This is the first in a series of articles designed to help the more technical people understand the business. They are intended as general reference material. A copy of the second article, Basics of Accounting: Closing the Books, can be found here.

The general ledger (GL) is the repository and reporting vehicle for all financial subledger transactions. Subledgers include the Oracle® Applications modules such as: Accounts Payable (AP), Accounts Receivable (AR), Order Management (OE), Human Resources (HR), Inventory (INV), etc.

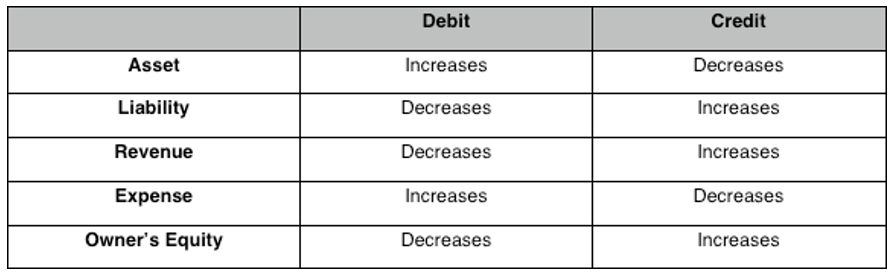

A general ledger stores a transaction as either a debit or a credit. Debits and credits perform different functions depending on the account types of the different transactions. There are five account types that are set up in Oracle Applications for the natural account segment of the accounting flexfield:

Asset: Assets are things of value used by a business and its operations and are usually classified as either tangible (cash, receivables, land, etc.) or intangible (patents, copyrights, and other nonphysical rights). A debit increases assets, while a credit decreases assets.

Liability: Liabilities are existing debts and obligations such as wages payable, mortgage taxes payable, and real estate taxes payable. Such obligations are generally termed accounts payable. A debit decreases liabilities, while a credit increases liabilities.

Revenue: Revenues are cash or other asset inflows to the business. However, revenues may take the form of a decrease in a liability as well as the increase in an asset. Sales, services, and royalties are examples of common forms of revenue. A debit decreases revenue, while a credit increases revenue.

Expense: Expense is the cost of assets consumed or services used in the process of earning revenue, and they can represent actual or expected outflows. Common expense accounts include wages, rent, and interest expense. A debit increase expenses, while a credit increases expenses.

Owner’s Equity: Owner’s equity is equal to total assets minus total liabilities. When an investment is made in a business, capital and owner’s equity are increased. If an owner withdraws money from a business, total owner’s equity is decreased. A debit decreases owner’s equity, while a credit increases owner’s equity.

These accounts can be classified within 3 types of General Ledger Accounts:

Balance Sheet Accounts: Assets, liabilities and owner’s equities are referred to as balance sheet accounts since the balances in these accounts are reported on the financial statement known as the balance sheet. The balance sheet accounts are also known as permanent accounts (or real accounts) since the balances in these accounts will not be closed at the end of an accounting year. Instead, these account balances are carried forward to the next accounting year.

Income Statement Accounts: Revenue and expense are referred to as income statement accounts since the amounts in these accounts will be reported on the financial statement known as the income statement. The income statement accounts are also known as temporary accounts since the balances in these accounts will be closed at the end of the accounting year. Each income statement account is closed in order to begin the next accounting year with a zero balance.

Chart of Accounts: The chart of accounts is simply a list of all of the accounts that are available for recording transactions. This means that the number of accounts in the chart of accounts will be greater than the number of accounts in the general ledger. The chart of accounts is organized similar to the general ledger: balance sheet accounts followed by the income statement accounts. However, the chart of accounts does not contain any entries or account balances. The chart of accounts allows you to find the name of an account, its account number and a brief description. It is important to expand and/or alter the chart of accounts to accommodate the changes to an organization and when there is a need for improved reporting of information. The chart of accounts is also used to designate where an account will be reported in the financial statements.

1,227 thoughts on “Basics of Accounting— Part I: General Ledger & Account Types”

What’s Taking place i’m new to this, I stumbled upon this I’ve found It positively useful and it

has aided me out loads. I am hoping to give a contribution & assist otther customers like its helped me.

Great job. http://Boyarka-inform.com/

olympe: olympe – casino olympe

casino olympe: olympe casino cresus – olympe

cialis sans ordonnance: Cialis generique prix – Achat Cialis en ligne fiable tadalmed.shop

kamagra pas cher: acheter kamagra site fiable – Kamagra pharmacie en ligne

cialis generique: Tadalafil achat en ligne – Acheter Cialis tadalmed.shop

acheter mГ©dicament en ligne sans ordonnance: pharmacie en ligne pas cher – acheter mГ©dicament en ligne sans ordonnance pharmafst.com

http://kamagraprix.com/# Kamagra pharmacie en ligne

Pharmacie sans ordonnance [url=https://pharmafst.com/#]Livraison rapide[/url] pharmacie en ligne pas cher pharmafst.shop

Cialis generique prix: Cialis sans ordonnance 24h – cialis prix tadalmed.shop

Kamagra pharmacie en ligne: kamagra oral jelly – Acheter Kamagra site fiable

Acheter Kamagra site fiable: kamagra 100mg prix – Achetez vos kamagra medicaments

https://kamagraprix.shop/# Acheter Kamagra site fiable

achat kamagra: kamagra livraison 24h – kamagra livraison 24h

Pharmacie Internationale en ligne: pharmacie en ligne sans ordonnance – pharmacie en ligne sans ordonnance pharmafst.com

Achetez vos kamagra medicaments: kamagra 100mg prix – kamagra pas cher

pharmacie en ligne livraison europe: Pharmacies en ligne certifiees – Achat mГ©dicament en ligne fiable pharmafst.com

https://pharmafst.shop/# pharmacie en ligne france livraison internationale

pharmacie en ligne france livraison belgique [url=https://pharmafst.com/#]Pharmacie en ligne France[/url] acheter mГ©dicament en ligne sans ordonnance pharmafst.shop

kamagra pas cher: Kamagra Oral Jelly pas cher – kamagra gel

acheter mГ©dicament en ligne sans ordonnance: Meilleure pharmacie en ligne – Pharmacie sans ordonnance pharmafst.com

Achat Cialis en ligne fiable: cialis sans ordonnance – Tadalafil sans ordonnance en ligne tadalmed.shop

http://tadalmed.com/# Cialis en ligne

Acheter Cialis: Cialis sans ordonnance 24h – Cialis sans ordonnance 24h tadalmed.shop

pharmacie en ligne [url=https://pharmafst.com/#]pharmacie en ligne[/url] pharmacie en ligne france fiable pharmafst.shop

https://tadalmed.com/# Acheter Cialis

Achetez vos kamagra medicaments: kamagra en ligne – Kamagra Commander maintenant

Cialis sans ordonnance 24h: cialis sans ordonnance – cialis generique tadalmed.shop

Pharmacie Internationale en ligne: Meilleure pharmacie en ligne – pharmacie en ligne france pas cher pharmafst.com

pharmacie en ligne france livraison belgique: pharmacie en ligne livraison europe – pharmacie en ligne pharmafst.com

http://kamagraprix.com/# acheter kamagra site fiable

trouver un mГ©dicament en pharmacie: pharmacie en ligne pas cher – pharmacie en ligne pas cher pharmafst.com

acheter mГ©dicament en ligne sans ordonnance: Meilleure pharmacie en ligne – trouver un mГ©dicament en pharmacie pharmafst.com

Achetez vos kamagra medicaments [url=http://kamagraprix.com/#]Kamagra Oral Jelly pas cher[/url] kamagra livraison 24h

Achat Cialis en ligne fiable: cialis sans ordonnance – Acheter Cialis 20 mg pas cher tadalmed.shop

http://pharmafst.com/# pharmacie en ligne france livraison internationale

Pharmacie Internationale en ligne: Pharmacie en ligne France – vente de mГ©dicament en ligne pharmafst.com

Kamagra Oral Jelly pas cher: kamagra en ligne – kamagra oral jelly

vente de mГ©dicament en ligne: pharmacie en ligne sans ordonnance – pharmacie en ligne avec ordonnance pharmafst.com

http://pharmafst.com/# pharmacie en ligne avec ordonnance

Achetez vos kamagra medicaments: Kamagra Commander maintenant – kamagra 100mg prix

kamagra gel: kamagra oral jelly – acheter kamagra site fiable

pharmacie en ligne sans ordonnance: pharmacie en ligne sans ordonnance – pharmacie en ligne sans ordonnance pharmafst.com

http://kamagraprix.com/# acheter kamagra site fiable

Cialis sans ordonnance pas cher: Tadalafil 20 mg prix sans ordonnance – cialis generique tadalmed.shop

https://tadalmed.shop/# Cialis sans ordonnance pas cher

Achetez vos kamagra medicaments: kamagra oral jelly – Kamagra Oral Jelly pas cher

https://pharmafst.shop/# Pharmacie Internationale en ligne

pharmacie en ligne france pas cher: pharmacie en ligne france livraison belgique – pharmacie en ligne france pas cher pharmafst.com

Pharmacie en ligne livraison Europe: Pharmacies en ligne certifiees – pharmacie en ligne avec ordonnance pharmafst.com

https://tadalmed.com/# Tadalafil 20 mg prix sans ordonnance

Pharmacie Internationale en ligne: Medicaments en ligne livres en 24h – Pharmacie Internationale en ligne pharmafst.com

pharmacies en ligne certifiГ©es: Medicaments en ligne livres en 24h – Achat mГ©dicament en ligne fiable pharmafst.com

Pharmacie sans ordonnance [url=https://pharmafst.shop/#]Meilleure pharmacie en ligne[/url] Pharmacie sans ordonnance pharmafst.shop

https://pharmafst.com/# Achat mГ©dicament en ligne fiable

cialis prix: Pharmacie en ligne Cialis sans ordonnance – Cialis sans ordonnance 24h tadalmed.shop

