Cross-validation rules determine which segment values in your chart of accounts (or other key flexfields) can be used together. Upon data entry, the rule determines and controls the valid values that may be used in conjunction with other values. This paper shows how to set up Cross-validation rules, discusses the design considerations for your chart of accounts so that you can reduce the number and complexity of your Cross-validation rules, and concludes with a list of the top seven things to remember when designing Cross-validation rules.

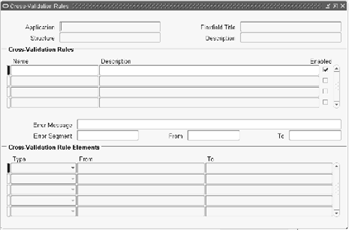

Setting up Cross-validation Rules

A Cross-validation rule applies only to a single chart of accounts structure or accounting flexfield. If you have more than one accounting flexfield, you will need to define Cross-validation rules for each COA structure name (even if different charts of accounts use the same value sets). Cross-validation rules only work on data entry and for the first time a combination is used. If a user tries to create a new combination that violates a new rule, they will get an error message and the combination will not be accepted. Cross-validation rules have no impact on code combinations that are already in use, so it is important to design and set up your Cross-validation rules before you enter transactions.

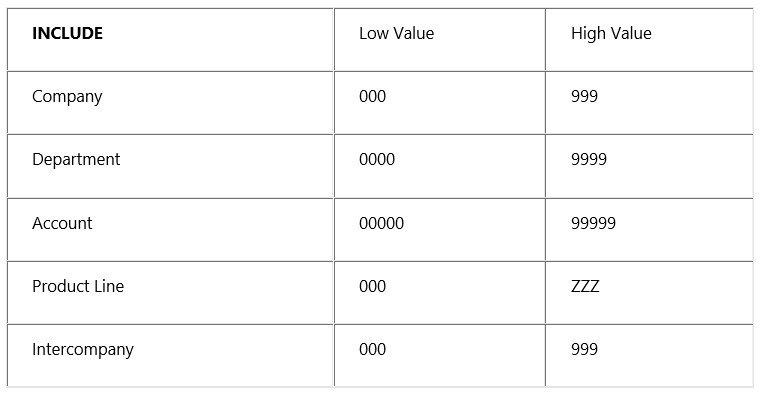

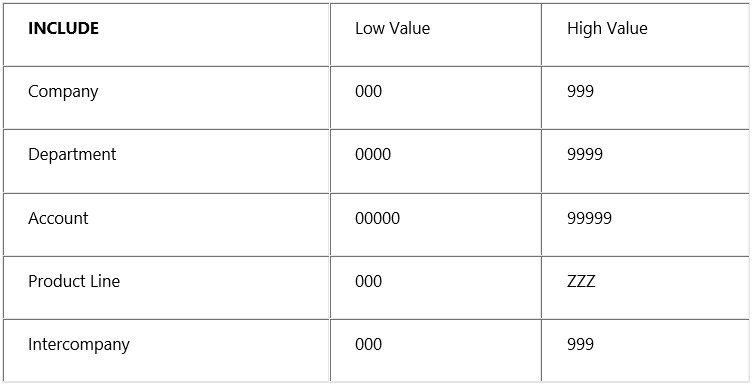

You set up Cross-validation rules by describing valid combinations. In the Define Cross-Validation Rules form, you will define rule elements that specify low and high values for each segment. Ideally, those low and high values are a range of individual values for each segment. You define each rule element as either an Include or Exclude type. Include contains all the values in the specified range, and Exclude eliminates values that are not valid combinations. With Include ranges you list valid combinations, while Exclude ranges list invalid combinations.

Example Cross-validation Rules

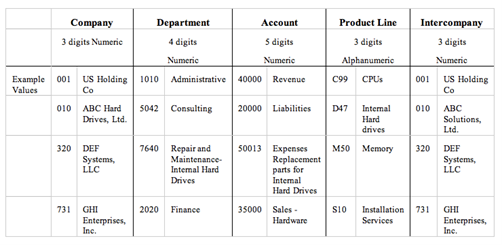

Let’s assume that your chart of accounts contains the following 5 segments:

Example 1

Let’s assume that you want to prevent revenue account values (between 30000 and 40000) from being used with the balance sheet department values (between 1000 and 1999). To do this, let’s create a rule called Revenue Accounts –Balance Sheet Departments.

The Error Message is what your users will see when they try to enter an incorrect combination, and the Error Segment is where the cursor returns in the event of an error. In this case, let’s make the error message, “CV – Revenue accounts may not be used with a balance sheet department.” When determining where the cursor will return if the rule fails, identify the segment most likely to be in error. In this case, let’s assume that the department value is where you expect that most of the errors will occur. Department will be the error segment.

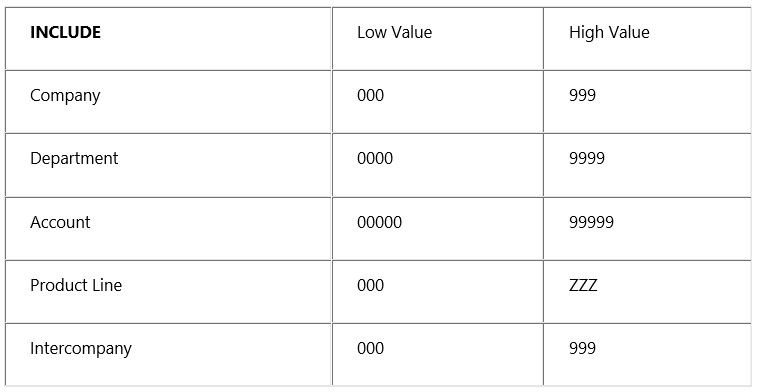

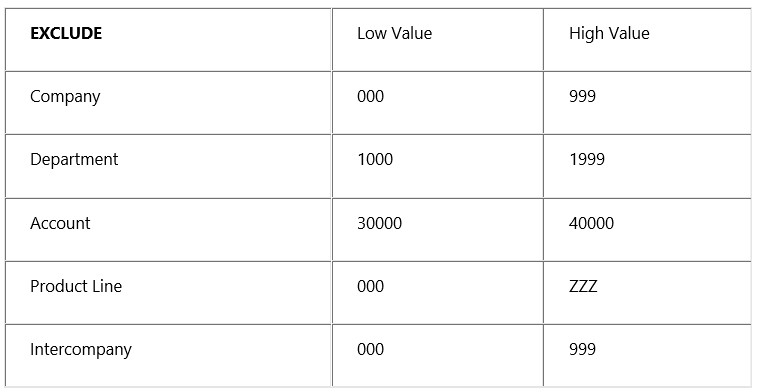

Next, you need to define the Cross-validation Rule Elements.

The first rule should always be an Include statement that includes the entire range of values for each segment.

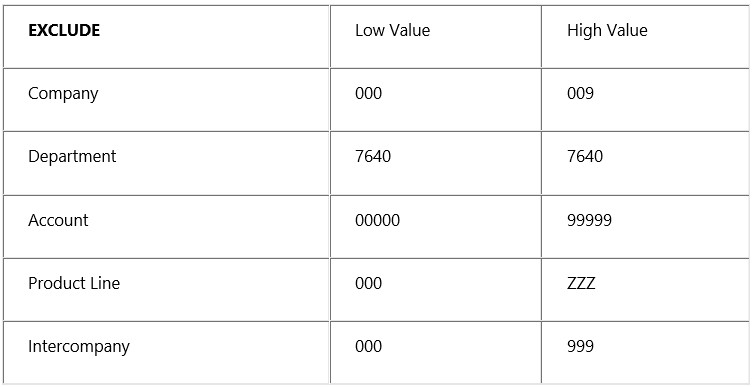

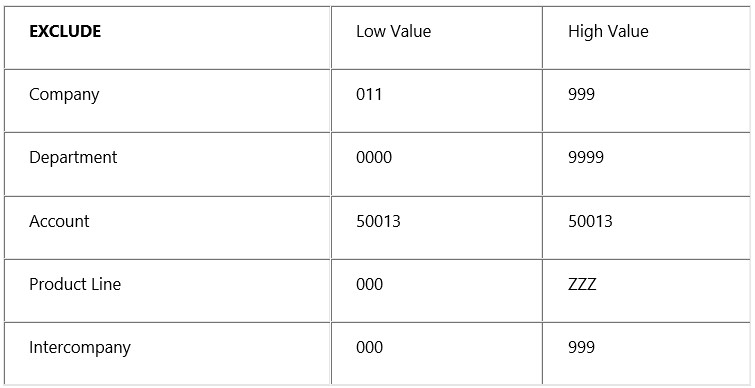

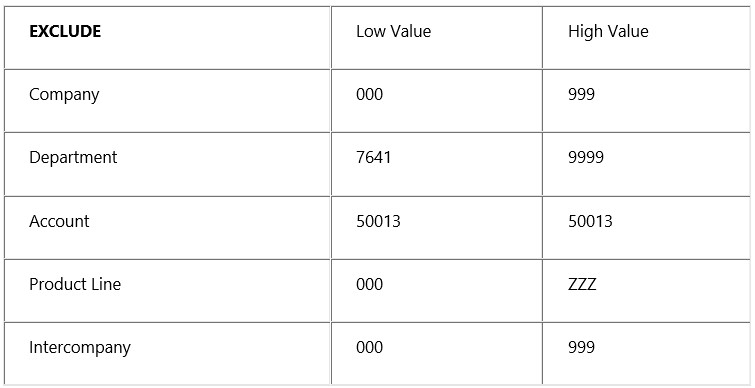

Then you will create Exclude rule statements or elements that limit the values that can be used. In this case, only one exclude statement is necessary. The following rule element prevents accounts 30000 to 40000 from being used with departments 1000-1999.

Example 2

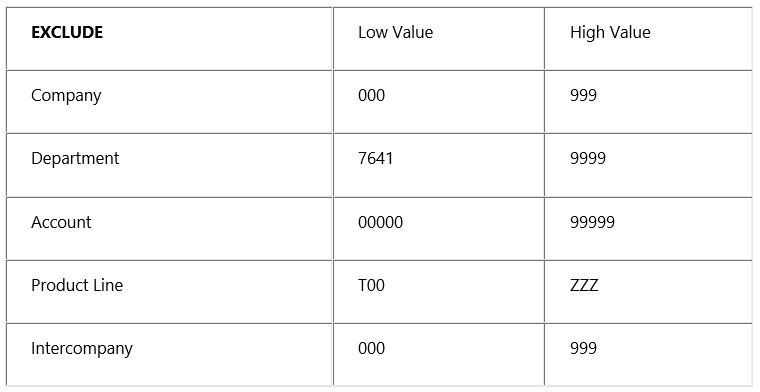

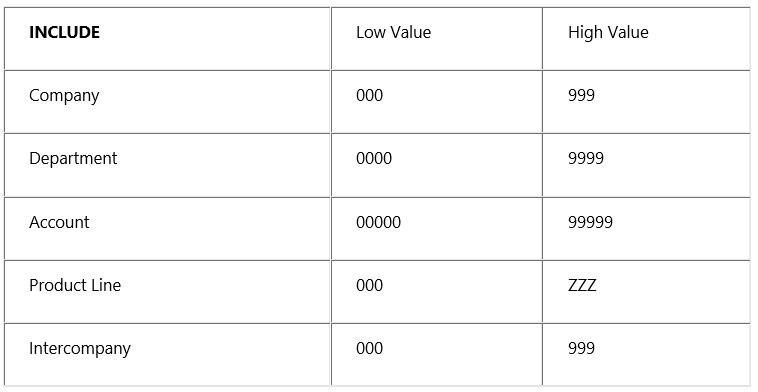

Next, let’s create a rule that says only department 7640 can be used with any product line that starts with S. Again, the rule starts with an Include statement that includes the entire range of values for each segment.

