In the past, improving business processes was the primary objective of most ERP implementations, and welcome outcomes were cost savings and productivity improvements. When ERP systems were initially implemented, the opportunities and gains in back office operations were considered significant strategic advantages. But although the strategic advantages of having robust ERP systems persist, today’s economy is forcing companies to look for ways to cut costs rather just improve their systems. The good news is that focusing on cost savings and improving ERP can go hand-in-hand and lead to better business processes if they are managed properly.

Because cost savings will continue to be the focus for the foreseeable future, this paper will review best practices in workflow improvement that reduce costs for three key business processes: Procure to Pay, Period-end Close, Order to Cash. When the economy becomes more certain, organizations will begin hiring again. Keeping an eye on key performance metrics will help organizations better decide when it’s time to flip the hiring switch.

ERP Objectives in the Past

Back office processes, finance, and procurement were not generally regarded as significant sources of competitive advantage until the advent of ERP systems that allowed organizations to identify day-to-day support processes as significant opportunities for differentiation. Once identified, organizations were typically looking to enhance information access, flexibility, and response time to market demands or customer service levels. Implementation was frequently part of a wider project, whether Business Process Reengineering or a classical operational improvement approach, driven by the emergence of the Malcolm Baldridge Award, Six Sigma, and ISO 9000 Standards compliance.

Although not the primary focus for the project, cost savings and improved productivity were often a consequence of the ERP implementation. For example, reducing manufacturing cycle times led to less inventory and less costs accumulated along the value chain. Similarly, reducing collection times increased the number of receivables that could be processed by a single Full Time Equivalent (FTE) in a day, week, month, or year, reducing staffing costs.

Accelerating the month-end close process (or making it a non-event) reduced finance staff costs and operational costs. Accelerating period-end through automation meant that fewer FTEs were required to close the period, thereby reducing the labor resources of the finance department. And in a project-oriented business like aerospace or energy where large-volume contracted work happens over a long span of time, decision makers have real-time access to actual and accumulated costs so they can proactively monitor project status and respond to cost overruns as soon as they happen.

History repeats itself – in reverse

Today, cost reduction and productivity enhancement projects have taken center stage. Across a host of business processes, managers have looked to improve productivity and reduce costs by migrating from manual processes that were heavy consumers of valuable resources to automated self-serve systems that consume significantly fewer resources. With shared services as a common model for each, below we review several common processes and the streamlined workflow that supports the best practice.