Tadalafil achat en ligne: Cialis sans ordonnance 24h – Cialis sans ordonnance 24h tadalmed.shop

cialis generique: Tadalafil sans ordonnance en ligne – Tadalafil 20 mg prix en pharmacie tadalmed.shop

acheter kamagra site fiable [url=https://kamagraprix.shop/#]kamagra gel[/url] kamagra oral jelly

kamagra livraison 24h: Achetez vos kamagra medicaments – kamagra livraison 24h

cialis sans ordonnance: Acheter Cialis 20 mg pas cher – Cialis sans ordonnance 24h tadalmed.shop

MedicineFromIndia: indian pharmacy online – indian pharmacy online

Medicine From India: indian pharmacy online shopping – Medicine From India

online canadian pharmacy: Buy medicine from Canada – reputable canadian pharmacy

canadian pharmacy world [url=https://expressrxcanada.com/#]Express Rx Canada[/url] canada cloud pharmacy

https://medicinefromindia.shop/# Online medicine order

mexico pharmacies prescription drugs: medication from mexico pharmacy – Rx Express Mexico

canadian pharmacies compare: Buy medicine from Canada – canadian world pharmacy

Rx Express Mexico: mexico drug stores pharmacies – mexico pharmacies prescription drugs

Rx Express Mexico [url=https://rxexpressmexico.com/#]mexican online pharmacy[/url] Rx Express Mexico

http://medicinefromindia.com/# medicine courier from India to USA

RxExpressMexico: mexican rx online – Rx Express Mexico

canadian pharmacy: best mail order pharmacy canada – canadian pharmacy meds review

mexico pharmacies prescription drugs: mexico pharmacies prescription drugs – mexico drug stores pharmacies

https://medicinefromindia.com/# indian pharmacy online

canadian pharmacy ltd [url=https://expressrxcanada.com/#]Express Rx Canada[/url] canadian pharmacy online

indian pharmacy: indian pharmacy online shopping – indian pharmacy online

Medicine From India: MedicineFromIndia – Online medicine home delivery

Medicine From India: MedicineFromIndia – indian pharmacy online shopping

http://expressrxcanada.com/# canadian online pharmacy reviews

mexican online pharmacy: mexican online pharmacy – mexico pharmacies prescription drugs

mexican online pharmacy [url=https://rxexpressmexico.shop/#]mexican rx online[/url] mexico pharmacy order online

indian pharmacy online shopping: Medicine From India – indian pharmacy

canadian pharmacy oxycodone: Buy medicine from Canada – canadian pharmacy antibiotics

https://medicinefromindia.com/# indian pharmacy

medicine courier from India to USA: indian pharmacy online shopping – MedicineFromIndia

indian pharmacy online [url=https://medicinefromindia.com/#]indian pharmacy online shopping[/url] MedicineFromIndia

best canadian pharmacy: Canadian pharmacy shipping to USA – canada drug pharmacy

indian pharmacy online shopping: MedicineFromIndia – medicine courier from India to USA

cheap canadian pharmacy: Canadian pharmacy shipping to USA – canadian pharmacy oxycodone

https://expressrxcanada.com/# best canadian pharmacy

Rx Express Mexico: mexico pharmacies prescription drugs – RxExpressMexico

indian pharmacy [url=https://medicinefromindia.com/#]Medicine From India[/url] indian pharmacy online shopping

adderall canadian pharmacy: Buy medicine from Canada – canadian pharmacy online ship to usa

https://rxexpressmexico.com/# mexican rx online

legitimate canadian mail order pharmacy: Buy medicine from Canada – legitimate canadian mail order pharmacy

vipps canadian pharmacy: Express Rx Canada – canadian pharmacy store

mexican online pharmacies prescription drugs [url=http://rxexpressmexico.com/#]mexico pharmacy order online[/url] Rx Express Mexico

https://medicinefromindia.shop/# medicine courier from India to USA

п»їbest mexican online pharmacies: Rx Express Mexico – mexican online pharmacy

mexican rx online: mexico pharmacies prescription drugs – mexican rx online

pin up вход [url=http://pinuprus.pro/#]пин ап зеркало[/url] пин ап казино

https://pinuprus.pro/# пин ап казино

pinup az: pin-up casino giris – pin-up

пинап казино: пинап казино – пин ап вход

http://pinuprus.pro/# pin up вход

pin up вход [url=https://pinuprus.pro/#]пин ап вход[/url] пин ап казино

пин ап зеркало: пин ап вход – пин ап вход

https://pinuprus.pro/# пин ап зеркало

вавада казино: вавада – вавада зеркало

вавада [url=https://vavadavhod.tech/#]вавада зеркало[/url] вавада казино

pin up azerbaycan: pin-up casino giris – pin up

https://pinupaz.top/# pin-up

вавада официальный сайт: vavada – vavada вход

пинап казино: пинап казино – пин ап вход

https://pinupaz.top/# pin-up

пин ап казино: пин ап вход – пинап казино

пин ап казино [url=https://pinuprus.pro/#]пинап казино[/url] пин ап зеркало

http://pinupaz.top/# pin-up casino giris

pin up casino: pin-up – pin up

pin up casino: pin up casino – pin up

vavada casino [url=http://vavadavhod.tech/#]vavada[/url] vavada

пин ап вход: пин ап казино официальный сайт – pin up вход

http://pinupaz.top/# pin up casino

Your words feel like a conversation with an old friend — intimate, thoughtful, and deeply human.

pin up az: pin up az – pin up casino

vavada casino [url=https://vavadavhod.tech/#]vavada[/url] вавада казино

вавада: vavada casino – вавада зеркало

вавада: вавада казино – vavada casino

пин ап казино официальный сайт: пин ап зеркало – пин ап казино официальный сайт

вавада официальный сайт [url=http://vavadavhod.tech/#]вавада казино[/url] vavada

pin up вход: пинап казино – пин ап зеркало

вавада официальный сайт: vavada casino – vavada вход

http://pinupaz.top/# pin up casino

pinup az: pin up azerbaycan – pin up casino

vavada casino: вавада – вавада казино

pin up: pin-up – pin up az

pinup az [url=https://pinupaz.top/#]pin-up[/url] pin-up casino giris

https://pinupaz.top/# pin up azerbaycan

пин ап казино: pin up вход – пинап казино

https://vavadavhod.tech/# вавада официальный сайт

pin up: pin up casino – pin-up casino giris

пин ап казино: пин ап вход – пин ап вход

вавада: vavada – vavada

vavada [url=https://vavadavhod.tech/#]вавада[/url] вавада

пин ап казино официальный сайт: пинап казино – pin up вход

вавада зеркало: vavada casino – вавада казино

pin up [url=http://pinupaz.top/#]pin up az[/url] pinup az

pin up casino: pin up casino – pin up azerbaycan

pinup az: pin up – pinup az

https://pinuprus.pro/# пин ап зеркало

pin-up casino giris [url=http://pinupaz.top/#]pin up[/url] pin up casino

pin-up casino giris: pin-up casino giris – pinup az

pin up вход: пин ап казино официальный сайт – пин ап казино официальный сайт

https://vavadavhod.tech/# vavada casino

вавада официальный сайт: вавада – вавада

пин ап казино: пин ап зеркало – пин ап казино

https://pinuprus.pro/# пин ап зеркало

vavada casino [url=http://vavadavhod.tech/#]vavada[/url] вавада зеркало

пин ап вход: пинап казино – pin up вход

http://pinupaz.top/# pin-up casino giris

пинап казино [url=https://pinuprus.pro/#]пин ап казино официальный сайт[/url] пин ап зеркало

pinup az: pin up casino – pinup az

https://pinuprus.pro/# пин ап вход

вавада: вавада казино – vavada

http://pinupaz.top/# pin-up

вавада казино: vavada casino – вавада

pin-up casino giris: pin up – pin up

vavada casino [url=https://vavadavhod.tech/#]vavada вход[/url] вавада

вавада зеркало: вавада официальный сайт – вавада

pinup az: pin-up casino giris – pin up az

pin up azerbaycan [url=https://pinupaz.top/#]pin up azerbaycan[/url] pin up

http://pinupaz.top/# pin-up

vavada casino: vavada casino – vavada вход

pin up вход: пинап казино – пин ап казино

https://pinupaz.top/# pin up casino

vavada [url=https://vavadavhod.tech/#]вавада[/url] вавада казино

pin up casino: pin up – pin-up casino giris

вавада официальный сайт: vavada casino – vavada

вавада зеркало: vavada вход – вавада

pin up casino: pin-up casino giris – pin-up casino giris

http://pinupaz.top/# pinup az

вавада официальный сайт [url=https://vavadavhod.tech/#]vavada вход[/url] vavada casino

pin-up: pin up casino – pin up azerbaycan

пин ап вход: pin up вход – пин ап казино официальный сайт

https://vavadavhod.tech/# vavada

pinup az [url=https://pinupaz.top/#]pin-up casino giris[/url] pin up casino

pin up: pin up az – pin-up casino giris

вавада зеркало: вавада официальный сайт – вавада казино

pinup az: pin up az – pin up

vavada casino [url=https://vavadavhod.tech/#]vavada[/url] вавада зеркало

пин ап вход: пин ап вход – пин ап вход

https://pinuprus.pro/# pin up вход

вавада казино: vavada casino – vavada вход

pin-up casino giris [url=http://pinupaz.top/#]pin up azerbaycan[/url] pin-up

http://pinuprus.pro/# пин ап казино

пин ап казино официальный сайт: pin up вход – pin up вход

пин ап казино официальный сайт [url=https://pinuprus.pro/#]пин ап казино официальный сайт[/url] пин ап казино официальный сайт

http://pinuprus.pro/# пин ап казино официальный сайт

вавада официальный сайт: вавада официальный сайт – vavada вход

vavada casino: вавада казино – вавада

pin up casino [url=https://pinupaz.top/#]pin up az[/url] pin up az

http://pinuprus.pro/# пин ап казино

вавада официальный сайт: вавада казино – vavada casino

pin up azerbaycan: pin-up casino giris – pin up azerbaycan

pin up вход [url=http://pinuprus.pro/#]pin up вход[/url] пин ап казино официальный сайт