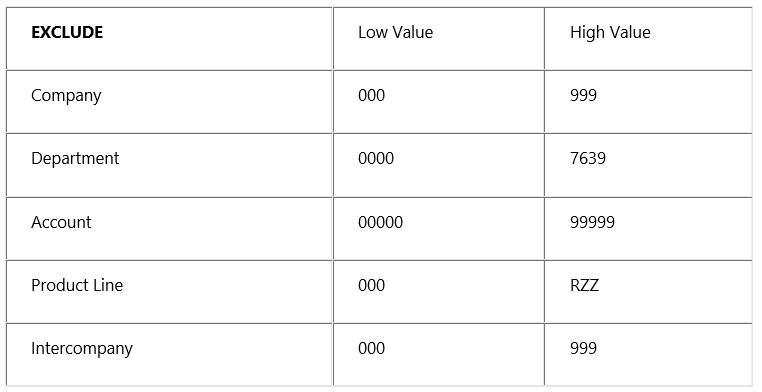

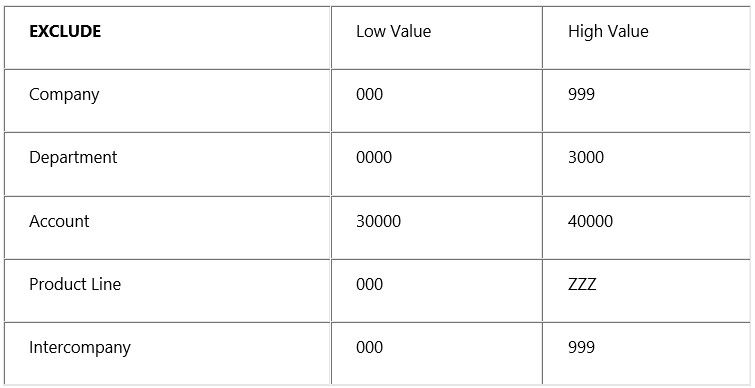

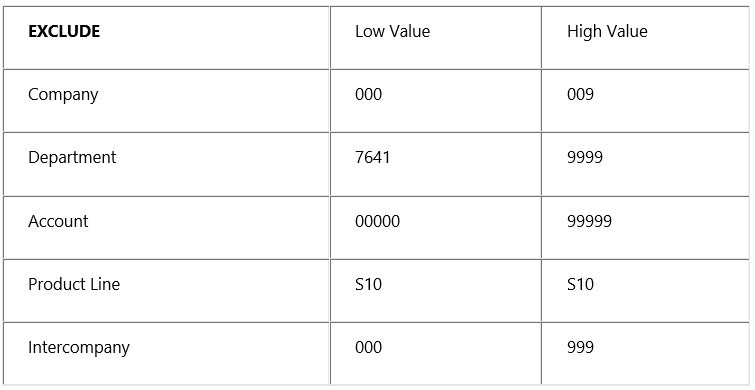

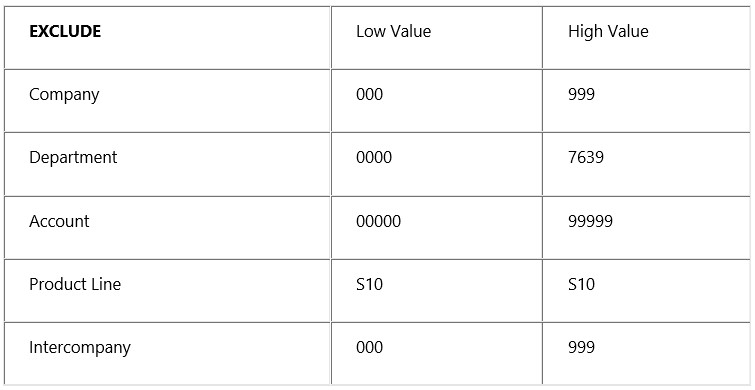

You will need to exclude the ranges above and below the department value, and the ranges above and below the product line value. It will be 4 rule elements in total. The following exclude statement prevents the departments below 7640 from using any product line that starts with anything below S.

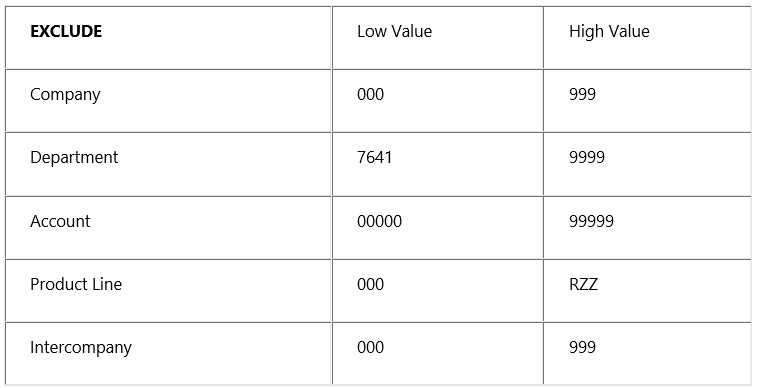

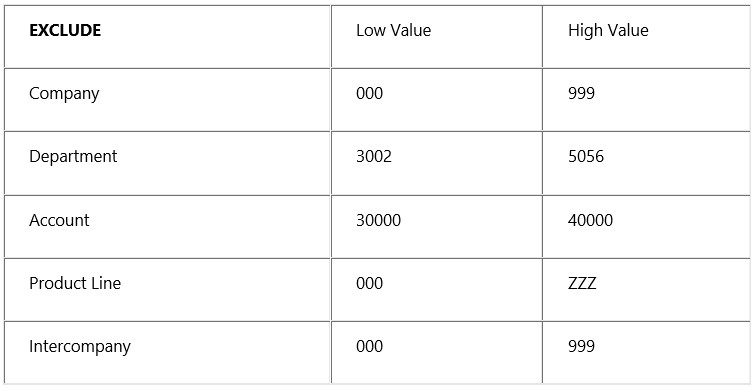

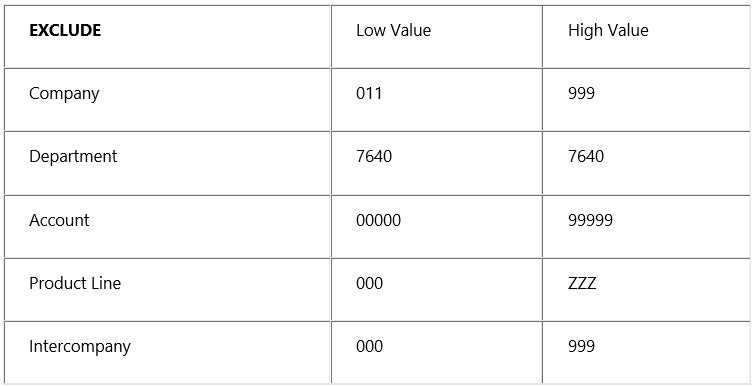

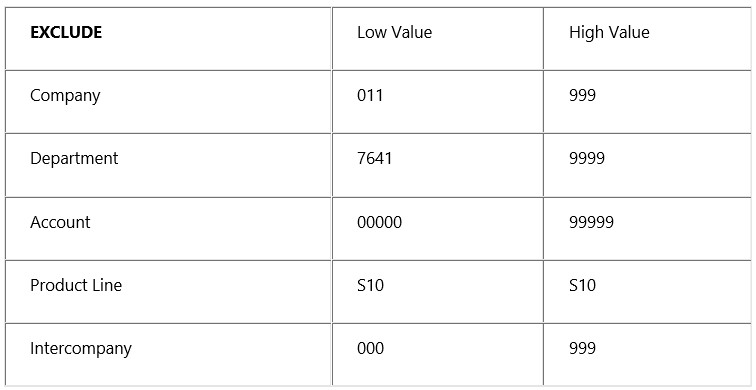

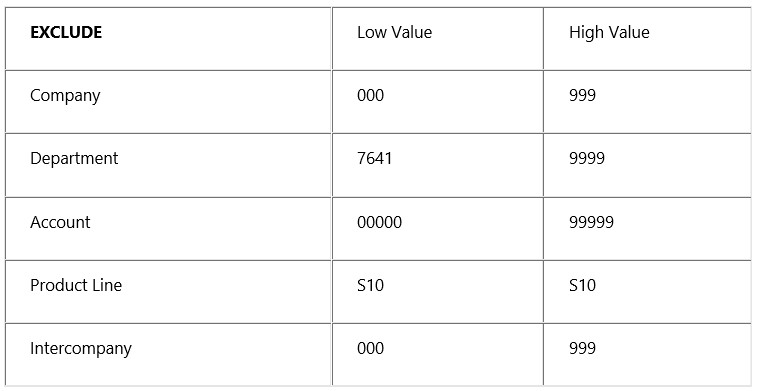

The following exclude statement prevents the departments above 7640 from using any product line that starts with anything below S.

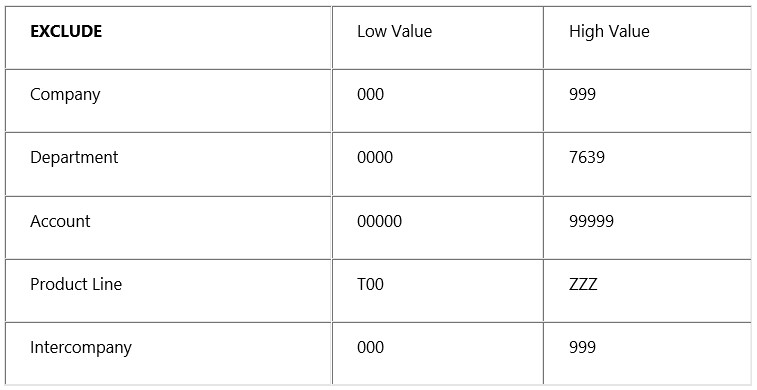

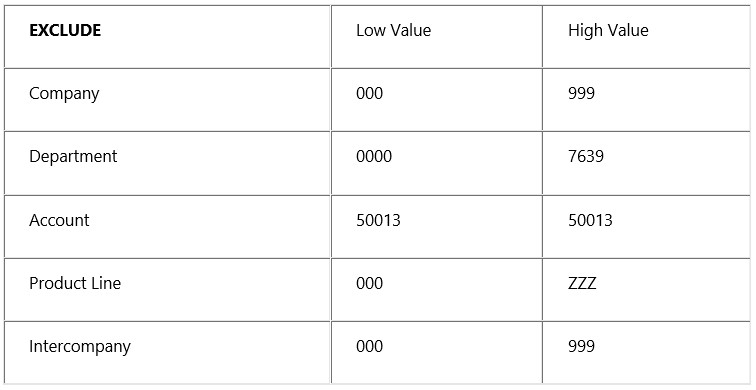

The following exclude statement prevents the departments below 7640 from using any product line that starts with anything above S.

The following exclude statement prevents the departments above 7640 from using any product line that starts with anything above S.

This cross-validation rule has 5 lines. The first line includes all possible values, and the next 4 exclude lines prevent the departments above or below 7640 from being used with any product line above or below those values starting with S.

A Good Chart of Accounts Design Helps in Optimizing Cross Validation Rules

Let’s now look at that same chart of accounts to see what would happen if the COA design did not follow the practices of good design. Click here to view a master class on best practices of chart of accounts design.

Out of Range Example 3

First, let’s see what would happen in Example 1 above if the values for the departments were not in a range. Let’s say instead that you want to prevent revenue account values (between 30000 and 40000) from being used with any department values other than these 5 values: 3001, 5057, 6124, 8537, and 9905. Now, my rule elements are much more complex because I cannot use a range for the department values.

I still start with my include statement.

