада казино – вавада официальный сайт

пинап казино: пин ап казино официальный сайт – пин ап казино официальный сайт

pin up azerbaycan: pinup az – pinup az

http://pinuprus.pro/# пин ап зеркало

vavada вход: вавада зеркало – vavada

вавада казино [url=http://vavadavhod.tech/#]vavada casino[/url] vavada casino

pin up azerbaycan: pinup az – pin up az

пинап казино: пин ап казино официальный сайт – пин ап казино официальный сайт

http://vavadavhod.tech/# вавада официальный сайт

pin up az: pin up – pin up

pin up azerbaycan [url=http://pinupaz.top/#]pinup az[/url] pin up az

vavada: vavada вход – vavada

http://pinuprus.pro/# пин ап зеркало

vavada: вавада казино – vavada вход

пин ап казино: пин ап вход – пин ап казино официальный сайт

пин ап казино [url=http://pinuprus.pro/#]пинап казино[/url] пинап казино

вавада: vavada вход – вавада казино

http://pinupaz.top/# pin up azerbaycan

pinup az: pin up – pinup az

pin-up casino giris: pin up az – pin up

pin up [url=http://pinupaz.top/#]pinup az[/url] pinup az

пин ап казино официальный сайт: пин ап казино официальный сайт – пинап казино

вавада зеркало: vavada – vavada вход

вавада: вавада официальный сайт – вавада казино

vavada: вавада казино – вавада

pin up casino [url=https://pinupaz.top/#]pin up az[/url] pin up az

https://pinuprus.pro/# pin up вход

пинап казино: пин ап вход – пин ап вход

vavada вход: vavada casino – vavada вход

вавада казино: vavada – вавада зеркало

pin up casino [url=https://pinupaz.top/#]pin up[/url] pin-up casino giris

http://vavadavhod.tech/# vavada casino

пин ап вход: пин ап зеркало – pin up вход

вавада: вавада официальный сайт – вавада казино

пин ап казино официальный сайт: пинап казино – пин ап казино

http://vavadavhod.tech/# вавада официальный сайт

vavada casino [url=https://vavadavhod.tech/#]вавада зеркало[/url] вавада казино

pin up az: pin up az – pin-up

вавада: вавада официальный сайт – вавада

https://pinuprus.pro/# пин ап зеркало

пин ап зеркало [url=http://pinuprus.pro/#]пин ап вход[/url] пин ап вход

pinup az: pin-up casino giris – pin-up casino giris

vavada: vavada casino – вавада зеркало

вавада официальный сайт [url=http://vavadavhod.tech/#]вавада официальный сайт[/url] вавада

вавада: вавада зеркало – вавада зеркало

vavada вход: вавада зеркало – вавада казино

https://pinupaz.top/# pin up casino

пин ап казино: пин ап казино официальный сайт – пин ап казино официальный сайт

пин ап казино официальный сайт [url=https://pinuprus.pro/#]пин ап зеркало[/url] пинап казино

https://vavadavhod.tech/# вавада казино

vavada casino: vavada casino – вавада

http://pinuprus.pro/# пин ап казино

вавада казино: вавада зеркало – vavada вход

пин ап казино: пин ап вход – пин ап казино

пин ап зеркало [url=http://pinuprus.pro/#]пинап казино[/url] pin up вход

http://vavadavhod.tech/# вавада официальный сайт

pin up вход: pin up вход – pin up вход

вавада казино: vavada – vavada

pin up вход [url=http://pinuprus.pro/#]pin up вход[/url] пинап казино

http://vavadavhod.tech/# вавада

вавада: вавада официальный сайт – вавада официальный сайт

pin up casino: pin-up – pin up az

vavada casino [url=https://vavadavhod.tech/#]вавада официальный сайт[/url] вавада официальный сайт

http://pinuprus.pro/# пинап казино

vavada вход: vavada вход – vavada

pin-up: pin-up casino giris – pin up azerbaycan

pin up az [url=http://pinupaz.top/#]pin-up[/url] pin up

https://pinuprus.pro/# пинап казино

пин ап казино: пин ап казино – пин ап вход

пин ап зеркало [url=https://pinuprus.pro/#]пинап казино[/url] пин ап казино

http://vavadavhod.tech/# vavada

pin up azerbaycan: pin up casino – pin up

vavada вход: вавада зеркало – vavada вход

pin-up [url=http://pinupaz.top/#]pinup az[/url] pin-up casino giris

https://pinuprus.pro/# пин ап вход

pin up az: pin-up casino giris – pin-up

пин ап зеркало: пинап казино – пин ап вход

pinup az [url=http://pinupaz.top/#]pin-up[/url] pin up casino

pin up az: pin up azerbaycan – pinup az

https://vavadavhod.tech/# вавада зеркало

pin-up casino giris: pin-up – pin up azerbaycan

pinup az [url=https://pinupaz.top/#]pin up casino[/url] pinup az

pin up вход: пин ап вход – pin up вход

http://pinuprus.pro/# пин ап вход

пин ап казино официальный сайт: пин ап казино – пин ап вход

вавада официальный сайт [url=http://vavadavhod.tech/#]vavada[/url] вавада официальный сайт

vavada: vavada casino – вавада зеркало

https://pinupaz.top/# pin up casino

пин ап казино официальный сайт [url=http://pinuprus.pro/#]пин ап казино[/url] пинап казино

вавада официальный сайт: вавада зеркало – vavada вход

http://vavadavhod.tech/# вавада зеркало

вавада зеркало: vavada – вавада казино

pin up azerbaycan [url=http://pinupaz.top/#]pin-up[/url] pin-up

вавада зеркало: вавада официальный сайт – вавада официальный сайт

http://vavadavhod.tech/# vavada вход

pinup az: pin-up – pin-up

pin up azerbaycan [url=https://pinupaz.top/#]pin-up[/url] pin up azerbaycan

вавада казино: вавада зеркало – вавада

https://vavadavhod.tech/# vavada вход

пин ап казино: пин ап казино официальный сайт – pin up вход

пин ап вход [url=https://pinuprus.pro/#]пин ап зеркало[/url] пинап казино

http://pinupaz.top/# pin up casino

вавада официальный сайт: вавада официальный сайт – вавада

Тележка с подъемной платформой предназначена для работы в складских помещениях, производственных предприятий для транспортировки коробок, инструментов и других грузов. Способны поднимать и перемещать грузы весом до 0,5т на высоту до 1500мм.

Высота подъёма: 450-1500 мм.

В качестве защиты от раздавливания подъемный стол оснащен кромкой безопасности, расположенной под наружными краями платформы. При активации она прекращает опускание. Для продолжения опускания платформа должна быть поднята для сброса защиты.

Получить коммерческое предложение:

Надежный гидроцилиндр обеспечивает плавный подъем.