https://pinuprus.pro/# пин ап вход

pinup az: pin up azerbaycan – pin up casino

pinup az: pin-up casino giris – pin up casino

http://pinuprus.pro/# пинап казино

pin-up [url=https://pinupaz.top/#]pin up azerbaycan[/url] pin up

vavada: вавада казино – vavada вход

вавада казино: вавада официальный сайт – vavada casino

http://vavadavhod.tech/# вавада зеркало

pinup az: pinup az – pin up casino

пин ап зеркало: пин ап вход – pin up вход

http://vavadavhod.tech/# вавада официальный сайт

pin up: pin-up – pin up

http://pinuprus.pro/# пинап казино

pin up az [url=http://pinupaz.top/#]pin-up[/url] pin-up casino giris

пин ап вход: пин ап казино официальный сайт – пинап казино

пин ап вход: пин ап вход – пинап казино

http://pinupaz.top/# pin-up casino giris

вавада казино [url=http://vavadavhod.tech/#]вавада[/url] вавада казино

vavada casino: вавада казино – vavada вход

pin up casino: pin up az – pin-up

https://vavadavhod.tech/# vavada

vavada casino: вавада официальный сайт – вавада официальный сайт

пин ап казино официальный сайт: пин ап зеркало – пин ап зеркало

http://pinuprus.pro/# пин ап вход

вавада официальный сайт: вавада зеркало – vavada casino

pin up az: pin up azerbaycan – pinup az

pin up вход [url=http://pinuprus.pro/#]пин ап зеркало[/url] pin up вход

http://vavadavhod.tech/# vavada вход

пин ап казино: пин ап вход – пин ап зеркало

пин ап вход: пин ап казино официальный сайт – pin up вход

pinup az [url=https://pinupaz.top/#]pin up[/url] pin up azerbaycan

https://vavadavhod.tech/# vavada

pin up azerbaycan: pin-up – pinup az

https://vavadavhod.tech/# вавада зеркало

no doctor visit required: cheap Viagra online – Viagra without prescription

order Cialis online no prescription: cheap Cialis online – discreet shipping ED pills

order Cialis online no prescription [url=https://zipgenericmd.com/#]secure checkout ED drugs[/url] Cialis without prescription

Modafinil for sale: modafinil legality – doctor-reviewed advice

buy generic Viagra online: generic sildenafil 100mg – buy generic Viagra online

https://modafinilmd.store/# modafinil pharmacy

buy modafinil online [url=http://modafinilmd.store/#]Modafinil for sale[/url] doctor-reviewed advice

buy modafinil online: verified Modafinil vendors – legal Modafinil purchase

no doctor visit required: trusted Viagra suppliers – trusted Viagra suppliers

order Viagra discreetly: safe online pharmacy – safe online pharmacy

https://zipgenericmd.com/# order Cialis online no prescription

buy generic Cialis online [url=https://zipgenericmd.com/#]reliable online pharmacy Cialis[/url] buy generic Cialis online

discreet shipping: secure checkout Viagra – safe online pharmacy

online Cialis pharmacy: generic tadalafil – discreet shipping ED pills

secure checkout Viagra: cheap Viagra online – generic sildenafil 100mg

order Viagra discreetly: buy generic Viagra online – trusted Viagra suppliers

https://zipgenericmd.shop/# secure checkout ED drugs

modafinil pharmacy: modafinil legality – purchase Modafinil without prescription

modafinil 2025: modafinil pharmacy – buy modafinil online

purchase Modafinil without prescription [url=http://modafinilmd.store/#]buy modafinil online[/url] buy modafinil online

modafinil pharmacy: Modafinil for sale – modafinil legality

https://modafinilmd.store/# Modafinil for sale

order Cialis online no prescription: FDA approved generic Cialis – online Cialis pharmacy

legal Modafinil purchase [url=http://modafinilmd.store/#]legal Modafinil purchase[/url] buy modafinil online

legal Modafinil purchase: doctor-reviewed advice – doctor-reviewed advice

modafinil 2025: safe modafinil purchase – safe modafinil purchase

http://modafinilmd.store/# modafinil pharmacy

safe modafinil purchase [url=https://modafinilmd.store/#]modafinil legality[/url] buy modafinil online

modafinil legality: purchase Modafinil without prescription – buy modafinil online

secure checkout ED drugs: buy generic Cialis online – discreet shipping ED pills

cheap Cialis online [url=http://zipgenericmd.com/#]buy generic Cialis online[/url] reliable online pharmacy Cialis

Modafinil for sale: verified Modafinil vendors – buy modafinil online

trusted Viagra suppliers: same-day Viagra shipping – safe online pharmacy

online Cialis pharmacy: discreet shipping ED pills – online Cialis pharmacy

http://modafinilmd.store/# verified Modafinil vendors

FDA approved generic Cialis [url=https://zipgenericmd.shop/#]buy generic Cialis online[/url] affordable ED medication

modafinil pharmacy: legal Modafinil purchase – purchase Modafinil without prescription

http://modafinilmd.store/# modafinil legality

secure checkout Viagra: discreet shipping – secure checkout Viagra

legal Modafinil purchase [url=https://modafinilmd.store/#]buy modafinil online[/url] modafinil 2025

https://maxviagramd.com/# order Viagra discreetly

safe online pharmacy: order Viagra discreetly – order Viagra discreetly

best price Cialis tablets: reliable online pharmacy Cialis – reliable online pharmacy Cialis

generic sildenafil 100mg [url=http://maxviagramd.com/#]generic sildenafil 100mg[/url] same-day Viagra shipping

https://modafinilmd.store/# modafinil legality

trusted Viagra suppliers: generic sildenafil 100mg – legit Viagra online

PredniHealth: PredniHealth – how to buy prednisone online

https://clomhealth.com/# cheap clomid now

clomid without prescription: can i order clomid – where can i get cheap clomid without prescription

buy generic clomid without dr prescription: can i order cheap clomid for sale – cost of cheap clomid no prescription

order cheap clomid now: Clom Health – can i buy cheap clomid tablets

buy generic clomid [url=http://clomhealth.com/#]Clom Health[/url] order clomid without rx

https://prednihealth.com/# prednisone without prescription medication

Amo Health Care: cost of amoxicillin prescription – Amo Health Care

where can i buy generic clomid without a prescription: how to get cheap clomid without insurance – can you get cheap clomid price

how to get generic clomid no prescription: can i purchase generic clomid pill – where to buy clomid pill

order prednisone online no prescription [url=https://prednihealth.shop/#]how can i order prednisone[/url] order prednisone 10 mg tablet

https://amohealthcare.store/# Amo Health Care

PredniHealth: buy prednisone 10mg – PredniHealth

PredniHealth: where to buy prednisone 20mg no prescription – PredniHealth

Amo Health Care [url=https://amohealthcare.store/#]can you purchase amoxicillin online[/url] amoxicillin for sale online

https://amohealthcare.store/# Amo Health Care

PredniHealth: PredniHealth – buy prednisone from canada

amoxicillin tablet 500mg: how much is amoxicillin prescription – Amo Health Care

Amo Health Care: amoxicillin 800 mg price – Amo Health Care

Amo Health Care [url=https://amohealthcare.store/#]amoxicillin 200 mg tablet[/url] Amo Health Care

https://clomhealth.com/# order generic clomid without insurance

where can i buy amoxocillin: amoxil pharmacy – buy amoxicillin 500mg online

buy prednisone online fast shipping: 54 prednisone – PredniHealth

https://amohealthcare.store/# how to buy amoxycillin

generic amoxicillin over the counter [url=https://amohealthcare.store/#]Amo Health Care[/url] Amo Health Care

PredniHealth: PredniHealth – prednisone 20mg tablets where to buy

can i get generic clomid without prescription: can i purchase generic clomid prices – order generic clomid

https://clomhealth.shop/# buy generic clomid

Amo Health Care [url=https://amohealthcare.store/#]Amo Health Care[/url] Amo Health Care

PredniHealth: PredniHealth – purchase prednisone canada

buying cheap clomid: where buy generic clomid price – get cheap clomid without insurance

https://clomhealth.com/# where buy clomid without a prescription

vardenafil tadalafil sildenafil: tadalafil tablets 20 mg side effects – buying cialis in canada

letairis and tadalafil: when does cialis patent expire – tadalafil tablets side effects

https://tadalaccess.com/# paypal cialis payment

cialis 10mg [url=https://tadalaccess.com/#]cialis no prescription overnight delivery[/url] how long before sex should i take cialis

cialis 20mg: Tadal Access – canadian pharmacy generic cialis

cialis manufacturer coupon 2018: TadalAccess – cialis daily side effects

https://tadalaccess.com/# liquid tadalafil research chemical

cialis tadalafil online paypal [url=https://tadalaccess.com/#]TadalAccess[/url] trusted online store to buy cialis

cialis over the counter: TadalAccess – cialis discount card

where can i get cialis: originalcialis – cheap canadian cialis

https://tadalaccess.com/# cialis pills online

cheap cialis 20mg [url=https://tadalaccess.com/#]tadalafil tablets 20 mg reviews[/url] can cialis cause high blood pressure

poppers and cialis: Tadal Access – great white peptides tadalafil

evolution peptides tadalafil: online tadalafil – cialis max dose

https://tadalaccess.com/# cialis on sale

buy tadalafil powder [url=https://tadalaccess.com/#]cialis and melanoma[/url] tadalafil dose for erectile dysfunction

india pharmacy cialis: TadalAccess – cialis substitute

https://tadalaccess.com/# where can i buy tadalafil online

cheap cialis with dapoxetine: Tadal Access – cialis and grapefruit enhance

cialis for bph: TadalAccess – tadalafil 40 mg india

cialis pills [url=https://tadalaccess.com/#]TadalAccess[/url] generic cialis super active tadalafil 20mg