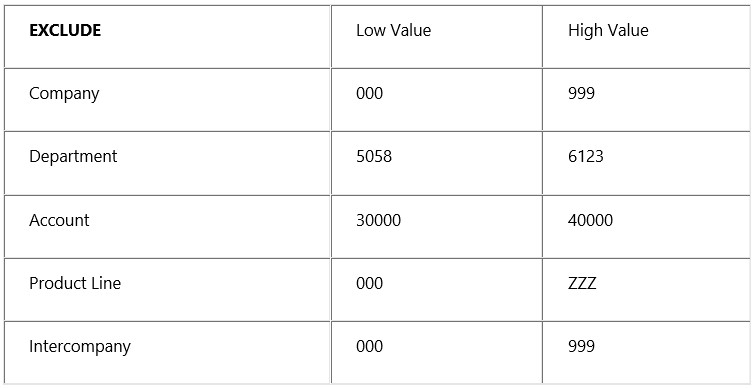

The next step is to create Exclude rules for all the values above and below each of the department values. This statement prevents all departments below 3001 from being used.

This statement prevents all departments greater than 3001 and less than 5057 from being used.

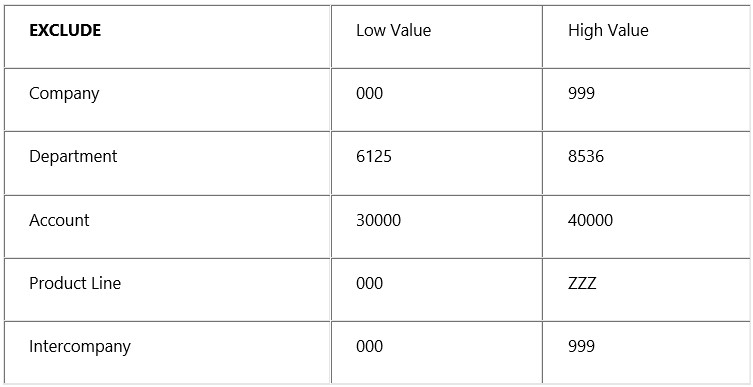

This statement prevents all departments greater than 5057 and less than 6124 from being used.

This statement prevents all departments greater than 6125 and less than 8537 from being used.

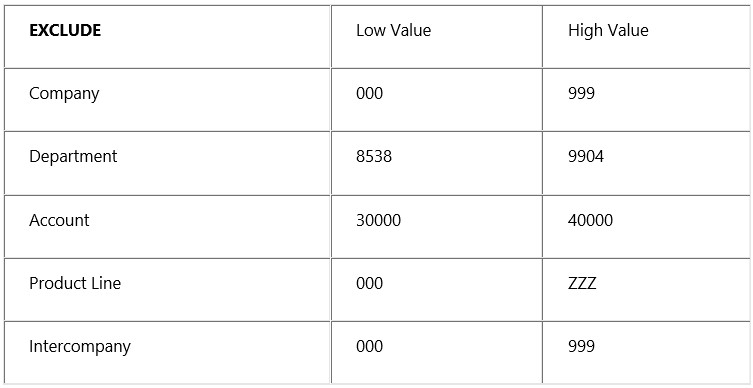

This statement prevents all departments greater than 8537 and less than 9905 from being used.

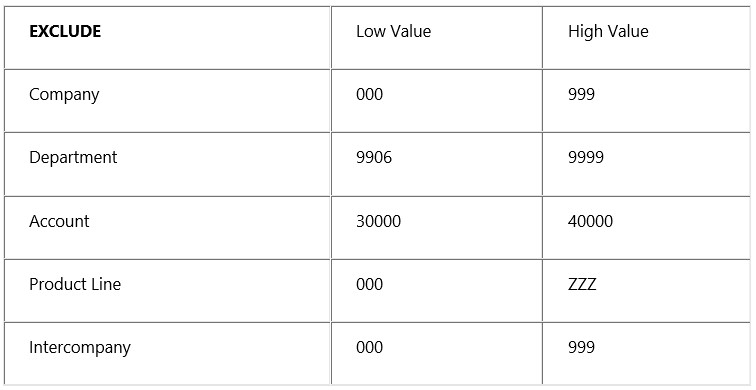

This statement prevents all departments greater than 9906 from being used.

I have very quickly gone to 6 lines and a lot more complexity. Imagine if the rule were to restrict more values, or if neither of the two segments that I am trying to control were in ranges. (In the above example, my accounts are still in a range.)

Similar Data in Multiple Segments – Example 4

In the above chart of accounts, I need to restrict Department 7640 and Account 50013, and Product Line S10 only to Company 010, Account 50013 only to Department 7640, and Product Line S10 only to Department 7640.

It is much too complex to try to exclude more than two segments in a cross validation rule, so I end up with 11 rule elements.

Exclude Rules: CV – Department 7640 may only be used with Company 010.

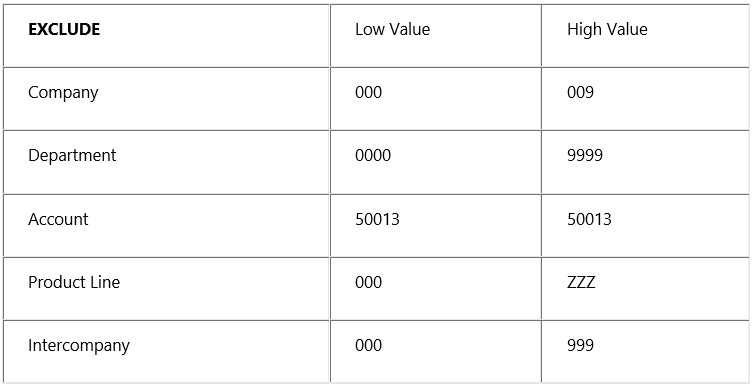

Exclude Rules: CV – Account 50013 may only be used with Company 010.

Exclude Rules: CV – Product Line S10 may only be used with Company 010.

Exclude Rules: CV – Account 50013 may only be used with Department 7640.

Exclude Rules: CV – Product Line S10 may only be used with Department 7640

As these very simple examples show, it is very easy to quickly get to thousands of cross validation rules to maintain. Notice also, that it was much more difficult to determine the ranges for alphanumeric data. If your chart of accounts follows the basic principles of good design of keeping values in ranges in each segment, keeping only one kind of data in a single segment, and putting similar data only in one segment, you will be able to simplify your cross validation rules and significantly reduce maintenance of the rule elements as your business changes.

7 Criteria for Designing Good Cross-validation Rules

- Design your chart of accounts with cross-validation rules in mind (keep values in ranges, put similar data in only one segment, and keep each segment for only one type of data, use alphanumerics only when necessary).

- Start each rule with an include statement that includes the entire range of values.

- Limit each rule to only 2 segments.

- Make your error messages very descriptive so that when a user gets an error, he or she understands what changes need to be made to the entered code combination.

- Use several simple rules rather than one complex rule.

- Start your Cross-validation Error Messages with CV so that the user knows that the combination is failing because of a Cross-validation rule (as opposed to a security rule, or an end-dated value) when they get the error message.

- Use a single chart of accounts for all your operations. This greatly reduces the number of cross-validation rules necessary.

3,998 thoughts on “Optimizing Cross-validation Rules in General Ledger”

There is little risk involved in the judicious use of isotonic bicarbonate for a patient who is volume depleted, so correcting a hyperchloremic acidosis makes sense during volume resuscitation as discussed in a prior post about pH guided resuscitation finasteride generic uk

