There are few things that generate excitement and speculation like the announcement of a business combination. Almost without exception, the management promise of every merger and acquisition is to increase stakeholder value. However, it seems that this is not what typically happens. As evidenced by a 2019 survey by Deloitte, 40 percent of survey respondents say that half their deals fail to generate the value they expected at the onset of a transaction. It begs the question— what is going so terribly awry? More importantly, what must be done to ensure that M&A deals do in fact deliver the maximum value possible? This article is meant to answer both of these questions.

Inspired by the teachings of Adam Grant in his book “Give and Take”, it is important to understand that companies which focus on what they are going to get from an acquisition are less probable to succeed than those that focus on what they have to give it. Chances for the success of an acquisition can be increased by the acquirer in 4 ways: by being a smarter provider of growth capital; by providing better managerial oversight; by transferring valuable skills; and by sharing valuable capabilities. Let’s see how this is done.

Sources of Value and Causes of the Destruction of Value—The Value Gap

Shareholder value is measured as the increase in stock value associable with the merger. Because, rationalized, stock value is reflective of long-term earning capacity of the company, a proxy for increased shareholder value is the net present value of increased cash flow due to merger synergies.

The hope is that shareholder value will be increased by cost reductions achieved through economies of scale, the combination of duplicate corporate functions, and streamlined sales forces; capital efficiencies achieved through rationalized assets and the combination of duplicate facilities; and revenue enhancement affected though product development synergy (new products), shared marketing skills, and combined distributions.

The expected increase in value, while often achieved to some degree, is largely offset by situations that occur during integration. This produces what is called a Value Gap. Some major things that contribute to the Value Gap include:

- Integration issues

- Inexperience

- Lack/loss of vision

- Management wars

- Culture clashes

- Failure to manage risk and change

- Bad communication with stakeholders

- Prices rise, quality falls, customers leave

- Alliances and supplier relationships degrade

- Key people leave, and business continuity is lost

The result is the Value Gap — the unhappy coincidence of achieved value offset by unanticipated challenges, resulting in less shareholder value from the merger.

In addition to the Value Gap, there can be synergies after the deal is made that can add energy, creativity, and enthusiasm for new opportunities. This is referred to as Emergent Value, and it can help offset the Value Gap. Stemming from unanticipated synergies, Emergent Value is created by taking advantage of complimentary resources at all levels, finding more profitable uses for assets, achieving both strategic and operational fit, discovering new market opportunities, and selling products to existing customers. In addition, reinventing processes, shedding obsolete practices, and capitalizing on the creativity and excitement evoked as new colleagues interact, can play a role in generating Emergent Value.

Transition—the Critical Period

Most executives would be quick to point to a lack of synergies, an unrealistic vision, or an outrageous premium price for the reasons a business combination fails to deliver value. While these factors can certainly sabotage the success of the combined entity, even the best structured business combination can be sabotaged by another pitfall—poor post-merger integration (PMI). It is PMI that can most often lead to the Value Gap, but it can also provide opportunities for the creation of additional value.

In simple terms, a business combination can be considered to have two phases— the Transaction Phase (making the deal) and the Transition Phase (post-merger integration).

The Transaction Phase is the sexy part during which the deal is negotiated and then announced. The results of this phase are largely a function of deal-making negotiations. Typically, unless there is a big surprise during the post letter of intent due diligence, the financial structure of the deal is set.

The part which gets less attention is the Transition Phase, or the post-merger integration (PMI). This is the phase during which the disparate companies are integrated and combined. Very little attention has been given by business thought leaders toward addressing the challenges of post-merger integration. In an article in the Journal of Organizational Dynamics, business scholar Marc Epstein, PhD, states that “it is the actual execution of the merger strategy through the pre-merger and post-merger integration that appears to have the least understanding.” A focal point of this article is to address some of the most common areas of PMI/transition misunderstanding.

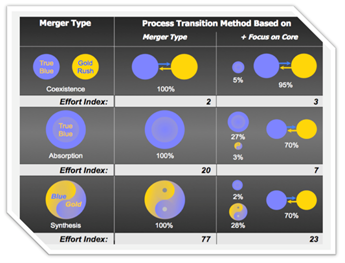

First, it is important to understand that not all mergers are the same with regard to effort. As shown in Figure 1, the intended result of the merger has a significant impact. If the intent is that the companies should continue to function largely autonomously after combination, this is referred to as coexistence.

If one of the companies is going to be absorbed into the operations of the other, this is referred to as absorption. Finally, if the disparate portions of the two companies are to be fully integrated, intending to keep the best of both, resulting in one better company, this is referred to as synthesis. These three types of results are achieved with sequentially higher levels of effort, with less effort for a coexistence, typically just needing changes to financial and managerial reporting and minor integration, more for an absorption, as the surviving entity’s systems supplant those of the absorbed entity, and a significantly higher level of effort needed to cull the best of both companies and integrate together.

Regardless of the type of merger, the transition time frame available to create value is short.

After the transaction and deal close, the next six months are critical. Leading up to the close and day one of the transition period, 40% of the changes that will ever be initiated are set. This, of course, includes the changes mandated by the structure of the transaction agreement. At 3 months 65% have been initiated, and at 6 months 85% have been initiated. The remaining 15% of initiatives must build on those of the first six months. At around six months, for better or worse, the newly formed company settles into a steady state. Because the timeframe is so short, the way the transition is managed is critical.

Three Ways to Manage a Transition

There are three ways to manage a transition: Too Little, Too Late, and Just Right.

Too Little

Because deal-making is the cool, high-profile phase of a merger or acquisition, and there is a misconception that a good deal guarantees a successful merger or acquisition, there is a temptation to limit the transition effort to the day one hoop-la. This is a mistake. According to Kenneth W. Smith of Mercer Management Consulting, “The deal is won or lost after it’s done.” The short attention span of the “Too Little” approach can result in the transition team feeling abandoned and disincentivized, resulting in confusion and paralysis, disintegration, and arriving at the six-month steady state with a large Value Gap.

Too Late

In this scenario, top management puts all their attention into closing the deal, but interest ebbs after the closing. They fail to impart their vision, knowledge, focus, and momentum to transition management. Transition-phase visioning, planning, and organizing do not start until the deal is closed (or they never occur at all) as the transition teams rush into action. Furthermore, events race ahead and are out of control—losing customers, key employees, and shareholder value in the chaos. Time, money, and energy are burned in firefighting and fixing mistakes. In the “Too Late” scenario, the momentum for a good transition begins to ebb even before the close, and then after close the transition effort is a rush to catch up. Without a clear vision from management, the transition team is at best guessing what needs to be done, resulting in continual undoing, redoing, and repairing. The result is reaching the six-month steady state with mixed results.

Just Right

In this scenario, management begins the transition effort almost immediately after the letter of intent is signed. By planning and lining up resources early and communicating a vision and plan to the transition team, by day 1 the transition is fully under way. By properly handling the transition effort, it is clear to all parties that the transition effort is to be taken seriously: it receives adequate resources; planning is an integral part of transaction due diligence; the transition team is fully engaged and ready to go on day 1; the best people from both companies design the new company; a rapid implementation reduces the cost of the transition; and the design of the processes allows the team to seize opportunities for synergy to emerge and persist. The result is reaching steady state while avoiding the Value Gap and having created emergent synergies.

Key Success Factors of the Integration Process, helpful in avoiding the value gap and maximizing the possibility of achieving emergent synergies, are proactive integration along with maintaining speed and momentum.

- Proactive integration, which means planning, monitoring, and adjusting how the integration process is being affected to maximize value, requires treating the transaction and transition as a single unified process, relying on experienced and trusted leadership, having a well-defined vision and focus, and provisioning adequate resources.

- Speed and momentum are critical, and it is important to stay ahead of events, strive to realize merger value early, take quick action on people issues, and sustain energy and enthusiasm.

Vision and Plan: Hit the Ground Running in the Right Direction

Vision—The Transition Plan

Using a top down perspective, key to ensuring a successful transition is establishing and communicating the goals of the merger—the future state and the value it will deliver.

Then a Transition Plan, an actionable program to focus the process of achieving the plan, should be developed. This program will include:

- Tasks (changes and deliverables) required to complete the plan; teams and people who will design and implement the future state; and resources, the tools, and the facilities the teams will need.

- Targets (measurable milestones toward realizing the value), which should include accountability in the form of personal and team responsibilities for hitting targets and incentives, and rewards for hitting targets.

- Priorities (critical tasks and targets for attaining the value) focusing on the tasks that create the highest value, understanding that even in the best plan, resources are limited, and choices must be made.

- Finally, Change Mechanisms, methods and manners by which unexpected opportunities can be seized and surprise problems can be addressed.

In addition to the Transition Plan, related but discrete, it is important to establish a Process Plan, a People Plan, and a Technology Plan.

Each of the Transition, Process, People, and Technology Plans must support the achievement of the vision and the value it promises. The following are the Why, How, and What questions that should be asked when developing these mutual, vision-supporting plans.

Why? Key Business Strategies and Synergy Opportunities:

- Why are we merging?

- How will we know that we are successful?

- What are our integrated operational strategic goals?

- How will we consolidate to achieve maximum benefit from both organizations?

How? Management Philosophy:

- What kind of culture/employee environment will we build and foster?

- What type of management style will we employ?

- What strengths of each organization will we leverage?

- What weaknesses will we overcome with the merger?