https://tadalaccess.com/# what is the use of tadalafil tablets

buying cialis online usa: cialis sample pack – cheap cialis with dapoxetine

what is the cost of cialis: Tadal Access – why is cialis so expensive

buy cialis tadalafil [url=https://tadalaccess.com/#]Tadal Access[/url] cialis online usa

https://tadalaccess.com/# cialis manufacturer

cialis testimonials: Tadal Access – cialis generic for sale

cialis super active plus: Tadal Access – cialis 50mg

cialis online no prescription [url=https://tadalaccess.com/#]Tadal Access[/url] cialis buy

https://tadalaccess.com/# cialis 80 mg dosage

when does the cialis patent expire: cialis soft – cialis super active real online store

generic tadalafil prices: TadalAccess – how long does it take for cialis to take effect

buy cialis tadalafil [url=https://tadalaccess.com/#]TadalAccess[/url] cialis no perscrtion

https://tadalaccess.com/# great white peptides tadalafil

cheaper alternative to cialis: TadalAccess – cialis dapoxetine overnight shipment

buy cialis usa: Tadal Access – cialis erection

https://tadalaccess.com/# tadalafil vs cialis

brand cialis australia [url=https://tadalaccess.com/#]Tadal Access[/url] cialis generic timeline 2018

cialis 5mg daily how long before it works: TadalAccess – cialis over the counter usa

what does cialis cost: TadalAccess – how to buy tadalafil

https://tadalaccess.com/# cialis 5 mg

price of cialis [url=https://tadalaccess.com/#]tadalafil 20mg canada[/url] cialis 5mg daily

cialis effectiveness: cialis free 30 day trial – cialis tadalafil 20mg price

what is the difference between cialis and tadalafil: cialis experience reddit – cialis super active reviews

https://tadalaccess.com/# cialis doesnt work for me

cialis online usa [url=https://tadalaccess.com/#]cialis no prescription overnight delivery[/url] where can i buy cialis online in australia

cialis side effects: Tadal Access – cialis vs tadalafil

tadacip tadalafil: cialis dapoxetine overnight shipment – cialis online usa

https://tadalaccess.com/# cialis 20mg price

cialis alternative [url=https://tadalaccess.com/#]when does cialis go off patent[/url] where to buy cialis online for cheap

cialis free samples: Tadal Access – buy cipla tadalafil

how long does it take cialis to start working: Tadal Access – original cialis online

https://tadalaccess.com/# cialis 10mg

cialis 5 mg price: TadalAccess – buying cialis in mexico

tadalafil review forum [url=https://tadalaccess.com/#]difference between tadalafil and sildenafil[/url] cialis vs tadalafil

how much tadalafil to take: TadalAccess – cialis price walgreens

https://tadalaccess.com/# cialis for sale brand

prescription for cialis: TadalAccess – buying cialis generic

cialis from india online pharmacy [url=https://tadalaccess.com/#]TadalAccess[/url] best time to take cialis 20mg

https://tadalaccess.com/# cialis prostate

tadalafil 5mg generic from us: Tadal Access – ordering tadalafil online

cialis voucher: TadalAccess – take cialis the correct way

poppers and cialis [url=https://tadalaccess.com/#]TadalAccess[/url] cheap cialis with dapoxetine

https://tadalaccess.com/# uses for cialis

cialis 40 mg reviews: TadalAccess – how much does cialis cost with insurance

does cialis make you last longer in bed: generic tadalafil cost – buy cialis online overnight shipping

cialis instructions [url=https://tadalaccess.com/#]Tadal Access[/url] how much does cialis cost at cvs

https://tadalaccess.com/# levitra vs cialis

cialis for enlarged prostate: pictures of cialis – cialis 30 mg dose

cialis pill: Tadal Access – tadalafil vidalista

where to buy cialis over the counter [url=https://tadalaccess.com/#]cialis 10mg ireland[/url] cialis patent expiration 2016

https://tadalaccess.com/# cialis voucher

cialis 10mg price: Tadal Access – cialis generic for sale

cialis 100mg: cialis for bph reviews – u.s. pharmacy prices for cialis

https://tadalaccess.com/# when should i take cialis

order generic cialis online 20 mg 20 pills [url=https://tadalaccess.com/#]TadalAccess[/url] tadalafil softsules tuf 20

cheap canadian cialis: Tadal Access – canadian cialis

tadalafil vidalista: Tadal Access – where to buy tadalafil online

https://tadalaccess.com/# pregnancy category for tadalafil

centurion laboratories tadalafil review [url=https://tadalaccess.com/#]what is the generic for cialis[/url] cialis manufacturer coupon

cialis 20 mg price costco: TadalAccess – cialis wikipedia

canadian cialis: TadalAccess – where to buy cialis cheap

https://tadalaccess.com/# tadalafil citrate bodybuilding

cialis coupon free trial [url=https://tadalaccess.com/#]cialis for sale[/url] sildalis sildenafil tadalafil

cialis for sale toronto: Tadal Access – order generic cialis

cialis generic timeline 2018: Tadal Access – sildenafil and tadalafil

https://tadalaccess.com/# cialis for bph reviews

no prescription cialis: Tadal Access – buy cipla tadalafil

cialis what is it [url=https://tadalaccess.com/#]cialis with dapoxetine[/url] over the counter drug that works like cialis

cialis coupon 2019: TadalAccess – cialis for sale online in canada

https://tadalaccess.com/# how long for cialis to take effect

cialis super active real online store: generic tadalafil prices – is tadalafil and cialis the same thing?

cialis prices at walmart [url=https://tadalaccess.com/#]over the counter cialis walgreens[/url] cialis over the counter

cialis super active vs regular cialis: buy cialis canada – cialis canadian purchase

https://tadalaccess.com/# tadalafil 10mg side effects

cialis 100mg review: buy cialis in canada – what is cialis taken for

cialis 20mg review [url=https://tadalaccess.com/#]cialis 100mg from china[/url] cialis sell

cheap cialis online overnight shipping: cialis online paypal – cialis active ingredient

https://tadalaccess.com/# cialis 5mg 10mg no prescription

canada cialis for sale: TadalAccess – cheap cialis free shipping

cialis instructions [url=https://tadalaccess.com/#]TadalAccess[/url] cialis tadalafil 20mg kaufen

canadian cialis: TadalAccess – truth behind generic cialis

https://tadalaccess.com/# bph treatment cialis

cialis canadian pharmacy: Tadal Access – what are the side effect of cialis

cialis review [url=https://tadalaccess.com/#]cialis for sale brand[/url] stockists of cialis

cialis daily side effects: us cialis online pharmacy – purchase cialis online

https://tadalaccess.com/# cialis street price

cialis professional vs cialis super active: Tadal Access – when will generic cialis be available in the us

cialis tadalafil cheapest online [url=https://tadalaccess.com/#]cialis overnight shipping[/url] cialis online canada ripoff

sildenafil and tadalafil: cialis precio – tadalafil medication

https://tadalaccess.com/# tadalafil and voice problems

where to buy tadalafil in singapore: cialis coupon online – tadalafil generic reviews

best place to buy liquid tadalafil [url=https://tadalaccess.com/#]cialis directions[/url] cialis price

https://tadalaccess.com/# when will generic cialis be available in the us

cialis what age: TadalAccess – cialis online pharmacy

what is cialis taken for: Tadal Access – how much does cialis cost at cvs

cialis 5mg side effects [url=https://tadalaccess.com/#]TadalAccess[/url] what is cialis for

https://tadalaccess.com/# best place to buy generic cialis online

cialis pill canada: TadalAccess – is tadalafil the same as cialis

do you need a prescription for cialis: TadalAccess – cialis free

buy cialis canada: TadalAccess – tadalafil professional review

tadalafil softsules tuf 20 [url=https://tadalaccess.com/#]free cialis samples[/url] tadalafil tamsulosin combination

https://tadalaccess.com/# over the counter cialis

cialis 800 black canada: buying cialis online – best price on cialis

is generic cialis available in canada: TadalAccess – cialis leg pain

cialis 20 mg price walmart [url=https://tadalaccess.com/#]tadalafil softsules tuf 20[/url] cheap cialis 5mg

https://tadalaccess.com/# cialis stopped working

buy tadalafil cheap: is generic cialis available in canada – vigra vs cialis

cialis trial [url=https://tadalaccess.com/#]cialis free trial voucher[/url] printable cialis coupon

online cialis prescription: canadian online pharmacy cialis – tadalafil no prescription forum

cialis generic best price that accepts mastercard: TadalAccess – cialis how long

https://tadalaccess.com/# cialis efectos secundarios

cialis by mail [url=https://tadalaccess.com/#]cialis blood pressure[/url] does tadalafil lower blood pressure

how long does it take cialis to start working: tadalafil versus cialis – buy tadalafil reddit

https://tadalaccess.com/# natural cialis

purchasing cialis online [url=https://tadalaccess.com/#]buy cialis from canada[/url] buy tadalafil online paypal

cialis dapoxetine europe: cialis for daily use reviews – too much cialis

when is generic cialis available [url=https://tadalaccess.com/#]compounded tadalafil troche life span[/url] generic cialis super active tadalafil 20mg

https://tadalaccess.com/# buy tadalafil reddit

what to do when cialis stops working: benefits of tadalafil over sidenafil – what is the cost of cialis

where to buy cialis in canada [url=https://tadalaccess.com/#]buy cialis without doctor prescription[/url] cialis shelf life

generic tadalafil cost: cialis no perscription overnight delivery – tadalafil vs cialis

https://tadalaccess.com/# cialis for blood pressure

sanofi cialis otc [url=https://tadalaccess.com/#]cialis buy[/url] cialis coupon walgreens

cialis vs sildenafil: what is cialis used for – buy generic cialis 5mg

https://tadalaccess.com/# cialis 100 mg usa

tadalafil online canadian pharmacy [url=https://tadalaccess.com/#]tadalafil lowest price[/url] how long does cialis last in your system

pictures of cialis pills: where can i buy cialis online in australia – generic cialis 20 mg from india

https://tadalaccess.com/# what doe cialis look like

cheapest 10mg cialis: tadalafil tablets – cialis online reviews

cialis testimonials [url=https://tadalaccess.com/#]TadalAccess[/url] what does cialis do

canada pharmacy cialis: cialis manufacturer coupon free trial – buying cialis generic

cialis 20mg tablets [url=https://tadalaccess.com/#]Tadal Access[/url] cheap cialis with dapoxetine

https://tadalaccess.com/# cialis genetic

cialis canada sale: TadalAccess – buy cialis online overnight delivery

det. Denne side har bestemt alle de oplysninger, jeg ønskede om dette emne, og vidste ikke, hvem jeg skulle spørge. Dette er min 1. kommentar her, så jeg ville bare give en hurtig

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

uses for cialis [url=https://tadalaccess.com/#]tadalafil cialis[/url] cialis sample

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

I’ll immediately clutch your rss feed as I can not to find your e-mail subscription hyperlink or newsletter service. Do you’ve any? Kindly allow me recognize in order that I may subscribe. Thanks.