darkmarkets darkmarket url

dark markets 2025 dark market list

bitcoin dark web bitcoin dark web

darknet drugs dark market

darknet market dark web drug marketplace

dark web market links darknet sites

dark web marketplaces darkmarket list

darknet markets onion address darknet market

dark web marketplaces darknet market lists

darknet markets url darknet drug links

darknet market lists dark market link

dark web market urls darknet markets

dark web market list dark market list

darknet drug store best darknet markets

darknet market list onion dark website

dark web market list dark market list

darkmarket dark market list

dark web market urls onion dark website

dark websites dark web market links

dark web link darknet marketplace

darkmarkets darknet markets url

darknet drugs onion dark website

dark market tor drug market

darknet markets 2025 dark web market urls

dark web drug marketplace dark web sites

best darknet markets darknet drug market

dark web market dark market

darknet site dark market url

darkmarkets darkmarkets

darkmarket list dark websites

dark web markets darknet site

dark markets darknet marketplace

darkmarket darknet market lists

darknet market list darknet markets url

dark web market darknet market lists

darknet market links darkmarket 2025

darkmarkets darkmarket 2025

darknet drugs dark market onion

darknet drug store dark web marketplaces

darknet market links dark websites

dark web market dark web sites

dark market onion darkmarkets

dark web market urls darknet drug market

dark web markets darknet markets

dark market onion best darknet markets

darkmarket 2025 darknet marketplace

dark market url darknet site

darknet market links dark web market list

tor drug market dark market

dark market onion darknet site

darkmarket 2025 tor drug market

dark market dark web market list

dark market onion darknet sites

dark market link dark market onion

darknet market darknet marketplace

dark websites darknet markets onion address

darknet drug market darknet marketplace

darknet links dark market list

darknet markets url darkmarket 2025

darknet market list darknet markets onion

darkmarkets dark market link

dark market darkmarket

dark web sites darkmarket 2025

dark markets darkmarket link

dark web marketplaces dark market list

darknet marketplace darknet links

tor drug market dark web market list

darkmarket 2025 darknet markets onion address

dark market link dark web market

dark web markets darknet markets

darknet drug links dark market 2025

darknet markets onion address darknet markets

dark web markets darknet markets url

best darknet markets best darknet markets

dark web markets darkmarket url

darknet drug links darknet markets 2025

dark markets darkmarket 2025

darkmarket darknet websites

darkmarket 2025 bitcoin dark web

dark market link darknet sites

darknet drug links dark web marketplaces

dark web market list darknet sites

dark market 2025 darknet markets url

darkmarkets darkmarket url

dark market 2025 darkmarket link

darknet marketplace darknet market links

darknet market dark market link

darknet markets url onion dark website

dark web drug marketplace dark market onion

darknet marketplace dark web market links

dark market url tor drug market

dark web link darknet markets

darknet drugs dark web drug marketplace

darkmarket 2025 darknet markets links

dark market onion darknet links

dark web marketplaces dark web market urls

dark web link dark market list

dark web markets dark market list

darknet markets onion address dark web sites

dark web market links darkmarket list

dark web link dark market url

darknet drug store darknet links

dark markets 2025 darknet markets onion address

darknet markets links dark web sites

darknet markets darknet links

dark market darknet markets onion address

darknet markets onion darknet markets onion

darknet market list dark market 2025

darknet drug market dark web drug marketplace

darkmarket link dark market

dark web link darkmarket link

darknet markets links dark markets 2025

dark web market dark market

onion dark website best darknet markets

darknet market list bitcoin dark web

darknet drug links darkmarket list

darknet links dark web markets

darknet links dark market url

darknet markets url darknet market

darknet markets onion darknet market list

dark market dark web markets

dark web marketplaces darknet drugs

darknet drug links darknet drugs

dark market onion dark web markets

best darknet markets darknet markets 2025

darknet drug market darknet markets onion address

darknet market list darknet markets onion address

dark web market links dark markets 2025

darkmarket 2025 darkmarket list

dark market onion dark markets

darknet sites bitcoin dark web

dark markets 2025 darknet markets onion address

best darknet markets darknet market list

darknet drug links darknet websites

darknet sites darknet market links

dark web market dark market url

dark market 2025 darknet site

darknet drug store dark market list

darknet websites darkmarket url

dark market url dark markets

olympe casino avis: olympe – olympe casino en ligne

dark web market list dark market link

darknet markets links darknet markets onion address

new comics new comics releases 2025

healing manga read shonen manga free

darknet market darkmarket 2025

darknet links dark web market

darkmarket list dark web drug marketplace

darknet markets url darkmarket list

darknet sites dark web sites

darknet drug store dark markets

dark market darknet markets onion

dark web market dark market url

darknet market list dark markets

dark web market list bitcoin dark web

darknet site darkmarket link

dark web marketplaces darkmarket 2025

dark market list darknet markets url

darknet markets onion address dark web drug marketplace

darknet links darkmarket link

best darknet markets best darknet markets

dark web drug marketplace dark web market urls

darknet websites dark market url

tor drug market darknet markets onion

darknet markets onion address darknet market

darknet market list dark web market urls

dark web market dark web market list

tor drug market dark markets 2025

dark market 2025 darknet marketplace

dark web market urls dark market 2025

darknet market links darknet drug links

darknet websites dark market

darkmarket list onion dark website

darknet markets onion address darknet market lists

dark market onion darknet markets url

darkmarket url darkmarket link

darknet markets onion address dark market

tor drug market dark web market links

bitcoin dark web dark market onion

darkmarket 2025 darknet markets

dark market url bitcoin dark web

darknet markets 2025 dark websites

dark web link darknet drugs

darknet drug market darknet sites

dark market 2025 darknet drug links

darkmarket url dark market url

darkmarkets dark websites

dark markets darknet markets url

dark market url darknet market

dark markets 2025 dark web marketplaces

dark web market darknet links

darknet market links darkmarket 2025

darknet websites tor drug market

darknet websites dark web link

dark market link darknet sites

tor drug market darknet markets onion address

darknet market lists darkmarket

darknet markets onion dark market url

dark web marketplaces darknet markets onion address

dark market url best darknet markets

dark web market urls best darknet markets

dark market list darknet market lists

dark web drug marketplace darknet markets 2025

darkmarket link dark web markets

darknet sites darkmarket url

darknet markets url darknet markets 2025

dark web market urls dark markets

tor drug market dark web market urls

darknet drug store darkmarket link

dark web market links dark web sites

darknet market links dark web market urls

darknet drug market darknet market lists

darkmarkets dark markets 2025

darknet drug store darknet links

darknet markets onion darknet drug store

darkmarkets dark web sites

darknet websites darknet market list

onion dark website darknet market

dark web markets darknet markets onion address

darknet drugs darknet markets onion

darknet market darknet drugs

tor drug market dark web sites

dark web link dark market link

dark market url dark market list

darknet drugs dark markets 2025

darkmarkets dark market onion

darknet market darkmarkets

darknet sites tor drug market

dark web market darknet market lists

darknet marketplace darknet links

dark web market dark web market urls

dark market 2025 dark web market

dark web market tor drug market

darknet drug links darknet drugs

dark market url dark markets

darknet websites darkmarket

darkmarket 2025 darknet links

darknet links darknet market list

bitcoin dark web darkmarket list

darkmarket list dark market 2025

dark market list darknet markets

darknet market list dark market onion

dark market link darknet markets

darknet links dark web market

darkmarket list darkmarket list

dark web markets darknet markets onion

darknet marketplace darkmarket

dark markets darknet market

dark market url dark market

darkmarket url dark web link

darkmarkets darkmarkets

dark market onion dark market url

darkmarket list dark market 2025

darknet markets onion address dark market url

darknet sites darknet drug store

dark web marketplaces dark market

dark web drug marketplace dark market link

dark web link darkmarket url

dark market onion darknet market lists

darkmarket darknet markets links

darkmarket url dark market list

darknet markets onion darkmarket link

bitcoin dark web darknet market list

dark web market links darknet marketplace

darknet websites darknet market

darkmarket list dark web sites

darkmarket darkmarket

darknet drug market dark web markets

darknet drug store dark web market links

darknet markets links darknet links

dark web market links darkmarkets

dark market 2025 darkmarket link

darknet market darknet markets onion address

dark market 2025 darkmarket

darknet sites best darknet markets

darknet market lists darknet markets onion address

dark market list best darknet markets

darkmarket darkmarkets

dark markets 2025 onion dark website

darknet websites darkmarkets

darkmarket link dark web markets

dark web market links dark markets

darknet links dark web market

darkmarket list darknet markets url

dark market onion darknet drug store

darknet markets 2025 dark market list

darknet sites darknet market

darknet market darknet markets

darkmarket link darknet markets onion address

darknet markets links darknet market

best darknet markets darkmarkets

dark web sites dark market link

darknet markets url darkmarket url

dark web marketplaces darknet markets onion

dark markets darknet market

darknet markets links darknet links

bitcoin dark web tor drug market

darknet marketplace darknet sites

dark web sites dark markets 2025

darknet drug market onion dark website

tor drug market dark market list

darknet markets onion darknet markets onion

dark web markets dark web link

dark web market darknet markets

darknet markets links bitcoin dark web

darkmarket dark web market

darknet drug market dark web drug marketplace

dark web marketplaces dark web drug marketplace

dark websites darknet site

dark web marketplaces onion dark website

darknet markets onion darknet marketplace

tor drug market dark web marketplaces

darknet marketplace dark web market

darknet markets links darknet websites

http://tadalmed.com/# Tadalafil achat en ligne

darknet market links darknet drugs

dark web market list darkmarket list

dark web market list dark market 2025

darknet markets links dark websites

darknet market dark web link

dark web marketplaces darknet markets onion address

Tadalafil achat en ligne: Achat Cialis en ligne fiable – Cialis sans ordonnance 24h tadalmed.shop

Achat mГ©dicament en ligne fiable [url=https://pharmafst.com/#]pharmacie en ligne[/url] Pharmacie Internationale en ligne pharmafst.shop

Tadalafil sans ordonnance en ligne: Cialis sans ordonnance 24h – Cialis sans ordonnance pas cher tadalmed.shop

dark market darkmarket

dark markets darkmarket

darkmarkets darkmarket 2025

darknet markets links dark markets

dark market list dark markets 2025

best darknet markets darknet markets url

darknet markets onion tor drug market

darknet drug links darknet market links

darkmarket url darkmarket list

darknet markets onion darknet drugs

dark markets darkmarket url

darknet marketplace darkmarket link

darknet markets 2025 bitcoin dark web

tor drug market darknet markets onion

darknet market dark market list

dark web market links darknet drug store

darknet websites darknet sites

onion dark website dark web marketplaces

darknet websites darknet market list

darkmarket 2025 darknet markets url

Pharmacie Internationale en ligne: pharmacie en ligne france livraison internationale – pharmacie en ligne fiable pharmafst.com

dark market onion darknet site

darkmarket 2025 bitcoin dark web

darknet market links darknet market

pharmacie en ligne france livraison internationale: Livraison rapide – pharmacie en ligne france livraison internationale pharmafst.com

darknet market lists dark web drug marketplace

darknet markets onion dark market

darknet markets url darknet markets

darknet markets links dark websites

darknet markets url dark market

https://pharmafst.shop/# vente de mГ©dicament en ligne

tor drug market dark market list

darkmarket url darknet links

dark web link darknet drug market

darkmarket list dark markets

darknet links darknet links

darknet market links darkmarket list

darknet markets onion address darkmarket link

darknet sites darknet site

onion dark website darknet market links

dark web market links best darknet markets

dark market 2025 dark web market links

darkmarket 2025 darknet drugs

Tadalafil achat en ligne: Cialis generique prix – cialis sans ordonnance tadalmed.shop

acheter mГ©dicament en ligne sans ordonnance [url=https://pharmafst.com/#]Livraison rapide[/url] Pharmacie en ligne livraison Europe pharmafst.shop

darknet markets 2025 darkmarket

darkmarkets darknet market list

dark websites dark websites

darknet links darknet drugs

dark markets 2025 darkmarket

darknet drug store darknet market list

bitcoin dark web dark market link

dark web marketplaces darknet markets onion

darknet site darkmarket list

darknet links dark markets

darkmarket link onion dark website

kamagra pas cher: kamagra gel – kamagra pas cher

darknet marketplace darkmarket list

dark market 2025 dark web marketplaces

onion dark website darknet markets url

darknet markets onion best darknet markets

onion dark website darknet market

darknet sites darknet market links

dark market link dark market onion

Kamagra Commander maintenant: kamagra 100mg prix – Kamagra Oral Jelly pas cher

tor drug market darknet drug links

darknet drug links dark web market

darkmarket dark web market urls

dark web market list darknet site

dark markets dark markets 2025

darkmarket list darknet market list

dark web market links darkmarket link

dark market url darknet websites

darkmarket 2025 darknet markets links

фильмы военные драмы ужасы 2025 смотреть онлайн HD

фильмы 2025 года уже вышедшие сериалы 2025 онлайн бесплатно HD

смотреть фильмы онлайн лучшие фильмы онлайн без смс

смотреть хороший русский фильм лучшие фильмы онлайн без смс

https://pharmafst.shop/# pharmacie en ligne avec ordonnance

darknet markets darknet markets onion

best darknet markets dark market list

dark web market links dark web drug marketplace

магазин аккаунтов купить аккаунт

darkmarket 2025 best darknet markets

darknet market darknet market list

dark markets onion dark website

darknet drugs darknet market

darkmarket darknet market lists

darknet drug links darkmarket list

dark web market list darknet market list

darkmarkets dark market 2025

dark market link darkmarket 2025

Pharmacie en ligne livraison Europe: Achat mГ©dicament en ligne fiable – trouver un mГ©dicament en pharmacie pharmafst.com

pharmacie en ligne france livraison internationale: Meilleure pharmacie en ligne – pharmacie en ligne pas cher pharmafst.com

darknet websites darknet drug links

darkmarket 2025 darknet links

darknet markets links darknet markets onion address

dark web market links darknet drugs

dark markets dark web drug marketplace

dark markets darknet drug store

pharmacie en ligne livraison europe [url=http://pharmafst.com/#]pharmacie en ligne pas cher[/url] pharmacies en ligne certifiГ©es pharmafst.shop

darknet markets url darknet markets url

darknet market darknet site

dark web market darknet drugs

dark websites dark web sites

darknet drug market darknet market lists

dark web market list darknet drug market

darknet drug links darknet sites

darkmarket link dark web sites

darkmarket link darknet markets onion address

darknet drug market dark web market links

dark market list darknet market

tor drug market dark web marketplaces

darknet sites dark websites

dark websites best darknet markets

dark market list dark markets 2025

dark websites onion dark website

darknet market links dark market

dark market url darkmarkets

kamagra gel: Kamagra Commander maintenant – achat kamagra

смотреть фильм драма смотреть фильмы онлайн бесплатно 2025

фильм все серии подряд фильмы 2025 без регистрации и рекламы

смотреть фильмы в качестве фильмы в 4К бесплатно онлайн

смотреть фильм полностью фантастика 2025 смотреть бесплатно

dark web sites dark web market list

darknet markets onion darknet site

https://pharmafst.com/# pharmacie en ligne fiable

darknet market tor drug market

kamagra oral jelly: kamagra pas cher – acheter kamagra site fiable

dark web market list darknet sites

dark web market urls darknet market links

dark websites darknet drug links

darknet websites tor drug market

darknet market list darknet drug links

darknet drug links darknet markets

darknet markets onion darknet market lists

darkmarket url dark web markets

darknet sites dark web market

tor drug market darknet websites

dark web link best darknet markets

darknet site dark websites

tor drug market darkmarket

darknet sites darkmarket 2025

darknet markets onion dark web sites

Kamagra Commander maintenant: Kamagra Commander maintenant – Achetez vos kamagra medicaments