Опыт разработки и производства гидравлических подъемных столов более 50 лет!

pin up casino: pin up azerbaycan – pin up casino

вавада официальный сайт [url=https://vavadavhod.tech/#]вавада казино[/url] вавада официальный сайт

https://pinuprus.pro/# пин ап казино

pin-up casino giris: pin up casino – pin-up

пинап казино: пин ап казино – пин ап казино

http://pinuprus.pro/# пин ап зеркало

pin up [url=http://pinupaz.top/#]pin up az[/url] pin up azerbaycan

pin-up casino giris: pinup az – pin up az

https://vavadavhod.tech/# vavada

pin up вход: pin up вход – пин ап казино официальный сайт

vavada вход [url=http://vavadavhod.tech/#]вавада официальный сайт[/url] вавада официальный сайт

vavada: вавада – vavada вход

http://vavadavhod.tech/# вавада казино

pin up azerbaycan: pin up – pin up azerbaycan

pin up [url=https://pinupaz.top/#]pin-up casino giris[/url] pin up casino

https://vavadavhod.tech/# вавада официальный сайт

pin up вход: пин ап казино – пин ап казино официальный сайт

вавада зеркало [url=http://vavadavhod.tech/#]вавада официальный сайт[/url] vavada casino

вавада официальный сайт: vavada casino – vavada

http://pinuprus.pro/# пин ап казино

vavada вход: vavada вход – vavada вход

pinup az [url=https://pinupaz.top/#]pin up casino[/url] pin up azerbaycan

pinup az: pin-up – pin up az

http://vavadavhod.tech/# vavada casino

pin up az: pin-up – pin up casino

generic tadalafil [url=http://zipgenericmd.com/#]affordable ED medication[/url] cheap Cialis online

trusted Viagra suppliers: Viagra without prescription – best price for Viagra

http://zipgenericmd.com/# affordable ED medication

order Viagra discreetly: fast Viagra delivery – Viagra without prescription

secure checkout ED drugs: reliable online pharmacy Cialis – secure checkout ED drugs

verified Modafinil vendors [url=https://modafinilmd.store/#]buy modafinil online[/url] verified Modafinil vendors

fast Viagra delivery: safe online pharmacy – fast Viagra delivery

buy generic Viagra online: generic sildenafil 100mg – buy generic Viagra online

http://maxviagramd.com/# secure checkout Viagra

modafinil pharmacy: buy modafinil online – safe modafinil purchase

buy modafinil online: modafinil legality – legal Modafinil purchase

order Cialis online no prescription: order Cialis online no prescription – order Cialis online no prescription

discreet shipping [url=http://maxviagramd.com/#]fast Viagra delivery[/url] best price for Viagra

http://modafinilmd.store/# legal Modafinil purchase

modafinil 2025: doctor-reviewed advice – buy modafinil online

trusted Viagra suppliers: order Viagra discreetly – order Viagra discreetly

Viagra without prescription: legit Viagra online – secure checkout Viagra

generic tadalafil: secure checkout ED drugs – affordable ED medication

buy generic Viagra online: generic sildenafil 100mg – buy generic Viagra online

Cialis without prescription: affordable ED medication – secure checkout ED drugs

doctor-reviewed advice [url=https://modafinilmd.store/#]modafinil pharmacy[/url] verified Modafinil vendors

https://maxviagramd.shop/# order Viagra discreetly

buy generic Cialis online: best price Cialis tablets – Cialis without prescription

same-day Viagra shipping: no doctor visit required – safe online pharmacy

best price Cialis tablets: buy generic Cialis online – buy generic Cialis online

order Cialis online no prescription [url=https://zipgenericmd.shop/#]secure checkout ED drugs[/url] online Cialis pharmacy

no doctor visit required: secure checkout Viagra – order Viagra discreetly

FDA approved generic Cialis: Cialis without prescription – Cialis without prescription

https://maxviagramd.com/# safe online pharmacy

generic sildenafil 100mg: secure checkout Viagra – same-day Viagra shipping

cheap Viagra online [url=http://maxviagramd.com/#]fast Viagra delivery[/url] legit Viagra online

modafinil 2025: modafinil legality – modafinil pharmacy

buy modafinil online: modafinil 2025 – safe modafinil purchase

https://maxviagramd.shop/# no doctor visit required

online Cialis pharmacy: reliable online pharmacy Cialis – reliable online pharmacy Cialis

reliable online pharmacy Cialis: online Cialis pharmacy – Cialis without prescription

secure checkout ED drugs [url=https://zipgenericmd.com/#]secure checkout ED drugs[/url] discreet shipping ED pills

modafinil 2025: modafinil 2025 – modafinil legality

https://maxviagramd.shop/# same-day Viagra shipping

purchase Modafinil without prescription: buy modafinil online – verified Modafinil vendors

best price for Viagra: best price for Viagra – secure checkout Viagra

same-day Viagra shipping [url=https://maxviagramd.shop/#]generic sildenafil 100mg[/url] cheap Viagra online

modafinil pharmacy: modafinil pharmacy – verified Modafinil vendors

http://zipgenericmd.com/# online Cialis pharmacy

purchase Modafinil without prescription: purchase Modafinil without prescription – modafinil legality

affordable ED medication [url=http://zipgenericmd.com/#]online Cialis pharmacy[/url] cheap Cialis online

http://zipgenericmd.com/# cheap Cialis online

online Cialis pharmacy: FDA approved generic Cialis – discreet shipping ED pills

no doctor visit required: safe online pharmacy – no doctor visit required

order Cialis online no prescription [url=https://zipgenericmd.shop/#]affordable ED medication[/url] reliable online pharmacy Cialis

trusted Viagra suppliers: discreet shipping – safe online pharmacy

https://modafinilmd.store/# modafinil legality

order Cialis online no prescription: buy generic Cialis online – order Cialis online no prescription

FDA approved generic Cialis: reliable online pharmacy Cialis – reliable online pharmacy Cialis

secure checkout Viagra [url=http://maxviagramd.com/#]legit Viagra online[/url] discreet shipping

legit Viagra online: order Viagra discreetly – generic sildenafil 100mg

http://modafinilmd.store/# Modafinil for sale

trusted Viagra suppliers: Viagra without prescription – fast Viagra delivery

order prednisone 10mg: prednisone 30 mg coupon – PredniHealth

prednisone for sale in canada: PredniHealth – prednisone uk price

https://amohealthcare.store/# Amo Health Care

prednisone medicine: PredniHealth – prednisone pack

azithromycin amoxicillin: order amoxicillin online – buy amoxil

amoxicillin 500mg buy online uk [url=https://amohealthcare.store/#]how to get amoxicillin[/url] Amo Health Care

Amo Health Care: Amo Health Care – Amo Health Care

https://prednihealth.com/# 5 prednisone in mexico

Amo Health Care: Amo Health Care – Amo Health Care

where buy cheap clomid without insurance: can you buy generic clomid – where to get generic clomid

PredniHealth: PredniHealth – PredniHealth

generic clomid without dr prescription [url=http://clomhealth.com/#]Clom Health[/url] where to buy cheap clomid online

https://clomhealth.com/# cost cheap clomid online

prednisone 5 mg tablet: PredniHealth – PredniHealth

get cheap clomid without dr prescription: order clomid price – generic clomid without insurance

Amo Health Care: Amo Health Care – Amo Health Care

amoxicillin 250 mg capsule [url=https://amohealthcare.store/#]Amo Health Care[/url] Amo Health Care

https://amohealthcare.store/# amoxicillin 500mg buy online canada

cost of amoxicillin 30 capsules: Amo Health Care – amoxicillin over counter

amoxicillin 750 mg price: amoxicillin 500mg – Amo Health Care

purchase amoxicillin 500 mg: Amo Health Care – amoxicillin 500 tablet

Amo Health Care [url=https://amohealthcare.store/#]can you buy amoxicillin over the counter in canada[/url] Amo Health Care

https://clomhealth.com/# can i order clomid for sale

prednisone 10mg tabs: how much is prednisone 10 mg – 54 prednisone

prednisone 60 mg tablet: prednisone uk – PredniHealth

https://clomhealth.com/# can i purchase generic clomid online

prednisone over the counter uk [url=https://prednihealth.com/#]PredniHealth[/url] prednisone 4mg tab