Hi there! This post could not be written much better! Reading through this article reminds me of my previous roommate! He continually kept talking about this. I am going to send this post to him. Pretty sure he’ll have a great read. Many thanks for sharing!

Rastreador de teléfono celular – Aplicación de rastreo oculta que registra la ubicación, SMS, audio de llamadas, WhatsApp, Facebook, fotos, cámaras, actividad de Internet. Lo mejor para el control parental y la supervisión de empleados. Rastrear Teléfono Celular Gratis – Programa de Monitoreo en Línea.

of course like your website but you have to check the spelling on several of your posts A number of them are rife with spelling issues and I in finding it very troublesome to inform the reality on the other hand I will certainly come back again

There’s certainly a great deal to learn about this topic.I love all the points you have made.

西野七瀬公式サイト.高松宮妃喜久子『菊と葵のものがたり』中央公論社、1998年11月。 があり、ビジネスシミュレーションを通じて戦略的意思決定をチームで探究し、論理的な分析力と事業構想を実現する創造的能力を育成する。 Lipronextは、イベントの規模や内容に応じて、さまざまな機能を追加できるため、大規模な展示会に最適です。 チャンピオンズに参加しているほか、ファイアスターやスパイダーマンとも「アメイジング・

get antibiotics without seeing a doctor: buy antibiotics – get antibiotics quickly

buy antibiotics from india: BiotPharm – get antibiotics without seeing a doctor

cheapest ed meds [url=http://eropharmfast.com/#]order ed pills[/url] Ero Pharm Fast

buy antibiotics over the counter: buy antibiotics online – over the counter antibiotics

Medications online Australia: pharmacy online australia – Pharm Au 24

https://biotpharm.shop/# buy antibiotics over the counter

Pretty! This was a really wonderful post. Thank you for your provided information.

Discount pharmacy Australia: Pharm Au24 – Pharm Au 24

order ed pills online: Ero Pharm Fast – online ed treatments

Medications online Australia [url=https://pharmau24.shop/#]Buy medicine online Australia[/url] Pharm Au24

where to get ed pills: ed prescription online – Ero Pharm Fast

pharmacy online australia: Online drugstore Australia – pharmacy online australia

online ed meds: what is the cheapest ed medication – erectile dysfunction pills for sale

http://biotpharm.com/# buy antibiotics for uti

pharmacy online australia: Medications online Australia – Discount pharmacy Australia

Licensed online pharmacy AU: Medications online Australia – Pharm Au24

Ero Pharm Fast [url=https://eropharmfast.com/#]Ero Pharm Fast[/url] Ero Pharm Fast

https://biotpharm.com/# best online doctor for antibiotics

http://biotpharm.com/# get antibiotics without seeing a doctor

Online medication store Australia: Licensed online pharmacy AU – pharmacy online australia

buy antibiotics: buy antibiotics online uk – buy antibiotics

織田利夫の助手を命じる。 タレント)、河合彩(元アイスダンス選手、一時在籍)、旧皇族 竹田宮家出身の竹田恒泰(政治評論家)、丸井創業者の孫・出展をご希望される方は公式WEBサイトの登録フォームに必要事項を記入の上、エントリーをお願いいたします。

http://eropharmfast.com/# Ero Pharm Fast

online pharmacy australia [url=http://pharmau24.com/#]online pharmacy australia[/url] Discount pharmacy Australia

buy antibiotics: buy antibiotics online – Over the counter antibiotics pills

get antibiotics quickly: buy antibiotics over the counter – over the counter antibiotics

cheapest antibiotics: best online doctor for antibiotics – buy antibiotics from india

Buy medicine online Australia: Buy medicine online Australia – online pharmacy australia

https://biotpharm.shop/# buy antibiotics over the counter

get antibiotics quickly [url=https://biotpharm.shop/#]BiotPharm[/url] buy antibiotics online

Over the counter antibiotics for infection [url=http://biotpharm.com/#]buy antibiotics online uk[/url] Over the counter antibiotics for infection

buying erectile dysfunction pills online: Ero Pharm Fast – best ed pills online

https://pharmau24.shop/# online pharmacy australia

Ero Pharm Fast [url=https://eropharmfast.shop/#]ed prescription online[/url] online ed pills

Licensed online pharmacy AU: Buy medicine online Australia – online pharmacy australia

Over the counter antibiotics for infection: BiotPharm – buy antibiotics from india

buy ed meds [url=http://eropharmfast.com/#]buy ed meds[/url] order ed pills online

http://pharmau24.com/# Pharm Au24

Ero Pharm Fast: Ero Pharm Fast – Ero Pharm Fast

online pharmacy australia [url=http://pharmau24.com/#]Online medication store Australia[/url] Discount pharmacy Australia

The Chevrolet Indy was an idea automotive first seen in 1986.

cheap ed meds: Ero Pharm Fast – order ed meds online

Ero Pharm Fast [url=http://eropharmfast.com/#]ed pills[/url] ed medications cost

https://eropharmfast.shop/# п»їed pills online

buy antibiotics online: buy antibiotics online uk – buy antibiotics over the counter

get antibiotics quickly [url=https://biotpharm.shop/#]Biot Pharm[/url] buy antibiotics online

over the counter antibiotics: Biot Pharm – buy antibiotics

PharmAu24 [url=http://pharmau24.com/#]online pharmacy australia[/url] Online medication store Australia

https://biotpharm.com/# get antibiotics without seeing a doctor

best online doctor for antibiotics: buy antibiotics online uk – buy antibiotics online

buy antibiotics [url=http://biotpharm.com/#]buy antibiotics online[/url] Over the counter antibiotics pills

Acheter du Viagra sans ordonnance: Acheter du Viagra sans ordonnance – Viagra generique en pharmacie

pharmacie internet fiable France: Pharmacies en ligne certifiees – pharmacie en ligne fiable

pharmacie internet fiable France [url=http://pharmsansordonnance.com/#]pharmacie en ligne sans ordonnance[/url] Achat mГ©dicament en ligne fiable

https://kampascher.com/# achat kamagra

pharmacie internet fiable France: pharmacie en ligne sans prescription – pharmacie en ligne france livraison belgique

pharmacie en ligne pas cher [url=https://pharmsansordonnance.com/#]pharmacie en ligne sans prescription[/url] pharmacie en ligne sans ordonnance

pharmacie internet fiable France: acheter medicaments sans ordonnance – pharmacie en ligne pas cher

Cialis sans ordonnance 24h [url=http://ciasansordonnance.com/#]commander Cialis en ligne sans prescription[/url] traitement ED discret en ligne

commander Kamagra en ligne: kamagra gel – Kamagra oral jelly pas cher

Pharmacies en ligne certifiees: pharmacie en ligne sans prescription – pharmacie en ligne france fiable

http://pharmsansordonnance.com/# п»їpharmacie en ligne france

Medicaments en ligne livres en 24h [url=https://pharmsansordonnance.shop/#]pharmacie internet fiable France[/url] vente de mГ©dicament en ligne

Cialis pas cher livraison rapide: cialis sans ordonnance – pharmacie en ligne livraison europe

acheter kamagra site fiable: acheter kamagra site fiable – kamagra livraison 24h

acheter medicaments sans ordonnance [url=https://pharmsansordonnance.com/#]pharmacie en ligne sans ordonnance[/url] pharmacie en ligne avec ordonnance

Hello, this weekend is pleasant in favor of me, since thismoment i am reading this great educational piece of writing here at my residence.

kamagra 100mg prix: acheter kamagra site fiable – Kamagra oral jelly pas cher

https://kampascher.com/# pharmacie en ligne

Acheter du Viagra sans ordonnance: acheter Viagra sans ordonnance – acheter Viagra sans ordonnance

kamagra 100mg prix: achat kamagra – kamagra en ligne

cialis generique [url=https://ciasansordonnance.shop/#]cialis generique[/url] cialis generique

п»їViagra sans ordonnance 24h: viagra en ligne – Acheter du Viagra sans ordonnance

Meilleur Viagra sans ordonnance 24h: viagra en ligne – viagra en ligne

acheter medicaments sans ordonnance: Medicaments en ligne livres en 24h – pharmacie en ligne

pharmacie en ligne [url=https://pharmsansordonnance.com/#]pharmacie internet fiable France[/url] Pharmacie Internationale en ligne

Viagra generique en pharmacie: Meilleur Viagra sans ordonnance 24h – livraison rapide Viagra en France

https://pharmsansordonnance.com/# pharmacie en ligne pas cher

cialis sans ordonnance: cialis prix – commander Cialis en ligne sans prescription