darknet markets onion address dark web sites

dark websites dark web link

darknet markets onion address dark market url

darknet markets 2025 dark web link

darknet markets links darknet market list

dark markets darknet site

Tadalafil 20 mg prix sans ordonnance [url=https://tadalmed.shop/#]Tadalafil 20 mg prix en pharmacie[/url] cialis sans ordonnance tadalmed.com

darkmarket 2025 dark markets 2025

dark market onion dark web market

darkmarkets darknet websites

dark web marketplaces dark markets 2025

darkmarket list darknet market

darkmarket darkmarket url

dark market list best darknet markets

darknet sites darknet links

darknet drug store darknet drug links

dark web market darknet drugs

bitcoin dark web bitcoin dark web

kamagra oral jelly: Kamagra Oral Jelly pas cher – kamagra pas cher

Pharmacie en ligne livraison Europe: pharmacies en ligne certifiГ©es – acheter mГ©dicament en ligne sans ordonnance pharmafst.com

tor drug market dark web market urls

смотреть фильмы 2025 в качестве смотреть кино на телефоне в Full HD

военные фильмы фильмы онлайн 2025 без подписки

смотреть русские фильмы новинки кино 2025 онлайн бесплатно

darknet market links darkmarket link

tor drug market darknet markets links

качестве драма фильмы лучшие фильмы 2025 года в HD

https://kamagraprix.shop/# Achetez vos kamagra medicaments

darknet drug store darknet markets 2025

best darknet markets darknet drug market

darknet market links darknet drug links

dark websites darknet markets onion

darknet links dark market list

darkmarkets dark market list

darknet links dark web drug marketplace

dark markets darknet site

darknet marketplace darkmarket list

dark market [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]dark web market links [/url]

darknet market [url=https://github.com/abacusdarknetlinkwrqqd/abacusdarknetlink ]darknet market [/url]

dark websites [url=https://mydarknetmarketsurl.com ]darknet markets onion address [/url]

dark websites [url=https://github.com/abacusshop97c81/abacusshop ]darknet drug links [/url]

dark market 2025 [url=https://github.com/darkwebwebsites/darkwebwebsites ]darknet market list [/url]

cialis generique: Tadalafil achat en ligne – Tadalafil 20 mg prix en pharmacie tadalmed.shop

Pharmacie en ligne livraison Europe: Pharmacies en ligne certifiees – pharmacie en ligne pharmafst.com

dark markets 2025 [url=https://github.com/abacusdarknetlinkwrqqd/abacusdarknetlink ]dark market 2025 [/url]

tor drug market [url=https://mydarknetmarketsurl.com ]best darknet markets [/url]

dark web market links [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]dark web link [/url]

bitcoin dark web [url=https://github.com/abacusshop97c81/abacusshop ]dark web market links [/url]

Kamagra pharmacie en ligne [url=http://kamagraprix.com/#]kamagra gel[/url] achat kamagra

dark markets 2025 [url=https://github.com/darkwebwebsites/darkwebwebsites ]dark market list [/url]

darknet markets links [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]dark web drug marketplace [/url]

dark market onion [url=https://mydarknetmarketsurl.com ]darknet websites [/url]

dark web markets [url=https://github.com/abacusdarknetlinkwrqqd/abacusdarknetlink ]dark web market urls [/url]

darknet markets onion address [url=https://github.com/abacusshop97c81/abacusshop ]darknet drug store [/url]

Acheter Kamagra site fiable: kamagra gel – kamagra en ligne

darkmarkets [url=https://github.com/darkwebwebsites/darkwebwebsites ]dark market onion [/url]

http://tadalmed.com/# Pharmacie en ligne Cialis sans ordonnance

русские фильмы онлайн качество фильмы 2025 без регистрации и рекламы

Актуальные юридические новости https://t.me/Urist_98RUS полезные статьи, практичные лайфхаки и советы для бизнеса и жизни. Понимайте законы легко, следите за изменениями, узнавайте секреты защиты своих прав и возможностей.

Топ магазинов техники reyting-magazinov-tehniki.ru по качеству, ценам и сервису! Сравниваем для вас популярные площадки, ищем выгодные предложения, делимся реальными отзывами. Экономьте время и деньги — изучайте наш рейтинг и выбирайте лучшее!

dark web market list [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]darknet drug store [/url]

darkmarket 2025 [url=https://mydarknetmarketsurl.com ]darknet drug store [/url]

dark market url [url=https://github.com/abacusshop97c81/abacusshop ]darknet drug links [/url]

darknet markets url [url=https://github.com/darkwebwebsites/darkwebwebsites ]dark websites [/url]

darkmarkets [url=https://github.com/nexusdarknetmarketp0isi/nexusdarknetmarket ]darknet markets 2025 [/url]

darkmarket 2025 [url=https://github.com/nexusonion1b4tk/nexusonion ]dark market 2025 [/url]

darkmarket url [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]dark markets [/url]

dark web market [url=https://mydarknetmarketsurl.com ]darknet drugs [/url]

darknet market links [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]darknet markets links [/url]

darknet market links [url=https://github.com/abacusdarknetlinkwrqqd/abacusdarknetlink ]dark market [/url]

best darknet markets [url=https://github.com/nexusdarknetmarketrtul8/nexusdarknetmarket ]darknet links [/url]

dark market list [url=https://github.com/abacusshop97c81/abacusshop ]best darknet markets [/url]

dark markets 2025 [url=https://github.com/darkwebwebsites/darkwebwebsites ]dark market onion [/url]

pharmacies en ligne certifiГ©es: pharmacie en ligne sans ordonnance – pharmacie en ligne france livraison internationale pharmafst.com

dark market 2025 [url=https://github.com/nexusonion1b4tk/nexusonion ]darknet markets [/url]

площадка для продажи аккаунтов безопасная сделка аккаунтов

dark web sites [url=https://github.com/nexusshopajlnb/nexusshop ]darkmarket link [/url]

Kamagra Oral Jelly pas cher: Kamagra Oral Jelly pas cher – kamagra livraison 24h

darkmarket list [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]darknet drugs [/url]

darknet market lists [url=https://github.com/abacusdarknetlinkwrqqd/abacusdarknetlink ]dark web sites [/url]

dark web market list [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]dark websites [/url]

darknet marketplace [url=https://github.com/abacusshop97c81/abacusshop ]darknet drug links [/url]

dark market 2025 [url=https://github.com/darkwebwebsites/darkwebwebsites ]dark market [/url]

darkmarket 2025 [url=https://github.com/nexusdarknetmarketrtul8/nexusdarknetmarket ]dark web market [/url]

dark web sites [url=https://github.com/nexusonion1b4tk/nexusonion ]darknet drugs [/url]

darknet links [url=https://github.com/nexusshopajlnb/nexusshop ]tor drug market [/url]

Kamagra Oral Jelly pas cher [url=https://kamagraprix.shop/#]achat kamagra[/url] kamagra pas cher

dark markets 2025 [url=https://github.com/nexusdarknetmarketp0isi/nexusdarknetmarket ]darknet markets links [/url]

darknet websites [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]darkmarket url [/url]

darknet markets 2025 [url=https://mydarknetmarketsurl.com ]dark web market urls [/url]

kamagra 100mg prix: kamagra oral jelly – Acheter Kamagra site fiable

darknet markets onion [url=https://github.com/abacusdarknetlinkwrqqd/abacusdarknetlink ]darkmarkets [/url]

best darknet markets [url=https://github.com/abacusshop97c81/abacusshop ]darkmarket link [/url]

dark markets [url=https://github.com/darkwebwebsites/darkwebwebsites ]darknet links [/url]

darknet marketplace [url=https://github.com/nexusonion1b4tk/nexusonion ]darknet market lists [/url]

darkmarket [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]onion dark website [/url]

darknet markets 2025 [url=https://github.com/nexusdarknetmarketrtul8/nexusdarknetmarket ]dark market 2025 [/url]

The best porn chat ai with AI is a place for private communication without restrictions. Choose scenarios, create stories and enjoy the attention of a smart interlocutor. Discover new emotions, explore fantasies and relax your soul in a safe atmosphere.

https://tadalmed.com/# Tadalafil 20 mg prix en pharmacie

Кактус Казино кактус казино официальный сайт мир азарта и развлечений! Тысячи слотов, карточные игры, рулетка и захватывающие турниры. Быстрые выплаты, щедрые бонусы и поддержка 24/7. Играйте ярко, выигрывайте легко — всё это в Кактус Казино!

darknet markets [url=https://github.com/nexusdarknetmarketp0isi/nexusdarknetmarket ]darknet market links [/url]

Любите кино и сериалы? https://tevas-film-tv.ru у нас собраны лучшие подборки — от блокбастеров до авторских лент. Смотрите онлайн без ограничений, выбирайте жанры по настроению и открывайте новые истории каждый день. Кино, которое всегда с вами!

tor drug market [url=https://mydarknetmarketsurl.com ]dark web market list [/url]

dark web market [url=https://github.com/nexusonion1b4tk/nexusonion ]darknet market links [/url]

dark market 2025 [url=https://github.com/abacusdarknetlinkwrqqd/abacusdarknetlink ]dark market url [/url]

darknet markets onion address [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]dark web market links [/url]

darkmarket list [url=https://github.com/nexusdarknetmarketrtul8/nexusdarknetmarket ]darknet site [/url]

Лучшие жизненные афоризмы, успехе и вдохновении. Короткие мысли великих людей, мудрые фразы и слова, которые заставляют задуматься. Найдите мотивацию, настрой и силу в правильных словах каждый день!

pharmacie en ligne france livraison internationale: Medicaments en ligne livres en 24h – pharmacies en ligne certifiГ©es pharmafst.com

bitcoin dark web [url=https://github.com/nexusdarknetmarketp0isi/nexusdarknetmarket ]darknet markets links [/url]

dark markets 2025 [url=https://github.com/nexusonion1b4tk/nexusonion ]darknet markets url [/url]

dark web market urls [url=https://mydarknetmarketsurl.com ]darknet drug store [/url]

darkmarket [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]darkmarkets [/url]

dark market 2025 [url=https://github.com/abacusshop97c81/abacusshop ]darknet markets url [/url]

dark web link [url=https://github.com/darkwebwebsites/darkwebwebsites ]darkmarkets [/url]

dark market list [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]darkmarket link [/url]

darknet drugs [url=https://github.com/nexusdarknetmarketrtul8/nexusdarknetmarket ]darknet markets 2025 [/url]

darknet market list [url=https://github.com/nexusonion1b4tk/nexusonion ]darknet drug links [/url]

darknet markets onion address [url=https://github.com/nexusdarknetmarketp0isi/nexusdarknetmarket ]bitcoin dark web [/url]

kamagra livraison 24h: kamagra 100mg prix – kamagra gel

darknet market [url=https://mydarknetmarketsurl.com ]darkmarkets [/url]

dark web drug marketplace [url=https://github.com/abacusshop97c81/abacusshop ]darknet markets url [/url]

darknet drug store [url=https://github.com/abacusdarknetlinkwrqqd/abacusdarknetlink ]dark markets [/url]

darkmarket 2025 [url=https://github.com/darkwebwebsites/darkwebwebsites ]darknet sites [/url]

купить аккаунт заработок на аккаунтах

dark web market [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]darknet markets onion [/url]

darknet markets onion [url=https://github.com/nexusdarknetmarketrtul8/nexusdarknetmarket ]darknet links [/url]

dark markets 2025 [url=https://github.com/nexusonion1b4tk/nexusonion ]darknet drug store [/url]

dark web market urls [url=https://github.com/nexusdarknetmarketp0isi/nexusdarknetmarket ]darknet site [/url]

darknet sites [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]dark web market links [/url]

создание металлических значков значки на заказ москва

значок металлический купить металлические значки

Хотите жить у моря? http://www.kvartira-v-chernogorii-kupit.com — квартиры, дома, виллы на лучших курортах. Удобные условия покупки, помощь на всех этапах, инвестиционные проекты. Откройте новые возможности жизни и отдыха на берегу Адриатики!

