Navigation in the modern world of global enterprise is often an exercise in duality. While developments in the digital world open doors to value-growth for businesses, they also increase the strain on business leaders to maintain hard-won forward momentum. According to the 2022 PwC Pulse Survey[1], 60% of surveyed C-Level executives reported ‘Digital Transformation’ to be their driving focus for future growth and 56% feel that turbulent environments require businesses increase agility and adaptability.

When undertaking a digital transformation in review of the business’ enterprise resource planning (ERP) implementation, start with the finance management systems (FMS). Transforming the finance department to realign with the matured business allows the organization to redefine performance from ‘where it started’ to ‘where it is now,’ ultimately leading into a more accurate ‘where it could be.’

Data transparency in the age of analytics, coupled with the surge in remote work, has increased the demand of financial measurements and the expectation for an accelerated turnaround – data that used to take a week to compile can now be done automatically and analytic reports can be generated as quickly as your browser can refresh. This can lead to additional pressure in pushing accelerated development plans as stakeholder expectation rises, while trying to balance business flexibility in global trends and economy.

This can become a problem when finance departments struggle with legacy set-ups and obfuscated, incorrect, or missing data when completing financial reports. Time is wasted on complex, manual work arounds to report on disparate charts of accounts, ledgers, inventory orgs. and more. The use of analytics and improved data transparency has pushed teams to work faster and for projects to gain more traction at earlier stages, because data that used to take a week to compile or reports that were generated twice monthly can now be accessed in the time it takes a browser to refresh.

The room for error has shrunk to zero and the fidelity of the underlying data is more important than ever. Any mistake can quickly become costly as, for example, reports that are pulled on Monday, may be incorporated into a high-level business plan on Wednesday and presented to stakeholders on Friday, regardless of any errors or misrepresentation within the report. A single error or misrepresentation can have lasting consequences when planning an enterprise roadmap involves frequent and accelerated decision making.

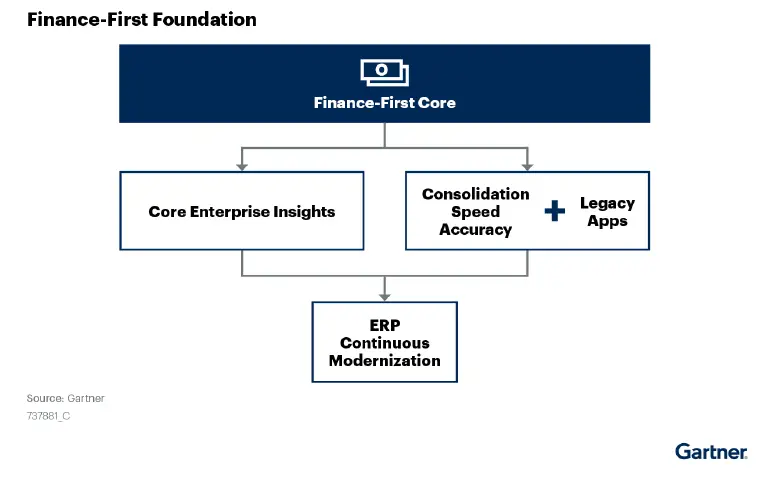

Gartner reports, “A finance-first ERP strategy first deploys the financial management suite to enable more rapid consolidation of financial results and creates impactful key performance measurements.[2]”

Functional solutions like changing a chart of accounts, merging disparate calendars, or inventory orgs eliminate bottlenecks to standardize wayward data and build core enterprise measurement systems. This saves time, money, and makes better use of organizational talent to adapt and perform in ways that push the enterprise forward. As a result, executives undertaking an ERP data transformation initiative with prioritization for the organization of their finance departments and integral financial data, ensures that both elements operate in a Complete, Consistent, and Correct manner.

[1] https://www.pwc.com/us/en/library/pulse-survey/executive-views-2022.html

[2] https://www.gartner.com/en/documents/3995993