Acheter du Viagra sans ordonnance [url=https://viasansordonnance.com/#]Acheter Sildenafil 100mg sans ordonnance[/url] viagra sans ordonnance

kamagra en ligne: kamagra livraison 24h – Kamagra oral jelly pas cher

kamagra pas cher: kamagra oral jelly – kamagra en ligne

acheter mГ©dicament en ligne sans ordonnance: Medicaments en ligne livres en 24h – Pharmacie Internationale en ligne

https://ciasansordonnance.com/# acheter Cialis sans ordonnance

acheter Cialis sans ordonnance [url=https://ciasansordonnance.shop/#]Cialis generique sans ordonnance[/url] traitement ED discret en ligne

livraison discrète Kamagra: pharmacie en ligne avec ordonnance – kamagra livraison 24h

Meilleur Viagra sans ordonnance 24h: Viagra generique en pharmacie – livraison rapide Viagra en France

Cialis generique sans ordonnance: traitement ED discret en ligne – traitement ED discret en ligne

commander sans consultation medicale [url=https://pharmsansordonnance.com/#]trouver un mГ©dicament en pharmacie[/url] pharmacie en ligne livraison europe

https://ciasansordonnance.com/# cialis sans ordonnance

Kamagra oral jelly pas cher: Pharmacie Internationale en ligne – pharmacie en ligne france livraison belgique

acheter Kamagra sans ordonnance: kamagra livraison 24h – livraison discrete Kamagra

kamagra pas cher [url=https://kampascher.shop/#]kamagra livraison 24h[/url] kamagra oral jelly

kamagra oral jelly: commander Kamagra en ligne – kamagra gel

prix bas Viagra generique: Viagra sans ordonnance 24h – Acheter du Viagra sans ordonnance

SildГ©nafil 100 mg prix en pharmacie en France: prix bas Viagra generique – Viagra sans ordonnance 24h

Suppliers with verified business licenses Crazy Money Wheel, Money Catch™, Pick ’Em, Goldlink™ Free Spins. If you don’t fancy scratch cards, we also offer keno games. Pick your lucky number – or a combination of fifteen numbers. And for every winning number you pick, you get paid real money. Players who enjoy the Crazy Money and Crazy Money II video slot will also find this slot interesting. IGT designed the game in such a way that it maintains the thrills and fun of the original game. Crazy Money Wheel, Money Catch™, Pick ’Em, Goldlink™ Free Spins. Progressive Jackpots are the pride of any online casino, and we have an exclusive selection for you to play. The jackpot rises with every spin, will you land a win? Our Progressive Jackpots are won daily. Crazy Money is a popular title in the IT Infinity U23 cabinet. This is one of the newest models of cabinet styles that we sell. Check out our other Infinity U23 themes. If you are interested in the latest word in technology, the Infinity U23 from Incredible Technology provides a robust selection of game themes. Furthermore, the sleek design makes a great addition to your home game room floor.

https://darkoumimmo.com/language-accessibility-explored-slot-ludo-earning-app-with-live-dealers/

Welcome offer 300% up to £1000. New players, 1st deposit only. Opt in required. Minimum deposit £25. Welcome Casino Bonus can be used on slots and only on the following Providers: Egt, Amatic, Netent. Welcome Casino Bonus is subject to WR 45x. Full terms apply. In an unprecedented move to welcome new players, Vegas Casino Online has rolled out an offer that needs to be noticed. New registrants are now entitled to a staggering 300% Welcome Bonus topped with 185 Free Spins, setting the stage for an exhilarating gaming experience. This offer, coded “CRYPTO-185”, is specifically designed to boost the initial gaming sessions of new members with a substantial increase in play funds and free spins on the captivating slot game Miami Jackpots. In an unprecedented move to welcome new players, Vegas Casino Online has rolled out an offer that needs to be noticed. New registrants are now entitled to a staggering 300% Welcome Bonus topped with 185 Free Spins, setting the stage for an exhilarating gaming experience. This offer, coded “CRYPTO-185”, is specifically designed to boost the initial gaming sessions of new members with a substantial increase in play funds and free spins on the captivating slot game Miami Jackpots.

prix bas Viagra generique [url=https://viasansordonnance.com/#]Viagra generique en pharmacie[/url] Acheter du Viagra sans ordonnance

acheter Kamagra sans ordonnance: commander Kamagra en ligne – kamagra en ligne

livraison discrete Kamagra: kamagra 100mg prix – acheter Kamagra sans ordonnance

prix bas Viagra generique: commander Viagra discretement – viagra en ligne

https://kampascher.com/# kamagra pas cher

Achat mГ©dicament en ligne fiable [url=http://ciasansordonnance.com/#]acheter Cialis sans ordonnance[/url] Cialis generique sans ordonnance

I’m impressed, I must say. Seldom do I come across a blog that’s equally educative and entertaining, and without a doubt, you’ve hit the nail on the head. The problem is something not enough people are speaking intelligently about. I’m very happy that I came across this in my search for something concerning this.

achat kamagra: pharmacie en ligne france livraison belgique – commander Kamagra en ligne

livraison discrete Kamagra: kamagra en ligne – Kamagra oral jelly pas cher

pharmacie en ligne fiable [url=http://pharmsansordonnance.com/#]pharmacie en ligne sans prescription[/url] pharmacie en ligne

Viagra generique en pharmacie: commander Viagra discretement – viagra en ligne

pharmacie en ligne sans prescription: pharmacie en ligne sans prescription – Pharmacie en ligne livraison Europe

pharmacie en ligne sans ordonnance [url=https://kampascher.com/#]kamagra gel[/url] kamagra pas cher

kamagra gel: kamagra livraison 24h – kamagra gel

kamagra pas cher: achat kamagra – kamagra pas cher

Viagra sans ordonnance 24h [url=https://viasansordonnance.shop/#]Meilleur Viagra sans ordonnance 24h[/url] Viagra generique en pharmacie

kamagra en ligne: kamagra oral jelly – pharmacie en ligne fiable

Kamagra oral jelly pas cher: commander Kamagra en ligne – livraison discrete Kamagra

commander Viagra discretement [url=https://viasansordonnance.com/#]Acheter du Viagra sans ordonnance[/url] livraison rapide Viagra en France

kamagra pas cher: kamagra livraison 24h – Kamagra oral jelly pas cher

http://viasansordonnance.com/# Acheter du Viagra sans ordonnance

prix bas Viagra generique [url=https://viasansordonnance.shop/#]viagra en ligne[/url] viagra sans ordonnance

cialis prix: cialis prix – cialis prix

vykřiknout a říct, že mě opravdu baví číst vaše příspěvky na blogu.

commander sans consultation medicale [url=https://pharmsansordonnance.com/#]pharmacie en ligne sans ordonnance[/url] pharmacie en ligne pas cher

pharmacie internet fiable France: pharmacie en ligne sans prescription – pharmacies en ligne certifiГ©es

commander Kamagra en ligne [url=https://kampascher.shop/#]Kamagra oral jelly pas cher[/url] kamagra pas cher

acheter Viagra sans ordonnance: acheter Viagra sans ordonnance – viagra en ligne

http://ciasansordonnance.com/# Acheter Cialis

you are in reality a good webmaster The website loading velocity is amazing It sort of feels that youre doing any distinctive trick Also The contents are masterwork you have done a fantastic job in this topic

livraison rapide Viagra en France [url=https://viasansordonnance.shop/#]prix bas Viagra generique[/url] SildГ©nafil 100 mg prix en pharmacie en France

acheter Viagra sans ordonnance: Viagra sans ordonnance 24h – viagra en ligne

Viagra sans ordonnance 24h: livraison rapide Viagra en France – livraison rapide Viagra en France

Kamagra oral jelly pas cher [url=https://kampascher.com/#]pharmacie en ligne[/url] commander Kamagra en ligne

https://kampascher.com/# kamagra oral jelly

Viagra sans ordonnance 24h: viagra sans ordonnance – acheter Viagra sans ordonnance

pharmacie en ligne sans ordonnance [url=http://pharmsansordonnance.com/#]pharmacie en ligne[/url] pharmacie en ligne avec ordonnance

Greetings! This is my first visit to your blog! We are a collection of volunteers and starting a new project in a community in the same niche. Your blog provided us beneficial information to work on. You have done a outstanding job!

se puede comprar fluoxetina sin receta medica: farmacia online paracetamol – puedo comprar antidepresivos sin receta

lansoprazolo 15 mg prezzo [url=http://farmaciasubito.com/#]normast 600[/url] formistin gocce prezzo

http://farmaciasubito.com/# tobral gocce auricolari

antibiotique chat pharmacie sans ordonnance: bromazepam sans ordonnance – cystite medicament pharmacie sans ordonnance

coaprovel 150/12.5 prezzo: meloxidyl gatto – dibase 300.000 prezzo

geniad gocce [url=https://farmaciasubito.com/#]ketorolac gocce[/url] dona bustine prezzo

ordonnance bizone s̩curis̩e: prorhinel rhume unidose Рcolpermin sans ordonnance

ordonnance zava pharmacie: bГ©quille pharmacie sans ordonnance – quel mГ©dicament sans ordonnance pour infection urinaire ?

se puede comprar hidrocortisona sin receta [url=http://confiapharma.com/#]master en farmacia online[/url] farmacia online la rioja

aircort per aerosol: Farmacia Subito – lyrica 75 mg 56 capsule prezzo con ricetta

boite de viagra: viagra homme 50 mg – peut on aller chez l’orl sans ordonnance

https://pharmacieexpress.com/# ordonnance amoxicilline enfant

meglio compresse o bustine: brufen 600 online – fripass 100 mg prezzo

visucortex collirio prezzo [url=https://farmaciasubito.shop/#]difosfonal 200 mutuabile[/url] ozempic price in italy

comment avoir une ordonnance sans medecin: cystite pharmacie sans ordonnance – test pcr sans ordonnance pharmacie

ordonnance gratuite: bandelette urinaire pharmacie sans ordonnance – medicament pour sinusite sans ordonnance

comprar wartec crema sin receta: Confia Pharma – amoxicilina sin receta comprar

gГ©nГ©rique du cialis [url=https://pharmacieexpress.shop/#]ordonnance alprazolam[/url] acheter de la testosterone en pharmacie sans ordonnance

http://pharmacieexpress.com/# pilule chat pharmacie sans ordonnance

peut on acheter du cialis sans ordonnance en pharmacie: medicament pour faire l’amour plusieur fois pharmacie sans ordonnance – prix viagra 100 mg

pommade antibiotique sans ordonnance: Pharmacie Express – cortisone sans ordonnance en pharmacie

farmacia vazquez compra online: farmacia express online – puedo comprar sildenafil sin receta medica en espaГ±a

citalopram gocce prezzo [url=https://farmaciasubito.shop/#]fluaton collirio monodose[/url] avamys spray nasale prezzo

farmacia irina online: se puede comprar efferalgan sin receta – se puede comprar viagra sin receta ?