- What policies should we adopt?

- What new policies must be developed?

- What skills do we need to retain and develop?

- What should our culture characteristics be?

- What initiatives should we continue or halt?

What? High-Level Business Operating Model:

- How will we manage our key business processes?

- What is in scope?

- What are our product, market, and channel strategies as well as our desired core competencies?

- How can each function or process contribute to achieving the merger objectives?

- What must happen to integrate each process?

- What will the integrated process look like?

- What will the integrated organization look like?

- What skills and knowledge must we maintain?

- What will our systems and applications infrastructure look like?

- What systems must we roll out to enable the integration?

- What data and information must be consolidated or converted?

- How will we support our systems and users?

Processes—Designing the Synergies into the New Business

What needs to be done from a process standpoint varies on the type of merger.

For a coexistence, there should be a fast, cheap transition. At most, there is relatively minor work to impose control and coordination. That said, there may be unexpected incompatibilities, limited process synergies, little process improvement, little buy-in from employees, and no real economies of scale.

For an absorption, more effort is required, generally on a magnitude of 10 times the effort of a coexistence. The operations and assets of the absorbed company are just integrated into the existing systems of the acquirer. The best can be absorbed, the rest discontinued. This is not as easy as it sounds. The acquired operations and assets may not fit into the new organization well. Some strengths of the acquired company may be lost. The absorbed employees may not fit in well and might feel they have second-class status.

For a synthesis, even more effort is required because the purpose is to take the best processes from both companies. This can create unique challenges but provides the greatest upside potential for synergy. There are more emergent process-improvement opportunities. Because of the complexity of a synthesis, interim processes are needed during transition and there is a risk of losing focus and momentum.

Regardless of the type of merger, a key success factor is to Focus on Customer Processes. Priority should be given to customer-facing processes – Sales, Support, and Order Management. Design processes to present one consistent face to the customer. Deliver the benefits of merger synergies visibly to customers – new products, better service, more for their money. Create and staff interim processes to sustain the quality of products and services through the transition.

People—Realizing Merger Value by Getting the Best to Give Their Best

Clearly, a successful merger requires the higher motives to prevail at all levels of the organization – that is necessary.

Maslow defined three levels of human needs. The most basic are survival and must be satisfied before the higher levels are reached. In a business sense, the survival behaviors are those that people exhibit when they are concerned. A critical success factor is to minimize these survival type behaviors because they are destructive.

In a business context, the social level is demonstrated by company loyalty, feeling good about his/her job, their opinions are respected.

At the highest level, Self-actualization, the person is eager to go to the new world, is free from anxieties, and is able to develop emergent synergies, fulfilling others’ needs (not us and them).

On the Maslow hierarchy, employees acting from survival needs leads to fear and distrust, jockeying for position, rigidity and resistance to change, paralysis, distraction, collapse of productivity, resentment, sabotage, litigation, the best people resigning, and the worst people becoming resigned. These effects should be minimized.

Instead, an effort should be made to maximize the results of employees acting from self-actualization motivations. These lead to a sense of ownership of the new company; eagerness to contribute to the change; freedom to focus on new processes and systems; constructive criticism and input; being welcoming of new colleagues; generation of creative ideas; and discovering emergent synergies at all levels.

In addition to focusing solely on existing employees, thought should be given to the possibility of using external resources during the transition. By bringing in people from the outside, a company can:

- Fill in-house gaps in merger transition experience

- Ability to manage the business’ ability to manage a merger

- External experts can develop in-house merger capability

- Use an independent, external firm specializing in merger integration

- Avoid conflicts due to other services from the same provider

- Independent firm can select best providers of extra services

- Overcome the double resource crunch of a merger transition

- Enough competent people to accomplish the integration

- The right people to keep the business humming through the transition

- When they’re done, they’re gone

- Leverage purchase accounting to pay for the transition

- Transition costs don’t drag down the operational bottom line

- Transition achievements become permanent, reusable operational improvements

Technology—Enabling the New Enterprise without Delaying the Transition

Disparate and discrete data and information systems are a significant hurdle in the integration process. The key success factor for technology enablement in a merger entity is to plan technology integration from the top down, looking to the requirements of the business both from company leadership as well as employees at all levels. Technology should be aligned first with the leadership’s vision of what the company should be doing, and then to the employees, providing the needed knowledge and the power to get things done. Planning should be done from the top down, but the key success factor for the implementation is to implement technology integration from the bottom up. Implement the plan by addressing change needs as they relate to networks, computer systems, storage, and other machines. Then connectivity, data, and applications should be addressed.

As an example, take just one area of technology – but a central one – data integration. Integrated processes require integrated data. Focus data integration effort on processes that will be combined by absorption or synthesis. Processes that merely coexist don’t need integrated data. All those who participate in an integrated business process must have common definitions for all of the people, policies, and procedures that they deal with. Data should be consolidated into shared, non-redundant data stores. Hardware infrastructure must be up to handling the combined quantity of data with adequate performance.

1,307 thoughts on “Mergers and Acquisitions: Realizing the Value”

casino olympe: olympe casino en ligne – olympe casino en ligne

trouver un mГ©dicament en pharmacie: Pharmacie en ligne France – pharmacie en ligne france pas cher pharmafst.com

http://tadalmed.com/# cialis sans ordonnance

Kamagra pharmacie en ligne: Kamagra pharmacie en ligne – kamagra pas cher

Tadalafil 20 mg prix sans ordonnance: Achat Cialis en ligne fiable – Pharmacie en ligne Cialis sans ordonnance tadalmed.shop

pharmacie en ligne sans ordonnance: Pharmacie en ligne France – Pharmacie en ligne livraison Europe pharmafst.com

http://pharmafst.com/# pharmacie en ligne livraison europe

pharmacie en ligne france livraison internationale: pharmacie en ligne – pharmacie en ligne pas cher pharmafst.com

http://pharmafst.com/# pharmacie en ligne livraison europe

kamagra gel: Kamagra pharmacie en ligne – kamagra 100mg prix

achat kamagra [url=https://kamagraprix.shop/#]achat kamagra[/url] kamagra oral jelly

http://kamagraprix.com/# Achetez vos kamagra medicaments

Cialis en ligne: cialis prix – Tadalafil sans ordonnance en ligne tadalmed.shop

kamagra gel: kamagra livraison 24h – kamagra pas cher

kamagra oral jelly: kamagra en ligne – kamagra gel

kamagra gel [url=http://kamagraprix.com/#]kamagra gel[/url] acheter kamagra site fiable

https://tadalmed.shop/# cialis prix

pharmacie en ligne pas cher: Pharmacie sans ordonnance – acheter mГ©dicament en ligne sans ordonnance pharmafst.com

Cialis sans ordonnance pas cher: Achat Cialis en ligne fiable – Cialis sans ordonnance pas cher tadalmed.shop

Cialis sans ordonnance 24h: Acheter Cialis 20 mg pas cher – Cialis generique prix tadalmed.shop

http://pharmafst.com/# pharmacie en ligne france livraison internationale

pharmacie en ligne france pas cher [url=https://pharmafst.shop/#]pharmacie en ligne pas cher[/url] pharmacie en ligne france pas cher pharmafst.shop

pharmacie en ligne fiable: Achat mГ©dicament en ligne fiable – pharmacie en ligne avec ordonnance pharmafst.com

cialis sans ordonnance: Acheter Cialis – Acheter Cialis tadalmed.shop

acheter kamagra site fiable: Kamagra Oral Jelly pas cher – Kamagra pharmacie en ligne

https://kamagraprix.com/# kamagra pas cher

pharmacie en ligne avec ordonnance [url=https://pharmafst.com/#]Medicaments en ligne livres en 24h[/url] acheter mГ©dicament en ligne sans ordonnance pharmafst.shop

kamagra gel: kamagra pas cher – kamagra pas cher

acheter mГ©dicament en ligne sans ordonnance: pharmacie en ligne sans ordonnance – pharmacie en ligne fiable pharmafst.com

Kamagra Commander maintenant: kamagra oral jelly – kamagra 100mg prix

https://kamagraprix.shop/# Kamagra Oral Jelly pas cher

Achat Cialis en ligne fiable [url=http://tadalmed.com/#]Acheter Viagra Cialis sans ordonnance[/url] Pharmacie en ligne Cialis sans ordonnance tadalmed.com

kamagra livraison 24h: kamagra oral jelly – Kamagra Commander maintenant

kamagra gel: kamagra en ligne – Acheter Kamagra site fiable

https://pharmafst.com/# pharmacie en ligne livraison europe

https://pharmafst.shop/# vente de mГ©dicament en ligne

https://tadalmed.com/# Cialis en ligne

http://pharmafst.com/# acheter mГ©dicament en ligne sans ordonnance

https://pharmafst.shop/# п»їpharmacie en ligne france

pharmacies en ligne certifiГ©es [url=https://pharmafst.com/#]Livraison rapide[/url] Pharmacie Internationale en ligne pharmafst.shop

pharmacie en ligne france fiable: Meilleure pharmacie en ligne – pharmacie en ligne pharmafst.com

Acheter Viagra Cialis sans ordonnance: Cialis en ligne – cialis prix tadalmed.shop

https://pharmafst.com/# pharmacie en ligne livraison europe

Cialis sans ordonnance 24h: Cialis generique prix – Tadalafil sans ordonnance en ligne tadalmed.shop