Amo Health Care: Amo Health Care – amoxicillin generic

Amo Health Care: amoxicillin without a prescription – generic amoxicillin over the counter

https://amohealthcare.store/# generic amoxicillin

where to buy amoxicillin pharmacy [url=https://amohealthcare.store/#]order amoxicillin 500mg[/url] Amo Health Care

amoxicillin 500mg prescription: amoxicillin 500 mg brand name – Amo Health Care

order generic clomid without insurance: Clom Health – cost cheap clomid without dr prescription

https://prednihealth.com/# order prednisone 10mg

cialis drug: TadalAccess – super cialis

cialis alcohol: cialis for daily use cost – cialis review

https://tadalaccess.com/# cheap cialis free shipping

tadalafil best price 20 mg [url=https://tadalaccess.com/#]TadalAccess[/url] purchasing cialis

cialis for sale in toront ontario: tadalafil and voice problems – where to get the best price on cialis

sunrise pharmaceutical tadalafil: Tadal Access – tadalafil citrate research chemical

https://tadalaccess.com/# cialis 20 mg tablets and prices

when will generic cialis be available [url=https://tadalaccess.com/#]tadalafil liquid review[/url] order generic cialis online 20 mg 20 pills

tadalafil review forum: Tadal Access – cialis professional review

tadalafil pulmonary hypertension: TadalAccess – tadalafil 5mg generic from us

https://tadalaccess.com/# whats the max safe dose of tadalafil xtenda for a healthy man

cialis and melanoma: tadalafil 20mg canada – tadalafil generic headache nausea

cialis pills for sale [url=https://tadalaccess.com/#]tadalafil 20 mg directions[/url] cialis definition

no prescription female cialis: buy cialis online in austalia – natural alternative to cialis

https://tadalaccess.com/# buy cialis canadian

cialis online without pres: cialis generic best price – cialis generic

buy cialis on line: cialis liquid for sale – where can i get cialis

tadalafil and ambrisentan newjm 2015 [url=https://tadalaccess.com/#]generic cialis from india[/url] generic cialis vs brand cialis reviews

https://tadalaccess.com/# buy cialis on line

benefits of tadalafil over sidenafil: side effects of cialis – cialis online paypal

best time to take cialis 5mg: TadalAccess – buy voucher for cialis daily online

price of cialis in pakistan [url=https://tadalaccess.com/#]TadalAccess[/url] cialis generic name

https://tadalaccess.com/# buy tadalafil cheap

cialis australia online shopping: Tadal Access – peptide tadalafil reddit

cialis sales in victoria canada: TadalAccess – where to get generic cialis without prescription

Преимущества подъемных столов.

Подъёмные столы NOBLELIFT.

Арт. 700058.

To view this video please enable JavaScript, and consider upgrading to a web browser that supports HTML5 video.

Цена: 75 840 руб.

Наш большой опыт в проектировании и производстве гарантирует надежность и качество вашего подъемника.

cialis super active plus [url=https://tadalaccess.com/#]cialis difficulty ejaculating[/url] compounded tadalafil troche life span

https://tadalaccess.com/# order cialis online no prescription reviews

does tadalafil lower blood pressure: canadian pharmacy cialis 20mg – cialis next day delivery

maximpeptide tadalafil review: side effects of cialis daily – buy liquid cialis online

cialis prescription assistance program [url=https://tadalaccess.com/#]Tadal Access[/url] best place to get cialis without pesricption

https://tadalaccess.com/# cialis with dapoxetine

cialis 20 mg coupon: mail order cialis – cialis and adderall

how long does cialis last in your system: free coupon for cialis – cialis generic purchase

https://tadalaccess.com/# cialis slogan

20 mg tadalafil best price [url=https://tadalaccess.com/#]Tadal Access[/url] canadian pharmacy generic cialis

buy generic cialis: Tadal Access – cialis 5mg daily how long before it works

is there a generic cialis available: cialis before and after pictures – cialis meme

https://tadalaccess.com/# cialis mechanism of action

tadalafil dose for erectile dysfunction [url=https://tadalaccess.com/#]cialis uses[/url] side effects of cialis

buy cheap cialis online with mastercard: cialis generic overnite – average dose of tadalafil

what is the use of tadalafil tablets: TadalAccess – purchase cialis online cheap

https://tadalaccess.com/# cheap generic cialis canada

cialis for pulmonary hypertension [url=https://tadalaccess.com/#]Tadal Access[/url] tadalafil liquid fda approval date

cialis strength: Tadal Access – cialis indien bezahlung mit paypal

buy tadalafil online paypal: TadalAccess – shop for cialis

https://tadalaccess.com/# cialis covered by insurance

tadalafil (exilar-sava healthcare) [generic version of cialis] (rx) lowest price [url=https://tadalaccess.com/#]TadalAccess[/url] when will cialis be over the counter

cialis generic overnite: Tadal Access – cialis online no prescription australia

https://tadalaccess.com/# buy cialis by paypal

cialis for daily use side effects: what are the side effect of cialis – cialis samples

what happens if you take 2 cialis: Tadal Access – what to do when cialis stops working

cialis generic release date [url=https://tadalaccess.com/#]buying cialis[/url] tadalafil 20mg

https://tadalaccess.com/# cialis free trial phone number

tadalafil daily use: TadalAccess – where to buy tadalafil in singapore

tadalafil 40 mg with dapoxetine 60 mg: cialis free trial voucher – cialis manufacturer

generic cialis available in canada [url=https://tadalaccess.com/#]TadalAccess[/url] order cialis from canada

https://tadalaccess.com/# cialis 20 mg price walmart

pastillas cialis: letairis and tadalafil – tadalafil generic 20 mg ebay

cialis online paypal: Tadal Access – when will cialis be generic

tadalafil tablets side effects [url=https://tadalaccess.com/#]Tadal Access[/url] cialis payment with paypal

https://tadalaccess.com/# cialis sample pack

tadalafil best price 20 mg: cialis drug – best price for cialis

buy tadalafil online paypal: Tadal Access – cialis discount card

what is the difference between cialis and tadalafil [url=https://tadalaccess.com/#]Tadal Access[/url] tadalafil lowest price

https://tadalaccess.com/# cialis wikipedia

cialis 100mg from china: where to buy cialis cheap – cialis 100mg from china

cialis review: tadalafil online paypal – cialis doesnt work

cialis prescription cost [url=https://tadalaccess.com/#]cialis price cvs[/url] cialis from canadian pharmacy registerd

https://tadalaccess.com/# what does cialis do

cialis 50mg: cialis prices in mexico – is there a generic cialis available in the us

cialis 20 mg best price: tadalafil soft tabs – cialis for sale over the counter

https://tadalaccess.com/# cialis dapoxetine overnight shipment

cialis generic overnite [url=https://tadalaccess.com/#]best price on cialis[/url] cialis headache

when should i take cialis: cialis canada price – cheap cialis by post

what does cialis look like: buying cialis generic – when to take cialis 20mg

https://tadalaccess.com/# cialis 30 mg dose

cialis manufacturer coupon [url=https://tadalaccess.com/#]cialis using paypal in australia[/url] snorting cialis

cheap cialis 20mg: TadalAccess – adcirca tadalafil

cialis 50mg: TadalAccess – cialis patent expiration date

https://tadalaccess.com/# tadalafil citrate powder

cialis 5mg price comparison [url=https://tadalaccess.com/#]Tadal Access[/url] snorting cialis

cialis black 800 to buy in the uk one pill: Tadal Access – online cialis prescription

cialis online pharmacy australia: TadalAccess – canada drugs cialis

https://tadalaccess.com/# letairis and tadalafil

tadalafil buy online canada: cialis payment with paypal – cialis how to use

cialis buy online [url=https://tadalaccess.com/#]Tadal Access[/url] no presciption cialis

generic cialis 5mg: TadalAccess – cialis online no prior prescription

https://tadalaccess.com/# is generic cialis available in canada

cialis side effects with alcohol: TadalAccess – cialis bodybuilding

cheap cialis dapoxitine cheap online [url=https://tadalaccess.com/#]natural cialis[/url] where can i buy cialis online in australia