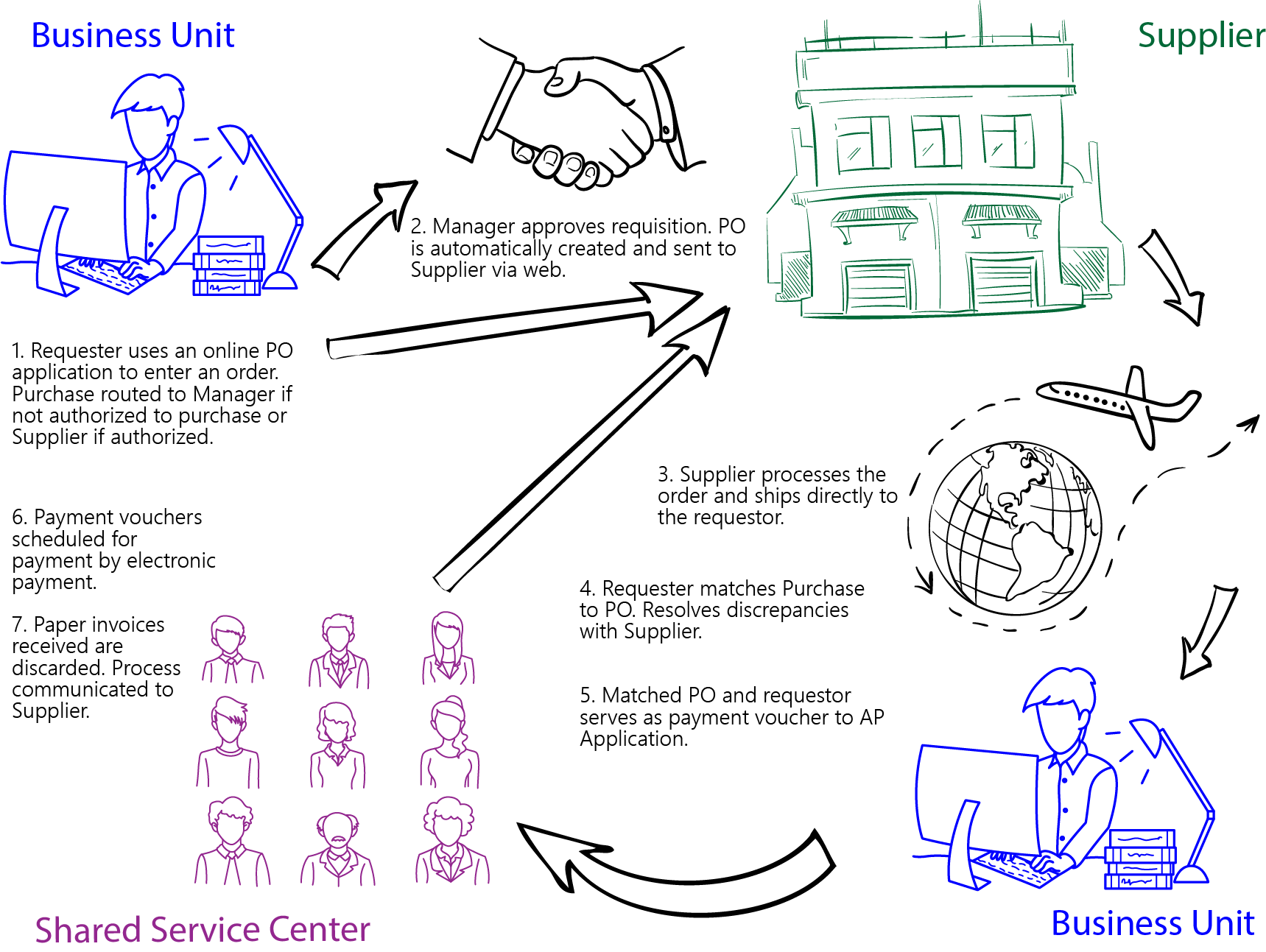

Procure to Pay Best Practice: Self-Serve and Invoiceless Processing

Eliminating bureaucratic non-value-adding gatekeepers, paper invoices, and other inefficient processes by replacing them with streamlined online purchasing that matches purchase orders to invoices automatically allows purchasing departments to increase their throughput significantly.