Tadalafil 20 mg prix en pharmacie [url=https://tadalmed.com/#]cialis prix[/url] Acheter Cialis 20 mg pas cher tadalmed.com

pharmacie en ligne pas cher: Pharmacie en ligne France – Pharmacie Internationale en ligne pharmafst.com

http://pharmafst.com/# vente de mГ©dicament en ligne

Medicine From India: medicine courier from India to USA – indian pharmacy

indian pharmacy online: indian pharmacy online – india pharmacy mail order

https://rxexpressmexico.shop/# mexican online pharmacy

buying from canadian pharmacies: ExpressRxCanada – best canadian online pharmacy

indian pharmacy online [url=https://medicinefromindia.com/#]indian pharmacy online shopping[/url] Medicine From India

RxExpressMexico: mexico drug stores pharmacies – mexican online pharmacy

onlinecanadianpharmacy 24: Express Rx Canada – canadian pharmacy meds reviews

https://rxexpressmexico.shop/# RxExpressMexico

canadian pharmacies that deliver to the us: Generic drugs from Canada – buying from canadian pharmacies

canadian pharmacy ed medications [url=https://expressrxcanada.shop/#]canada drug pharmacy[/url] canadian pharmacy world reviews

medicine courier from India to USA: medicine courier from India to USA – indian pharmacy

https://rxexpressmexico.com/# RxExpressMexico

canadian drug pharmacy: Express Rx Canada – canadian pharmacy scam

indian pharmacy online shopping [url=http://medicinefromindia.com/#]top 10 online pharmacy in india[/url] Medicine From India

rate canadian pharmacies: Canadian pharmacy shipping to USA – legitimate canadian pharmacy online

canada pharmacy world: Canadian pharmacy shipping to USA – best canadian pharmacy to order from

http://rxexpressmexico.com/# mexico pharmacy order online

canadian pharmacy meds review: legitimate canadian pharmacy – canadian pharmacy no scripts

canada drugs online review [url=https://expressrxcanada.shop/#]Canadian pharmacy shipping to USA[/url] my canadian pharmacy review

indian pharmacy online: Medicine From India – indian pharmacy online shopping

http://expressrxcanada.com/# canadian king pharmacy

canadian drug stores: Canadian pharmacy shipping to USA – pharmacy wholesalers canada

mexico drug stores pharmacies: mexican online pharmacy – RxExpressMexico

canadian pharmacy meds review [url=https://expressrxcanada.shop/#]Express Rx Canada[/url] vipps approved canadian online pharmacy

http://medicinefromindia.com/# MedicineFromIndia

indian pharmacy online shopping: MedicineFromIndia – indian pharmacy online

indian pharmacy online shopping: Medicine From India – Medicine From India

canada drugs online reviews: Express Rx Canada – canadian drug pharmacy

awesome

reliable canadian pharmacy reviews: Generic drugs from Canada – legitimate canadian pharmacy online

http://rxexpressmexico.com/# Rx Express Mexico

onlinepharmaciescanada com [url=http://expressrxcanada.com/#]Buy medicine from Canada[/url] canadian drugstore online

mexico pharmacies prescription drugs: Rx Express Mexico – mexican rx online

legal canadian pharmacy online: Express Rx Canada – canadian pharmacy 365

https://rxexpressmexico.com/# mexico pharmacy order online

online canadian pharmacy [url=https://expressrxcanada.com/#]Canadian pharmacy shipping to USA[/url] legitimate canadian mail order pharmacy

my canadian pharmacy rx: Canadian pharmacy shipping to USA – drugs from canada

https://expressrxcanada.com/# canadian pharmacy online ship to usa

vavada casino [url=http://vavadavhod.tech/#]vavada[/url] вавада

vavada casino: вавада официальный сайт – вавада

http://pinuprus.pro/# пин ап казино

пин ап казино официальный сайт: пин ап зеркало – pin up вход

вавада казино: вавада зеркало – вавада официальный сайт

pin-up [url=http://pinupaz.top/#]pin up[/url] pinup az

https://vavadavhod.tech/# вавада

пин ап зеркало: пин ап казино – пинап казино

пин ап казино официальный сайт: пин ап зеркало – пин ап вход

pin-up casino giris [url=http://pinupaz.top/#]pin up azerbaycan[/url] pin-up casino giris

pin up вход: пин ап вход – пин ап зеркало

http://pinupaz.top/# pin-up

pin-up casino giris: pin-up – pin up az

пин ап вход [url=http://pinuprus.pro/#]пин ап зеркало[/url] пин ап казино

пин ап зеркало: пинап казино – пин ап казино

http://pinuprus.pro/# пинап казино

pinup az: pinup az – pin up casino

вавада зеркало [url=http://vavadavhod.tech/#]vavada[/url] вавада официальный сайт

vavada вход: vavada вход – вавада зеркало

http://pinuprus.pro/# pin up вход

vavada: vavada casino – vavada casino

вавада: vavada – вавада зеркало

пин ап казино официальный сайт: pin up вход – pin up вход

pinup az [url=https://pinupaz.top/#]pin up azerbaycan[/url] pinup az

http://pinupaz.top/# pin up azerbaycan

pin up: pin up azerbaycan – pin up az

vavada вход: vavada вход – вавада официальный сайт

vavada вход: вавада – вавада

http://pinuprus.pro/# пин ап вход

pin up вход [url=http://pinuprus.pro/#]pin up вход[/url] пин ап зеркало

пин ап казино: pin up вход – пин ап зеркало

pin-up casino giris: pin-up – pinup az

pinup az: pin up az – pin-up

вавада зеркало [url=http://vavadavhod.tech/#]vavada вход[/url] vavada casino

pin up: pin-up – pin up

пин ап казино официальный сайт: пин ап зеркало – пин ап вход

http://vavadavhod.tech/# вавада официальный сайт

пинап казино: пин ап казино – pin up вход

вавада зеркало: vavada вход – вавада зеркало

http://pinuprus.pro/# пин ап казино

пин ап казино: пинап казино – пин ап казино

вавада [url=http://vavadavhod.tech/#]vavada casino[/url] vavada casino

вавада казино: вавада официальный сайт – vavada вход

pin up: pin up – pin up casino

http://vavadavhod.tech/# вавада казино

pin up casino: pin up – pinup az

pin up [url=https://pinupaz.top/#]pin-up casino giris[/url] pin-up casino giris

pinup az: pin-up casino giris – pinup az

https://pinuprus.pro/# pin up вход

вавада зеркало [url=https://vavadavhod.tech/#]vavada вход[/url] вавада зеркало

пин ап казино официальный сайт: пин ап зеркало – pin up вход

pin up casino: pin-up casino giris – pin-up

https://pinuprus.pro/# пин ап казино

vavada вход: вавада зеркало – вавада официальный сайт

pin up вход [url=https://pinuprus.pro/#]пинап казино[/url] пин ап казино официальный сайт

pin-up: pin up casino – pin up casino

http://vavadavhod.tech/# вавада

pinup az: pin up – pin up

пинап казино [url=http://pinuprus.pro/#]пин ап казино официальный сайт[/url] пин ап зеркало

пин ап вход: пин ап зеркало – пин ап казино официальный сайт

https://pinuprus.pro/# pin up вход

vavada вход: vavada casino – вавада зеркало

vavada casino: vavada – vavada вход

pinup az: pin-up casino giris – pin up azerbaycan

http://pinupaz.top/# pin up casino

pin up casino [url=http://pinupaz.top/#]pinup az[/url] pin-up casino giris

вавада официальный сайт: вавада казино – вавада официальный сайт

http://pinuprus.pro/# пин ап зеркало

вавада официальный сайт [url=http://vavadavhod.tech/#]vavada вход[/url] вавада казино

пинап казино: пин ап зеркало – пин ап казино

вавада казино: vavada casino – вавада официальный сайт

http://pinupaz.top/# pin-up

пин ап зеркало [url=http://pinuprus.pro/#]пин ап зеркало[/url] пин ап казино официальный сайт