https://tadalaccess.com/# cialis overnight shipping

tadalafil (exilar-sava healthcare) [generic version of cialis] (rx) lowest price: safest and most reliable pharmacy to buy cialis – cialis and grapefruit enhance

cialis 20 mg: Tadal Access – cialis buy australia online

tadalafil 40 mg india [url=https://tadalaccess.com/#]tadalafil daily use[/url] snorting cialis

https://tadalaccess.com/# cialis vs tadalafil

cialis prices in mexico: TadalAccess – cialis store in philippines

cialis experience: Tadal Access – how long does cialis take to work 10mg

cialis online paypal [url=https://tadalaccess.com/#]TadalAccess[/url] cialis purchase canada

cialis samples: stockists of cialis – stockists of cialis

whats cialis: generic cialis super active tadalafil 20mg – cialis generic canada

cialis mechanism of action [url=https://tadalaccess.com/#]Tadal Access[/url] can you drink wine or liquor if you took in tadalafil

https://tadalaccess.com/# cialis back pain

cialis price cvs: TadalAccess – where can i get cialis

brand cialis: TadalAccess – canadian online pharmacy cialis

cialis before and after [url=https://tadalaccess.com/#]cialis 30 mg dose[/url] tadalafil price insurance

https://tadalaccess.com/# cialis patent

buy cialis 20mg: is tadalafil available at cvs – tadalafil tablets 20 mg reviews

online cialis australia: cialis 2.5 mg – achats produit tadalafil pour femme en ligne

cialis in canada [url=https://tadalaccess.com/#]online cialis prescription[/url] cialis soft

https://tadalaccess.com/# cialis advertisement

active ingredient in cialis: cialis 20mg review – how long does cialis last 20 mg

buy cialis online reddit: buy cialis cheap fast delivery – buy cialis online usa

how to buy tadalafil online [url=https://tadalaccess.com/#]Tadal Access[/url] find tadalafil

https://tadalaccess.com/# cialis reddit

price of cialis at walmart: cialis 800 black canada – cialis genetic

cialis contraindications: pastilla cialis – cialis price costco

buy tadalafil cheap online: Tadal Access – cialis goodrx

is tadalafil and cialis the same thing? [url=https://tadalaccess.com/#]Tadal Access[/url] tadalafil generic usa

https://tadalaccess.com/# cialis samples for physicians

cialis prices at walmart: TadalAccess – cialis professional ingredients

buy cialis no prescription australia: mantra 10 tadalafil tablets – no prescription tadalafil

safest and most reliable pharmacy to buy cialis [url=https://tadalaccess.com/#]cialis cost at cvs[/url] cialis vs flomax for bph

https://tadalaccess.com/# sildalis sildenafil tadalafil

cialis side effects: Tadal Access – cialis for sale

cialis free sample [url=https://tadalaccess.com/#]Tadal Access[/url] cialis bathtub

cialis for daily use reviews: Tadal Access – generic cialis 20 mg from india

https://tadalaccess.com/# cialis online usa

prescription for cialis: Tadal Access – what is the generic name for cialis

buy cialis canada paypal [url=https://tadalaccess.com/#]Tadal Access[/url] cialis online no prior prescription

max dosage of cialis: cialis tadalafil discount – what happens if you take 2 cialis

https://tadalaccess.com/# order generic cialis online 20 mg 20 pills

cialis online paypal [url=https://tadalaccess.com/#]vidalista 20 tadalafil tablets[/url] over the counter drug that works like cialis

what is cialis used for: no prescription female cialis – cheap cialis pills uk

https://tadalaccess.com/# how to buy tadalafil

cialis and adderall [url=https://tadalaccess.com/#]Tadal Access[/url] cialis side effects forum

cialis buy: Tadal Access – is cialis a controlled substance

https://tadalaccess.com/# cialis for sale brand

buy cialis online usa: vardenafil and tadalafil – cialis over the counter in spain

buy cialis on line [url=https://tadalaccess.com/#]TadalAccess[/url] tadalafil review forum

buy cialis online free shipping: cialis canada online – cialis for prostate

https://tadalaccess.com/# sildalis sildenafil tadalafil

cialis time [url=https://tadalaccess.com/#]cialis side effect[/url] how long before sex should you take cialis

purchase cialis online: TadalAccess – cialis high blood pressure

https://tadalaccess.com/# tadalafil liquid review

cialis as generic: peptide tadalafil reddit – cialis online no prescription australia

does cialis really work [url=https://tadalaccess.com/#]TadalAccess[/url] cialis when to take

https://tadalaccess.com/# cialis generic overnite

cheap cialis pills uk: cialis canada online – cialis tadalafil cheapest online

what are the side effects of cialis [url=https://tadalaccess.com/#]TadalAccess[/url] cialis coupon rite aid

does tadalafil work: generic tadalafil canada – cialis reviews

cialis canadian pharmacy [url=https://tadalaccess.com/#]TadalAccess[/url] cialis with out a prescription

https://tadalaccess.com/# cialis com free sample

cialis pills online: TadalAccess – teva generic cialis

cialis side effects with alcohol [url=https://tadalaccess.com/#]TadalAccess[/url] cialis goodrx

Устройство передвижного подъемного стола.

Арт. Артикул 67-5005.

Доп. скидка 5% на всю технику Smartlift из наличия до 15.04, суммируется с акциями, применяется автоматически (заказ через корзину) или менеджером (заказ по телефону, Email или в форме).

Передвижной подъемный стол является оборудованием для поднятия и перемещения груза. Устройство представляет специальную платформу, на которой поднимаются различные предметы при помощи ножничного механизма. Тележка с подъемной платформой часто применяются при выполнении сборочных, погрузочно-разгрузочных операций на производстве, на складах, стройках, в автосервисах. Тележки с подъемом используется в производственных цехах, на складах и торговых объектах, в мастерских и автосервисах. Они предназначены для облегчения работы с грузами в различной упаковке (таре): в ящиках, мешках, рулонах. Также применяются при выполнении сборочных, погрузочно-разгрузочных операций. Стол позволяет сравнять груз на уровне рабочего механизма и поддерживать технологический процесс.

Собственный вес: 160 кг.

Подъемники паллет.

get antibiotics without seeing a doctor: Biot Pharm – buy antibiotics over the counter

get antibiotics quickly: BiotPharm – buy antibiotics

buy antibiotics over the counter: BiotPharm – best online doctor for antibiotics

Buy medicine online Australia [url=http://pharmau24.com/#]PharmAu24[/url] Buy medicine online Australia

antibiotic without presription: buy antibiotics online uk – get antibiotics quickly

ed medications cost: online ed medication – boner pills online

https://pharmau24.com/# Online medication store Australia

antibiotic without presription: BiotPharm – best online doctor for antibiotics

Discount pharmacy Australia: Online medication store Australia – Discount pharmacy Australia

Over the counter antibiotics for infection [url=https://biotpharm.com/#]buy antibiotics online uk[/url] Over the counter antibiotics pills

online ed medicine: best online ed treatment – online erectile dysfunction

over the counter antibiotics: BiotPharm – get antibiotics quickly

https://eropharmfast.shop/# erectile dysfunction pills online

get antibiotics quickly: buy antibiotics online – antibiotic without presription

get ed meds online: get ed prescription online – Ero Pharm Fast

https://biotpharm.com/# buy antibiotics over the counter

buy antibiotics over the counter: Biot Pharm – buy antibiotics for uti

best ed medication online [url=https://eropharmfast.com/#]Ero Pharm Fast[/url] Ero Pharm Fast