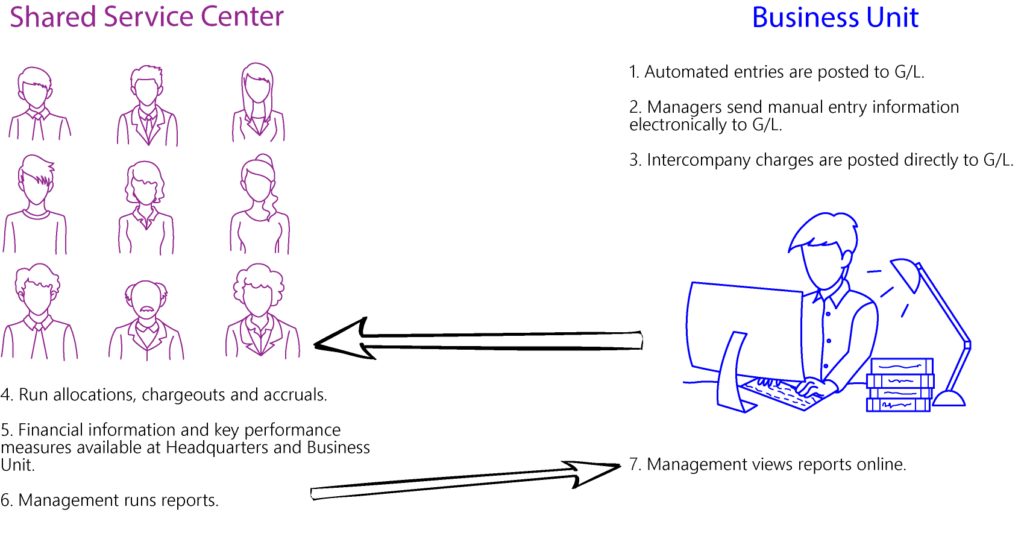

Period-end Closing Best Practice: Monthly Soft Close, One-Day Close, or Perpetual Close

Automating posting to GL (as well as subledgers in Oracle® E-Business Suite) and eliminating any and all manual postings may require changes to the ERP system, including consolidating charts of accounts to a single structure and possibly reorganizing or consolidating transaction processing systems. The reduction in labor costs can be significant, and although consolidations of this magnitude were once a daunting task, there are new software products that will now automate these processes. Furthermore, once the labor cost is driven out of the process, the company will continue to be more productive with fewer resources.

Best practices that contribute to considerable accounting labor cost savings as they relate to a Soft, One-day, or Perpetual close include:

- Closing all feeder systems (such as subledgers) on the same day

- Automating reconciliation of accounts with pre-determined built-in materiality levels for reconciliation tolerances

- Fully automating any recurring journal entries

- Implementing a single, global chart of accounts

- Using Create Accounting and secondary ledger functionality of R12 so that each transaction is entered only one time

- Providing management self-service reports, queries, and access to data

Steps like closing all subledgers on the same day require that all instances use the same calendar type – month-end or 4-5-5, for example. If this isn’t the case, then determining which calendar is optimal and adopting that calendar in all instances is a necessary step in streamlining accounting operations.

Order to Cash Best Practices: e-procurement and 3-way Matching

Order to Cash best practices include e-procurement and 3-way matching. Best practices can be achieved through a combination of business process improvements, data quality improvements or consolidation, and changes to ERP systems including the following:

- Consolidating customer data so that a customer and corresponding customer sites appear consistently in the system and invoices for all purchases are consolidated for the customer in a given month

- Providing customers one point of contact for product, ordering, and billing questions

- Providing secure self-service access to customers and employees, including access to master data and transaction data, as appropriate

Having consistent terms, credit limits, and discount policies across all operating units so that all parts of the company have accurate customer history and provide consistent customer service

ERP users, whether they are running a single instance or multiple instances, will be challenged with consolidating customer data. However, the cost savings realized by migrating to a shared service center model and adopting best practices will result in significant cost savings while driving complexity out of the process so that transactions are processed only one time.

The Unexpected Consequences of Cost Reductions

These types of projects may also result in improvements across a wide variety of business processes and strategic initiatives. For example, companies that undertake cost reductions or productivity enhancements – such as migrating to a shared services model in finance and ITT – might also report that they are better positioned to support rapid growth because duplicate work and duplicate bureaucracies that added to workflow complexities were eliminated. Anything and everything that had to be done repeatedly, rather than just once or as few times as possible, was eliminated. For example, companies consolidated business groups and operating units and, as a consequence, improved both access to and quality of customer and supplier information. Both on the supply side and on the sell side, these organizations are now better positioned to respond quickly and efficiently to future market demands. Finance Teams can handle significantly larger volumes of transactions, and hiring can be delayed because individual productivity is high.