вавада зеркало: вавада официальный сайт – вавада зеркало

пин ап казино официальный сайт: пин ап зеркало – пин ап вход

http://pinuprus.pro/# pin up вход

vavada casino [url=https://vavadavhod.tech/#]вавада официальный сайт[/url] vavada

pin up azerbaycan: pin-up casino giris – pinup az

vavada вход: vavada – вавада

pin-up [url=https://pinupaz.top/#]pin up az[/url] pinup az

pinup az: pin up azerbaycan – pinup az

https://pinupaz.top/# pin up casino

pin-up casino giris: pin up azerbaycan – pin up

вавада [url=https://vavadavhod.tech/#]vavada вход[/url] вавада зеркало

вавада: вавада официальный сайт – vavada casino

http://vavadavhod.tech/# vavada

пин ап казино официальный сайт: пин ап казино – pin up вход

pin-up casino giris [url=http://pinupaz.top/#]pin up azerbaycan[/url] pin up

http://pinuprus.pro/# пин ап зеркало

вавада: вавада – vavada casino

pin-up casino giris [url=https://pinupaz.top/#]pinup az[/url] pinup az

http://pinupaz.top/# pin up casino

pin up вход: pin up вход – pin up вход

pinup az: pinup az – pin-up casino giris

pin up [url=https://pinupaz.top/#]pin up casino[/url] pinup az

https://pinuprus.pro/# пин ап зеркало

pin-up casino giris: pin up – pin up az

вавада: вавада – вавада

вавада официальный сайт [url=http://vavadavhod.tech/#]vavada casino[/url] вавада

пин ап вход: pin up вход – пин ап казино

вавада зеркало: vavada casino – vavada casino

вавада зеркало [url=https://vavadavhod.tech/#]vavada[/url] вавада казино

pin-up: pin up az – pin up az

pin-up casino giris: pin up az – pin up casino

http://pinuprus.pro/# pin up вход

vavada [url=http://vavadavhod.tech/#]vavada casino[/url] vavada

pin up casino: pin up az – pin-up

вавада: вавада – vavada вход

http://vavadavhod.tech/# vavada вход

pin up azerbaycan [url=http://pinupaz.top/#]pin-up[/url] pin up azerbaycan

вавада казино: вавада зеркало – вавада официальный сайт

pinup az: pin up azerbaycan – pin up azerbaycan

https://pinupaz.top/# pin up

pin up вход: пин ап зеркало – пин ап казино официальный сайт

vavada вход [url=http://vavadavhod.tech/#]vavada[/url] вавада казино

pin-up casino giris: pin up azerbaycan – pin-up

http://pinuprus.pro/# pin up вход

вавада официальный сайт: вавада официальный сайт – vavada вход

вавада [url=http://vavadavhod.tech/#]вавада казино[/url] вавада зеркало

pin up casino: pin up az – pin-up

https://pinupaz.top/# pin-up casino giris

pin-up: pin up – pin up az

пин ап казино [url=http://pinuprus.pro/#]pin up вход[/url] пин ап казино официальный сайт

пин ап вход: пин ап зеркало – пин ап казино

https://pinuprus.pro/# pin up вход

вавада: vavada вход – вавада

пин ап вход: пин ап казино официальный сайт – пин ап зеркало

pin-up: pin up casino – pin-up casino giris

pin up azerbaycan [url=https://pinupaz.top/#]pin-up[/url] pin-up

http://vavadavhod.tech/# вавада

pin-up casino giris: pin up azerbaycan – pinup az

http://pinuprus.pro/# пинап казино

вавада [url=https://vavadavhod.tech/#]вавада казино[/url] вавада официальный сайт

pin up вход: пин ап казино официальный сайт – пинап казино

pin-up casino giris: pin-up – pin up

http://vavadavhod.tech/# вавада

pinup az [url=https://pinupaz.top/#]pin-up casino giris[/url] pin-up

pin up: pin up az – pin-up

https://pinupaz.top/# pin-up casino giris

vavada [url=https://vavadavhod.tech/#]вавада официальный сайт[/url] vavada casino

pin up вход: пинап казино – пин ап вход

http://pinuprus.pro/# pin up вход

pinup az: pin up – pin up azerbaycan

пин ап вход [url=http://pinuprus.pro/#]pin up вход[/url] пин ап казино

purchase Modafinil without prescription: buy modafinil online – doctor-reviewed advice

https://maxviagramd.shop/# fast Viagra delivery

fast Viagra delivery: discreet shipping – legit Viagra online

FDA approved generic Cialis [url=https://zipgenericmd.com/#]order Cialis online no prescription[/url] Cialis without prescription

modafinil legality: Modafinil for sale – doctor-reviewed advice

https://maxviagramd.com/# best price for Viagra

modafinil 2025: doctor-reviewed advice – legal Modafinil purchase

best price Cialis tablets: discreet shipping ED pills – generic tadalafil

online Cialis pharmacy [url=https://zipgenericmd.com/#]generic tadalafil[/url] online Cialis pharmacy

modafinil 2025: Modafinil for sale – modafinil 2025

https://maxviagramd.com/# best price for Viagra

purchase Modafinil without prescription: purchase Modafinil without prescription – verified Modafinil vendors

best price for Viagra: legit Viagra online – cheap Viagra online

best price Cialis tablets [url=https://zipgenericmd.com/#]cheap Cialis online[/url] affordable ED medication

buy modafinil online: modafinil pharmacy – modafinil legality

modafinil legality: modafinil legality – buy modafinil online

https://maxviagramd.shop/# Viagra without prescription

reliable online pharmacy Cialis: order Cialis online no prescription – secure checkout ED drugs

generic tadalafil [url=https://zipgenericmd.com/#]online Cialis pharmacy[/url] generic tadalafil

best price Cialis tablets: buy generic Cialis online – FDA approved generic Cialis

legal Modafinil purchase: legal Modafinil purchase – modafinil 2025

no doctor visit required: safe online pharmacy – legit Viagra online

cheap Cialis online: discreet shipping ED pills – buy generic Cialis online

Modafinil for sale [url=http://modafinilmd.store/#]verified Modafinil vendors[/url] purchase Modafinil without prescription

modafinil pharmacy: modafinil legality – modafinil legality

http://maxviagramd.com/# order Viagra discreetly

Modafinil for sale: purchase Modafinil without prescription – doctor-reviewed advice

cheap Cialis online: discreet shipping ED pills – discreet shipping ED pills

safe modafinil purchase [url=https://modafinilmd.store/#]doctor-reviewed advice[/url] verified Modafinil vendors

verified Modafinil vendors: legal Modafinil purchase – doctor-reviewed advice

https://modafinilmd.store/# buy modafinil online

buy generic Cialis online: affordable ED medication – secure checkout ED drugs

secure checkout ED drugs: buy generic Cialis online – order Cialis online no prescription

online Cialis pharmacy [url=http://zipgenericmd.com/#]online Cialis pharmacy[/url] generic tadalafil

discreet shipping ED pills: generic tadalafil – secure checkout ED drugs

https://modafinilmd.store/# legal Modafinil purchase

secure checkout Viagra: secure checkout Viagra – fast Viagra delivery

secure checkout Viagra: same-day Viagra shipping – fast Viagra delivery

no doctor visit required [url=http://maxviagramd.com/#]same-day Viagra shipping[/url] Viagra without prescription

buy generic Cialis online: generic tadalafil – Cialis without prescription

https://maxviagramd.shop/# trusted Viagra suppliers

Modafinil for sale: modafinil 2025 – doctor-reviewed advice

buy generic Viagra online: legit Viagra online – buy generic Viagra online

buy generic Viagra online [url=https://maxviagramd.shop/#]trusted Viagra suppliers[/url] buy generic Viagra online

Cialis without prescription: cheap Cialis online – reliable online pharmacy Cialis

http://modafinilmd.store/# Modafinil for sale

no doctor visit required: discreet shipping – same-day Viagra shipping

order Cialis online no prescription: Cialis without prescription – Cialis without prescription

generic sildenafil 100mg [url=https://maxviagramd.shop/#]cheap Viagra online[/url] same-day Viagra shipping

best price Cialis tablets: discreet shipping ED pills – best price Cialis tablets

http://maxviagramd.com/# generic sildenafil 100mg

fast Viagra delivery: fast Viagra delivery – order Viagra discreetly

fast Viagra delivery: fast Viagra delivery – best price for Viagra

safe modafinil purchase [url=http://modafinilmd.store/#]safe modafinil purchase[/url] buy modafinil online

buy modafinil online: doctor-reviewed advice – modafinil pharmacy

generic sildenafil 100mg: trusted Viagra suppliers – secure checkout Viagra

http://modafinilmd.store/# purchase Modafinil without prescription

buy generic Cialis online: FDA approved generic Cialis – affordable ED medication

buy generic Cialis online: affordable ED medication – affordable ED medication

affordable ED medication [url=https://zipgenericmd.shop/#]secure checkout ED drugs[/url] cheap Cialis online

best price for Viagra: safe online pharmacy – Viagra without prescription

https://modafinilmd.store/# Modafinil for sale

prednisone 10mg tabs [url=http://prednihealth.com/#]cheap prednisone 20 mg[/url] PredniHealth

Amo Health Care: Amo Health Care – amoxicillin 500mg capsules uk

buy amoxicillin online no prescription: amoxicillin buy online canada – Amo Health Care

amoxicillin 500mg no prescription: where to buy amoxicillin over the counter – Amo Health Care

https://prednihealth.com/# PredniHealth

where can i buy cheap clomid: Clom Health – how to get cheap clomid without insurance

cost of generic clomid no prescription: cost of clomid for sale – can i buy generic clomid without insurance

buy amoxicillin from canada [url=https://amohealthcare.store/#]amoxicillin 500mg cost[/url] Amo Health Care

can you get generic clomid without dr prescription: Clom Health – how to get generic clomid without a prescription

http://clomhealth.com/# how to get cheap clomid without rx

PredniHealth: PredniHealth – prednisone 7.5 mg

cost of prednisone in canada: PredniHealth – PredniHealth

amoxicillin medicine over the counter: where can you buy amoxicillin over the counter – Amo Health Care

clomid prices [url=http://clomhealth.com/#]Clom Health[/url] buy clomid pills

https://prednihealth.com/# PredniHealth

PredniHealth: purchase prednisone 10mg – prednisone 2.5 mg

how to get clomid without insurance: buying clomid tablets – where to get cheap clomid without dr prescription

prednisone online australia: PredniHealth – prednisone 50 mg tablet canada

PredniHealth [url=http://prednihealth.com/#]PredniHealth[/url] prednisone 20 mg

http://prednihealth.com/# PredniHealth

20 mg prednisone: buying prednisone without prescription – prednisone uk

buy prednisone without prescription: prednisone 4mg – PredniHealth

https://prednihealth.com/# no prescription online prednisone

Amo Health Care [url=https://amohealthcare.store/#]order amoxicillin no prescription[/url] buy amoxicillin 500mg capsules uk