Over the counter antibiotics pills: buy antibiotics from india – buy antibiotics from canada

http://biotpharm.com/# buy antibiotics

Ero Pharm Fast: Ero Pharm Fast – Ero Pharm Fast

get antibiotics without seeing a doctor [url=https://biotpharm.com/#]Biot Pharm[/url] Over the counter antibiotics for infection

Medications online Australia: Medications online Australia – pharmacy online australia

pharmacy online australia: Buy medicine online Australia – Online medication store Australia

pharmacy online australia: online pharmacy australia – Pharm Au24

http://biotpharm.com/# buy antibiotics

Ero Pharm Fast [url=https://eropharmfast.com/#]erectile dysfunction medicine online[/url] Ero Pharm Fast

Ero Pharm Fast: buy ed meds online – ed drugs online

how to get ed pills: Ero Pharm Fast – buy erectile dysfunction treatment

Over the counter antibiotics for infection: buy antibiotics online – Over the counter antibiotics pills

over the counter antibiotics [url=https://biotpharm.shop/#]antibiotic without presription[/url] buy antibiotics from india

https://eropharmfast.com/# cheap ed meds online

cheap ed: Ero Pharm Fast – online erectile dysfunction prescription

buy antibiotics over the counter [url=http://biotpharm.com/#]BiotPharm[/url] best online doctor for antibiotics

Pharm Au 24: Discount pharmacy Australia – Online medication store Australia

ed rx online [url=https://eropharmfast.shop/#]ed rx online[/url] online erectile dysfunction medication

http://pharmau24.com/# Pharm Au 24

where to buy erectile dysfunction pills: ed meds on line – where to get ed pills

low cost ed pills [url=https://eropharmfast.shop/#]ed online prescription[/url] ed prescriptions online

buy antibiotics from canada: cheapest antibiotics – get antibiotics without seeing a doctor

ed medication online [url=https://eropharmfast.com/#]Ero Pharm Fast[/url] cheap erectile dysfunction pills

Pharm Au24: Buy medicine online Australia – Pharm Au 24

https://pharmau24.shop/# Medications online Australia

Ero Pharm Fast [url=https://eropharmfast.shop/#]best ed medication online[/url] discount ed pills

cheapest ed medication: best online ed treatment – Ero Pharm Fast

ed medication online [url=https://eropharmfast.com/#]Ero Pharm Fast[/url] ed medications online

Online drugstore Australia: Buy medicine online Australia – Online medication store Australia

https://pharmau24.com/# online pharmacy australia

online pharmacy australia [url=http://pharmau24.com/#]Discount pharmacy Australia[/url] pharmacy online australia

Ero Pharm Fast: online ed medication – online erectile dysfunction prescription

pharmacie en ligne sans ordonnance: pharmacie en ligne pas cher – Achat mГ©dicament en ligne fiable

pharmacie en ligne pas cher: pharmacie en ligne sans ordonnance – Pharmacie Internationale en ligne

acheter medicaments sans ordonnance [url=https://pharmsansordonnance.com/#]acheter medicaments sans ordonnance[/url] Achat mГ©dicament en ligne fiable

acheter Viagra sans ordonnance: commander Viagra discretement – viagra sans ordonnance

https://kampascher.shop/# kamagra livraison 24h

viagra sans ordonnance: Meilleur Viagra sans ordonnance 24h – prix bas Viagra générique

Viagra sans ordonnance 24h: Meilleur Viagra sans ordonnance 24h – Viagra vente libre pays

pharmacie en ligne [url=http://pharmsansordonnance.com/#]pharmacie en ligne sans ordonnance[/url] pharmacie en ligne france livraison belgique

Kamagra oral jelly pas cher: acheter Kamagra sans ordonnance – acheter kamagra site fiable

cialis prix: acheter Cialis sans ordonnance – cialis generique

pharmacie en ligne sans ordonnance [url=http://pharmsansordonnance.com/#]pharmacie internet fiable France[/url] pharmacie en ligne france livraison internationale

viagra en ligne: acheter Viagra sans ordonnance – viagra sans ordonnance

viagra en ligne: Meilleur Viagra sans ordonnance 24h – viagra sans ordonnance

http://pharmsansordonnance.com/# vente de mГ©dicament en ligne

Kamagra oral jelly pas cher: acheter kamagra site fiable – kamagra gel

acheter Kamagra sans ordonnance [url=https://kampascher.com/#]kamagra en ligne[/url] kamagra en ligne

livraison discrete Kamagra: livraison discrete Kamagra – achat kamagra

achat kamagra: commander Kamagra en ligne – kamagra oral jelly

Cialis sans ordonnance 24h: Cialis pas cher livraison rapide – traitement ED discret en ligne

Medicaments en ligne livres en 24h: Medicaments en ligne livres en 24h – trouver un mГ©dicament en pharmacie

pharmacie en ligne sans ordonnance [url=https://pharmsansordonnance.shop/#]pharmacie en ligne pas cher[/url] pharmacie en ligne avec ordonnance

http://kampascher.com/# trouver un mГ©dicament en pharmacie

prix bas Viagra générique: Meilleur Viagra sans ordonnance 24h – viagra sans ordonnance

kamagra 100mg prix: kamagra gel – kamagra livraison 24h

trouver un mГ©dicament en pharmacie: pharmacie en ligne sans prescription – Achat mГ©dicament en ligne fiable

prix bas Viagra generique [url=https://viasansordonnance.com/#]prix bas Viagra generique[/url] Meilleur Viagra sans ordonnance 24h

Viagra sans ordonnance 24h Amazon: Meilleur Viagra sans ordonnance 24h – Viagra sans ordonnance 24h

commander Cialis en ligne sans prescription: Acheter Cialis – Acheter Cialis

pharmacie en ligne sans ordonnance: commander sans consultation medicale – pharmacies en ligne certifiГ©es

kamagra pas cher [url=https://kampascher.shop/#]achat kamagra[/url] achat kamagra

http://ciasansordonnance.com/# Cialis sans ordonnance 24h

kamagra livraison 24h: achat kamagra – kamagra livraison 24h

commander Viagra discretement: viagra en ligne – Acheter du Viagra sans ordonnance

Acheter Cialis: Cialis générique sans ordonnance – cialis sans ordonnance

acheter Kamagra sans ordonnance [url=https://kampascher.com/#]Kamagra oral jelly pas cher[/url] kamagra oral jelly

Acheter du Viagra sans ordonnance: acheter Viagra sans ordonnance – commander Viagra discretement

cialis generique: acheter Cialis sans ordonnance – Pharmacie sans ordonnance

viagra en ligne: acheter Viagra sans ordonnance – Viagra sans ordonnance 24h

https://viasansordonnance.shop/# viagra en ligne

commander sans consultation medicale [url=https://pharmsansordonnance.com/#]acheter medicaments sans ordonnance[/url] pharmacie en ligne sans ordonnance

pharmacie en ligne france livraison belgique: Medicaments en ligne livres en 24h – acheter mГ©dicament en ligne sans ordonnance

Cialis sans ordonnance 24h: commander Cialis en ligne sans prescription – commander Cialis en ligne sans prescription

acheter Viagra sans ordonnance: Acheter du Viagra sans ordonnance – prix bas Viagra générique

acheter kamagra site fiable [url=http://kampascher.com/#]Kamagra oral jelly pas cher[/url] kamagra 100mg prix

pharmacie en ligne: Medicaments en ligne livres en 24h – pharmacie en ligne france fiable

commander Cialis en ligne sans prescription: Acheter Cialis – cialis generique

https://kampascher.shop/# kamagra gel

commander Viagra discretement [url=http://viasansordonnance.com/#]acheter Viagra sans ordonnance[/url] acheter Viagra sans ordonnance

kamagra en ligne: pharmacie en ligne – kamagra pas cher

Meilleur Viagra sans ordonnance 24h: Viagra sans ordonnance 24h – Meilleur Viagra sans ordonnance 24h