Manufacturers reported that they have improved product quality as a result of reducing costs. Cost reduction required improving product quality both upstream and downstream of the manufacturing plant by eliminating rework, scrap, or returns caused by bad parts received from unreliable suppliers. Purchasers required consolidated, real-time supplier data so they could identify unreliable suppliers and improve their supplier management systems and processes. By consolidating to a shorter list of qualified suppliers, companies were better able to manage their suppliers and focus on component quality. So, an added bonus of the cost reduction process was improved and consistent product quality.

Companies might report that cost reductions have also resulted in improved business processes, flexibility, and business process evolution speed. Smaller teams took ownership of their new responsibilities, took on additional work, and were forced by circumstances to change processes with little advanced notice and with each new reduction in force. Those who survived learned quickly to be flexible, nimble, and adaptive. Across the board and in virtually every department, remaining staff was forced to reprioritize their responsibilities and reduce the steps needed to produce results with fewer handoffs and less work flowing outside the system. Migrating to a shared service model was a significant business process improvement. E-Business Suite organizations consolidated business units, legal entities, sets of books, and COAs, and changed calendars so that all subledgers could be closed on the same day. The resulting business process improvements were significant, and at the same time, organizations learned that they could be flexible and respond with the quickness required by their changing businesses.

Companies also report having improved customer service. When headcount in Accounts Receivable was cut, customers that may have been dealing with more than one AR manager were now dealing with one or two. But customer data may have been distributed across different instances or a single customer may have been entered into the system in different ways (XYZ Corp, XYZ Inc., or XYZ), making it difficult for AR managers to do more with less. As a result, improving customer data became increasingly important: consolidating data from multiple instances, eliminating duplicates, and ensuring that credit limits are correct and that contact information is current were of vast importance to the organizations’ data quality. The AR Business Service function can now become a center of expertise by providing better service to any one of its clients or customers.

IT efficiency was also improved. Like everyone else, IT departments were charged to do more with less or outsource and offshore to countries with lower labor costs. But their internal customers continued to clamor for support. Everyone had to do more with less, and improving productivity was possible through the better use of IT. For E-Business Suite users this meant migrating what were distributed finance, procurement, AR, and AP teams to single shared service organizations with the support of the IT team. The results: a reduced ERP ecosystem footprint that requires diminished support from IT and tremendous cost savings.

Predicting the Future

Although implementing cost containment measures was essential to virtually every organization as the economy moved into recession, rigid and permanent cost containment is not a strategy that will ensure a company’s success in the future. Eventually company objectives will change, and in time they will again boost spending in R&D, marketing, sales, finance, operations, and IT. But until that time, it will be important for companies to keep a close eye on key business metrics and assess how they are progressing. Trend lines for each of the ratios below should be watched into the foreseeable future. (Example benchmark costs for companies over a billion dollars in revenue are provided in parenthesis after the ratios)

Finance Costs

Total finance cost as a percent of revenue (Low 0.67)

In 2015 CFO.com reported, using metrics from APQC research, that while great strides have been made in the last decade to reduce the overall cost of finance, 75% of companies within a typical sampling were still spending up to 2% of their revenue on these functions. On the other hand, companies with world-class finance organizations spent 0.6% or less.

If teams are working at full throttle but the ratio is high then a company may have identified an area where improvements can be made in their business processes, their ERP system, or both.

Number of Finance Full Time Equivalent (FTE) employees per billion $ of total revenue (Average 75.7)

This ratio will give an organization an assessment of its productivity. The ratio can be compiled for the entire company or by department: Finance, AP, AR, and Purchasing. The ratio will also help to indicate the ideal tipping point, that point after a given amount of additional business is generated when it will be necessary to bring on more staff. Delaying the staffing ramp up too long, whether through direct hiring or outsourcing, may result in too large an increase of delinquent receivables.