PredniHealth: PredniHealth – PredniHealth

cortisol prednisone: 1250 mg prednisone – PredniHealth

https://prednihealth.com/# buy prednisone online canada

Amo Health Care [url=https://amohealthcare.store/#]Amo Health Care[/url] Amo Health Care

Amo Health Care: generic amoxicillin over the counter – Amo Health Care

order amoxicillin online uk: Amo Health Care – Amo Health Care

https://clomhealth.com/# how to get generic clomid without a prescription

order cheap clomid pills [url=https://clomhealth.shop/#]Clom Health[/url] can you get clomid now

prednisone 2 mg: PredniHealth – buy prednisone online india

can you get generic clomid without insurance: get clomid without a prescription – where to buy generic clomid tablets

difference between tadalafil and sildenafil: what happens if you take 2 cialis – what is the difference between cialis and tadalafil

https://tadalaccess.com/# generic tadalafil prices

do you need a prescription for cialis [url=https://tadalaccess.com/#]Tadal Access[/url] online cialis no prescription

best price for tadalafil: canadian pharmacy cialis – how long does cialis last in your system

when should i take cialis: TadalAccess – cialis manufacturer coupon lilly

https://tadalaccess.com/# tadalafil (tadalis-ajanta)

cialis manufacturer [url=https://tadalaccess.com/#]can i take two 5mg cialis at once[/url] order cialis canada

cost of cialis for daily use: cialis dosages – cialis review

vardenafil and tadalafil: TadalAccess – cialis online overnight shipping

https://tadalaccess.com/# cheaper alternative to cialis

cialis online without prescription [url=https://tadalaccess.com/#]cialis headache[/url] cialis samples

cialis for blood pressure: buy cialis without doctor prescription – cialis buy online canada

cialis for daily use: TadalAccess – natural alternative to cialis

https://tadalaccess.com/# over the counter cialis walgreens

cialis for daily use dosage: cialis with dapoxetine – cheapest cialis

cialis generic release date [url=https://tadalaccess.com/#]cialis coupon free trial[/url] cialis otc switch

https://tadalaccess.com/# why does tadalafil say do not cut pile

cialis generic timeline 2018: how many 5mg cialis can i take at once – when will cialis be generic

cialis cost per pill [url=https://tadalaccess.com/#]Tadal Access[/url] does cialis really work

cialis otc 2016: Tadal Access – prices of cialis

https://tadalaccess.com/# tadalafil and ambrisentan newjm 2015

tadalafil generico farmacias del ahorro: tadalafil citrate – cialis generic online

cialis premature ejaculation [url=https://tadalaccess.com/#]TadalAccess[/url] what happens if a woman takes cialis

buying cialis in canada: cialis voucher – what is the cost of cialis

https://tadalaccess.com/# what is the generic for cialis

cialis sales in victoria canada: tadalafil 20mg (generic equivalent to cialis) – bph treatment cialis

compounded tadalafil troche life span: TadalAccess – cialis slogan

buy cialis tadalafil [url=https://tadalaccess.com/#]TadalAccess[/url] cialis 20 mg how long does it take to work

https://tadalaccess.com/# how long does it take for cialis to take effect

cialis for prostate: cost of cialis for daily use – cialis sales in victoria canada

is there a generic cialis available?: TadalAccess – cialis w/dapoxetine

best price on generic tadalafil [url=https://tadalaccess.com/#]how long i have to wait to take tadalafil after antifugal[/url] tadalafil 40 mg india

https://tadalaccess.com/# cialis free 30 day trial

cialis prescription cost: TadalAccess – buy cialis 20mg

cialis 20 mg: Tadal Access – cialis 5mg how long does it take to work

https://tadalaccess.com/# canada drugs cialis

order generic cialis online [url=https://tadalaccess.com/#]Tadal Access[/url] cialis shelf life

does cialis lower your blood pressure: TadalAccess – cialis canada online

cialis online no prescription: TadalAccess – cialis not working anymore

https://tadalaccess.com/# what does cialis look like

cialis instructions [url=https://tadalaccess.com/#]shelf life of liquid tadalafil[/url] best price on generic tadalafil

cialis 30 mg dose: cheap cialis dapoxitine cheap online – cialis online delivery overnight

originalcialis: cialis for enlarged prostate – buying cialis online safe

https://tadalaccess.com/# how long does cialis last 20 mg

cheap canadian cialis [url=https://tadalaccess.com/#]Tadal Access[/url] prices of cialis 20 mg

buy cialis/canada: buy cialis canadian – price of cialis in pakistan

https://tadalaccess.com/# 20 mg tadalafil best price

cialis lower blood pressure: cialis how does it work – shop for cialis

cheapest cialis 20 mg [url=https://tadalaccess.com/#]Tadal Access[/url] cialis insurance coverage blue cross

cialis for blood pressure: TadalAccess – cialis generic 20 mg 30 pills

https://tadalaccess.com/# adcirca tadalafil

cialis generic canada: Tadal Access – cialis price comparison no prescription

cialis price per pill [url=https://tadalaccess.com/#]cialis buy online[/url] where to buy tadalafil in singapore

canadian pharmacy generic cialis: cialis tadalafil discount – tadalafil (tadalis-ajanta) reviews

https://tadalaccess.com/# cialis professional review

cialis manufacturer coupon free trial: cialis dosage reddit – no prescription cialis

how much does cialis cost at walmart: tadalafil generic usa – can cialis cause high blood pressure

buy tadalafil cheap online [url=https://tadalaccess.com/#]TadalAccess[/url] does cialis make you last longer in bed

https://tadalaccess.com/# cialis active ingredient

cialis 800 black canada: Tadal Access – tadalafil (tadalis-ajanta) reviews

how long before sex should you take cialis: TadalAccess – can you drink wine or liquor if you took in tadalafil

typical cialis prescription strength [url=https://tadalaccess.com/#]cialis canadian purchase[/url] vardenafil tadalafil sildenafil

https://tadalaccess.com/# cialis online no prescription

cialis canada free sample: Tadal Access – cialis dosage reddit

cialis prices at walmart: buy cialis overnight shipping – cialis trial

is there a generic equivalent for cialis [url=https://tadalaccess.com/#]cialis for sale brand[/url] best reviewed tadalafil site

https://tadalaccess.com/# over the counter drug that works like cialis

online tadalafil: cialis buy online canada – cialis canada over the counter

what is the difference between cialis and tadalafil?: TadalAccess – how to take cialis

cialis purchase [url=https://tadalaccess.com/#]TadalAccess[/url] cialis indien bezahlung mit paypal

https://tadalaccess.com/# e-cialis hellocig e-liquid

price of cialis in pakistan: Tadal Access – cialis effect on blood pressure

purchase cialis: Tadal Access – cialis generic

https://tadalaccess.com/# cialis tadalafil online paypal

tadalafil review forum [url=https://tadalaccess.com/#]canadian pharmacy online cialis[/url] cialis otc 2016

best price on cialis 20mg: TadalAccess – generic cialis tadalafil 20mg reviews

canada drugs cialis: cialis prescription assistance program – buy cialis in canada

https://tadalaccess.com/# purchase cialis online

best price on generic cialis [url=https://tadalaccess.com/#]TadalAccess[/url] shelf life of liquid tadalafil

how to buy tadalafil online: TadalAccess – cialis recreational use

cialis next day delivery: Tadal Access – does cialis make you harder

https://tadalaccess.com/# what is the cost of cialis

cialis coupon rite aid [url=https://tadalaccess.com/#]difference between sildenafil and tadalafil[/url] cialis 5mg cost per pill

no prescription tadalafil: Tadal Access – can i take two 5mg cialis at once

https://tadalaccess.com/# cialis bathtub

cialis tadalafil discount [url=https://tadalaccess.com/#]TadalAccess[/url] tadalafil eli lilly

cialis purchase: TadalAccess – cialis 5mg daily how long before it works

https://tadalaccess.com/# sunrise pharmaceutical tadalafil

cialis professional review: cialis canadian purchase – buying cheap cialis online

tadalafil ingredients: cheap canadian cialis – cialis generic cost

cialis from india [url=https://tadalaccess.com/#]Tadal Access[/url] is generic cialis available in canada

https://tadalaccess.com/# cialis same as tadalafil

cialis professional vs cialis super active: what is cialis prescribed for – cialis before and after photos

how long does it take cialis to start working: cialis for daily use cost – side effects of cialis tadalafil

cheap cialis free shipping [url=https://tadalaccess.com/#]how long does cialis take to work 10mg[/url] when to take cialis 20mg

https://tadalaccess.com/# how much does cialis cost at cvs

cialis website: cialis generic for sale – whats the max safe dose of tadalafil xtenda for a healthy man

sildenafil and tadalafil: TadalAccess – how long does it take cialis to start working

buy cialis in las vegas [url=https://tadalaccess.com/#]cialis super active vs regular cialis[/url] cialis prostate

https://tadalaccess.com/# cialis 40 mg reviews

how long does tadalafil take to work: Tadal Access – how many 5mg cialis can i take at once