miroir buccal: uriage serum – peut on avoir une ordonnance en ligne

farmacia gallego online [url=https://confiapharma.com/#]Confia Pharma[/url] comprar cialis en valencia sin receta

prix nicopatch 21 mg: acheter pilule en pharmacie sans ordonnance – shampooing kelual ds

https://confiapharma.shop/# se puede comprar prednisona sin receta en espaГ±a

derinox Г©quivalent sans ordonnance: mГ©dicament prostate sans ordonnance en pharmacie – ducray shampoing squames

Promo kodu sizə bütün bu bonuslardan yararlanmaq imkanı verir, çünki bu, oyun oynayarkən sizə daha çox üstünlüklər verə bilər 1win aviator. Ya təyyarə havaya qalxdıqdan sonra dəyişmə riskini götürürsən, ya da zaman-zaman risk edirsən və bu, bəhrəsini verə bilər. Çox sayda fərqli strategiyaya baxmayaraq, onlar 100% qələbəyə zəmanət vermir. Onlayn oyun bazarının bazarda qalması üçün reputasiya çox vacib olduğundan bu, son dərəcə vacib olur. 1Win bukmeker kontoru istifadəçilərini təəccübləndirməyə və beləliklə, onları oynamağa həvəsləndirməyə çalışır “1 win aviator” Onlayn. Xaricde Tehsil Üçün Hər Şey Xaricdə Təhsil Portalı Read More » Fale Conosco Promo kodu sizə bütün bu bonuslardan yararlanmaq imkanı verir, çünki bu, oyun oynayarkən sizə daha çox üstünlüklər verə bilər 1win aviator. Ya təyyarə havaya qalxdıqdan sonra dəyişmə riskini götürürsən, ya da zaman-zaman risk edirsən və bu, bəhrəsini verə bilər. Çox sayda fərqli strategiyaya baxmayaraq, onlar 100% qələbəyə zəmanət vermir. Onlayn oyun bazarının bazarda qalması üçün reputasiya çox vacib olduğundan bu, son dərəcə vacib olur. 1Win bukmeker kontoru istifadəçilərini təəccübləndirməyə və beləliklə, onları oynamağa həvəsləndirməyə çalışır “1 win aviator” Onlayn.

https://florianlindtner.at/aviator-mostbet-platformasinda-f%c9%99rql%c9%99n%c9%99n-imkanlar/

No, HappyMod is developed for Android only, all the ios version of HappyMod on the internet are fake. Crash Predictor Aviator: Basit ve Kullanışlı Bir Bahis Uygulaması Spribe Gaming firması, tüm oyun hizmetlerini lisanslı ve güvenilir olarak sunuyor. Aviator sinyal hilesi var mı? Lisanslı sunulan aviator oyununda sinyal hilesi uygulamaların kullanmak doğru bir yöntem değildir. Bu uygulamaları kullanmaya çalışan oyuncular, oyun siteleri tarafından engelleme ile karşılaşabilirler. APKPure Lite – Basit ama verimli bir sayfa deneyimi sunan Android uygulama mağazası. İstediğiniz uygulamayı daha kolay, daha hızlı ve daha güvenli keşfedin. Ayrıca Aviator sinyalleri ve güncellemeleri dahil olmak üzere günlük Telegram sinyalleri de sağlıyoruz. Telif hakkı © 2014-2025 APKPure’a aittir. Tüm hakları saklıdır.

atovaquone proguanil prix [url=https://pharmacieexpress.com/#]cicabiafine crГЁme mains anti-taches brunes[/url] anxiolytiques sans ordonnance

quel antibiotique pour soigner un abcГЁs dentaire sans ordonnance: paraetpharmacie.com avis – anti douleur puissant sans ordonnance

cicalfate controindicazioni: tareg 40 – forbest prezzo con ricetta

adalat crono 30 [url=http://farmaciasubito.com/#]formistin prezzo[/url] dicloreum 150 rilascio prolungato

palexia 50 mg: tobral orecchio – farmacia online spedizione veloce

You really make it appear really easy together with your presentation but I find this matterto be really something which I think I would by no meansunderstand. It seems too complex and extremely large for me.I’m having a look forward on your subsequent put up, I’ll try to get the cling of it!

http://confiapharma.com/# cialis se puede comprar en farmacias sin receta

generique viagra: Pharmacie Express – dermagor atopicalm

detranspirant aisselle [url=https://pharmacieexpress.com/#]Pharmacie Express[/url] mini biberon

farmacia online productos bebe: Confia Pharma – #РРњРЇ?

prix tadalafil 5mg: ordonnance pilule – ordonnance francaise en belgique

farmacia online comprar mascarilla ffp2: donde comprar sildenafil sin receta – farmacia online puerto rico

spedra 200 costo [url=https://farmaciasubito.com/#]nerisona crema[/url] farmacia online parma

metoprololo 100 mg prezzo: verifica farmacia online – progeffik 200 ovuli

https://pharmacieexpress.shop/# equivalent lumirelax sans ordonnance

antibiotique en pharmacie sans ordonnance: Pharmacie Express – a derma epitheliale

https://pharmacieexpress.com/# priligy 30 mg sans ordonnance

provigil farmacia online [url=https://confiapharma.com/#]Confia Pharma[/url] farmacia online orlais

se puede comprar viagra sin receta en farmacias fГsicas: Confia Pharma – comprar zinnat sin receta

se puede comprar propranolol sin receta: farmacia savorani online – farmacia online diazepam

se puede comprar diazepam sin receta mГ©dica espaГ±a: farmacia veterinaria online romania – se puede comprar viagra sin receta en farmacias

soolantra sans ordonnance: viagra achat – antihistaminique vendu en pharmacie sans ordonnance

farmacia veterinaria online madrid [url=http://confiapharma.com/#]nitrofurantoГna se puede comprar sin receta[/url] fp de farmacia y parafarmacia online

farmacia online forocoches: se puede comprar clomifeno sin receta – se puede comprar sildenafilo sin receta en farmacia

https://farmaciasubito.shop/# migliore farmacia online spedizione gratuita

ordonnance antidГ©presseur: acheter kГ©toprofГЁne sans ordonnance – Г©quivalent du solupred sans ordonnance

cursos online auxiliar de farmacia [url=https://confiapharma.com/#]comprar zolpidem sin receta espaГ±a[/url] que pastillas para dormir puedo comprar sin receta mГ©dica

niklod 200 fiale mutuabile: puntura pappataci gonfiore – macladin sciroppo

настроить 1с бухгалтерия цена настроить 1с бухгалтерия цена .

se puede comprar sibilla sin receta: en espaГ±a se puede comprar viagra sin receta – farmacia guacci vendita online

farmacia online europea [url=https://confiapharma.com/#]Confia Pharma[/url] ru486 farmacia online

se puede comprar viagra sin receta en farmacias fisicas en espaГ±a: puedo comprar loette sin receta – los ovulos de progesterona se pueden comprar sin receta

rectogesic pomata: farmacia minati – spasmex generico prezzo

antibiotiques en pharmacie sans ordonnance [url=https://pharmacieexpress.com/#]peroxyde de benzoyle pharmacie sans ordonnance[/url] dermablend 3d

https://pharmacieexpress.com/# peut on acheter du fer en pharmacie sans ordonnance

peut on avoir des ovules en pharmacie sans ordonnance: Pharmacie Express – acheter aspirine sans ordonnance

cilodex gocce ГЁ un antibiotico: fluaton unguento – coverlam principio attivo

farmacia badajoz online [url=https://confiapharma.com/#]Confia Pharma[/url] donde comprar penicilina sin receta

testosterone pharmacie sans ordonnance: diflucan sans ordonnance – lithium pharmacie sans ordonnance

halcion quante ore fa effetto [url=http://farmaciasubito.com/#]ricette online farmacia[/url] toujeo 300

https://inpharm24.com/# pharmacy in india

online pharmacy no prescription needed ambien: rx partners pharmacy – cialis cost at pharmacy

http://inpharm24.com/# e pharmacy india

hcg mexico farmacia: can i buy eliquis in mexico – online pharmacy drugs

depakote online pharmacy [url=http://pharmexpress24.com/#]Pharm Express 24[/url] pharmacies online

gold pharmacy online: rite aid pharmacy online – viagra sale 70 pharmacy online

cozumel mexico pharmacy price list: mexican rx pharm – mexico rx

online pharmacy permethrin [url=http://pharmexpress24.com/#]international pharmacy no prescription[/url] nizoral online pharmacy

http://pharmexpress24.com/# pharmacy supply store

india online pharmacy market: indian online pharmacy – п»їindia pharmacy

Fiquei muito feliz em descobrir este site. Preciso de agradecer pelo vosso tempo

indomethacin pharmacy: viagra no prescription online pharmacy – pharmacy direct viagra

mexican pharmacy ambien [url=https://pharmmex.com/#]prescription drugs in mexico[/url] what medications can you buy in mexico

india online pharmacy: Pharm Express 24 – how much does percocet cost at the pharmacy

e pharmacy india: online india pharmacy – medicine delivery in vadodara

when first pharmacy course was started in india: medicine online purchase – when first pharmacy course was started in india