Acheter du Viagra sans ordonnance: prix bas Viagra generique – livraison rapide Viagra en France

acheter Viagra sans ordonnance [url=https://viasansordonnance.shop/#]commander Viagra discretement[/url] Acheter du Viagra sans ordonnance

commander Cialis en ligne sans prescription: Cialis sans ordonnance 24h – cialis prix

cialis prix: cialis sans ordonnance – Cialis sans ordonnance 24h

https://kampascher.com/# acheter kamagra site fiable

acheter medicaments sans ordonnance [url=http://pharmsansordonnance.com/#]acheter medicaments sans ordonnance[/url] pharmacie en ligne france livraison belgique

commander Viagra discretement: Meilleur Viagra sans ordonnance 24h – Acheter du Viagra sans ordonnance

prix bas Viagra generique: Acheter du Viagra sans ordonnance – prix bas Viagra generique

acheter kamagra site fiable: kamagra livraison 24h – Kamagra oral jelly pas cher

http://pharmsansordonnance.com/# п»їpharmacie en ligne france

kamagra pas cher: achat kamagra – acheter Kamagra sans ordonnance

pharmacie en ligne: acheter medicaments sans ordonnance – pharmacies en ligne certifiГ©es

pharmacie internet fiable France [url=http://pharmsansordonnance.com/#]Pharmacies en ligne certifiees[/url] pharmacie en ligne sans ordonnance

viagra en ligne: acheter Viagra sans ordonnance – Viagra generique en pharmacie

commander Cialis en ligne sans prescription: acheter Cialis sans ordonnance – traitement ED discret en ligne

pharmacie en ligne sans ordonnance [url=https://pharmsansordonnance.com/#]pharmacie en ligne sans prescription[/url] pharmacie en ligne pas cher

pharmacie en ligne france livraison internationale: Acheter Cialis – Cialis pas cher livraison rapide

https://ciasansordonnance.com/# Acheter Cialis

acheter Kamagra sans ordonnance [url=https://kampascher.com/#]achat kamagra[/url] kamagra oral jelly

pharmacie en ligne sans ordonnance: acheter medicaments sans ordonnance – pharmacie en ligne france livraison internationale

pharmacie en ligne pas cher [url=https://pharmsansordonnance.shop/#]Pharmacies en ligne certifiees[/url] Pharmacie sans ordonnance

pharmacie en ligne pas cher: commander sans consultation medicale – trouver un mГ©dicament en pharmacie

Acheter du Viagra sans ordonnance: Viagra sans ordonnance 24h – SildГ©nafil 100 mg prix en pharmacie en France

https://kampascher.shop/# achat kamagra

cialis prix [url=https://ciasansordonnance.com/#]Cialis pas cher livraison rapide[/url] cialis prix

Viagra sans ordonnance 24h: livraison rapide Viagra en France – Viagra sans ordonnance 24h Amazon

Cialis pas cher livraison rapide [url=https://ciasansordonnance.shop/#]Acheter Cialis[/url] commander Cialis en ligne sans prescription

cialis prix: Cialis pas cher livraison rapide – cialis prix

Cialis pas cher livraison rapide [url=http://ciasansordonnance.com/#]traitement ED discret en ligne[/url] Cialis generique sans ordonnance

cialis prix: pharmacie en ligne livraison europe – Cialis generique sans ordonnance

http://pharmsansordonnance.com/# Pharmacie en ligne livraison Europe

Kamagra oral jelly pas cher [url=https://kampascher.com/#]kamagra en ligne[/url] livraison discrete Kamagra

Cialis generique sans ordonnance: Acheter Cialis 20 mg pas cher – commander Cialis en ligne sans prescription

tadalafil 20mg acheter [url=http://pharmacieexpress.com/#]medicament avec ordonnance[/url] prorhinel rhume dosette

donde puedo comprar azitromicina sin receta medica: Confia Pharma – se puede comprar concerta sin receta

http://pharmacieexpress.com/# achat viagra

comprar naproxeno sodico sin receta: Confia Pharma – farmacia online para rumanos

decapeptyl 3.75 prezzo [url=http://farmaciasubito.com/#]Farmacia Subito[/url] farmacia online lombardia

farmacia online legitima: ВїquГ© antibiГіticos puedo comprar sin receta? – mascherine chirurgiche farmacia online

zolpeduar principio attivo [url=http://farmaciasubito.com/#]Farmacia Subito[/url] robilas antistaminico prezzo

puedo comprar viagra sin receta: farmacia badajoz online – puedo comprar amoxicilina sin receta mГ©dica

https://pharmacieexpress.com/# ordonnance par internet

flixotide spray: xatral 10 mg prezzo – cialis 5 mg 28 compresse prezzo

la farmacia online descuento: comprar antalgin sin receta – donde comprar xenical sin receta

pilule sans ordonnance pharmacie [url=https://pharmacieexpress.shop/#]acheter tadalafil en ligne[/url] durex feeling sensual

tecnico auxiliar de farmacia y parafarmacia online: farmacia online gastos envio gratis – comprar cialis online sin receta

https://pharmacieexpress.com/# angine medicament sans ordonnance

muscoril fiale sono mutuabili [url=https://farmaciasubito.shop/#]Farmacia Subito[/url] prezzo augmentin

spirale kyleena: Farmacia Subito – farmacia orlando

colpogyn ovuli: п»їfarmacia online – online farmacia italy

dГіnde comprar sildenafil sin receta [url=https://confiapharma.com/#]se puede comprar miconazol sin receta[/url] la farmacia online mas barata

farmacia online clembuterol: farmacia online peru – comprar cialis en madrid sin receta

acheter viagra homme [url=https://pharmacieexpress.shop/#]medicament infection urinaire sans ordonnance[/url] pharmacie bagnolet

tadalafil arrow sans ordonnance: suprax sans ordonnance en pharmacie – cialis generique 20mg

http://confiapharma.com/# se puede comprar dutasteride sin receta

tavor morte: Farmacia Subito – feldene fiale

farmacia online puglia: comprar tryptizol sin receta – mascarillas fp3 farmacia online

paises donde se puede comprar viagra sin receta [url=http://confiapharma.com/#]Confia Pharma[/url] se puede comprar tobrex sin receta

farmacia online chat: farmacia online trieste – panacef sciroppo alla fragola prezzo

sachet infection urinaire sans ordonnance [url=https://pharmacieexpress.com/#]antibiotique ordonnance[/url] medicament pour maigrir en pharmacie sans ordonnance

cialis prix en pharmacie: Pharmacie Express – prix cialis 5mg

https://farmaciasubito.shop/# farmacia sicura online

farmacia bagnolo cremasco: Farmacia Subito – farmacia shop online recensioni

palexia 50 mg [url=https://farmaciasubito.shop/#]linezolid 600[/url] dottor max farmacia online

como comprar medicamento sin receta: loja farmacia online – farmacia guareГ±a online

dapoxetina se puede comprar sin receta: Confia Pharma – mi farmacia online sin receta preferida

pharmacie sans ordonnance montpellier [url=https://pharmacieexpress.shop/#]cГ©tirizine sans ordonnance prix[/url] sulfur 15ch

opiniones mi farmacia online: Confia Pharma – diane 35 se puede comprar sin receta

rubifen sin receta comprar: master en farmacia hospitalaria online – farmacia barata online cordoba

https://confiapharma.com/# farmacia online alzira

acheter solupred 20 mg sans ordonnance [url=https://pharmacieexpress.shop/#]arnica montana 7 ch[/url] sro sachet

alcion farmaco: medrol a cosa serve – movicol soluzione orale

ketoderm sans ordonnance en pharmacie: infection urinaire femme medicament sans ordonnance – viagra pas cher

comprar wegovy sin receta: Confia Pharma – farmacia online preservativos

cerotti antinfiammatori [url=https://farmaciasubito.shop/#]test hiv farmacia online[/url] punture pappataci immagini

https://confiapharma.shop/# farmacia sarasketa online

coverlam 5/5: sirdalud compresse prezzo – menaderm simplex crema a cosa serve

farmacia genericos comprar cialis generico online tadalafil precio: mascarillas ffp2 comprar online farmacia – el diazepam se puede comprar sin receta?