Acheter Viagra Cialis sans ordonnance: Cialis sans ordonnance 24h – cialis sans ordonnance tadalmed.shop

dark web market links [url=https://github.com/abacusshop97c81/abacusshop ]dark markets [/url]

dark market 2025 [url=https://github.com/darkwebwebsites/darkwebwebsites ]dark web market [/url]

Мечтаете о доме у моря? http://www.nedvizhimost-v-chernogorii-kupit.com — идеальный выбор! Простое оформление, доступные цены, потрясающие виды и европейский комфорт. Инвестируйте в своё будущее уже сегодня вместе с нами.

pharmacie en ligne pas cher [url=http://pharmafst.com/#]pharmacie en ligne[/url] п»їpharmacie en ligne france pharmafst.shop

http://kamagraprix.com/# kamagra gel

dark web marketplaces [url=https://github.com/nexusonion1b4tk/nexusonion ]darknet drug links [/url]

darknet markets links [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]dark markets 2025 [/url]

dark markets [url=https://github.com/nexusdarknetmarketrtul8/nexusdarknetmarket ]dark web market links [/url]

darknet markets onion [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]darknet marketplace [/url]

Achetez vos kamagra medicaments: kamagra gel – acheter kamagra site fiable

dark market 2025 [url=https://github.com/nexusdarknetmarketp0isi/nexusdarknetmarket ]darknet market lists [/url]

darknet market links [url=https://github.com/abacusdarknetlinkwrqqd/abacusdarknetlink ]dark web link [/url]

darknet markets 2025 [url=https://github.com/darkwebwebsites/darkwebwebsites ]dark markets [/url]

заработок на аккаунтах магазин аккаунтов социальных сетей

dark market onion [url=https://github.com/nexusonion1b4tk/nexusonion ]dark market list [/url]

darknet markets onion address [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]darkmarket link [/url]

dark web market links [url=https://github.com/nexusdarknetmarketrtul8/nexusdarknetmarket ]dark web market [/url]

dark web sites [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]dark market link [/url]

dark market 2025 [url=https://mydarknetmarketsurl.com ]dark web link [/url]

darknet drug links [url=https://github.com/abacusdarknetlinkwrqqd/abacusdarknetlink ]onion dark website [/url]

darknet links [url=https://github.com/nexusshopajlnb/nexusshop ]dark market link [/url]

dark web drug marketplace [url=https://github.com/nexusdarknetmarketp0isi/nexusdarknetmarket ]dark web market urls [/url]

darknet site [url=https://github.com/darkwebwebsites/darkwebwebsites ]dark web market [/url]

darknet markets onion address [url=https://github.com/nexusonion1b4tk/nexusonion ]dark market [/url]

darknet links [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]darknet site [/url]

купить аккаунт с прокачкой перепродажа аккаунтов

dark market 2025 [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]dark web link [/url]

darknet markets 2025 [url=https://mydarknetmarketsurl.com ]dark market list [/url]

dark web markets [url=https://github.com/nexusdarknetmarketrtul8/nexusdarknetmarket ]darknet markets onion address [/url]

darknet drug links [url=https://github.com/abacusdarknetlinkwrqqd/abacusdarknetlink ]darkmarket 2025 [/url]

darkmarket url [url=https://github.com/abacusshop97c81/abacusshop ]bitcoin dark web [/url]

darknet markets links [url=https://github.com/darkwebwebsites/darkwebwebsites ]darknet drugs [/url]

dark web market list [url=https://github.com/nexusonion1b4tk/nexusonion ]darkmarket link [/url]

dark market url [url=https://github.com/nexusshopajlnb/nexusshop ]dark market link [/url]

Kamagra pharmacie en ligne: kamagra gel – kamagra 100mg prix

onion dark website [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]darknet sites [/url]

dark markets 2025 [url=https://mydarknetmarketsurl.com ]darknet drugs [/url]

dark markets [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]darknet drug links [/url]

darkmarket url [url=https://github.com/nexusdarknetmarketrtul8/nexusdarknetmarket ]dark web market links [/url]

darknet markets url [url=https://github.com/abacusshop97c81/abacusshop ]dark markets 2025 [/url]

dark web market list [url=https://github.com/nexusonion1b4tk/nexusonion ]dark market 2025 [/url]

darknet markets [url=https://github.com/darkwebwebsites/darkwebwebsites ]darkmarket 2025 [/url]

pharmacie en ligne france pas cher: pharmacie en ligne – pharmacie en ligne avec ordonnance pharmafst.com

darkmarkets [url=https://github.com/nexusdarknetmarketp0isi/nexusdarknetmarket ]darkmarket url [/url]

http://tadalmed.com/# cialis generique

Kamagra pharmacie en ligne: Acheter Kamagra site fiable – achat kamagra

dark web market [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]darknet links [/url]

dark market list [url=https://mydarknetmarketsurl.com ]darkmarket list [/url]

dark market list [url=https://github.com/nexusonion1b4tk/nexusonion ]dark web markets [/url]

Acheter Kamagra site fiable [url=http://kamagraprix.com/#]Achetez vos kamagra medicaments[/url] achat kamagra

darkmarket list [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]dark market 2025 [/url]

darknet market lists [url=https://github.com/abacusdarknetlinkwrqqd/abacusdarknetlink ]dark web link [/url]

darkmarket [url=https://github.com/abacusshop97c81/abacusshop ]darknet marketplace [/url]

best darknet markets [url=https://github.com/nexusdarknetmarketrtul8/nexusdarknetmarket ]darknet market list [/url]

dark market 2025 [url=https://github.com/darkwebwebsites/darkwebwebsites ]dark web market list [/url]

darknet drug links [url=https://github.com/nexusshopajlnb/nexusshop ]dark market list [/url]

darknet marketplace [url=https://github.com/nexusdarknetmarketp0isi/nexusdarknetmarket ]dark web marketplaces [/url]

dark web drug marketplace [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]darknet drug store [/url]

dark web market [url=https://mydarknetmarketsurl.com ]darkmarket list [/url]

darknet markets links [url=https://github.com/nexusonion1b4tk/nexusonion ]darknet links [/url]

darknet market links [url=https://github.com/abacusshop97c81/abacusshop ]dark websites [/url]

darknet markets 2025 [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]dark web markets [/url]

dark market link [url=https://github.com/darkwebwebsites/darkwebwebsites ]darknet markets onion [/url]

dark web sites [url=https://github.com/nexusdarknetmarketrtul8/nexusdarknetmarket ]dark web link [/url]

best darknet markets [url=https://github.com/nexusdarknetmarketp0isi/nexusdarknetmarket ]darknet drug store [/url]

darknet marketplace [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]darknet market list [/url]

best darknet markets [url=https://github.com/nexusonion1b4tk/nexusonion ]darknet markets [/url]

dark market [url=https://mydarknetmarketsurl.com ]darkmarket url [/url]

Pharmacie sans ordonnance: pharmacie en ligne pas cher – pharmacies en ligne certifiГ©es pharmafst.com

http://pharmafst.com/# trouver un mГ©dicament en pharmacie

darkmarket url [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]dark web drug marketplace [/url]

darknet markets onion address [url=https://github.com/abacusshop97c81/abacusshop ]dark market list [/url]

darknet drugs [url=https://github.com/darkwebwebsites/darkwebwebsites ]darknet markets 2025 [/url]

best darknet markets [url=https://mydarknetmarketsurl.com ]darkmarket url [/url]

dark market onion [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]dark web market links [/url]

darknet drug links [url=https://github.com/abacusshop97c81/abacusshop ]darknet links [/url]

dark market [url=https://github.com/darkwebwebsites/darkwebwebsites ]darknet drug links [/url]

darknet markets links [url=https://github.com/abacusshop97c81/abacusshop ]darknet sites [/url]

darknet markets onion address [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]dark markets [/url]

dark web sites [url=https://github.com/darkwebwebsites/darkwebwebsites ]darkmarket list [/url]

Tadalafil sans ordonnance en ligne: cialis generique – Acheter Cialis tadalmed.shop

https://kamagraprix.com/# Kamagra Commander maintenant

darkmarket 2025 [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]dark markets [/url]

darknet marketplace [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]darknet marketplace [/url]

darknet markets 2025 [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]onion dark website [/url]

pharmacie en ligne france fiable: Medicaments en ligne livres en 24h – acheter mГ©dicament en ligne sans ordonnance pharmafst.com

darkmarket list [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]dark web market list [/url]

dark markets [url=https://github.com/abacusdarknetlinkwrqqd/abacusdarknetlink ]darknet market list [/url]

darknet markets onion address [url=https://github.com/nexusshopajlnb/nexusshop ]darknet markets 2025 [/url]

darknet market lists [url=https://github.com/nexusonion1b4tk/nexusonion ]dark web marketplaces [/url]

dark websites [url=https://github.com/nexusdarknetmarketrtul8/nexusdarknetmarket ]best darknet markets [/url]

http://tadalmed.com/# Cialis sans ordonnance 24h

darkmarket 2025 [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]dark web market links [/url]

darknet drug links [url=https://github.com/nexusdarknetmarketp0isi/nexusdarknetmarket ]darknet markets [/url]

darkmarket [url=https://mydarknetmarketsurl.com ]darknet market list [/url]

маркетплейс аккаунтов соцсетей аккаунты с балансом

dark websites [url=https://github.com/darkwebwebsites/darkwebwebsites ]darknet drugs [/url]

darkmarket 2025 [url=https://github.com/abacusshop97c81/abacusshop ]tor drug market [/url]

металлические значки под заказ железные значки на заказ

darknet drug market [url=https://github.com/abacusdarknetlinkwrqqd/abacusdarknetlink ]darknet drugs [/url]

bitcoin dark web [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]darknet drug market [/url]

darkmarkets [url=https://github.com/nexusshopajlnb/nexusshop ]dark market url [/url]

darknet market lists [url=https://github.com/nexusonion1b4tk/nexusonion ]darknet markets [/url]

darknet site [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]darknet markets onion address [/url]

darknet websites [url=https://github.com/nexusdarknetmarketrtul8/nexusdarknetmarket ]darknet market list [/url]

darknet drugs [url=https://mydarknetmarketsurl.com ]darknet site [/url]

dark market onion [url=https://github.com/nexusdarknetmarketp0isi/nexusdarknetmarket ]dark web market links [/url]

darkmarket 2025 [url=https://github.com/abacusshop97c81/abacusshop ]dark markets [/url]

dark web sites [url=https://github.com/abacusdarknetlinkwrqqd/abacusdarknetlink ]darknet markets 2025 [/url]

dark web market list [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]darknet drug store [/url]

darknet markets 2025 [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]darknet markets 2025 [/url]

Tadalafil 20 mg prix en pharmacie: Acheter Viagra Cialis sans ordonnance – Tadalafil achat en ligne tadalmed.shop

darknet markets 2025 [url=https://github.com/nexusshopajlnb/nexusshop ]dark market 2025 [/url]

darknet sites [url=https://mydarknetmarketsurl.com ]darknet drug store [/url]

darknet websites [url=https://github.com/nexusonion1b4tk/nexusonion ]darknet market [/url]

dark market [url=https://github.com/nexusdarknetmarketrtul8/nexusdarknetmarket ]bitcoin dark web [/url]

darknet market links [url=https://github.com/nexusdarknetmarketp0isi/nexusdarknetmarket ]darknet market lists [/url]

dark web sites [url=https://github.com/darkwebwebsites/darkwebwebsites ]darknet marketplace [/url]

darkmarket 2025 [url=https://github.com/abacusdarknetlinkwrqqd/abacusdarknetlink ]bitcoin dark web [/url]