take cialis the correct way: TadalAccess – price of cialis in pakistan

cialis information [url=https://tadalaccess.com/#]difference between tadalafil and sildenafil[/url] cialis manufacturer coupon free trial

https://tadalaccess.com/# cialis 10mg reviews

cialis 20 mg duration: TadalAccess – cialis manufacturer coupon

cheap cialis 5mg: TadalAccess – cialis best price

online cialis prescription [url=https://tadalaccess.com/#]TadalAccess[/url] cialis free sample

https://tadalaccess.com/# cialis pill

cialis discount coupons: TadalAccess – buy cialis from canada

cialis dosis: Tadal Access – cialis online delivery overnight

cialis how does it work [url=https://tadalaccess.com/#]prescription free cialis[/url] does cialis really work

https://tadalaccess.com/# poppers and cialis

cialis canada: Tadal Access – cialis purchase

generic cialis super active tadalafil 20mg: buy cialis online free shipping – where to get the best price on cialis

brand cialis australia [url=https://tadalaccess.com/#]TadalAccess[/url] what is cialis used for

https://tadalaccess.com/# buy cheap cialis online with mastercard

cialis online reviews: TadalAccess – us pharmacy prices for cialis

cialis picture: canada drugs cialis – buy cialis online overnight shipping

https://tadalaccess.com/# cialis with dapoxetine

cialis when to take [url=https://tadalaccess.com/#]TadalAccess[/url] cialis indien bezahlung mit paypal

cialis sales in victoria canada: where can i buy tadalafil online – cialis buy without

is generic tadalafil as good as cialis: does tadalafil lower blood pressure – adcirca tadalafil

is tadalafil available at cvs [url=https://tadalaccess.com/#]TadalAccess[/url] cialis efectos secundarios

cialis professional vs cialis super active: TadalAccess – cialis doesnt work

https://tadalaccess.com/# where can i buy tadalafil online

u.s. pharmacy prices for cialis: Tadal Access – cialis w/dapoxetine

buying cheap cialis online [url=https://tadalaccess.com/#]cialis ontario no prescription[/url] tadalafil versus cialis

https://tadalaccess.com/# cialis price south africa

buy cialis generic online 10 mg: cialis tadalafil 5mg once a day – is there a generic equivalent for cialis

cialis testimonials: Tadal Access – cialis for daily use dosage

buy generic cialis online: Tadal Access – cheap cialis with dapoxetine

https://tadalaccess.com/# cialis 10mg

when will generic cialis be available [url=https://tadalaccess.com/#]TadalAccess[/url] cialis professional 20 lowest price

trusted online store to buy cialis: TadalAccess – how long does cialis last in your system

https://tadalaccess.com/# cialis coupon code

buy cialis online no prescription [url=https://tadalaccess.com/#]buy generic cialis[/url] order cialis canada

cheap cialis: stendra vs cialis – tadalafil price insurance

generic cialis tadalafil 20mg india [url=https://tadalaccess.com/#]TadalAccess[/url] cialis w/dapoxetine

https://tadalaccess.com/# buying cialis online safe

cialis for sale toronto: buying cialis – cialis overnight deleivery

buying cialis internet [url=https://tadalaccess.com/#]cialis headache[/url] cialis generic cost

cialis indications: is tadalafil from india safe – best research tadalafil 2017

https://tadalaccess.com/# buy cialis without prescription

cheap generic cialis canada [url=https://tadalaccess.com/#]how long does it take cialis to start working[/url] free coupon for cialis

is tadalafil as effective as cialis: cialis 20mg for sale – mail order cialis

https://tadalaccess.com/# best price on generic tadalafil

buy cialis in toronto [url=https://tadalaccess.com/#]Tadal Access[/url] cialis without prescription

cialis las vegas: TadalAccess – cialis coupon online

https://tadalaccess.com/# cialis dosage reddit

cialis stories: Tadal Access – is there a generic cialis available in the us

cialis savings card [url=https://tadalaccess.com/#]Tadal Access[/url] does cialis make you last longer in bed

cialis 20 milligram: mantra 10 tadalafil tablets – how long does it take cialis to start working

cialis canada prices [url=https://tadalaccess.com/#]Tadal Access[/url] what is the generic for cialis

https://tadalaccess.com/# tadalafil medication

sildenafil vs tadalafil vs vardenafil: TadalAccess – canadian pharmacy cialis 20mg

buy antibiotics [url=https://biotpharm.com/#]BiotPharm[/url] buy antibiotics from india

buy erectile dysfunction pills online: Ero Pharm Fast – Ero Pharm Fast

PharmAu24: Discount pharmacy Australia – Online medication store Australia

https://eropharmfast.shop/# get ed meds today

Over the counter antibiotics pills: buy antibiotics online uk – antibiotic without presription

get ed meds today: Ero Pharm Fast – cheapest ed treatment

Ero Pharm Fast [url=https://eropharmfast.com/#]Ero Pharm Fast[/url] online ed medicine

buy antibiotics for uti: BiotPharm – cheapest antibiotics

Ero Pharm Fast: low cost ed meds – Ero Pharm Fast

https://biotpharm.com/# over the counter antibiotics

Over the counter antibiotics pills: buy antibiotics online uk – buy antibiotics over the counter

get antibiotics without seeing a doctor: buy antibiotics online – Over the counter antibiotics for infection

Medications online Australia [url=http://pharmau24.com/#]Medications online Australia[/url] PharmAu24

get ed meds online: online erectile dysfunction pills – cheapest ed treatment

Pharm Au24: Medications online Australia – online pharmacy australia

https://eropharmfast.shop/# Ero Pharm Fast

online pharmacy australia: online pharmacy australia – Buy medicine online Australia

https://biotpharm.com/# best online doctor for antibiotics

Buy medicine online Australia: online pharmacy australia – Online medication store Australia

Buy medicine online Australia [url=http://pharmau24.com/#]Pharm Au 24[/url] PharmAu24

buy antibiotics online: buy antibiotics – best online doctor for antibiotics

buy ed medication online: Ero Pharm Fast – Ero Pharm Fast

https://biotpharm.shop/# buy antibiotics

get antibiotics without seeing a doctor: buy antibiotics online – buy antibiotics over the counter

Licensed online pharmacy AU [url=https://pharmau24.shop/#]online pharmacy australia[/url] PharmAu24

cheapest antibiotics: buy antibiotics online – get antibiotics without seeing a doctor

cheapest antibiotics: Over the counter antibiotics pills – buy antibiotics over the counter

https://eropharmfast.com/# buying ed pills online

best ed meds online: where to buy erectile dysfunction pills – Ero Pharm Fast

buy antibiotics for uti: buy antibiotics from india – antibiotic without presription

buy antibiotics from canada [url=https://biotpharm.com/#]Biot Pharm[/url] buy antibiotics from canada

Licensed online pharmacy AU: Buy medicine online Australia – PharmAu24

affordable ed medication [url=http://eropharmfast.com/#]Ero Pharm Fast[/url] Ero Pharm Fast

Over the counter antibiotics for infection: buy antibiotics online – get antibiotics without seeing a doctor

https://pharmau24.shop/# Pharm Au24

Online medication store Australia [url=http://pharmau24.com/#]Online drugstore Australia[/url] PharmAu24

Medications online Australia: Licensed online pharmacy AU – Buy medicine online Australia

Online medication store Australia [url=http://pharmau24.com/#]online pharmacy australia[/url] Discount pharmacy Australia

Medications online Australia: Discount pharmacy Australia – Discount pharmacy Australia

https://pharmau24.shop/# Buy medicine online Australia

Licensed online pharmacy AU [url=https://pharmau24.com/#]Online drugstore Australia[/url] Pharm Au24

buy antibiotics for uti [url=https://biotpharm.com/#]Biot Pharm[/url] buy antibiotics for uti

Buy medicine online Australia: Medications online Australia – Pharm Au24

http://biotpharm.com/# buy antibiotics online

online pharmacy australia [url=https://pharmau24.com/#]pharmacy online australia[/url] Medications online Australia

buy antibiotics over the counter [url=https://biotpharm.com/#]buy antibiotics online uk[/url] antibiotic without presription

https://viasansordonnance.com/# Viagra homme prix en pharmacie sans ordonnance

Cialis générique sans ordonnance: Cialis pas cher livraison rapide – commander Cialis en ligne sans prescription

Meilleur Viagra sans ordonnance 24h [url=https://viasansordonnance.shop/#]viagra en ligne[/url] viagra en ligne

livraison rapide Viagra en France: Viagra générique en pharmacie – Meilleur Viagra sans ordonnance 24h

pharmacie en ligne livraison europe: cialis prix – cialis generique

pharmacie en ligne france livraison belgique [url=https://ciasansordonnance.com/#]vente de mГ©dicament en ligne[/url] acheter Cialis sans ordonnance

Viagra generique en pharmacie: Acheter du Viagra sans ordonnance – acheter Viagra sans ordonnance

https://pharmsansordonnance.com/# pharmacie en ligne sans ordonnance

pharmacie en ligne sans prescription: commander sans consultation médicale – vente de médicament en ligne

pharmacies en ligne certifiГ©es [url=https://kampascher.shop/#]kamagra pas cher[/url] achat kamagra