come far prendere l’antibiotico ai bambini [url=https://farmaciasubito.shop/#]effortil gocce[/url] lyrica prezzo 50 mg

dubine crema a cosa serve: Farmacia Subito – pillola jadiza

farmacia 24 h online: campoamor farmacia online – auxiliar de farmacia y parafarmacia online

farmacia jerez online [url=http://confiapharma.com/#]farmacia online portugal envio a espaГ±a[/url] puedo comprar citalopram sin receta

farmacia santa rita online: Confia Pharma – el sildenafil se puede comprar sin receta

https://pharmacieexpress.com/# melatonine 3 mg en pharmacie sans ordonnance

comprar minoxidil farmacia online: antica farmacia online – puedo comprar anticonceptivos sin receta medica

puedes comprar ibuprofeno sin receta [url=http://confiapharma.com/#]farmacia online test embarazo[/url] farmacia online american express

canigen dhppi/l: giant farmaco – movicol soluzione orale

donde comprar antidepresivos sin receta: farmacia online termometro – farmacia online preguntas

biorinil spray nasale prezzo [url=http://farmaciasubito.com/#]zolpeduar 5 mg effetti collaterali[/url] viagra price

peut on voir un rhumatologue sans ordonnance: ordonnance securisee medecin – ozempic sans ordonnance belgique

farmacia liceo online opiniones: tu farmacia online online – farmacia online san marino

http://pharmacieexpress.com/# ordonnance cholesterol

consultation medecin en ligne ordonnance [url=https://pharmacieexpress.shop/#]cialis sans ordonnance pharmacie france[/url] mГ©dicament pour grossir en pharmacie sans ordonnance

deltacortene per cani: meloxidyl cane – endodien prezzo

http://pharmmex.com/# allergy medicine in mexico

prescriptions from india [url=https://inpharm24.com/#]doctor of pharmacy india[/url] india pharmacy of the world

online medicine order: india prescription drugs – pharmacy from india

mexican medicine cream: Pharm Mex – canadian pharmacies that ship to the us

http://inpharm24.com/# buy medicine online in india

Brand Levitra [url=https://pharmexpress24.shop/#]kroger online pharmacy[/url] viagra pharmacy thailand

sun pharmacy india: online medicine delivery in india – b pharmacy salary in india

online medicine shopping: percocet pharmacy – bupropion pharmacy prices

clozaril registry pharmacy [url=http://pharmexpress24.com/#]Pharm Express 24[/url] diplomat pharmacy lipitor

dulcolax pharmacy: Pharm Express 24 – claritin d online pharmacy

india rx: buy viagra online india – buy viagra online in india

https://pharmmex.com/# mexican pharmacy viagra

mexican online stores: Pharm Mex – mexican packaging

online pharmacy chat: buy cialis cheap us pharmacy – online pharmacy motilium

simvastatin people’s pharmacy [url=https://pharmexpress24.shop/#]boots pharmacy viagra[/url] pharmacy coupons

pharmacy rx one online pharmacy: Pharm Express 24 – viagra target pharmacy

tramadol mexicano: best mexican online pharmacy – mexican pharmacy dr simi

mexican steroids online [url=http://pharmmex.com/#]mexican pharmacy order online[/url] online drugstore

walgreen pharmacy: buy adipex online pharmacy – ez pharmacy

top online pharmacy india: india pharmacy viagra – pharmacy in india online

http://inpharm24.com/# best online pharmacy

online medicine delivery in india: ivermectin india pharmacy – order medicines online

b pharmacy fees in india: india mart pharmacy – india e-pharmacy market size 2025

pharmacy india online [url=https://inpharm24.shop/#]InPharm24[/url] overseas pharmacy india

crestor pharmacy card: medicine online shopping – discount pharmacy card

managing warfarin therapy in various pharmacy settings: fry’s pharmacy – generic cialis india pharmacy

how much does percocet cost at pharmacy: online pharmacy weight loss – reliable online pharmacy accutane

cytotec malaysia pharmacy [url=http://pharmexpress24.com/#]online drug store[/url] target pharmacy gabapentin

best online pharmacy india: pharmacy from india – india pharmacy reviews

https://inpharm24.shop/# medical store online

unicare pharmacy artane castle opening hours: Pharm Express 24 – lipitor generic target pharmacy

french pharmacy online [url=https://pharmexpress24.com/#]Pharm Express 24[/url] riteaid pharmacy

india drug store: InPharm24 – online india pharmacy reviews

medicines online india: best pharmacy franchise in india – india pharmacy of the world

kamagra pharmacy bangkok [url=https://pharmexpress24.shop/#]Pharm Express 24[/url] buy viagra uk pharmacy

uk pharmacy no prescription: online pharmacy flonase – lamotrigine online pharmacy

pharmacy india: india pharmacy market – aster pharmacy india

https://pharmmex.com/# can you buy prescription drugs in mexico

Brand Cialis [url=https://pharmexpress24.com/#]pharmacy website[/url] metoprolol people’s pharmacy

percocet indian pharmacy: Pharm Express 24 – kaiser pharmacy hours

order medicine online: painkillers buy online – mounjaro cost mexico

online pharmacy india [url=https://inpharm24.com/#]medicine online india[/url] pharmacy in india

how to get ozempic from mexico: order mounjaro from mexico – tramadol mexico

accutane online pharmacy reviews [url=http://pharmexpress24.com/#]indian pharmacy provigil[/url] finasteride uk pharmacy

https://inpharm24.com/# online medicine delivery in india

xenical pharmacy direct: Pharm Express 24 – percocet online pharmacy without prescriptions

pharmacy name ideas in india: online medicine india – best online indian pharmacy

india pharmacy international shipping [url=https://inpharm24.shop/#]apotheke academy[/url] top online pharmacy india

viagra brand price: VGR Sources – buying sildenafil uk

discount viagra for sale: buy viagra pills online india – what does viagra do

cheap generic viagra from canada: VGR Sources – where can i get sildenafil

sildenafil 100mg canadian pharmacy [url=https://vgrsources.com/#]VGR Sources[/url] sildenafil tabs 20mg

https://vgrsources.com/# viagra for cheap

brand viagra from canada: viagra sales – viagra canada for sale

daily viagra: VGR Sources – viagra online fast delivery

viagra online best price: VGR Sources – where to buy viagra otc

best online sildenafil prescription [url=https://vgrsources.com/#]VGR Sources[/url] cheap viagra pills online

sildenafil citrate online pharmacy: VGR Sources – price viagra 100mg

sildenafil over the counter: viagra cost comparison – best viagra tablets india

https://vgrsources.com/# generic otc viagra

generic viagra from canada: 200 mg viagra for sale – canadian online pharmacy generic viagra

buy viagra in canada [url=https://vgrsources.com/#]VGR Sources[/url] sildenafil over the counter us

prices for viagra: us online viagra – where to order viagra online

where to buy viagra in usa: VGR Sources – sildenafil canada

viagra united states: VGR Sources – female viagra real

viagra capsules in india [url=https://vgrsources.com/#]VGR Sources[/url] sildenafil citrate online

canadian pharmacy viagra pills: viagra 200mg uk – where to get real viagra online