безопасная сделка аккаунтов профиль с подписчиками

darknet links [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]darknet markets links [/url]

darknet markets url [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]dark web link [/url]

dark web sites [url=https://mydarknetmarketsurl.com ]darkmarket 2025 [/url]

dark markets 2025 [url=https://github.com/nexusshopajlnb/nexusshop ]darkmarkets [/url]

darkmarket list [url=https://github.com/abacusshop97c81/abacusshop ]darkmarket url [/url]

dark market url [url=https://github.com/nexusonion1b4tk/nexusonion ]dark market link [/url]

darknet drug store [url=https://github.com/nexusdarknetmarketrtul8/nexusdarknetmarket ]dark market url [/url]

darknet markets [url=https://github.com/nexusdarknetmarketp0isi/nexusdarknetmarket ]dark web link [/url]

darknet markets url [url=https://github.com/abacusdarknetlinkwrqqd/abacusdarknetlink ]darkmarket [/url]

dark web market links [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]dark web marketplaces [/url]

dark market link [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]dark market onion [/url]

dark web marketplaces [url=https://mydarknetmarketsurl.com ]darknet markets onion address [/url]

darknet markets 2025 [url=https://github.com/abacusshop97c81/abacusshop ]darknet markets onion address [/url]

best darknet markets [url=https://github.com/darkwebwebsites/darkwebwebsites ]tor drug market [/url]

darkmarket [url=https://github.com/nexusshopajlnb/nexusshop ]darkmarket url [/url]

darknet markets 2025 [url=https://github.com/nexusonion1b4tk/nexusonion ]dark web sites [/url]

dark market [url=https://github.com/abacusdarknetlinkwrqqd/abacusdarknetlink ]dark web market urls [/url]

https://kamagraprix.shop/# kamagra livraison 24h

dark web market urls [url=https://github.com/nexusdarknetmarketrtul8/nexusdarknetmarket ]dark web markets [/url]

dark market list [url=https://github.com/nexusdarknetmarketp0isi/nexusdarknetmarket ]dark web markets [/url]

Acheter Viagra Cialis sans ordonnance: Cialis sans ordonnance 24h – cialis prix tadalmed.shop

darkmarket list [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]darkmarket 2025 [/url]

darknet market [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]darknet marketplace [/url]

dark web market [url=https://mydarknetmarketsurl.com ]darknet markets url [/url]

darknet site [url=https://github.com/darkwebwebsites/darkwebwebsites ]dark market onion [/url]

dark websites [url=https://github.com/nexusshopajlnb/nexusshop ]darknet markets url [/url]

darknet market lists [url=https://github.com/abacusdarknetlinkwrqqd/abacusdarknetlink ]tor drug market [/url]

dark web market urls [url=https://github.com/nexusonion1b4tk/nexusonion ]darkmarket [/url]

darkmarkets [url=https://github.com/nexusdarknetmarketrtul8/nexusdarknetmarket ]tor drug market [/url]

darknet market [url=https://github.com/nexusdarknetmarketp0isi/nexusdarknetmarket ]darknet markets onion address [/url]

dark web market urls [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]best darknet markets [/url]

платформа для покупки аккаунтов аккаунты с балансом

bitcoin dark web [url=https://mydarknetmarketsurl.com ]dark web market links [/url]

dark market onion [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]dark market url [/url]

darknet markets url [url=https://github.com/abacusshop97c81/abacusshop ]darkmarket list [/url]

darknet drug market [url=https://github.com/abacusdarknetlinkwrqqd/abacusdarknetlink ]darknet drug links [/url]

продажа аккаунтов соцсетей гарантия при продаже аккаунтов

магазин аккаунтов магазин аккаунтов

dark market list [url=https://github.com/nexusshopajlnb/nexusshop ]dark web link [/url]

dark market url [url=https://github.com/nexusonion1b4tk/nexusonion ]dark web marketplaces [/url]

darknet drug market [url=https://github.com/nexusdarknetmarketrtul8/nexusdarknetmarket ]darknet markets onion address [/url]

dark web markets [url=https://github.com/nexusdarknetmarketp0isi/nexusdarknetmarket ]darknet websites [/url]

darknet sites [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]dark market [/url]

dark web sites [url=https://mydarknetmarketsurl.com ]dark market url [/url]

darknet site [url=https://github.com/darkwebwebsites/darkwebwebsites ]dark market url [/url]

dark web market list [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]darknet drug market [/url]

darknet markets 2025 [url=https://github.com/abacusshop97c81/abacusshop ]dark web marketplaces [/url]

Kamagra pharmacie en ligne: kamagra oral jelly – Achetez vos kamagra medicaments

best darknet markets [url=https://github.com/abacusdarknetlinkwrqqd/abacusdarknetlink ]tor drug market [/url]

best darknet markets [url=https://github.com/nexusshopajlnb/nexusshop ]dark market link [/url]

onion dark website [url=https://github.com/nexusonion1b4tk/nexusonion ]dark web link [/url]

darknet site [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]darknet drug store [/url]

darkmarket list [url=https://github.com/nexusdarknetmarketp0isi/nexusdarknetmarket ]dark markets 2025 [/url]

dark market url [url=https://mydarknetmarketsurl.com ]darknet marketplace [/url]

darknet marketplace [url=https://github.com/darkwebwebsites/darkwebwebsites ]dark web sites [/url]

dark web market links [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]darknet websites [/url]

dark web markets [url=https://github.com/abacusdarknetlinkwrqqd/abacusdarknetlink ]darknet markets onion [/url]

kamagra 100mg prix: kamagra pas cher – kamagra 100mg prix

dark web marketplaces [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]darknet market lists [/url]

darknet markets links [url=https://github.com/nexusonion1b4tk/nexusonion ]darknet market list [/url]

darknet markets onion address [url=https://github.com/nexusdarknetmarketrtul8/nexusdarknetmarket ]darknet markets [/url]

dark market [url=https://github.com/nexusdarknetmarketp0isi/nexusdarknetmarket ]dark web drug marketplace [/url]

darknet websites [url=https://mydarknetmarketsurl.com ]darknet sites [/url]

darknet drug links [url=https://github.com/darkwebwebsites/darkwebwebsites ]dark web market [/url]

dark market url [url=https://github.com/abacusshop97c81/abacusshop ]darknet markets [/url]

dark market link [url=https://github.com/abacusdarknetlinkwrqqd/abacusdarknetlink ]dark market list [/url]

darknet markets 2025 [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]darknet site [/url]

pharmacies en ligne certifiГ©es: Pharmacies en ligne certifiees – Pharmacie en ligne livraison Europe pharmafst.com

dark market list [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]darkmarket [/url]

onion dark website [url=https://github.com/nexusshopajlnb/nexusshop ]darknet links [/url]

платформа для покупки аккаунтов продать аккаунт

биржа аккаунтов биржа аккаунтов

https://tadalmed.com/# Cialis sans ordonnance 24h

pharmacie en ligne france pas cher: pharmacie en ligne – trouver un mГ©dicament en pharmacie pharmafst.com

darknet markets links [url=https://mydarknetmarketsurl.com ]dark web drug marketplace [/url]

dark websites [url=https://github.com/nexusonion1b4tk/nexusonion ]dark markets [/url]

dark web market links [url=https://github.com/nexusdarknetmarketrtul8/nexusdarknetmarket ]darknet markets onion address [/url]

darknet markets links [url=https://github.com/nexusdarknetmarketp0isi/nexusdarknetmarket ]darknet markets onion [/url]

darknet marketplace [url=https://github.com/darkwebwebsites/darkwebwebsites ]dark markets [/url]

dark market 2025 [url=https://github.com/abacusshop97c81/abacusshop ]darknet markets links [/url]

darkmarket url [url=https://github.com/abacusdarknetlinkwrqqd/abacusdarknetlink ]darknet market list [/url]

dark market link [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]darkmarket link [/url]

Kamagra pharmacie en ligne [url=https://kamagraprix.com/#]Acheter Kamagra site fiable[/url] Achetez vos kamagra medicaments

darknet markets 2025 [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]dark market url [/url]

dark market link [url=https://github.com/nexusshopajlnb/nexusshop ]darknet markets links [/url]

tor drug market [url=https://mydarknetmarketsurl.com ]darknet markets 2025 [/url]

darkmarkets [url=https://github.com/darkwebwebsites/darkwebwebsites ]darkmarket 2025 [/url]

darkmarkets [url=https://github.com/nexusonion1b4tk/nexusonion ]darknet drug market [/url]

tor drug market [url=https://github.com/nexusdarknetmarketp0isi/nexusdarknetmarket ]dark market list [/url]

darknet drugs [url=https://github.com/abacusdarknetlinkwrqqd/abacusdarknetlink ]dark market url [/url]

darknet market [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]darknet drugs [/url]

darknet drug market [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]dark market 2025 [/url]

супер маркетплейс кракен ссылка онион с современным интерфейсом и удобным функционалом онион, специализируется на продаже запрещенных веществ по всему миру. У нас ты найдешь всё, от ароматных шишек до белоснежного порошка. Кракен. Купить.

dark market [url=https://github.com/nexusshopajlnb/nexusshop ]darknet market links [/url]

darknet websites [url=https://mydarknetmarketsurl.com ]dark web drug marketplace [/url]

darkmarket list [url=https://github.com/abacusshop97c81/abacusshop ]onion dark website [/url]

dark web market urls [url=https://github.com/darkwebwebsites/darkwebwebsites ]bitcoin dark web [/url]

dark web market [url=https://github.com/abacusdarknetlinkwrqqd/abacusdarknetlink ]dark markets 2025 [/url]

dark web link [url=https://github.com/nexusdarknetmarketrtul8/nexusdarknetmarket ]darkmarket list [/url]

darknet site [url=https://github.com/nexusonion1b4tk/nexusonion ]darknet site [/url]

darknet market list [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]darknet marketplace [/url]

darkmarket link [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]darknet drug market [/url]

Acheter Viagra Cialis sans ordonnance: Cialis generique prix – Acheter Cialis 20 mg pas cher tadalmed.shop

Acheter Viagra Cialis sans ordonnance: cialis generique – Achat Cialis en ligne fiable tadalmed.shop

darknet sites [url=https://github.com/nexusshopajlnb/nexusshop ]darknet markets onion [/url]

dark web marketplaces [url=https://mydarknetmarketsurl.com ]darkmarket link [/url]

darknet marketplace [url=https://github.com/darkwebwebsites/darkwebwebsites ]darknet markets links [/url]

darknet markets links [url=https://github.com/abacusshop97c81/abacusshop ]darknet markets 2025 [/url]

darkmarket [url=https://github.com/abacusdarknetlinkwrqqd/abacusdarknetlink ]dark market link [/url]

dark market [url=https://github.com/nexusonion1b4tk/nexusonion ]darkmarkets [/url]

darkmarket [url=https://github.com/nexusdarknetmarketrtul8/nexusdarknetmarket ]dark market [/url]

darknet market [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]darknet websites [/url]