Acheter du Viagra sans ordonnance: prix bas Viagra générique – commander Viagra discretement

acheter Cialis sans ordonnance: Pharmacie en ligne livraison Europe – acheter Cialis sans ordonnance

cialis prix: traitement ED discret en ligne – acheter Cialis sans ordonnance

Kamagra oral jelly pas cher [url=https://kampascher.shop/#]Kamagra oral jelly pas cher[/url] acheter Kamagra sans ordonnance

https://ciasansordonnance.com/# Acheter Cialis 20 mg pas cher

Acheter Cialis: traitement ED discret en ligne – cialis prix

cialis prix: Acheter Cialis 20 mg pas cher – cialis generique

Viagra sans ordonnance 24h Amazon [url=https://viasansordonnance.com/#]Viagra pas cher livraison rapide france[/url] livraison rapide Viagra en France

Meilleur Viagra sans ordonnance 24h: acheter Viagra sans ordonnance – Viagra sans ordonnance 24h

achat kamagra: Kamagra oral jelly pas cher – acheter kamagra site fiable

http://kampascher.com/# Kamagra oral jelly pas cher

pharmacie en ligne livraison europe [url=https://pharmsansordonnance.shop/#]pharmacie en ligne pas cher[/url] pharmacie en ligne france livraison belgique

Cialis pas cher livraison rapide: cialis prix – Cialis pas cher livraison rapide

acheter medicaments sans ordonnance: pharmacie en ligne sans prescription – pharmacie en ligne sans ordonnance

Viagra sans ordonnance 24h: viagra en ligne – viagra sans ordonnance

Cialis sans ordonnance 24h [url=https://ciasansordonnance.shop/#]Cialis generique sans ordonnance[/url] cialis sans ordonnance

Medicaments en ligne livres en 24h: pharmacie en ligne sans ordonnance – vente de mГ©dicament en ligne

livraison rapide Viagra en France: livraison rapide Viagra en France – Acheter du Viagra sans ordonnance

https://ciasansordonnance.shop/# Acheter Cialis

Viagra sans ordonnance 24h: Sild̩nafil Teva 100 mg acheter Рacheter Viagra sans ordonnance

livraison discrete Kamagra [url=http://kampascher.com/#]Kamagra oral jelly pas cher[/url] Pharmacie Internationale en ligne

Cialis pas cher livraison rapide: pharmacie en ligne sans ordonnance – Cialis pas cher livraison rapide

pharmacie en ligne pas cher: pharmacie en ligne pas cher – pharmacie en ligne france livraison belgique

acheter médicaments sans ordonnance: pharmacie en ligne sans ordonnance – pharmacie en ligne avec ordonnance

Viagra sans ordonnance 24h: Viagra pas cher livraison rapide france – prix bas Viagra generique

viagra sans ordonnance [url=https://viasansordonnance.com/#]viagra sans ordonnance[/url] Viagra generique en pharmacie

https://pharmsansordonnance.com/# trouver un mГ©dicament en pharmacie

Meilleur Viagra sans ordonnance 24h: livraison rapide Viagra en France – viagra sans ordonnance

Acheter du Viagra sans ordonnance: livraison rapide Viagra en France – Viagra sans ordonnance 24h

Viagra generique en pharmacie: livraison rapide Viagra en France – viagra en ligne

vente de mГ©dicament en ligne [url=http://pharmsansordonnance.com/#]Medicaments en ligne livres en 24h[/url] pharmacie en ligne

cialis sans ordonnance: Acheter Cialis 20 mg pas cher – Acheter Cialis

Acheter du Viagra sans ordonnance: Viagra sans ordonnance 24h – acheter Viagra sans ordonnance

pharmacie en ligne sans ordonnance [url=http://pharmsansordonnance.com/#]commander sans consultation medicale[/url] pharmacies en ligne certifiГ©es

https://kampascher.com/# acheter kamagra site fiable

Cialis generique sans ordonnance: pharmacies en ligne certifiГ©es – traitement ED discret en ligne

Viagra generique en pharmacie: livraison rapide Viagra en France – viagra sans ordonnance

Many of RTG’s games, particularly the newer titles, are available for use while you’re on the go. All the same jackpots and win potential is available on mobile slots, the only thing to be wary of is using games with cramped user interfaces, as this issue can be worsened by smaller screens. Straightforward slots like Bubble Bubble and Caesar’s Empire are well-suited for mobile play. A new favourite is emerging at this casino. It hasn’t caught up with established games in terms of spins, but Cash of Command is turning heads. The nine-by-nine grid appears over the sea and skies, where you hope to defeat your enemies. This slot is reminiscent of Battleship, making us all feel nostalgic. Playing video slots with a higher RTP can improve your chances of winning, and we’ve looked at thousands of games to find those offering the highest RTPs. We’ll look at the best RTP slots shortly; firstly, let’s explore more about RTP and how it works.

https://tukuconsulting.co.za/play-aviator-in-dollars-international-access-local-thrill/

A list of blackjack games found online by major software providers of Internet casinos with the house edge of each. Add a little table casino to your play with some of the best online Blackjack games on MrQ. Here are some of the awesome titles you can get your hands on now including: We have an entire section on live blackjack but I’ll touch on it briefly here. Here’s a video of what it looks like If you need a break from live dealers, there are 22 non-live blackjack games to choose from. Some of my favorites include Blackjack Perfect Pairs, Super 7 Blackjack, and Blackjack 11. The side bet in Blackjack 11 lets you win if you get a hand with 11 or more cards without busting. Looking to play Online Blackjack for real money? BlackJack players also enjoy:

Cialis pas cher livraison rapide [url=https://ciasansordonnance.shop/#]Cialis pas cher livraison rapide[/url] Cialis generique sans ordonnance

Acheter du Viagra sans ordonnance: viagra sans ordonnance – commander Viagra discretement

Medicaments en ligne livres en 24h: pharmacie en ligne sans prescription – acheter mГ©dicament en ligne sans ordonnance

pharmacie internet fiable France [url=http://pharmsansordonnance.com/#]pharmacie en ligne pas cher[/url] pharmacie en ligne pas cher

kamagra livraison 24h: Kamagra oral jelly pas cher – kamagra pas cher

https://viasansordonnance.shop/# Viagra sans ordonnance 24h

traitement ED discret en ligne: Cialis sans ordonnance 24h – Acheter Cialis

Medicaments en ligne livres en 24h [url=https://pharmsansordonnance.shop/#]pharmacie en ligne sans ordonnance[/url] pharmacie en ligne pas cher

acheter Viagra sans ordonnance: Viagra generique en pharmacie – Viagra gГ©nГ©rique pas cher livraison rapide

kamagra gel: acheter Kamagra sans ordonnance – acheter Kamagra sans ordonnance

Viagra 100mg prix [url=http://viasansordonnance.com/#]Meilleur Viagra sans ordonnance 24h[/url] viagra en ligne

Cialis sans ordonnance 24h: commander Cialis en ligne sans prescription – Cialis sans ordonnance 24h

pharmacie en ligne: Medicaments en ligne livres en 24h – pharmacie en ligne france livraison internationale

https://ciasansordonnance.shop/# Acheter Cialis 20 mg pas cher

Acheter Cialis 20 mg pas cher [url=https://ciasansordonnance.com/#]Cialis sans ordonnance 24h[/url] cialis sans ordonnance

Acheter Cialis 20 mg pas cher [url=https://ciasansordonnance.com/#]cialis generique[/url] Acheter Cialis

cialis generique: Cialis generique sans ordonnance – cialis prix

cialis prix [url=https://ciasansordonnance.com/#]Acheter Cialis[/url] Acheter Cialis 20 mg pas cher

https://ciasansordonnance.com/# traitement ED discret en ligne

pharmacie en ligne: pharmacie internet fiable France – pharmacie en ligne fiable

pharmacie en ligne [url=https://pharmsansordonnance.shop/#]Pharmacies en ligne certifiees[/url] acheter mГ©dicament en ligne sans ordonnance

Kamagra oral jelly pas cher: kamagra 100mg prix – kamagra en ligne

acheter Kamagra sans ordonnance [url=http://kampascher.com/#]Kamagra oral jelly pas cher[/url] livraison discrete Kamagra

kamagra 100mg prix: kamagra livraison 24h – kamagra livraison 24h

Meilleur Viagra sans ordonnance 24h [url=https://viasansordonnance.com/#]commander Viagra discretement[/url] prix bas Viagra generique

pharmacie en ligne pas cher: acheter medicaments sans ordonnance – vente de mГ©dicament en ligne

https://viasansordonnance.shop/# Viagra sans ordonnance 24h

acheter medicaments sans ordonnance [url=https://pharmsansordonnance.shop/#]pharmacie en ligne france livraison internationale[/url] Pharmacie en ligne livraison Europe

Pharmacie sans ordonnance: pharmacie en ligne sans ordonnance – vente de mГ©dicament en ligne

kamagra en ligne [url=https://kampascher.com/#]kamagra gel[/url] kamagra livraison 24h

pharmacie en ligne: pharmacie en ligne sans ordonnance – Pharmacie en ligne livraison Europe

https://farmaciasubito.com/# dibase 50.000 vendita online

pharmacie en ligne fiable cialis: pilule sans ordonnance en pharmacie – quel est le meilleur anxiolytique sans ordonnance ?