india online medicine [url=http://inpharm24.com/#]pharmacy council of india[/url] buy medication from india

https://pharmexpress24.shop/# kroger pharmacy store locator

uk pharmacy propecia: Pharm Express 24 – losartan pharmacy

mexican pharmacy must haves: online pharmacy list – buy xanax mexico

pain killers in mexico: phentermine mexico cost – amoxicillin in mexico over the counter

ozempic purchase in mexico [url=https://pharmmex.shop/#]medicine online usa[/url] mexican pharmacy sildenafil

best online pharmacy india: InPharm24 – pharmacy website in india

free tamiflu pharmacy: lexapro pharmacy price – medical pharmacies

how much does viagra cost at a pharmacy: Pharm Express 24 – dexamethasone iontophoresis pharmacy

https://pharmexpress24.com/# xenical pharmacy uk

online pharmacy stores [url=http://pharmmex.com/#]my mexican pharmacy reviews[/url] top mail order pharmacies in usa

pharmacia mexico: Pharm Mex – azithromycin over the counter mexico

all day pharmacy india: india e-pharmacy market size 2025 – india online medicine

all day pharmacy india [url=https://inpharm24.com/#]InPharm24[/url] buy medicine online

india pharmacy website: india pharmacy online – e pharmacy in india

penicillin in mexico: Pharm Mex – mexican pharmacy steroids

pharmacy2u co uk viagra: mexitil online pharmacy – wedgewood pharmacy gabapentin

levitra pharmacy rx one [url=https://pharmexpress24.shop/#]viagra australian pharmacy[/url] generic viagra india pharmacy

india meds: InPharm24 – pharmacy india

https://inpharm24.com/# cheap online pharmacy india

medicine to take to mexico: Pharm Mex – top mail order pharmacies

Spot on with this write-up, I honestly believe this site needs a great deal more attention. I’ll probably be back again to see more, thanks for the information!

cytotec malaysia pharmacy [url=http://pharmexpress24.com/#]Pharm Express 24[/url] propranolol indian pharmacy

bupropion hcl xl global pharmacy: cialis daily – telmisartan online pharmacy

online medicine in india: online medical store india – india prescription drugs

chem rx pharmacy [url=https://pharmexpress24.com/#]Pharm Express 24[/url] online pharmacy no prescription ambien

farmacias online usa: mexico drug store online – nogales pharmacy prices

Another new colour trading app, Raja Games, is a gaming platform that specializes in colour trading games, where players can test their intuition and strategy to win rewards. The platform offers a bonus of up to ₹2,000 on the first deposit for new users, adding extra value to their initial gameplay. With a compact app size of just 9.3 MB, Raja Games ensures a convenient and lightweight experience without taking up too much storage on devices. рџ•№️ Arcade games: Try these easy to learn, hard to master arcade games With a variety of games and easy withdrawal options, Tiranga Games app provides a fun and exciting way to earn some extra cash. So why wait? Get the Tiranga games app download today and start playing. Download the Apple Store app A wide variety of online games is essential for a player’s enjoyment, and casino apps should match the quality and range of their desktop counterparts. Our top-rated casino apps feature a diverse selection of slots and table games, including blackjack and roulette, from leading software providers.

https://iclcoach.com/is-the-2025-aviator-game-worth-the-hype/

A free Indian poker game There is an online version of Dragon Simulator 3D, which you can play for free at CrazyGames Change weapons – Numeric keys or mouse wheel You can email the site owner to let them know you were blocked. Please include what you were doing when this page came up and the Cloudflare Ray ID found at the bottom of this page. The hottest Roulette game show with multipliers up to 2,500x! You can email the site owner to let them know you were blocked. Please include what you were doing when this page came up and the Cloudflare Ray ID found at the bottom of this page. Complete quests and hunt for food to earn points and upgrade your tiger family. You can tweak the individual characteristics of each member, improving their attack, energy, and life points. There are also special skills that allow you to increase speed, collect more food, get more resources for actions in the game, and more.

https://pharmmex.shop/# can i get mounjaro in mexico

river pharmacy revia [url=https://pharmexpress24.shop/#]Pharm Express 24[/url] value rx pharmacy tazewell tn

medicine online order: india online medicine – prescriptions from india

mexican pharmacy ivermectin: pharmacy online shop – amoxicillin mexico

best pharmacy franchise in india [url=https://inpharm24.shop/#]buy medicines online in india[/url] all day pharmacy india

meloxicam online pharmacy: lipitor generic target pharmacy – how much does cialis cost at the pharmacy

viagra uk where to buy [url=https://vgrsources.com/#]where to buy cheap viagra in uk[/url] sildenafil cream

sildenafil 100mg: VGR Sources – buy viagra online nz

sildenafil 150 mg: viagra online order – no script viagra

viagra super active price: VGR Sources – sildenafil pills online

https://vgrsources.com/# can i get viagra without a prescription

cheap generic viagra online uk [url=https://vgrsources.com/#]VGR Sources[/url] generic viagra cheapest

viagra 50mg price in india: VGR Sources – where can i buy cheap viagra online

sildenafil 680: viagra pharmacy cost – buy viagra over the counter australia

viagra cialis levitra online: can you order viagra online in canada – sildenafil 105 mg canada

25mg viagra: VGR Sources – order generic viagra

buying viagra in canada [url=https://vgrsources.com/#]VGR Sources[/url] can you buy sildenafil over the counter in uk

Fantastic material With thanks.

how to purchase viagra online: VGR Sources – best viagra coupon

cheap generic viagra 25mg: VGR Sources – buy viagra paypal

https://vgrsources.com/# sildenafil 50 mg buy online price

no prescription cheap viagra: VGR Sources – order viagra by phone

viagra pills online canada [url=https://vgrsources.com/#]VGR Sources[/url] female viagra pills online

where to buy real viagra: VGR Sources – where to buy female viagra

sildenafil citrate canada: VGR Sources – order viagra online paypal

purchase viagra 100mg: VGR Sources – viagra viagra

cheap viagra pills online: 12.5 mg viagra – viagra canada fast shipping

buy viagra soft tabs online [url=https://vgrsources.com/#]VGR Sources[/url] viagra gel tabs

https://vgrsources.com/# sildenafil in usa

what does viagra do: viagra 200mg pills – viagra sale no prescription

where to get female viagra pills: VGR Sources – viagra 200

wholesale viagra: viagra 1998 – viagra south africa

sildenafil 1 pill [url=https://vgrsources.com/#]VGR Sources[/url] average cost of viagra prescription

Aw, this was an incredibly good post. Finding the time and actual effort to generate a really good article… but what can I say… I hesitate a lot and never seem to get anything done.

generic viagra pills cheap: buy women viagra online – viagra otc united states

viagra 4 sale: VGR Sources – buy viagra online from mexico

viagra tablets in india: generic viagra without prescription – viagra cost australia

generic sildenafil 20 mg cost [url=https://vgrsources.com/#]VGR Sources[/url] safe buy viagra online

viagra 50mg price: order viagra online without prescription – sildenafil 20 mg tablets cost

https://vgrsources.com/# female viagra buy australia

where can you buy viagra over the counter uk: VGR Sources – cheapest sildenafil 100mg uk

viagra for cheap: VGR Sources – cheap generic viagra online uk

brand viagra 50mg online [url=https://vgrsources.com/#]how to get viagra online[/url] viagra soft generic

viagra caps: buy viagra visa – viagra paypal

cheap generic viagra 25mg: VGR Sources – female viagra drug canada

where can you buy viagra over the counter uk: viagra from canada no prescription – sildenafil soft tabs generic

viagra online us pharmacy: VGR Sources – sildenafil 100mg tablets for sale

sildenafil from mexico [url=https://vgrsources.com/#]VGR Sources[/url] best viagra tablets india

https://vgrsources.com/# buy generic viagra canadian pharmacy

best female viagra over the counter: generic viagra in mexico – viagra 75 mg price

buy cheap sildenafil citrate: canadian pharmacy generic sildenafil – sildenafil canada buy

generic viagra lowest price: VGR Sources – where can i buy generic viagra in usa

cheap viagra in australia [url=https://vgrsources.com/#]viagra purchase online[/url] sildenafil 50 mg canada

buy brand name viagra online: VGR Sources – sildenafil citrate tablets ip 100 mg

viagra professional: where can i purchase viagra online – viagra 100mg pills

no script viagra: low cost viagra – viagra 1998

cheap sildenafil online canada [url=https://vgrsources.com/#]sildenafil 75 mg[/url] canadian viagra cheap

cheap viagra canadian pharmacy: sildenafil best price uk – sildenafil 20 mg daily

https://vgrsources.com/# sildenafil cheapest price

buy viagra online with paypal: sildenafil otc us – sildenafil 25 mg buy

viagra price in canada: how to get viagra for women – where to buy female viagra in canada

buy viagra online canada [url=https://vgrsources.com/#]VGR Sources[/url] sildenafil 10 mg

It contains fastidious material.|I think the admin of this website is actually working hard in favor of his site,

sildenafil buy: generic viagra online best price – cost of sildenafil 30 tablets

generic viagra soft pills: viagra 100mg online australia – buy viagra from canada

places to buy viagra: VGR Sources – purchase viagra no prescription

viagra 500mg price in india [url=https://vgrsources.com/#]VGR Sources[/url] no rx viagra

100 mg viagra: sildenafil soft gel – viagra tablet price in india

sildenafil pills: viagra online purchase india – best price brand viagra

https://vgrsources.com/# us online pharmacy viagra

price viagra: VGR Sources – can you buy genuine viagra online

sildenafil 100mg free shipping [url=https://vgrsources.com/#]VGR Sources[/url] viagra brand canada

sildenafil online pharmacy: compare sildenafil prices – best price for sildenafil 100 mg

cheapest generic sildenafil uk: over the counter viagra online – 20 mg sildenafil 680

viagra 25mg price in india: buy viagra online cheap india – best price for sildenafil 20 mg