https://vgrsources.com/# brand viagra 100mg price

cheap viagra 100mg canada: viagra cost in mexico – preГ§o do viagra 50mg

viagra generic discount: VGR Sources – viagra online cheap no prescription

generic viagra for sale [url=https://vgrsources.com/#]VGR Sources[/url] best rx prices for sildenafil

buy viagra australia online: VGR Sources – buy sildenafil online nz

sildenafil 100mg india: buy sildenafil no prescription – sildenafil soft tablets

sildenafil online pharmacy: buy viagra online in canada – buy viagra 100mg uk

viagra generic in mexico [url=https://vgrsources.com/#]VGR Sources[/url] us pharmacy viagra prices

authentic viagra: VGR Sources – order viagra online canada mastercard

can i buy viagra online from canada: VGR Sources – real viagra pills online

https://vgrsources.com/# brand viagra online

can you buy viagra in mexico: sildenafil over the counter india – buying viagra online

how to buy viagra in us [url=https://vgrsources.com/#]cheapest sildenafil 50 mg[/url] order viagra pills online

buying sildenafil citrate online: viagra 100mg price in india online – viagra usa online

where can you buy viagra in south africa: viagra pills australia – generic viagra mexico pharmacy

viagra online best price: buying viagra in canada – where to buy viagra online usa

sildenafil tablet brand name in india [url=https://vgrsources.com/#]viagra 100 tablet[/url] viagra for sale in australia

generic viagra uk: can you buy viagra over the counter nz – viagra pfizer price

generic viagra online pharmacy usa: VGR Sources – generic viagra discount

https://vgrsources.com/# viagra pills for men

canadian pharmacy viagra 150 mg: VGR Sources – where to buy generic sildenafil

how to order viagra in india [url=https://vgrsources.com/#]VGR Sources[/url] sildenafil gel uk

generic viagra in us: real viagra online prescription – sildenafil pills 100mg

purchase cheap viagra: female viagra 2017 – generic sildenafil online uk

sildenafil citrate buy: VGR Sources – cipla viagra

viagra for sale in united states [url=https://vgrsources.com/#]VGR Sources[/url] sildenafil citrate online

viagra 500: viagra online in usa – viagra coupon online

sildenafil 20 mg buy online: VGR Sources – buy viagra uk pharmacy

https://vgrsources.com/# buy viagra 100

can i buy viagra online legally: buy viagra without prescription – 100mg sildenafil 30 tablets price

generic viagra online pharmacy canada [url=https://vgrsources.com/#]VGR Sources[/url] sildenafil 25

sildenafil pills: viagra 100mg in canada – pfizer viagra online pharmacy

sildenafil for sale usa: discount viagra prices – viagra cost uk

viagra online pharmacies: viagra 25mg cost – how to get viagra in us

viagra prescription medicine: VGR Sources – 2 viagra

female viagra australia for sale [url=https://vgrsources.com/#]order sildenafil canada[/url] viagra price online

generic viagra online pharmacy usa: VGR Sources – purchase viagra 100mg

canada generic sildenafil: VGR Sources – buy viagra without rx

sildenafil online prices [url=https://vgrsources.com/#]viagra fast shipping usa[/url] viagra pharmacy coupon

https://vgrsources.com/# viagra 100 mg for sale

india viagra tablets: VGR Sources – can i buy viagra over the counter canada

buy viagra uk pharmacy: sildenafil 20 mg prescription online – online pharmacy viagra prescription

sildenafil over the counter nz: can you buy viagra canada – how do i buy viagra

viagra over the counter cost [url=https://vgrsources.com/#]VGR Sources[/url] canada pharmacy online viagra prescription

sildenafil cost compare: viagra buy online canada – viagra otc

Safe delivery in the US: Rybelsus 3mg 7mg 14mg – oral semaglutide (rybelsus)

buy prednisone online from canada: PredniPharm – PredniPharm

buying prednisone: Predni Pharm – can i buy prednisone online without a prescription

https://crestorpharm.com/# rosuvastatin calcium 10 mg price

prednisone 25mg from canada [url=https://prednipharm.shop/#]Predni Pharm[/url] Predni Pharm

lipitor cost walmart: LipiPharm – Generic Lipitor fast delivery

Semaglu Pharm: SemagluPharm – SemagluPharm

can you eat grapefruit with atorvastatin: foods to avoid with lipitor – lipitor pancreatitis

Best price for Crestor online USA [url=https://crestorpharm.shop/#]Crestor Pharm[/url] Crestor Pharm

Lipi Pharm: LipiPharm – Lipi Pharm

http://lipipharm.com/# price of lipitor

rybelsus bottle: Rybelsus side effects and dosage – Semaglu Pharm

rybelsus cost goodrx [url=https://semaglupharm.shop/#]Online pharmacy Rybelsus[/url] semaglutide dry mouth

Semaglu Pharm: Where to buy Semaglutide legally – Rybelsus 3mg 7mg 14mg

LipiPharm: Online statin drugs no doctor visit – Lipi Pharm

SemagluPharm: SemagluPharm – Semaglu Pharm

prednisone 20mg [url=http://prednipharm.com/#]Predni Pharm[/url] PredniPharm

https://crestorpharm.com/# Crestor Pharm

Crestor Pharm: CrestorPharm – Crestor mail order USA

Predni Pharm: drug prices prednisone – prednisone 60 mg price

Online pharmacy Rybelsus: what is compounded semaglutide – Semaglu Pharm

buy prednisone without a prescription: PredniPharm – prednisone acetate

rosuvastatin calcium 40 mg [url=https://crestorpharm.com/#]Buy statins online discreet shipping[/url] CrestorPharm

https://lipipharm.shop/# high intensity statin atorvastatin

Crestor Pharm: CrestorPharm – Crestor Pharm

Lipi Pharm: lipitor canada – Lipi Pharm

Predni Pharm [url=https://prednipharm.shop/#]Predni Pharm[/url] PredniPharm

SemagluPharm: Where to buy Semaglutide legally – Semaglu Pharm

can you take ashwagandha with crestor: CrestorPharm – CrestorPharm

SemagluPharm: rybelsus for sale – 14 mg rybelsus

can i buy prednisone over the counter in usa: PredniPharm – prednisone purchase canada

buy prednisone online paypal [url=http://prednipharm.com/#]Predni Pharm[/url] PredniPharm

http://crestorpharm.com/# can you take lipitor and crestor together

CrestorPharm: Rosuvastatin tablets without doctor approval – Rosuvastatin tablets without doctor approval

Semaglutide tablets without prescription: Online pharmacy Rybelsus – SemagluPharm

can you buy prednisone over the counter in mexico [url=https://prednipharm.com/#]prednisone 10 mg over the counter[/url] Predni Pharm

CrestorPharm: CrestorPharm – CrestorPharm

LipiPharm: Lipi Pharm – c2 pill atorvastatin

LipiPharm [url=http://lipipharm.com/#]Online statin drugs no doctor visit[/url] LipiPharm

Predni Pharm: prednisone 3 tablets daily – PredniPharm

https://crestorpharm.shop/# CrestorPharm

Where to buy Semaglutide legally: Semaglu Pharm – FDA-approved Rybelsus alternative

PredniPharm [url=https://prednipharm.com/#]prednisone canada pharmacy[/url] brand prednisone

CrestorPharm: Online statin therapy without RX – CrestorPharm

Predni Pharm: over the counter prednisone cheap – prednisone over the counter uk

No doctor visit required statins [url=http://crestorpharm.com/#]CrestorPharm[/url] ezetimibe vs rosuvastatin

Rybelsus online pharmacy reviews: SemagluPharm – SemagluPharm

https://prednipharm.com/# PredniPharm