How long does it take to complete a budget? (Number of working days to perform monthly consolidations – internal range 3-11 days)

Every organization has its own system for producing the annual budget. Usually the process starts 2 to 3 months before the fiscal year end, and sometimes more. After the board sets the company’s overall financial objectives, the information is rolled throughout the organization to the various business units and their managers. Whether the budget development process is bottom up, top down, or a combination of both, in the end the budget provides management a means to control the company’s direction as well as a roadmap to be used to correct course if necessary as the year unfolds. If the budgeting process lasts more than a few months, or budgets aren’t delivered to front line managers until well after the start of the new fiscal year, then this may be an indication that either the process or the system could use improvement. Some organizations have adopted one-month budgets, eliminating the annual budgeting process altogether. Like the rolling month-end close, the budget “happens” every month.

Procurement Costs

As with Finance costs, the Cost of Procurement (as a department) as a percentage of total revenue and the number of FTE’s as a percentage of total revenue can be tracked. But…

How much of the department cost is directed to managing suppliers rather than processing transactions? (Active Suppliers per Purchasing Employee – Average All Industries 79)

Purchasers add value to an organization not by processing transactions but by managing the supplier relationship. If purchasers spend all of their time in the minutiae of processing transactions, then they are not spending time on value-adding activities such as assessing the second- or third-order consequences of any contracts they may be negotiating. For example, if a contract for a component reduces costs by 15% but in turn slows the manufacturing line by 2% and ends up costing the company 120% of what is saved on the component, then the purchaser should be able to discover this and correct it. However, if the purchaser is overwhelmed with day to day transaction processing that requires immediate attention; changes needed to such a contract may go unnoticed.

Receivables costs

Receivables management has an important impact on the bottom line, enabling a business to minimize overall working capital and maximize both cash flow and return on corporate investment. It improves billing and collections and improves cycle times for converting both raw materials and human knowledge into cash, rather than just stopping at finished goods or services. The overall goal is to reduce or eliminate delinquent accounts and spot slow payers before they become uncollectable. Traditionally, the metric is Days Sales Outstanding (see Everyone Take a Hit, add link here). But the cost of the department assessed against revenue will give a new and different view of the department’s efficiency and costs. The cost of customer order management and invoice management and number of FTEs for each as a percentage total revenue are essential ratios that provide insight and should be tracked:

- Cost of customer order management FTEs as a percent of revenue (0.0004 – Low)

- Number of FTEs for customer order management as a percent of revenue

- Cost of customer invoice management FTEs as a percent of revenue

- Number of customer invoices processed per A/R employee (10,500 Average)

- Number of remittances processed per A/R employee (Best 17,000)

- Unit Cost per Customer (Low Volume Billers – Median $103.89)

- Cost per Bill Issued (Low Volume Billers – Median $3.13, High Volume Billers – Low $0.23)

Payables Costs

Like Finance, Procurement, and Receivables costs, assessing Payables costs, or the number of FTEs as a percentage of total company revenue, will expose the department’s productivity. In addition, the same numerators can be assessed as a percentage of total value of payables or number of invoices. Finally, whether or not payment is cost effective can be measured by reviewing if payment is made on the last day of the discount.

- Frequency of cost-effective payment by paying on the last day of discount

- Cost of supplier invoice FTEs as a percentage of total revenue

- Number of supplier invoice FTEs as a percentage of total revenue

- Cost of supplier invoice FTEs as a percentage of total invoice value

- Number of supplier invoice FTEs as a percentage of total invoice value

- Cost of supplier invoice FTEs as a percentage of total invoices

- Number of supplier invoice FTEs as a percentage of total invoices

- Number of supplier invoices processed per FTE (Average 12,541)

- Unit cost per invoice processed (Low $4.10)

Conclusion

Companies that chase cost reductions cause discontinuities in users’ daily tasks and day to day workflow practices. This creates opportunities for not only cheaper but also for faster and better business processes, delivering more value to customers, and delivering more cash to the bottom line.

Keeping an eye on a variety of metrics will also help a company to assess whether it is operating efficiently and where there may be opportunities for further productivity improvements. The continuous challenge for finance and accounting teams is how to do more with less.