farmacia alicante online: puedo comprar levotiroxina sin receta en estados unidos – dГіnde puedo comprar metronidazol sin receta

se puede comprar rhodogil sin receta mГ©dica [url=http://confiapharma.com/#]comprar viagra sin receta en farmacia[/url] comprar orlistat 120 mg sin receta

farmacia bacchini: tauxib 60 prezzo – argotone neonato 1 mese

lybella pillola prezzo: xarenel 50.000 prezzo – buccolam 10 mg

prezzo dicloreum compresse: Farmacia Subito – procoralan 5 mg prezzo

pyralvex solution [url=https://pharmacieexpress.shop/#]viagra ou cialis en ligne[/url] dГ©finition ordonnance mГ©dicale

http://confiapharma.com/# quetiapina se puede comprar sin receta

meritene farmacia online: duphalac farmacia online Рse puede comprar diazepam sin receta m̩dica espa̱a

brosse a dent gum [url=https://pharmacieexpress.shop/#]ketoderm crГЁme sans ordonnance en pharmacie[/url] achat viagra sans ordonnance pharmacie

caudalie parfum rose de vigne: cialis pharmacie en ligne avec ordonnance – peut on acheter du furosГ©mide sans ordonnance

farmacia online viata: comprar online gafas de farmacia toro osborne – comprar online farmacia viГ±amata

https://pharmacieexpress.shop/# doliprane sans ordonnance

farmacia castro coruГ±a online [url=https://confiapharma.com/#]Confia Pharma[/url] top farmacia online

farmacia del pueblo online tucuman: Confia Pharma – farmacia online mas barata 2015

lutenyl prezzo: recensioni farmacia online – spedra 100 mg 4 compresse

lansoprazolo 30 mg: gelenterum adulti – diosmectal 30 bustine prezzo

spedra prezzo [url=http://farmaciasubito.com/#]farmacia online tamponi rapidi[/url] glicole propilenico farmacia online

epitheliale ah duo: Pharmacie Express – vichy liftactiv fond de teint

bupropione prezzo: Farmacia Subito – didrogyl gocce prezzo

https://farmaciasubito.com/# mycostatin sospensione orale

brusonex spray nasale [url=http://farmaciasubito.com/#]Farmacia Subito[/url] xanax gocce prezzo

ebastina prezzo: perfalgan a cosa serve – adenuric 80 mg prezzo

comprar clotrimazol sin receta: farmacia online benzocaina – comprar antibioticos sin receta madrid

zitromax sciroppo: brufen 600 compresse – codice sconto farmacia online

amoxicilline chat sans ordonnance [url=https://pharmacieexpress.com/#]ballon gastrique en pharmacie sans ordonnance[/url] cialis prix pharmacie sans ordonnance

clensia bustine prezzo: tadalafil mylan 20 mg prezzo – vessel 250 uls amazon

https://farmaciasubito.shop/# farmacia online contrassegno gratuito

mittoval 10 mg prezzo [url=http://farmaciasubito.com/#]slowmet principio attivo[/url] natecal d3 600 mg + 400 ui italfarmaco

Penalty Shoot Out di EvoPlay è un emozionante gioco online. Grazie all’esperienza di EvoPlay nello sviluppo di giochi, Penalty Shoot Out offre un’esperienza di gioco avvincente. L’obiettivo del gioco è semplice: colpire il pallone con precisione per segnare gol, evitando che il portiere avversario riesca a parare i tiri. Ogni rigore che segni ti porta più vicino alla vittoria, ma il portiere diventa ogni volta più difficile da battere, aumentando la sfida. Penalty Shoot Out è perfetto per chi ama il calcio e cerca un gioco di casinò che combini emozioni sportive con la possibilità di vincere premi. Inoltre, con il tuo consenso, utilizzeremo i cookie per ottimizzare la tua esperienza d’acquisto negli store Amazon, come specificato nella nostra Informativa sui cookie. La tua scelta si applica all’utilizzo di cookie pubblicitari proprietari e di terze parti su questo servizio. I cookie memorizzano o accedono alle informazioni standard sul dispositivo, ad esempio un identificatore univoco. Le 96 terze parti utilizzano i cookie su questo servizio allo scopo di mostrare e misurare annunci personalizzati, generare informazioni sul pubblico e sviluppare e migliorare i prodotti.

https://aikatechnology.com/2025/05/28/supporto-regionale-per-giocare-ad-aviator-cosa-sapere/

– Teams and player stats- Landscape mode- Bug fixes Pick-up Game: Instant play! The computer chooses a random team for you and itself and the game starts immediately. “JoomSport – for Sports: Team & League, Football, Hockey & more” è un software open source. Le persone che hanno contribuito allo sviluppo di questo plugin sono indicate di seguito. Staying calm is key to winning the game, especially when the theme soundtrack comes to serve. The authentic samba soundtrack takes you to the lively streets in Brazil, giving you a cozy feeling during the game. prezzo dedicato.” data-mobile-description=”Registra o accedi con la Partita IVA e acquistali ad un prezzo dedicato. “> The South Americans were in the driver’s seat and had everything under control until Kylian Mbappé took matters into his own hands with just 10 minutes remaining.

ovaleap 900: Farmacia Subito – robilas antistaminico prezzo

monuril parafarmacia [url=https://farmaciasubito.shop/#]farmacia online verona[/url] resilient 83 mg prezzo

que antibiГіtico se puede comprar sin receta mГ©dica: comprar tobradex sin receta – farmacia online farmavazquez zaragoza

farmacia online guatemala: farmacia online proteoglicanos – easy farmacia online

farmacia soccavo online recensioni [url=https://confiapharma.shop/#]Confia Pharma[/url] farmacia online 24 pm

duphaston prix sans ordonnance: cialis 5mg sans ordonnance – atovaquone prix

http://pharmacieexpress.com/# pharmacie en ligne cialis

enantyum se puede comprar sin receta: puedo comprar fluconazol sin receta – farmacia online madrid recogida en tienda

dibase 25000 vendita online [url=https://farmaciasubito.com/#]tadalafil 5 mg 28 compresse prezzo[/url] celebrex 200 mg prezzo

recensioni farmacia online: Farmacia Subito – coverlam 10/5

e commerce farmacia online: Confia Pharma Рcomprar rubifen sin receta espa̱a

http://confiapharma.com/# farmacia online termometro

sirop pharmacie sans ordonnance: somnifere pharmacie sans ordonnance – qsp sur ordonnance mГ©dicale

kenacort 40 mg prezzo: aglae pillola scatola – testavan gel prezzo

viagra generique: g̩n̩rique viagra homme Рt̩tine avent natural 0

mejor precio farmacia online: farmacia online,es – comprar viagra sin receta online

plaunazide 20 mg/12.5 mg [url=http://farmaciasubito.com/#]diclofenac 100 mg prezzo[/url] synflex forte 550

mГ©dicament pour tomber enceinte pharmacie sans ordonnance: Pharmacie Express – pharmacie en ligne france avec ordonnance

https://pharmacieexpress.com/# pharmacie en ligne 24 en france vente de mГ©dicaments sans ordonnance

prix sildenafil: Pharmacie Express – cachet infection urinaire sans ordonnance

mГ©dicament pour la tension sans ordonnance [url=http://pharmacieexpress.com/#]acheter azithromycine sans ordonnance[/url] achat tramadol en ligne sans ordonnance

paracodina gocce prezzo: Farmacia Subito – sconto farmacia online

clasteon 200 mg prezzo: lyrica compresse 75 mg prezzo – farmacia online verona

farmacia cuadrado online opiniones: puedo comprar amoxicilina sin receta medica – donde comprar fortacin sin receta

magnГ©sium pharmacie sans ordonnance: Pharmacie Express – medicament antidГ©presseur sans ordonnance

cytotec sans ordonnance en pharmacie [url=https://pharmacieexpress.shop/#]Pharmacie Express[/url] gratte langue action

https://pharmacieexpress.shop/# pilule du lendemain en pharmacie sans ordonnance

dapoxetine sans ordonnance: Г©quivalent daflon remboursГ© – crГЁme bouton de fiГЁvre sans ordonnance

farmacia via monticelli [url=https://farmaciasubito.shop/#]Farmacia Subito[/url] crema cicatrizzante parti intime

publix pharmacy cipro: Albenza – mebendazole boots pharmacy

https://pharmexpress24.shop/# zoloft online pharmacy no prescription

can you get antibiotics over the counter in mexico: medicine to take to mexico – best canadian pharmacy for u.s. citizens

https://inpharm24.com/# buy drugs from india

buy medicines online: how much is mounjaro in mexico – cheap prednisone

india meds: InPharm24 – medplus pharmacy india

best online indian pharmacy: reliable pharmacy india – online pharmacy india

https://pharmexpress24.com/# Lamictal

tramadol in mexico name: online rx shop – mexican online pharmacy prescription drugs

cialis online pharmacy no prescription: baclofen river pharmacy – viagra online pharmacy usa

mexican pharmacy oxycontin: buying painkillers online – top online pharmacy

advair diskus online pharmacy: Pharm Express 24 – wellness rx pharmacy

buy viagra online india: buy medicines online in india – god of pharmacy in india

ozempic prices in mexico: farmacia online mexico – mounjaro mexico cost

http://pharmmex.com/# pharmacy tijuana

apollo pharmacy india: god of pharmacy in india – india pharmacy international shipping

medical store online [url=https://inpharm24.com/#]InPharm24[/url] india meds

online pharmacy drugs: Pharm Mex – can u order pain pills online

Atarax: online pharmacy overnight delivery – ambien internet pharmacy