Acheter Cialis 20 mg pas cher: Cialis sans ordonnance 24h – Cialis sans ordonnance 24h tadalmed.shop

darknet markets url [url=https://mydarknetmarketsurl.com ]darkmarket [/url]

https://tadalmed.shop/# Acheter Cialis

darknet drug links [url=https://github.com/nexusshopajlnb/nexusshop ]darknet market [/url]

dark market list [url=https://github.com/abacusshop97c81/abacusshop ]darknet links [/url]

dark markets 2025 [url=https://github.com/abacusdarknetlinkwrqqd/abacusdarknetlink ]dark market url [/url]

darknet markets onion [url=https://github.com/nexusonion1b4tk/nexusonion ]darknet links [/url]

dark web market [url=https://github.com/nexusdarknetmarketp0isi/nexusdarknetmarket ]darknet marketplace [/url]

darknet market list [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]darkmarket 2025 [/url]

dark market list [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]dark web market urls [/url]

darknet links [url=https://mydarknetmarketsurl.com ]dark web market urls [/url]

darkmarkets [url=https://github.com/nexusshopajlnb/nexusshop ]dark market 2025 [/url]

dark markets [url=https://github.com/abacusshop97c81/abacusshop ]dark web market list [/url]

darknet websites [url=https://github.com/darkwebwebsites/darkwebwebsites ]dark market onion [/url]

tor drug market [url=https://github.com/abacusdarknetlinkwrqqd/abacusdarknetlink ]dark web sites [/url]

bitcoin dark web [url=https://github.com/abacusmarketurl7h9xj/abacusmarketurl ]dark market [/url]

darknet market lists [url=https://github.com/nexusdarknetmarketrtul8/nexusdarknetmarket ]darknet markets onion address [/url]

dark web marketplaces [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]dark market [/url]

medicine courier from India to USA [url=http://medicinefromindia.com/#]medicine courier from India to USA[/url] pharmacy website india

dark market link [url=https://github.com/nexusshopajlnb/nexusshop ]dark web drug marketplace [/url]

mexican online pharmacy: mexico drug stores pharmacies – mexico drug stores pharmacies

darknet markets onion address [url=https://github.com/nexusonion1b4tk/nexusonion ]darknet markets [/url]

indian pharmacy: Medicine From India – cheapest online pharmacy india

dark market 2025 [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]darkmarkets [/url]

профиль с подписчиками магазин аккаунтов

аккаунт для рекламы купить аккаунт с прокачкой

darknet market lists [url=https://github.com/nexusshopajlnb/nexusshop ]darkmarket url [/url]

dark web markets [url=https://github.com/nexusdarknetmarketp0isi/nexusdarknetmarket ]darknet market list [/url]

darknet drug market [url=https://github.com/nexusdarknetmarketrtul8/nexusdarknetmarket ]darknet websites [/url]

Rx Express Mexico: Rx Express Mexico – RxExpressMexico

darknet drugs [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]darknet market list [/url]

dark market 2025 [url=https://github.com/nexusshopajlnb/nexusshop ]dark web drug marketplace [/url]

платформа для покупки аккаунтов маркетплейс аккаунтов

darkmarket [url=https://github.com/nexusdarknetmarketrtul8/nexusdarknetmarket ]darkmarket link [/url]

darknet markets [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]dark market link [/url]

darknet markets onion [url=https://github.com/nexusshopajlnb/nexusshop ]darknet links [/url]

dark market [url=https://github.com/nexusonion1b4tk/nexusonion ]darknet marketplace [/url]

dark markets [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]darknet websites [/url]

продажа аккаунтов соцсетей безопасная сделка аккаунтов

площадка для продажи аккаунтов продажа аккаунтов соцсетей

dark web drug marketplace [url=https://github.com/nexusshopajlnb/nexusshop ]darknet market list [/url]

mexican online pharmacy: Rx Express Mexico – mexican border pharmacies shipping to usa

https://rxexpressmexico.com/# mexico pharmacies prescription drugs

Надежный обмен валюты https://valutapiter.ru в Санкт-Петербурге! Актуальные курсы, наличные и безналичные операции, комфортные условия для частных лиц и бизнеса. Гарантия конфиденциальности и высокий уровень обслуживания.

Займы под материнский капитал https://юсфц.рф решение для покупки жилья или строительства дома. Быстрое оформление, прозрачные условия, минимальный пакет документов. Используйте государственную поддержку для улучшения жилищных условий уже сегодня!

Medicine From India [url=https://medicinefromindia.com/#]indian pharmacy online[/url] MedicineFromIndia

Кредитный потребительский кооператив https://юк-кпк.рф доступные займы и выгодные накопления для своих. Прозрачные условия, поддержка членов кооператива, защита средств. Участвуйте в финансовом объединении, где важны ваши интересы!

dark market 2025 [url=https://github.com/nexusdarknetmarketrtul8/nexusdarknetmarket ]dark websites [/url]

darkmarket 2025 [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]darkmarket 2025 [/url]

darknet market links [url=https://github.com/nexusshopajlnb/nexusshop ]dark web market links [/url]

my canadian pharmacy review: pharmacy com canada – canadian pharmacy online reviews

darknet markets onion address [url=https://github.com/nexusdarknetmarketrtul8/nexusdarknetmarket ]darknet market [/url]

dark market list [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]dark markets [/url]

darknet market [url=https://github.com/nexusshopajlnb/nexusshop ]darknet markets onion address [/url]

darknet drug market [url=https://github.com/nexusonion1b4tk/nexusonion ]dark market 2025 [/url]

darknet markets 2025 [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]dark web sites [/url]

darknet marketplace [url=https://github.com/nexusshopajlnb/nexusshop ]dark market url [/url]

dark websites [url=https://github.com/nexusonion1b4tk/nexusonion ]dark market [/url]

маркетплейс аккаунтов маркетплейс аккаунтов соцсетей

заработок на аккаунтах магазин аккаунтов

my canadian pharmacy: Buy medicine from Canada – canadian drug stores

dark web link [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]darknet sites [/url]

http://rxexpressmexico.com/# buying from online mexican pharmacy

darknet links [url=https://github.com/nexusshopajlnb/nexusshop ]dark market 2025 [/url]

mexico pharmacies prescription drugs: mexican mail order pharmacies – Rx Express Mexico

canadian drugs online [url=https://expressrxcanada.shop/#]Express Rx Canada[/url] canadian pharmacy drugs online

dark web market list [url=https://github.com/nexusdarknetmarketrtul8/nexusdarknetmarket ]darknet markets 2025 [/url]

darknet market links [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]dark markets [/url]

dark markets 2025 [url=https://github.com/nexusshopajlnb/nexusshop ]dark market onion [/url]

medicine courier from India to USA: indian pharmacy – Medicine From India

darknet drug store [url=https://github.com/nexusdarknetmarketp0isi/nexusdarknetmarket ]darknet markets url [/url]

darknet markets url [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]darknet markets 2025 [/url]

dark market [url=https://github.com/nexusshopajlnb/nexusshop ]darknet markets onion address [/url]

dark market list [url=https://github.com/nexusdarknetmarketp0isi/nexusdarknetmarket ]darknet market [/url]

darknet websites [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]darknet drugs [/url]

bitcoin dark web [url=https://github.com/nexusshopajlnb/nexusshop ]dark web market urls [/url]

маркетплейс аккаунтов соцсетей продать аккаунт

покупка аккаунтов маркетплейс аккаунтов

заработок на аккаунтах купить аккаунт

dark web link [url=https://github.com/nexusonion1b4tk/nexusonion ]dark market [/url]

Medicine From India: indian pharmacies safe – MedicineFromIndia

dark web market list [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]darknet market [/url]

https://expressrxcanada.com/# canadianpharmacymeds com

darknet market list [url=https://github.com/nexusshopajlnb/nexusshop ]onion dark website [/url]

online shopping pharmacy india: indian pharmacy – medicine courier from India to USA

dark web sites [url=https://github.com/nexusonion1b4tk/nexusonion ]dark web sites [/url]

darknet links [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]onion dark website [/url]

ed meds online canada [url=https://expressrxcanada.com/#]Generic drugs from Canada[/url] canadian pharmacy antibiotics

mexico drug stores pharmacies: mexico pharmacy order online – п»їbest mexican online pharmacies

dark market 2025 [url=https://github.com/nexusdarknetmarketp0isi/nexusdarknetmarket ]dark market onion [/url]

darknet site [url=https://github.com/nexusdarknetmarketrtul8/nexusdarknetmarket ]darknet site [/url]

darknet drug store [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]dark websites [/url]

dark web market links [url=https://github.com/nexusshopajlnb/nexusshop ]dark web sites [/url]

dark markets [url=https://github.com/nexusdarknetmarketp0isi/nexusdarknetmarket ]darknet drug market [/url]

darknet drugs [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]dark websites [/url]

dark web market list [url=https://github.com/nexusdarknetmarketrtul8/nexusdarknetmarket ]dark web drug marketplace [/url]

Medicine From India: indian pharmacy – indian pharmacy online

dark market [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]darkmarket list [/url]

dark web market [url=https://github.com/nexusshopajlnb/nexusshop ]dark markets 2025 [/url]

http://expressrxcanada.com/# canadian pharmacy ed medications

dark market 2025 [url=https://github.com/nexusonion1b4tk/nexusonion ]dark market url [/url]

dark market link [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]tor drug market [/url]

Rx Express Mexico: mexican rx online – Rx Express Mexico

northwest pharmacy canada: ExpressRxCanada – safe online pharmacies in canada

dark web markets [url=https://github.com/nexusonion1b4tk/nexusonion ]darknet site [/url]

dark web sites [url=https://github.com/nexusdarknetmarketp0isi/nexusdarknetmarket ]darkmarket link [/url]

darknet market lists [url=https://github.com/nexusshopajlnb/nexusshop ]dark markets [/url]

legit canadian pharmacy [url=http://expressrxcanada.com/#]Express Rx Canada[/url] canadian drug pharmacy

darknet market lists [url=https://github.com/nexusonion1b4tk/nexusonion ]dark market onion [/url]

dark market link [url=https://github.com/nexusshopajlnb/nexusshop ]dark web marketplaces [/url]

купить аккаунт гарантия при продаже аккаунтов

магазин аккаунтов продажа аккаунтов соцсетей

dark markets [url=https://github.com/nexusdarknetmarketrtul8/nexusdarknetmarket ]dark web market urls [/url]

tor drug market [url=https://github.com/nexusshopajlnb/nexusshop ]darknet markets 2025 [/url]

onlinecanadianpharmacy: Generic drugs from Canada – trustworthy canadian pharmacy

Официальный сайт лордфильм универ лордфильм смотреть зарубежные новинки онлайн бесплатно. Фильмы, сериалы, кино, мультфильмы, аниме в хорошем качестве HD 720

https://expressrxcanada.shop/# cheapest pharmacy canada

dark market link [url=https://github.com/nexusdarknetmarketp0isi/nexusdarknetmarket ]best darknet markets [/url]

darknet market [url=https://github.com/nexusshopajlnb/nexusshop ]bitcoin dark web [/url]

продать аккаунт маркетплейс для реселлеров

darknet sites [url=https://github.com/nexusonion1b4tk/nexusonion ]darknet drug links [/url]

darknet markets links [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]darknet markets onion address [/url]

canadian pharmacy com: Generic drugs from Canada – canadian pharmacy 24 com

canadian pharmacy meds: best canadian online pharmacy reviews – safe canadian pharmacies

darknet market links [url=https://github.com/nexusonion1b4tk/nexusonion ]dark market 2025 [/url]

darknet drug links [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]darknet market [/url]

продажа аккаунтов заработок на аккаунтах

аккаунт для рекламы маркетплейс аккаунтов соцсетей

MedicineFromIndia [url=https://medicinefromindia.com/#]indian pharmacy online shopping[/url] Medicine From India

darknet markets onion address [url=https://github.com/nexusdarknetmarketrtul8/nexusdarknetmarket ]dark market url [/url]

Rx Express Mexico: mexico pharmacies prescription drugs – RxExpressMexico

darknet markets [url=https://github.com/abacusdarknetmarketfpyjk/abacusdarknetmarket ]dark web drug marketplace [/url]

dark web drug marketplace [url=https://github.com/nexusdarknetmarketrtul8/nexusdarknetmarket ]darkmarket url [/url]

onion dark website [url=https://github.com/nexusshopajlnb/nexusshop ]dark market onion [/url]

http://medicinefromindia.com/# Medicine From India